Understanding The 5 Key Factors That Impact Your Credit Score

7/16/2018

Topics: Credit Score, FICO, Credit Report

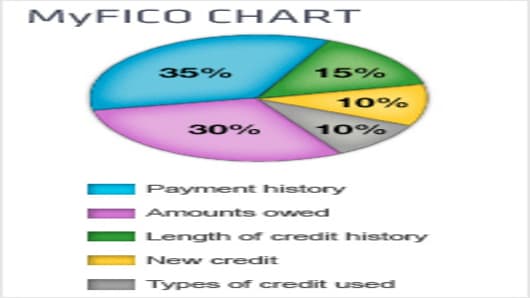

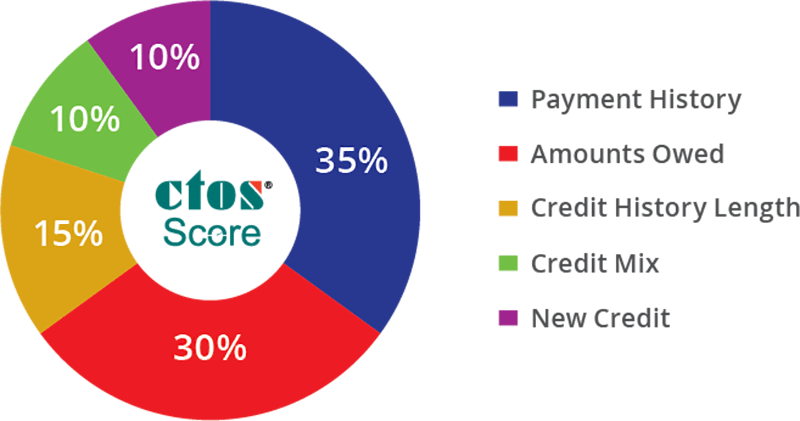

Your FICO Credit Score is made up of 5 different sections that determine your overall credit score. Your FICO score is a credit score that is based off of FICO , a company which analyzes credit behavior to determine the credit risk of the borrower/customer. FICO looks at a range of credit information and uses that to create scores that help lenders predict consumer behavior, such as how likely someone is to pay their bills on time , or whether they are able to handle a larger credit line. The Three Major Credit Bureaus use your FICO Score to determine your credit score for lenders.

How To Improve Your Credit Score

Improving your credit score can be easy once you understand why your score is struggling. It may take time and effort, but developing responsible habits now can help you grow your score in the long run.

A good first step is to get a free copy of your credit report and score so you can understand what is in your credit file. Next, focus on what is bringing your score down and work toward improving these areas.

Here are some common steps you can take to increase your credit score.

How Long Do Late Payments Stay On Credit Reports

Late payments can stay on your credit report for up to seven years. They can damage your credit score, but the effect on your score fades over time.

Not all late payments show up on your payment history, however. If you didn’t make a credit card payment by the due date and instead made the payment a day late or a week late, you could be hit with a late fee by the card issuer, but your credit won’t be hurt.

Why is that? Because credit card issuers won’t notify the major credit bureaus about a late payment until a full billing cycle, or 30 days, has gone by.

The situation changes if the payment is more than 30 days late. In this case, the effect on your credit scores depends on how long your account was delinquent before you made a payment. So, a payment that’s 60 days late will do more harm than a payment that’s more than 30 days late but less harm than a payment that’s 90 days late.

You May Like: Klarna Credit Approval Odds

What To Do If You Don’t Have A Credit Score

If you want to establish and build your credit but don’t have a credit score, these options will help you get going.

- Get a secured credit card. A secured credit card can be used the same way as a conventional credit card. The only difference is that a security deposittypically equal to your credit limitis required when signing up for a secured card. This security deposit helps protect the credit issuer if you default and makes them more comfortable taking on riskier borrowers. Use the secured card to make small essential purchases and be sure to pay your bill in full and on time each month to help establish and build your credit. Click here to learn more about how secured cards work and here to browse Experian’s secured card partners.

- Become an authorized user. If you are close with someone who has a credit card, you could ask them to add you as an authorized user to jump-start your credit. In this scenario, you get your own card and are given spending privileges on the main cardholder’s account. In many cases, credit card issuers report authorized users to the credit bureaus, which adds to your credit file. As long as the primary cardholder makes all their payments on time, you should benefit.

Want to instantly increase your credit score? Experian Boost helps by giving you credit for the utility and mobile phone bills you’re already paying. Until now, those payments did not positively impact your score.

Different Types Of Credit

Your Different Types of Credit also have an impact on your credit score. Lenders like to see that you are able to balance making payments to several different types of credit lines preferably over 10 open and closed accounts. As long as you closed an account that made on time payments and you did not owe anything additional on that line, it can benefit you for this factor of your credit score.

You May Like: Cbcinnovis Credit Report Inquiry

What Factors Affect Your Credit Scores

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Your credit scores are determined by several factors, such as whether you pay bills on time and the length of time you’ve used credit. Understanding what factors affect credit scores helps you plan the most effective way to or protect it.

Why do you care? Because your : whether you can get a credit card or car loan, and at what interest rate whether you can buy a house or rent the apartment you want even how much you pay on car insurance and utility deposits.

The two major scoring companies in the U.S., , differ a bit in their approaches, but they agree on the two factors that are most important. Payment history and , the portion of your credit limits that you actually use, make up more than half of your credit scores. Focus your attention mostly on those two while keeping an eye on the other factors.

Here’s a breakdown of all the factors that affect your scores:

Your credit reports reveal your , or whether you’ve consistently paid bills and other obligations on time. FICO says payment history accounts for 35% of your score. doesnt give percentages, but it calls payment history extremely influential.

Payment History And Negative Credit Information

Simple, right? Not so much. The FICO score depends on the information in borrowers , which is provided by creditors. And not all creditors behave the same. For example, many creditors dont report missed payments until they become at least 60 days late. Others may wait even longer, if they even report at all.

How long those blemishes remain on your credit report can also vary: Negative items generally stay on a credit report for seven years, but can remain for up to 10 years in the case of certain bankruptcies. Meanwhile, you can expect on-time payments to appear, but payment information from other businesses, such as utility companies, renters and landlords, isnt necessarily listed on credit reports or included in your FICO score. Positive information remains on your credit reports for 10 years.

See related: 18 things that hurt your credit score, 16 things that dont hurt your credit score

Don’t Miss: Can Lexington Law Remove Repossessions

Types Of Accounts That Impact Credit Scores

Typically, credit files contain information about two types of debt: installment loans and revolving credit. Because revolving and installment accounts keep a record of your debt and payment history, they are important for calculating your credit scores.

- Installment credit usually comprises loans where you borrow a fixed amount and agree to make a monthly payment toward the overall balance until the loan is paid off. Student loans, personal loans, and mortgages are examples of installment accounts.

- Revolving credit is typically associated with credit cards but can also include some types of home equity loans. With revolving credit accounts, you have a credit limit and make at least minimum monthly payments according to how much credit you use. Revolving credit can fluctuate and doesn’t typically have a fixed term.

Check Your Credit Report For Errors

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report.

Remember: checking your own credit report or FICO Score has no impact on your credit score.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Length Of Credit History: 15%

Your credit score also takes into account how long you have been using credit. For how many years have you had obligations? How old is your oldest account and what is the average age of all your accounts?

Long is helpful , but a short history can be fine too as long as you’ve made your payments on time and don’t owe too much.

This is why personal finance experts always recommend leaving credit card accounts open, even if you dont use them anymore. The accounts age by itself will help boost your score. Close your oldest account and you could see your overall score decline.

Types Of Credit In Use

The last contributing factor to your score is Types of Credit in Use. Your score relies on credit diversity. If you only have one type of account, your score will reflect this. Try to financially diversify yourself by maintaining different types of credit, such as credit cards, a mortgage loan, and an auto loan.

While each of these five factors contributes to your score, financial awareness is the key to financial responsibility. When it comes to maintaining a good score, try to pay all of your obligations on time. Be mindful of how your credit decisions affect your credit score and your future ability to get credit.

If you believe your rights have been violated and would like the advice of assistance of counsel, for a completely free case review.

Don’t Miss: Which Credit Score Matters The Most

Here Are The 6 Factors That Impact Your Credit Score The Most

We all know our credit score is important. A good credit score can be the key to buying your first home or purchasing a new car, but exactly what a credit score is, and how it is calculated is much more confusing. In fact, a recent study found that 40% of Americans were unsure of how their credit score was calculated. Even if you have a strong understanding of the components that make up your credit score, it never hurts to review them when planning out purchases or big life events. In this post, we unravel the components that go into your credit score and identify a few key strategies for improving credit.

In short your FICO credit score is a three digit number that informs a lender of your credit worthiness. Most lenders use your FICO credit score to determine whether or not to provide you with access to credit, and at what cost. While the exact formula used to calculate your Fico score is a proprietary secret, FICO does provide the factors it uses to calculate your score and a rough measure of how much each factor is weighted.

There are six factors that impact your credit score. These factors include:

Number Of Hard Inquiries 10%

Talking about things that hurt your credit score, we have hard inquiries. Unlike soft pulls that are for informative purposes only, hard pulls are used by lenders and utility providers. Hard inquiries show that you need money or that you plan to increase your debt or expenses.

A hard inquiry can decrease your FICO rating by around five points. The exact number may be lower or higher, depending on other factors. Hard pulls stay on records for 24 months, but negatively impact them for about 12 months.

Recommended Reading: Is 524 A Good Credit Score

Mix Up Your Credit Strategically

The types of credit you have make a difference in how you get scored by FICO, too. It comprises 10 percent of your credit score. Having a single loan or credit card may not be enough to generate a credit score. In most cases, you need at least two or three trade lines to generate a credit score.

And creditors view you more favorably if you have a variety of debt types you manage well.

That means having more than one revolving account and a few types of installment credit like personal loans, mortgages and car notes. Having them all and keeping them paid on time makes you look more responsible to creditors.

But, that doesnt mean you should overextend yourself by opening new credit accounts to get the credit mix right. Paying a few credit cards and an installment loan on time can give you the good credit score you need to get better rates on loans and credit cards.

In fact, since its at the bottom of the list of factors, you should focus on FICO score fundamentals like paying bills on time, keeping credit utilization low and opening new accounts only when you need them.

How New Credit Can Lower Fico Scores

When applying for new credit, an inquiry is placed on your credit report. That means, for instance, if you’re trying to get a new credit card, the lender will “inquire” into your credit report from one of the three major credit agencies. Depending on the other factors in your report, this inquiry can lower your score by a few points.

A new credit card or line of credit will also affect your length of credit history. This part of your score is made up of your “oldest” account and the average of all your accounts. Opening new credit lowers the average age of your total accounts. This, in effect, lowers your length of credit history and subsequently, your credit score.

New credit, once used, will increase the “amounts owed” factor of your credit score. Amounts owed is composed of credit utilization the ratio of your credit balances to your credit limits. Very often, the lower your credit utilization , the higher your credit score. When you open and use a new credit card or line of credit, you’re getting closer to your credit limit, which could mean a lower score.

Also Check: What Credit Report Does Comenity Bank Pull

Credit Score Loan Options

Its hard to find any loan with a 524-credit score. Lenders look at your payment history, credit utilization rate, and outstanding debts.

But even with a timely payment history and no debts outstanding, a 524-credit score speaks for itself.

If you do get a loan, it will likely be a secured credit card or personal loan with an APR as high as 35.99% and an origination fee of as much as 5% of the loan amount.

Factors That Don’t Affect Your Credit

Some factors are commonly thought to influence your credit score, but they don’tnot directly at least. Information like income, bank balances, and employment status can influence your ability to get approved, but they don’t actually factor into the algorithm that calculates your credit score. Age, marital status, and debit or prepaid card usage also do not influence your credit score.

Recommended Reading: Credit Removed After 7 Years

Why Is A Credit Score Important

If you want to qualify for loans and mortgages, you need a good credit score. Additionally, people with excellent and exceptional FICO ratings get access to the best loan deals.

In other words, your three-digit grade represents your creditworthiness. So, a bad one can significantly limit your options when it comes to buying a car or renting an apartment.

What Is A Fico Credit Score

FICO, or the Fair Isaac Corporation, determines the creditworthiness of an individual with a number, typically between 300 and 850. This FICO credit score is the lending industry standard for making credit-related decisions.

FICO scores are calculated from information pulled from the 3 major credit bureaus in the United States: Experian, TransUnion, and Equifax. These bureaus, in turn, gather information from lenders like credit card companies, student loan lenders, and banks.

A score above 670 is generally considered good, and a score above 800 is considered exceptional. Only 21% of Americans have exceptional scores, while another 46% have scores above 670 but under 800.

Your personal credit score can have a large impact on your ability to get a business loan, too. Banks typically want applicants to have credit scores above 800, but there are other options.

FICO determines your credit score based on 5 factors, but each factor is weighted differently. Your repayment history and overall credit utilization are the main components of your score.

You May Like: How To Remove Repossession From Credit Report

What’s In My Fico Scores

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.