How Much Does A Charge

As with any other negative entry on your credit report, the number of credit score points a charge-off will cost you depends on the scoring system used , what your score was before the entry appeared and how many other negative entries already appear on your credit report.

The appearance of a charge-off on your credit report might not actually lower your score by much, but only because you would have have acquired many other negative entries on the way to getting a charge-off. The charge-off itself is simply the cherry on top. Late and missed payments do more damage to your credit scores than any other single factor: The first payment that’s 30 days late often has the most significant impact, and your score suffers more every month the bill remains unpaid. Since a charge-off typically appears after six consecutive months of score reductions due to missed payments, your score may be so degraded by then that there aren’t a lot of points left to lose.

You Can Negotiate With Debt Collection Agencies To Remove Negative Information From Your Credit Report

By , Attorney

If you’re negotiating with a collection agency on payment of a debt, consider making your part of the negotiations. You can ask the collector to agree to report your debt a certain way on your credit reports. Here’s how: The three major credit reporting bureausExperian, Equifax, and TransUnionproduce credit reports. Ask the collector to tell the bureaus to remove any negative information about the debt from your credit files. The collector might not agree, it might have to get the creditor’s approval first, or you might have to pay a bit more on the debt but it doesn’t hurt to ask.

And if you get the collector to agree to accept less than the full amount to settle the debt, be sure the collector also agrees to report the debt as “paid in full” on your report.

How Long Can A Charge

As discussed, the creditor can still legally collect on a charge-off, file suit or refer the account to a collection company as long as the account is within your states statute of limitations. This is assuming that the account is not relating to fraud or identity theft issues, in which case youd be able to do fraud and identity theft claim. The statute of limitations is the duration of time a creditor is allowed to collect on a debt in a specific state. Find out what the statute of limitations for debts is in your state. You should never dispute a valid and accurately reporting charge-off account if its within the statute of limitations and if its an account you are unable to settle in a lump sum payment. Disputing such a debt may put you on the creditors radar and they may be more likely to file suit.

Read Also: Paypal Credit Reporting To Credit Bureaus 2019

The Case Against Paying Charge

There are instances where you know you owe on a particular account that has been charged-off, but it may not be in your best interest to remit payment. Most importantly, if the statute of limitations has passed and the debt is no longer legally collectible, dont bother paying it. Instead, file a dispute with the credit bureaus to have it removed.

Some additional reasons to not pay charge-offs:

- The corresponding information listed on your credit report contains inaccuracies. Creditors and collection agencies cant just report whatever information they want on your credit file and expect you to pay it. Per the Fair Credit Reporting Act, the contents must be complete, accurate, and verifiable, or it must be corrected deleted. And more often than not, you may find that all it takes is a dispute for the charge-off to be deleted because the collection agency does not have the proper documentation on hand to verify the debt.

- The charge-off appears multiple times on your credit report. Imagine if you paid the charge-off through one of the five collection agencies listed on your credit report, only to find out that you still owe the money. This is not uncommon as old debts are sometimes sold over and over without the paper trail to prove you actually owe it. So, paying it off only makes the situation worse as youll be out of your hard earned cash and still feel the wrath of the charge-off on your credit report.

Can A Creditor Remove A Charge Off From Credit Report

Speak in a well mannered and professional means. Don’t blame the believer, are not making excuses, and do not tell the tale of your life. Be concise and to the point. Ideally, the lender agrees to lighten the load of your credit report. Sending a elimination reminder email is otherwise to negotiate a rate withdrawal.

Don’t Miss: Removing Hard Inquiries Increase Credit Score

How Do I Remove An Old Collection From My Credit Report

There are only two ways to remove fees from credit reports: If your collection information is valid, you must wait 7 years from the original default date for the information to disappear from your credit reports. The original default date is the date the account was first used by default and never updated.

Can Lexington Law Remove Collections

If you dispute the notice and Collections Unlimited cant verify it, it could be removed from your credit report. Lexington Law Firm is a professional credit repair organization that helps individuals remove false, unsubstantiated, unfair or inaccurate negative items, such as charge offs, from their reports.

Don’t Miss: Timeshare Foreclosure On Credit Report

Paid Vs Unpaid Charge

A charge-off will show up on your credit report as either paid or unpaid. When you pay the charge-off in full, it will be updated as paid on your credit report. However, paying your charge-off wont remove it from your credit report and will have a minimal impact on your credit score. Still, future lenders who go through the effort of underwriting will be able to see that while you have a charge-off on your credit report, you did pay it in full.

And keep in mind that if your charged-off account goes unpaid, either the original lender or the debt collection company that bought your debt may attempt to collect the debt from you.

Can A Credit Bureau Dispute Letter Be Removed

Valid or recent direct debits or recent past due payments cannot be got rid of from your credit report with a request letter from a credit reporting company. Let me provide an explanation for how to get rid of them: Recently Delinquents: For recent delinquents inside the ultimate 2 years or on open accounts, the only means to do away with them is to call the provider directly.

You May Like Also

Also Check: How To Get Credit Report Without Social Security Number

How Should You Deal With A Charge

Your best strategy depends on which course of action the creditor uses to try to get some of its money back.

If the creditor has not yet sold your debt to a collector or tried to sue you, you can negotiate a settlement in the same manner that I discussed in the section about dealing with collection accounts. Generally, this is the case for the first three to six months after your account became delinquent, although the timetable can certainly be longer or shorter than this.

On the other hand, if the creditor sues you for the debt or sells it to a third-party debt collector, it gets a little more complicated. To be clear, either of these situations will likely result in two negative items on your credit report — the original charged-off account as well as the resulting collection account or legal judgement.

You’ll probably need to deal with the collection and charge-off individually, especially if the debt has been sold to a third-party collector. A debt collector has no control over what the original creditor reports to the credit bureaus. Plus, the original creditor has no incentive to help you out simply because you paid off the debt collector.

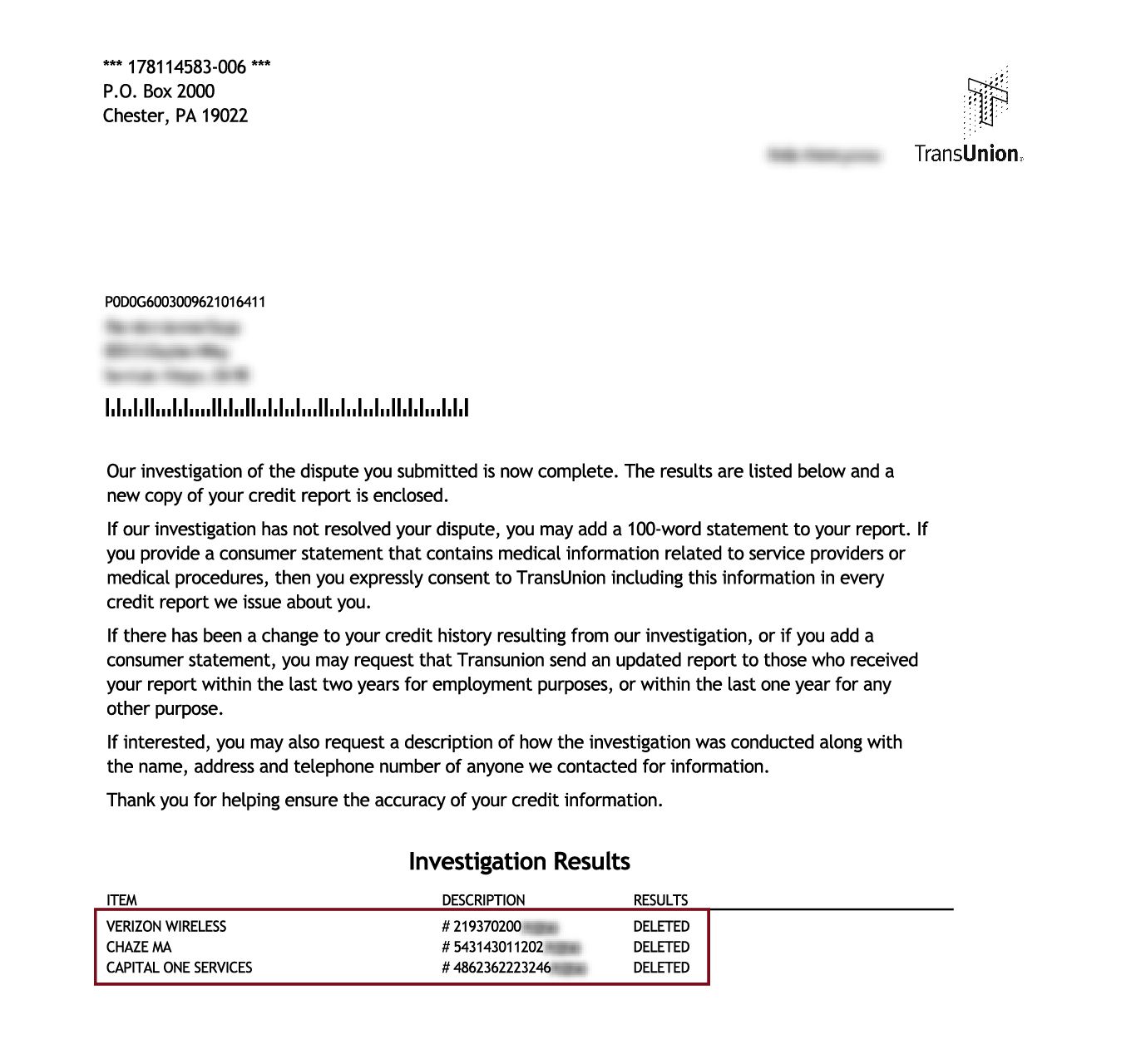

File A Dispute With The Credit Bureaus

The companies you do business can legally share details about how you pay your bills with the credit bureaus. Those credit bureaus, in turn, can gather information about you from multiple sources and package it together into easy-to-read reports. The credit bureaus then sell those reports to others who want to review your data to forecast the risk of doing business with you.

You also have rights when it comes to your personal credit information. One such right comes from the Fair Credit Reporting Act . Per the FCRA, a consumer can dispute with the consumer reporting agency the accuracy or completeness of any information in a report.

When you dispute a charge off or any other item, the credit reporting agency that receives your request has 30 days to investigate. At the end of the investigation period, the bureau must take one of the following actions with the disputed item:

- Delete it

- Update/correct it

- Verify that its accurate

If your dispute is successful, they may remove the charge off from your file. But if the investigation doesnt go in your favor, the account will stay put.

Read Also: Does Cashnetusa Check Credit

Paid In Full Better Than Unpaid Charge

In case there is anything inaccurate about the reporting, you could dispute it with the creditor or ask the credit bureaus to investigate.

Paying a balance on a charge-off will be helpful to your credit score over time. Lenders tend to view charge-offs that have been paid in full more favorably than those that have not been paid.

Also, some credit scoring models, such as FICO 9, dont count paid off collection accounts in their score calculations, so it is in your interest to pay off the delinquency, Jeffrey Arevalo, financial wellness expert at GreenPath Financial Wellness, advises.

Is It Better To Pay Off Collections Or Wait

From the viewpoint of repairing your credit score, its better to pay off a collection sooner rather than later, assuming you can afford to do so. However, a paid collection will only help your credit score if the collector agrees to remove the item from your credit report. Short of that, paying off a collection may have no effect on your credit score.

As explained above, you may have bargaining leverage with a collection agency. This manifests when you submit a pay for delete letter that offers to pay the debt in return for removing the collection item from your credit report. Your offer may be for the full amount owed, but you can request a partial write-down of the balance due.

For example, suppose you had a $10,000 credit card balance and were unable to make payments. Eventually, the card issuer wrote off your account and sold it to a collection agency for 20 cents on the dollar. The issuer collected $2,000, which means the collection agency must collect at least that much just to break even.

The fact that your original debt was $10,000 may be less important to the collector than to the credit card issuer. If the collector were to collect, say, $4,000 on the debt, it would rack up a gross profit of 100%. Therefore, the collector may be willing to accept a pay to delete deal.

That is, a higher score will improve your access to credit and lower the amount of interest youll be charged. A higher credit limit will reduce your credit utilization ratio.

Also Check: Can A Public Record Be Removed From Credit Report

How Much Does A Credit Restore Service Price

How credit repairs help you toughen your credit. You pay a monthly fee, typically $60 to $100, and the method can take anywhere from a few months to a yr. You too can pay an installation fee to get started. Some firms claim that they are able to save you repair costs, or much more, on account of the decrease rates of interest you are entitled to with the next credit score.

Ways To Remove Old Debt From Your Credit Report

Having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Also Check: Carmax Interest Rates 2020

How Do I Dispute A Collection On My Credit Report

The best way to dispute the forfeiture of your credit report is to seek help from a qualified credit repair company such as Credit Glory. How long do charges remain on your credit report? Negative items, such as fees, will remain on your credit report for 7 years. If you have a debt you can’t pay, you still have options.

Are Pay For Delete Illegal

Removing Collection Accounts from a Credit Report

Whether your attempts to pay for delete are successful can depend on whether youre dealing with the original creditor or a debt collection agency. As to the debt collector, you can ask them to pay for delete, says McClelland. This is completely legal under the FCRA.

You May Like: What Credit Score Does Navy Federal Require For Auto Loans

What Is An Example Of A Derogatory Remark

Derogatory examples in a sentence. For a person with mental retardation, the term mental retardation is considered derogatory.. The owner of the basketball team has been criticized by the public for making disparaging comments about minorities.. The restaurants’ derogatory name encourages people not to eat there.. Because the woman looked down on the children of the president, she lost the position of deputy to the senator.

Tips For Managing Debt

- Be sure to make payments on time and in full as much as possible. That way, you dont add on more and more to what you owe. If you need help making a payment plan, online debt calculators can lead you in the right direction

- If youve not yet reached a charge-off, you may want to look into a balance transfer card. This allows you to transfer a loan balance to the card that has a time period where you can pay off your debts without a hefty interest rate.

Also Check: Verizon Collections Removal

How Often Do I Get A Free Credit Report

Check back anytime: Under the Fair Credit Reporting Act, each of the three credit bureaus offers you only one free credit report per year. However, your odds may change more than once a year. At Credit Karma, your reports can be updated once a week and can be viewed at any time for free.

Does being an authorized user build creditDoes adding an authorized user affect credit? Basic concepts about credit cards. How does adding an authorized user to your account affect your balance? If you are the primary account holder, adding an authorized user to your credit card will not directly affect your credit report or score. However, the way an authorized user uses your account can affect yoâ¦

Sample Letter To Remove A Charge

Note: Use this in attempting to negotiate a complete removal or PAID AS AGREED on a debt that states CHARGE-OFF or SERIOUSLY PAST DUE on your credit report.

RE: account #

Dear Sir or Madam, After recently reviewing my credit report, I took notice that the above-mentioned account is currently in status. I sincerely would like to take care of this account as soon as possible.

Due to , I unfortunately got behind on my payments and was unable to meet my obligations. However, since then my situation has greatly improved and I am in the position to recompense this debt.

I am willing to pay equalling the amount of provided that the above account is updated on all credit reporting agencies to state: PAID AS AGREED, or completely removed from all credit reporting agencies upon my final payment.

I am not agreeing to an updated credit report that states this account as: PAID CHARGE-OFF or the like, as this will not significantly increase my credit score, nor will it reflect my sincere willingness to restore my good name and hopefully, someday, again do business with your company.

Your written response will serve as an agreement to my proposal and I will begin payments. Thank you very much for your valued time.

Best regards,

Recommended Reading: Free Credit Report Usaa

What Should You Not Say To Debt Collectors

3 Things You Should NEVER Say To A Debt Collector

- Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions.

- Never Admit That The Debt Is Yours. Even if the debt is yours, dont admit that to the debt collector.

- Never Provide Bank Account Information.

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Don’t Miss: Credit Inquiries Fall Off