How Do I Check My Credit Score

You can check your credit score for free with the Finder app. It’s a secure way to find your credit score and your credit report so you know exactly where your finances are at. We’ll update it automatically every month, let you know if your score has changed and will give you handy tips to improve it. Getting your credit score through the Finder app also unlocks additional benefits like finding out how likely you are to be approved for a personal loan or credit card.

1. Average credit score in Finder’s member database from June 2018 to February 2021.

Fha Loan Credit Score Requirements For 2021

FHA loans may be particularly appealing to first-time home buyers who have a young credit history, as well as people with more experience but who might have bad credit. Part of the attraction can be attributed to the more lenient credit requirements associated with an FHA loan.

In this article, well go over what you need to know if youre considering an FHA loan to buy or refinance a home.

How Long Does It Take To Fix A Fair Credit Score

How long it takes to fix a score of 632 will depend on various factors. If you have accurate negative items on your report, such as a collection account, these items can stay on your report for up to seven years. Until these items fall off your report, itll be much more challenging to see significant increases in your credit.

On the other hand, if you dont have anything serious bringing your score down, a few months of on-time payments and responsible financial patterns can result in a relatively quick improvement in your score.

As we mentioned earlier, a fair score is only a few points away from a good credit score. If you take the right actions, your score might improve to the good range within a few months.

Also Check: Verizon Late Payment Credit Report

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

Pay Off Your Balance Quickly And Regularly

There are three basic problems with carrying a balance:

- Balances incur interest, and that raises the cost of having the card.

- It further reduces an already low credit limit.

- It increases the chance of you defaulting.

That last point needs more discussion. A major cause of fair or poor credit is a maxed-out credit card. Not only is the monthly payment more difficult to handle, but youre more likely to default because the card no longer provides the credit it once did. Default, and you can go from fair credit to poor credit in just a few weeks.

Recommended Reading: How To Notify Credit Bureaus Of Death

Go Slow Applying For New Credit

Weve already touched on this factor, but its worth reminding you that lenders dont like seeing applicants applying for multiple lines credit. It could be an indication youre having budget problems, and looking to solve them by obtaining additional credit. You should apply for no more than one or two new lines of credit per year.

Why Is It Important To Have A Good Credit Score

There are several reasons why itâs important to have a good credit score. If youâre hoping, for example, to take out a mortgage to buy your own home one day, your credit score will need to be in good shape to get accepted and to get the best rates. Having a good credit score also means youâre much more likely to get the best rates when you take out other credit products. For example, youâre much more likely to get better credit card offers , low-APR loans, and even 0% finance agreements if your credit score is good. If your credit score isnât good, though, it doesnât necessarily mean you wonât get accepted for credit. However, lenders will view you as more of a risk, and as a result your interest rates will probably be higher, and any purchase or balance transfer offers you get will probably be shorter. Before you apply for anything, itâs always a good idea to check your eligibility and see your chances of being accepted.

Read Also: Speedy Cash Collection Agency

How Long Does It Take To Get A 632 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Different Types Of Credit Scores

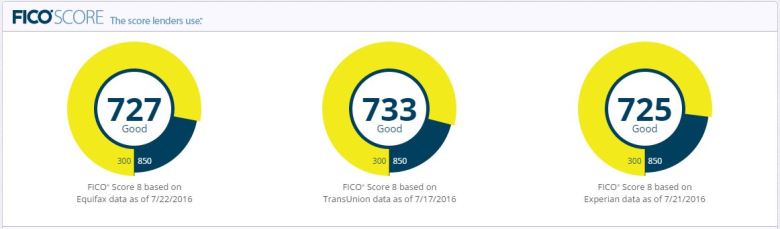

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 632 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Also Check: Can A Landlord Report To Credit Bureau

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Does Age Typically Influence Credit Scores

Interestingly enough, there is a correlation between age and credit score. Data from both Borrowell and Equifax shows that the average credit score increases by age group. Borrowell members between 20 to 29 years old have an average credit score of 649, while members between 70 to 79 years old have an average credit score of 721.

Equifax surveyed individuals from various age ranges and monitored their credit scores for a full decade. According to their most recent Generational Study, here are the average credit scores by age group.

-

Age 18-25:692

-

Age 56-65: 737

-

Age 65+: 750

There are some high-level reasons why credit scores seem to increase with age. Two factors that impact your credit score are your credit history and your credit mix. As you grow older, you might make bigger purchases to reach major milestones. Buying a car or a house involves adding different forms of credit to your credit mix. When you take out a car loan or a mortgage, your credit mix becomes more diverse. As you pay these off, your credit history grows. These two factors both help in increasing your credit score.

A word of caution, though: growing older doesnât guarantee that your credit score will increase. Building good credit requires strong financial habits, like paying your bills on time and in full.

Recommended Reading: How Do I Unfreeze My Afterpay Account

What Is A Good Credit Score According To Lenders

Lenders will favour people with an average, very good or excellent credit score. Generally anything 620 or above will be looked at favourably by lenders.

-

What is a good credit score to buy a car?

To buy a car, a good credit score is normally above 620. However, there is no “official” industry-wide minimum credit score in order to qualify for a loan. You will not automatically be ruled out for a loan if you have a low credit score but you may face higher interest rates.

-

What is a good credit score to buy a house?

If you have a credit score above 620, you have a good chance of being approved for a home loan. It’s not easy to settle on one specific number you need for a mortgage because many Australian lenders don’t publish their credit criteria. Most lenders also look at other factors to assess your risk, not just your credit score.

-

What is a good credit score for renting an apartment?

Real estate agents and landlords prefer signing a lease with someone with a good credit score, around 620. However, this is not the only thing they will look at. They will also likely look at your pay slips and previous rental history.

How To Improve My Score

If you want to give your credit score a bit of a boost, you can improve it by following these five easy steps:

You May Like: Reporting Death To Credit Bureaus

Conventional Loan With 632 Credit Score

The minimum credit score requirement to get a conventional loan is 632. In order to qualify for a conventional loan, you will need to meet all other loan requirements. This includes having at least 2 years of steady employment, a down payment of at least 3-5%, and no recent major credit events .

Would you like to find out if you qualify for a conventional loan? We can help match you with a mortgage lender that offers conventional loans in your location.

What Is The Minimum Credit Score To Qualify For A Mortgage

There is no official minimum credit score since lenders can take other factors into consideration when determining if you qualify for a mortgage. You can be approved for a mortgage with a lower credit score if, for example, you have a solid down payment or your debt load is otherwise low. Since many lenders view your credit score as just one piece of the puzzle, a low score wont necessarily prevent you from getting a mortgage.

You May Like: What Credit Score Does Usaa Use For Credit Cards

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Pay Attention To Your Credit Utilization Rate

Your is your total credit card balance divided by your total available credit. For instance, the average American has a credit limit of $22,589 on four cards and a $6,028 balance, according to Experian. That results in a CUR of about 27%. Experts typically recommend keeping your total CUR below 30%, and below 10% is even better.

If your CUR is above 30% and you have no problem paying your bills on time and in full, you can call your card issuer and ask for a credit increase. If you’re struggling to pay off your bills and you have a high CUR, it’s smarter to figure out some areas where you can cut back your spending.

Don’t Miss: Syncb/ppc On Credit Report

What Lenders Like To See

Since there are various credit scores available to lenders, make sure you know which score your lender is using so you can compare apples to apples. A score of 850 is the highest FICO score you could get. Each lender also has its own strategy, so while one lender may approve your mortgage, another may noteven when both are using the same credit score.

While there are no industry-wide standards for credit scores, the following scale from personal finance education website www.credit.org serves as a starting point for FICO scores and what each range means for getting a mortgage:

740850: Excellent credit Borrowers get easy credit approvals and the best interest rates.

670740: Good credit Borrowers are typically approved and offered good interest rates.

620670: Acceptable credit Borrowers are typically approved at higher interest rates.

580620: Subprime credit It’s possible for borrowers to get a mortgage, but not guaranteed. Terms will probably be unfavorable.

300580: Poor credit There is little to no chance of getting a mortgage. Borrowers will have to take steps to improve credit score before being approved.

Dont Cancel Credit Cards

Cancelling credit cards has a direct affect on your credit utilization ratio and your credit score. Your ratio goes up each time you cancel a card because doing so lowers the maximum amount of borrowing room you have in comparison to your debts. To avoid the potential hit your score could take when you cancel a card, only sign up for the credit cards you actually need.

Don’t Miss: Vantage Score Definition

Understanding Credit Score Ranges

The credit score you see if youre signed up for TransUnion Credit Monitoring or if you purchased a credit score with your credit report is based on the VantageScore® 3.0 model. Scores in this model range from 300 to 850. A good score with TransUnion and VantageScore® 3.0 is between 720 and 780. As your score climbs through and above this range, you can benefit from the increased freedom and flexibility healthy credit brings. Some people want to achieve a score of 850, the highest credit score possible. Having this perfect score may feel like a win, but it isnt necessary to enjoy the benefits of strong credit.

In TransUnion Credit Monitoring, you may also see a letter grade with your credit score. For VantageScore® 3.0, an A score is in the range of 781850, while a B score is 720780. A score of 658719 is labeled a C. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. You can use them to help stay on the right track, but they dont necessarily indicate if you will or wont be approved for credit.

Think of these rankings and ranges as guides, not hard and fast rules for what good credit is.

The Top Credit Card Recommendation For Canadians With Fair Credit

If you have fair credit, youll be happy to know that you have access to credit card options to fit your needs. While you may not get approved for the most competitive card options those with exclusive perks and generous rewards you will qualify for cards that still offer some great benefits. Its important to know what cards will be available to you with an average score, as well as the benefits and limitations that come along with them.

If you have a fair credit score, heres a great option to consider:

BMO Preferred Rate Mastercard

Also Check: What Time Does Speedy Cash Open