What Credit Score Do I Need For The Chase Sapphire Preferred

The Sapphire Preferred is a premium travel rewards card, and, as such, you cant expect to be approved if you have a credit score thats considered fair or bad. Those who have credit scores that are good or excellent will have a much greater chance of being approved.

According to FICO, one of the leading producers of credit scores, a good score is 670 to 739, while a very good score is 740 or above. Therefore, youre unlikely to be approved for this card if your credit score is below 670, and you have a very good chance of being approved if your score is 740 or above.

Chase, like most lenders, will typically take into account other factors beyond your credit score. For example, you may have a greater chance of being approved for the Sapphire Preferred if you already have a relationship with Chase, such as a deposit account or a home mortgage. You may also be able to increase your chances of being approved if you have low outstanding balances on your other Chase cards.

Is The Chase Sapphire Reserve Worth It

The Chase Sapphire Reserve® card is unequivocally worth its $550 annual fee with a sign-up bonus worth at least $750, a $300 annual travel credit, complimentary lounge membership, Lyft and DoorDash benefits and the ability to earn highly-valuable Chase Ultimate Rewards points.

The math changes after the first year, as you only receive the welcome bonus once still, the ongoing earning rates and excellent travel benefits make it easy to come out ahead with the Chase Sapphire Reserve® card.

The card also offers fantastic synergy when used in conjunction with other Ultimate Rewards-earning cards, holding its own against other premium travel cards like The Platinum Card® from American Express.

The Chase Sapphire Reserve® is best for frequent travelers looking for a premium credit card that offers easy-to-use benefits, valuable points and a good ongoing return on travel spend. More casual travelers, or those strictly interested in earning points for travel, should take a closer look at its $95-annual-fee counterpart, the Chase Sapphire Preferred® Card.

Compare to other cards:

Chase Sapphire Reserve Benefits And Perks

The list of Chase Sapphire Reserve benefits is long. A higher-end version of the Chase Sapphire Preferred® Card, this card goes beyond basic travel and shopping protections. Here is the start of the long list of things enjoyed by Sapphire Reserve cardholders:

- Enjoy a stunning sign-up bonus: Earn 50,000 points after spending $4,000 on purchases in the first 3 months after account opening. When redeemed through the Chase travel portal, those points alone are worth $750.

- Annual travel credit: Receive $300 a year as a statement credit as reimbursement for travel expenses.

- Huge earnings: Earn 10X points on Lyft rides, Chase Dining purchases, hotels and cars booked via Ultimate Rewards, and Peloton Bike and Tread purchases 5X points on air travel booked via Ultimate Rewards 3X points on travel and dining and 1X points on everything else.

- Stretch your points further: Redeem your points through the Chase Ultimate Rewards program and theyll be worth 50% more. For example, 50,000 points would be worth $750 rather than just $500.

- Indulge with the Luxury Hotel & Resort Collection: Enjoy benefits at partner hotels, such as complimentary room upgrades, free WiFi, and complimentary breakfast.

You May Like: Remove Repossession From Credit Report

Browse And Tinker With Chase Ultimate Rewards Travel

Whats better than 2x on travel?

How about 5x?

Thats why all new cardholders should familiarize themselves with the Chase Ultimate Rewards® travel portal, which is like Chases own Kayak.com.

There are two ways you can subsidize your travel bookings through Chase Ultimate Rewards®:

- Pay using Chase Ultimate Rewards® points for a 1.25x multiplier .

- Or book using your Chase Sapphire Preferred®, and get 5x points back.

So although we updated your payment method on Delta.com earlier to ensure you got at least 2x on bookings, youll definitely want to try finding a flight through Chase Ultimate Rewards® first to get 5x.

Read more: How to fly free with Chase Ultimate Rewards®

How Can I Redeem My Chase Sapphire Reserve Points

Every travel or dining purchase you make using the card earns you points and cash backs. You can redeem those rewards later, any way you want, at a penny per point rate .

However, there is an even better way to get the most from your rewards redeeming your points for travel via the Chase Ultimate Rewards.

Here, instead of each point being equal to a penny, it appreciates to 1.5 cents. Thats 50% more.

Even better, the program doesnt have blackout dates and restrictions.

Recommended Reading: Chase Sapphire Preferred Credit Score Requirement

Chase Sapphire Preferred Credit Score: What Do You Need

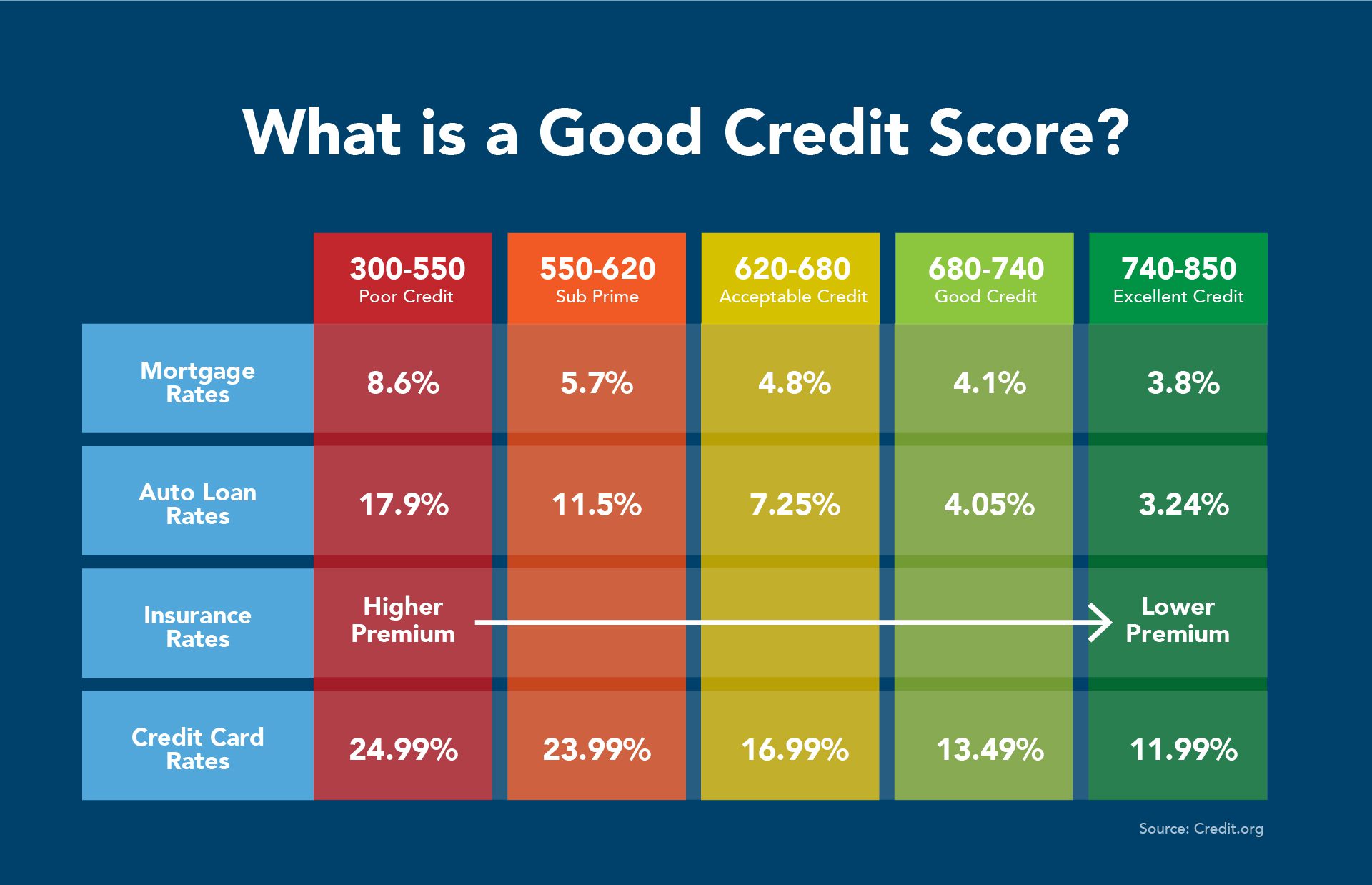

Historically, Chase has indicated that you need to fall into the Good to Excellent credit buckets to be approved for the Chase Sapphire Preferred.

That means youd need at least a 680 credit score to get approved. But in practice, its been much different. From our own experience, accounts from readers, and historical data from anyone with a credit score below 700 generally will have a hard time getting approved for the Chase Sapphire Preferred Card.

Now, thats not a hard-and-fast rule. There are certainly exceptions. But your best bet for getting the Chase Sapphire Preferred is likely by having a credit score of 700 or higher.

But even now, that is changing.

How Credit Score Is Determined

Your credit score is made up of five factors:

- Payment history : Do you pay your bills on time and do you have a balance?

How to Apply for a Chase Credit Card

Editorial Note: This content is not provided by Chase. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by Chase.

Recommended Reading: How To Get A Repossession Off Your Credit

Read Up On The Chase Rules

If you think that youre ready to apply for the Sapphire Preferred, then make sure you read about the Chase application rules first. The Sapphire Preferred is subject to the Chase 5/24 Rule and these articles will walk you through those restrictions. Or better yet, sign-up for the free app, WalletFlo to get a jump start on your credit card eligibility.

Restaurant And Dining Apps

If youre like me, you have apps for every major dining chain near your place. Chilis, Popeyes, the whole gamut of calorie-heavy temptation.

Now, itll be tedious, but swapping your default payment method in each dining app to your new Chase Sapphire Preferred® will save you 3x back on everything for as long as you have the card. As a fellow foodie, lemme tell ya those 3x points add up quickly.

Also Check: 626 Credit Score Car Loan

Bottom Line About The Chase Sapphire Reserve Card And Credit Scores

The Chase Sapphire Reserve Card requires an excellent credit score for approval. As a general rule of thumb, youll need a score of 740 or higher to get approved.

If your credit score isnt that high , we think the Chase Sapphire Preferred is a better option to get started with Chase Sapphire cards.

Stop overpaying for travel!

Get our daily email for the latest in travel, flight deals, and how to save on your next trip.

Set It As Your Default Payment Method In Lots Of Places

Ever had that moment when you accidentally used the wrong card, needlessly missing out on 3x points or cash back?

Source: made by Chris Butsch using Meme Generator

For a split second you consider asking the merchant to reverse the transaction so you can use the right card but you stop yourself, because you realize that you shouldnt burden others with your first-world problems.

Well, lets avoid all that awkwardness and ensure you get your sweet, sweet points by setting your shiny new Chase Sapphire Preferred® card as your default payment method in a few key places, like:

Read Also: Speedy Cash Card Balance

Can I Convert My Chase Sapphire Preferred Card To The Chase Sapphire Reserve

Yes, you may be eligible to convert a Chase Sapphire Preferred® Card to the Chase Sapphire Reserve®. You must be eligible for a $10,000 minimum credit limit and your Chase Sapphire Preferred® Card account must be at least 12 months old. However, you wont receive the sign-up bonus for the Chase Sapphire Reserve® if you convert to the product.

How To Earn A Good Credit Score:

If you currently have a credit score below the goodrating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the good range, start by requesting your credit report to see if there are any errors. Going over your report will reveal whats hurting your score, and guide you on what you need to do to build it.

You May Like: What Credit Score Do You Need For Carecredit

Approved Applicants Had An Average Score Above 760

When the Chase Sapphire Reserve® first launched, it came with a nearly unheard-of 100,000-point signup bonus that resulted in thousands of consumers flooding the bank with applications more than Chase ever planned on receiving, in fact.

Even with its half-size signup bonus, however, the Chase Sapphire Reserve® continues to be a popular pick for its lucrative Ultimate Rewards® points and bevvy of extra benefits .

| Good/Excellent |

The cards popularity begs the question, what does it actually take to get approved?

Thanks to the generous reports from thousands of applicants compiled by a helpful Reddit user we can dive deep into the statistics to get a big-picture look at the credit scores likely to be approved for the Chase Sapphire Reserve®. Overall, we looked at the reported data for just under 3,000 Chase Sapphire Reserve® applicants from 2016.

Of those who reported, around 84% were approved for the card, while the remaining 16% reported being denied. The average credit score of all approved applicants who reported their score was 766.

However, this score may need to come with a grain of salt. Further analysis suggests a reporting bias, as the average overall score of all applicants was nearly the same as that for approved applicants 766.2 and the average score of a denied applicant was also similar at 766.9.

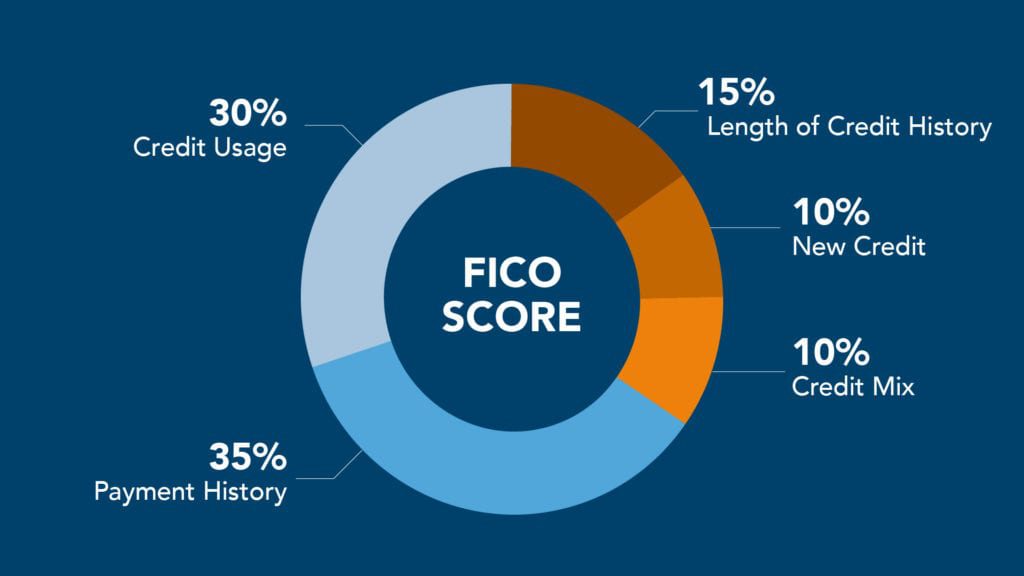

How Is Your Credit Score Calculated

Most lenders, including credit card issuers, use a FICO Score, which analyzes the information on your credit report. Using this information it predicts the risk of you paying a bill 90 days late or more within the next 24 months.

FICO scoring models usually issue scores on a scale of 300 to 850. If your score falls on the higher end of that range, you have a good credit score. The higher the score, the less risky you appear to potential lenders. The lower the score the bigger chance there is of you defaulting on your loan and the less likely you are to get approved for a premium credit card, like the Chase Sapphire Reserve®.

The factors that determine your FICO score will fall into one of these five categories:

- Payment History: 35%

Read Also: Does Aarons Report To The Credit Bureau

Chase Sapphire Preferred Eligibility Requirements

There are often questions about what it takes to get approved for the Chase Sapphire Preferred, so in this post I wanted to share the four main things to consider before applying for the Chase Sapphire Preferred, to try and figure out if youre eligible. The below considerations are the main reasons you may be denied for the card, so lets go over each of those.

Additional Chase Sapphire Preferred Benefits

Food

Additional Chase Sapphire Preferred benefits include unlimited deliveries with a $0 delivery fee and reduced service fees on eligible orders over $12 for a minimum of one year with DashPass, DoorDashs subscription service. Activate by 03/31/22.

Extra Perks

Additionally, cardholders can earn 5x points on Lyft rides, through March 2022.

Points are worth 25% more when redeemed for statement credits against existing purchases in select, rotating categories with the Chase Pay Yourself Back feature.

Also, enjoy new Chase Sapphire benefits such as a $50 annual Ultimate Rewards Hotel Credit, 5x points on travel purchased through Chase Ultimate Rewards®, 3x points on dining, and 2x points on all other travel purchases, plus more.

You May Like: Credit Score To Get Chase Sapphire Reserve

Generous Rewards And Cash Back

Heres a quick and dirty summary of the Chase Sapphire Preferred®s cash back:

- 5x points on travel purchased through Chase Ultimate Rewards®.

- 3x back on dining, grocery stores, and select streaming services.

- 2x on travel .

- 1x back on everything else.

- 10% account anniversary points boost.

- $50 annual hotel credit.

Sure, some American Express cards manage to beat the Chase Sapphire Preferred® on rewards but they also charge higher annual fees .

Qualifying For The Chase Sapphire Reserve Vs The Chase Sapphire Preferred Card

Years before the Chase Sapphire Reserve® graced cardholders with its big purchase rewards , Chases travel-happy customers were using the Chase Sapphire Reserve®s sibling, the Chase Sapphire Preferred® Card.

The two cards are part of the same card family, hence the shared names and similar rewards categories. However, where the more expensive card offers 3X Ultimate Rewards® points on travel and dining, the Chase Sapphire Reserve® gives cardholders 2X points per dollar in the same travel and dining categories but it does so with less than a quarter of the annual fee.

Also Check: Zzounds Payment Plan Denied

How Do You Activate Doordash On The Chase Sapphire Reserve

You can receive at least 12 months of complementary DashPass when you activate with your Chase Sapphire Reserve® card before Dec. 31, 2021. To activate DoorDash, add your Chase Sapphire Reserve® card as a payment method in the DoorDash or Caviar mobile application and then click the activation button.

Is The Travel Insurance On Chase Sapphire Reserve Enough

Chase Sapphire Reserve® travel insurance shouldn’t be viewed as a substitute for medical insurance it simply provides supplemental coverage and support if you encounter trouble during your trip. However, the card’s travel insurance benefits do provide substantial protections against loss if your vacation is canceled or interrupted by a covered event, or if your luggage is lost while you’re away.

Don’t Miss: 24 Hour Inquiry Removal

How Do You Achieve The Perfect Credit Score

As we have already seen, a good credit score is a great boost to your Chase Sapphire Reserve card approval.

But how do you get your credit score to the level they want?

Well, understanding how your credit score is calculated will help you change your financial habits and improve your score.

FICO percentages are the most widely used ones, and here are the main factors they consider:

1. Payment History

This is the most important factor in calculating your credit score and accounts for 35% of the entire score. Therefore, improving your financial habits can help you get a better score.

2. Credit Utilization Ratio

This is the amount of credit you utilize on your credit card, against the allowed credit limit. Your credit utilization ratio should always be below 30%. It accounts for around 30% of your credit score.

3. Credit History Length

Longer credit history favors your credit score calculations. It shows the potential lenders that you have been borrowing and repaying your debts, rising your creditworthiness.

Your credit history length will accrue another 15% on your score.

4. Credit Mix

How many lines of credit do you have? Diversified credit accounts work in your favor.

For instance, you can have an auto loan, a student loan, a credit card, and a mortgage. The more diversified your credit mix is, the better. It accounts for about 10% of your credit score.

5. New Credit

Is It Bad For Your Credit Score If You Get Denied For The Chase Sapphire Preferred

What are the negative impacts of applying for a credit card and getting denied? The only downside is that theres a new inquiry on your credit file, which could temporarily ding your score by a few points. While everyones situation is different, personally I wouldnt consider that to be a big issue, as losing a few points temporarily shouldnt have major implications.

Meanwhile getting approved for the card and using it responsibly could have a very positive impact on your credit score, by improving your total available credit, history of on-time payments, credit utilization, etc.

You May Like: How To Get A Repo Off Your Credit Report

Oh And Dont Forget Chases Funky 5/24 Rule

Lastly, current and future Chase customers should all know about the infamous Chase 5/24 rule.

In short, Chase will reject any applicant who has already applied for five new credit cards from any card company within the last 24 months.

So if the Chase Sapphire Preferred® is your sixth card in two years, best to wait a while before you get auto-rejected and suffer a needless hard pull of your credit.

Chase Delivers Attractive Benefits For New And Seasoned Travelers

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Chase offers no shortage of financial products, but it has gained much attention for its Sapphire brand of credit cards. The Chase Sapphire Reserve joins the original Chase Sapphire Preferred card, but the competing credit cards have many wondering just which one is best. The answer is that it all depends on you.

The Chase Sapphire Reserve was created with the intention of serving as a premium credit card offering elevated travel rewards for the regular or would-be road warrior. The Sapphire Preferred remains the more approachable card, offering fewer purchase points but awarding a higher introductory bonus and lower annual fees with lower starting .

However, where the Reserve shines is in its everyday rewards points, giving you three times the points on dining and travel purchases instead of just the double points allotted on the Preferred. Either way, with Chase Ultimate Reward points, the benefits look more attractive than ever. Its just a matter of how you plan to use your card and how often.

We take a detailed look at the Chase Sapphire Preferred versus Reserve credit cards, offering a key breakdown of their strengths and weaknesses so you can choose the best card for you.

You May Like: How To Report Death To Credit Bureaus