What Is Ccb/bbbmc On Your Credit Report

CCB/BBBMC will show up on your credit report if you have applied for a Bed,Bath & Beyond Mastercard with Comenity Capital Bank. Applying for a credit card means a hard pull of your credit, which impacts your score. If CCB/BBBMC is on your credit report, but you didn’t apply, Credit Glory helps you dispute and remove the error.

Comenity Banks Most Popular Credit Cards

Now that weve highlighted the top 3 credit cards from Comenity Bank, lets take a look at some of the other popular cards;they offer to see if your favorite store made the list.

Ann Taylor is a womens retail store under the Ann Inc. umbrella of stores, which includes LOFT, Ann Taylor Factory Store, LOFT Outlet, and Lou & Grey.

The Ann Taylor Mastercard earns 5 rewards points per dollar spent with Ann Inc. stores. For every 2,000 rewards points or $400 spent online or in-store, youll get rewarded with a $20 rewards card .

Your first purchase made outside the Ann Inc. family will also trigger a $20 rewards;card. Use this card at grocery stores and gas stations to earn 2 rewards points per dollar spent.

You will earn 15% off your first purchase if you open your account in-store or online at any Ann Taylor or LOFT store and 15% off purchases made on the first Tuesday of the month at those same locations. To top it off, youll receive a $15 birthday gift each year.

What Is Comenity Bank

Last updated Aug 9, 2021| ByMatt Miczulski

FinanceBuzz is reader-supported. We may receive compensation from the products and services mentioned in this story, but the opinions are the author’s own. Compensation may impact where offers appear. We have not included all available products or offers. Learn more about how we make money and our editorial policies.

Comenity Bank has been a pretty big player in the credit card industry for more than 30 years, but theres a good chance youve never even heard of it. Comenity provides retail partners with their own private-label and co-branded , so when the time comes to brand the credit card, the name Comenity takes a back seat.

Since Comenity has partnered with over 145 retailers to provide these credit solutions, its possible you have a Comenity or Comenity Capital Bank credit card account without even knowing. Whether youre already a customer or in the market for a new credit card, understanding the financial institution behind many of these store cards might be worthwhile. Why? Because at the end of the day, Comenity is the credit card issuer, and knowing more about the bank you might do business with cant hurt.

Lets dive in and see what Comenity is all about.

Also Check: What Credit Score Do You Need For A Conventional Loan

Comenity Bank Retail Store Credit Cards

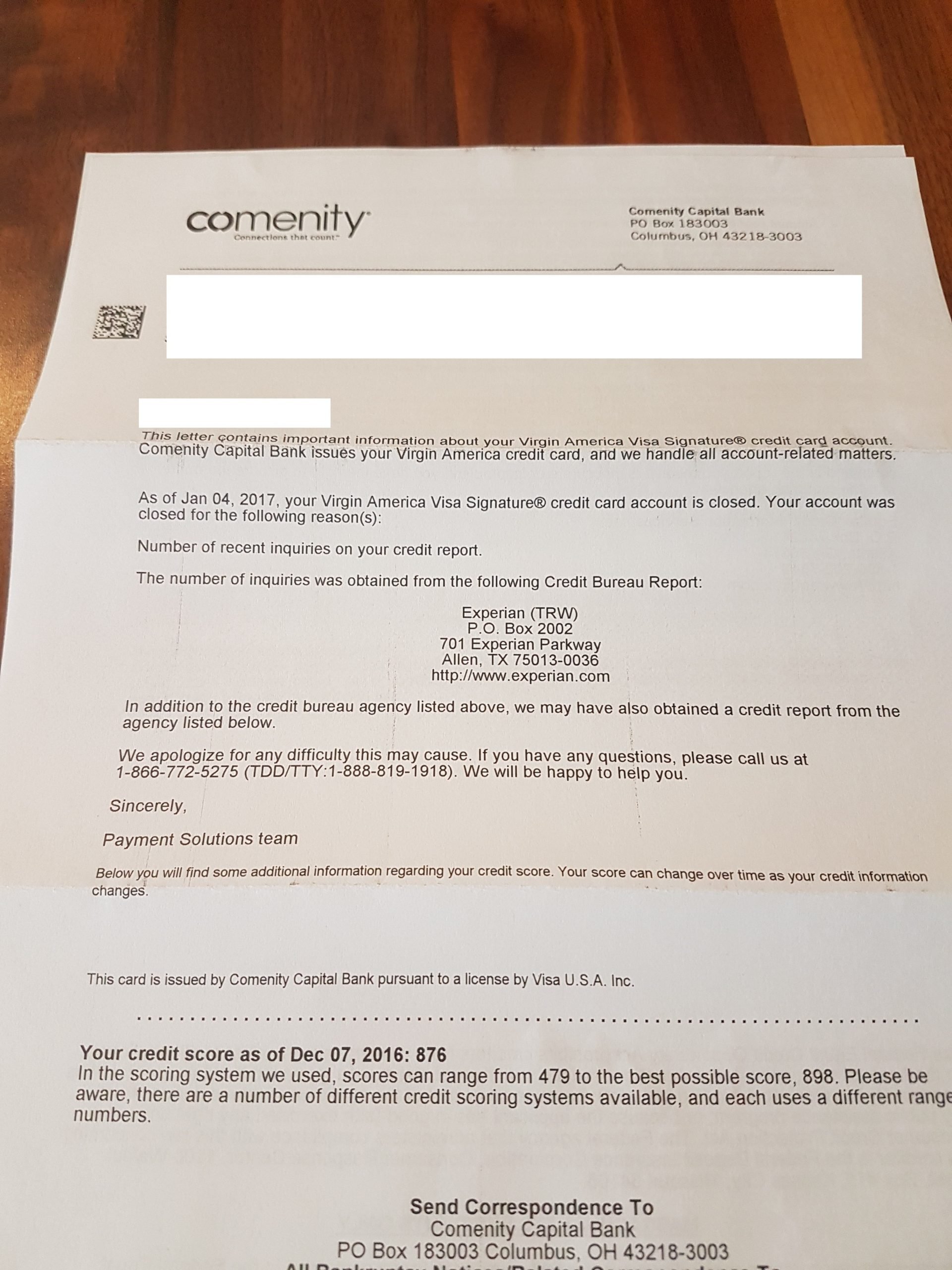

Take note that some of the Comenity credit cards in the following tables are discontinued for new applicants , although you can still use the links below to log in to your account, to see details and make payments.;In some cases the cards were discontinued for current cardholders as well, meaning your account would have been closed. If that happened you should have received a notice; you can follow your cards link to learn more.

Or, your card account may have been transferred to a different issuer, like Synchrony.

| Retail Store |

|---|

Can You Have A Payment Plan For An Engagement Ring

Can you finance an engagement ring? You do have the option of financing a ring with a loan arranged through your jeweler. Depending on the price of the ring, consumers enjoy 0% APR for the first six, 12 or 18 months after purchasing. If you choose a longer payment plan, with equal payments, theres a 9.99% APR.

Also Check: Which Information Can Be Found On A Person’s Credit Report

Re: Comenity Hard Pull On Experian

Put on the brakes immediately!Work with what you have for awhile to build seniority on those first.And You Came To The Right Place Just In TimeWelcome To The Forums

Wow, you’ve been very busy.; Congrats on your new cards, and like others said….put on those brake and slow down a bit and let your new accounts to marinate & age well.;

What Do Credit Card Users Say

Melinda Opperman, president and chief relationship officer at Credit.org, a nonprofit agency that provides credit counseling and related services, says her organizations review of online forums and discussion boards indicates American Express, Discover and U.S. Bank rely mostly or solely on Experian, whereas Barclays and Goldman Sachs depend primarily or only on TransUnion.

Heres how the credit-reporting landscape looks for other card issuers, according to Credit.org:

- Bank of America: Experian or TransUnion

- Capital One: Equifax, Experian and TransUnion

- Chase: Equifax, Experian and TransUnion

- Citi: Equifax and Experian

- Wells Fargo: Equifax, Experian and TransUnion

Opperman warned that this information only represents a quick survey of what users report. So it could differ from what you experience when applying for a credit card.

Nonetheless, visiting online credit card forums and discussion boards can give you a sense of which credit bureau will help decide the fate of your application.

Read Also: How To Get Fico Credit Score

Free Annual Credit Report

As a result of the FACT Act , each legal U.S. resident is entitled to a free copy of his or her from each credit reporting agency once every twelve months. The law requires all three agencies, Equifax, Experian, and Transunion, to provide reports. These credit reports do not contain credit scores from any of the three agencies. The three credit bureaus run Annualcreditreport.com, where users can get their free credit reports. Non-FICO credit scores are available as an add-on feature of the report for a fee. This fee is usually $7.95, as the FTC regulates this charge through the Fair Credit Reporting Act. The FTC tracks various scams and reports on other sites that provide fake credit reports or charge fees for their services. Instances of illegal behaviors by credit report services have been settled in court such as that of Experian Consumer Direct that was charged with deceptively signed people up for credit report monitoring services that charged them monthly fees.

Clear Your Browser History

Right before you visit your chosen stores website , be sure to clear your browser history. This includes wiping your cache and cookies.

To do this, simply find your browser settings in your menu bar, then select History. Alternatively, you can simply hit the CTRL button and H to reach the same page.

Next, click on Clear Browsing Data and select the following options: Browsing History, Download History, Cached Images and Files, and Cookies and Other Site Data.

If you want to skip all of those steps and you use Google Chrome as your web browser, you can also use an Incognito Window.

You can find this option in your browser settings as well, or just click CTRL + Shift + N. Then you dont have to worry about any browsing history interrupting your shopping cart trick.

You May Like: Why Is There Aargon Agency On My Credit Report

Alternatives To Comenity Cards

If you’re interested in applying for a new credit card and you’re looking for a flexible option that allows you to earn rewards on your everyday purchases, both the Chase Freedom Unlimited and the Capital One Quicksilver are worth considering. Both cards offer generous cashback rewards that you can redeem for statement credits, gift cards, and more.;

With the Chase Freedom Unlimited, new cardmembers can earn a $200 cash back bonus after spending $500 in the first 3 months, plus earn 5% cash back on grocery store purchases . And the benefits don’t stop there. As a Freedom Unlimited cardmember, you’ll also get;5% on travel purchased through Chase Ultimate Rewards, 3% on dining and drugstore purchases, and 1.5% on all other purchases. That can add up to a big bonus at the grocery store as well as some decent rewards on your other purchases.;

The Capital One Quicksilver also offers generous rewards for your everyday spending. New cardmembers can;earn a $200 cash back bonus after spending $500 in the first 3 months, and this credit card offers flat-rate 1.5% cash back rewards on every purchase, every day. It’s a great option if you prefer straightforward and simple cashback rewards.;

Opensky Secured Visa Credit Card: Best For Low Annual Fee

| Put down $200 to $3,000 dollars as a deposit and get a matching credit limit

All cardholders get an APR of 17.39% Annual fee of $35 Can pay deposit online or by mail via check or money order Our take: The OpenSky Secured Visa credit card is a good option if you want to avoid a hard pull, build credit and keep costs low. It carries a relatively low APR and annual fee, as well as a potentially high credit limit. |

With the OpenSky Secured Visa, you wont even face a soft inquiry. You can get the card with absolutely no credit check and you dont even need a bank account to apply you can send your security deposit via money order or have someone else send a check on your behalf.

While the card comes with a $35 annual fee, this is much lower than youll find on many cards designed for people with damaged credit. Plenty of such cards charge upward of $75 per year in fees, with some tacking on additional fees in your second year.

The OpenSky Secured Visa also carries a reasonable APR of 17.39% and allows you to put down a security deposit as high as $3,000 , which will be a big help as you work to maintain low .

All of these factors make the OpenSky Secured Visa a good soft pull credit card option for credit-builders looking to avoid a credit check. They also helped land the card a top spot on our list of the best credit cards after bankruptcy.

Don’t Miss: What Does Charge Off Mean On Credit Report

How To Find Out Which Credit Bureau Will Be Pulled

The truth is that all we have are imperfect tools to work with to determine which credit bureau will be pulled.

With that said, we also have certain trends that we can base our predictions on. These trends and tools can at least help us make an educated guess as to which bureau will be pulled.

Ill start by identifying which credit card issuers are known for pulling certain bureaus and then get into the different methods for figuring out which bureau will be pulled by using databases.

What Is Ccb/mprcc On Your Credit Report

CCB/MPRCC will show up on your credit report if you have applied for a MyPoints Rewards Visa with Comenity Capital Bank. Applying for a credit card means a hard pull of your credit, which impacts your score. If CCB/MPRCC is on your credit report, but you didn’t apply, Credit Glory helps you dispute and remove the error.

Also Check: How To Remove A Delinquency From Your Credit Report

Is A Credit Card From Comenity Bank Right For You

Clearly, there are countless options available when it comes to getting a credit card from Comenity Bank. Whether one is right for you depends on your credit history and financial goals. If youre primarily motivated by lucrative rewards and benefits, explore all of your options before settling on one.

If you plan on making an expensive one-time purchase, you may benefit from opening a Comenity Bank store card to get that big discount. But dont do it just because a sales associate is pressuring you in the checkout line.

How Often Do Credit Reports Update

Your credit reports are updated when lenders provide new information to the nationwide credit reporting agencies for your accounts. This usually happens once a month, or at least every 45 days. However, some lenders may update more frequently than this. So, say you paid down a credit card recently. You may not see your account balance updated on your credit report immediately. If you look at the account in your TransUnion credit report, you may see a line that reads Date Updated. This would tell you the most recent day the account information was provided to TransUnion.

Because lenders dont all provide updates on the same day, new information may be added to your reports quite frequently. You can get your credit report from each of the three nationwide credit reporting agencies weekly at annualcreditreport.com. If youd like to more tools to help you manage your credit with confidence, consider a paid subscription to TransUnion Credit Monitoring. Youll get access to daily credit report and score refreshes and alerts when there are changes to your accounts, helping you better keep track of important account changes.

Don’t Miss: How To Get Free Credit Report From Transunion

What Are Soft Pull Credit Cards

Soft pull credit cards are cards you can get with only a soft pull of your credit. Sometimes called no credit check credit cards, these products allow you to apply for credit or open a new account without damaging your credit score via a hard pull.

Soft pull credit cards are tough to find, and its virtually impossible to get an unsecured credit card without a credit check. Opting for a soft pull credit card will almost certainly mean missing out on the top rewards credit cards and sticking to secured credit cards instead.

As their name implies, secured cards require a security deposit and will be most useful if you need to build credit or want to control spending.

Tip: If you already have an account with a card issuer, you likely wont have to undergo a hard pull to switch or upgrade to a new credit card with that same issuer. Still, to protect your credit, its best to double check what sort of inquiry your issuer performs before you request a product change.

When Are Credit Scores Updated

Your credit score isnt included on your free weekly reports, but knowing the information in your report can help you understand credit score movements. When information is received by the credit reporting agencies, its typically added to your credit reports immediately. And when the information in your credit report changes, your scores may as well. How much they change depends on what information is updated. For example, making one more on-time payment may not cause your score to jump significantly after a year of consistent payments. But if you significantly lowered your balances across your credit cards, you may see some positive score movements. Making payments consistently and keeping balances low are good ways to keep your credit on track. Over time, with these good habits, you should see your score continue to improve.

Recommended Reading: How To Gain Credit Score

Applied Bank Secured Visa Gold Preferred Credit Card: Best For A High Credit Limit

| Put down $200 to $1,000 dollars as a deposit and get a matching credit limit

Increase credit limit up to $5,000 by making additional deposits after youre approved All cardholders get an APR of 9.99% No grace period on purchases Annual fee of $48 Our take: This no-credit-check secured card offers a chance at a high credit limit with a matching deposit, but its lack of a grace period on interest charges is a major shortcoming. |

To be frank, the Applied Bank Secured Visa Card is hard to recommend for the majority of cardholders, and it makes this list due simply to the scarcity of no-credit-check credit cards on the market. To start, it charges a ton of fees including a $48 annual fee, a $30 fee per additional or replacement card and a $12.95 fee for making your card payment by phone.

And though the card carries an otherwise impressive fixed APR of 9.99%, it comes with no grace period. This means youll be charged interest on purchases on the transaction date. Most credit cards charge no interest until after your minimum payment due date. Since this card also requires a security deposit, having no grace period essentially means you may end up paying interest on money youre borrowing from yourself.

Tip: If you decide to try this card, consider using it only for small recurring charges that you can quickly pay off. This will give you a better chance at minimizing interest charges while keeping the account active and your credit utilization low.

Soft Inquiry Credit Card Preapproval

While only a handful of true soft pull credit cards are on the market, most issuers allow you to check whether youre preapproved for one of their credit cards via a soft pull. This allows you to get a good idea of your odds of approval before you apply .

You can visit an issuers website directly to check for soft pull prequalification options or use a tool like CardMatch to search across multiple issuers for cards that fit your credit profile. Most issuers also send out prescreened credit card offers via mail or email.

Tip: Check for offers on CardMatch without the worry of impacting your credit score; youll be able to receive special offers as well as prequalified matches. Plus, the tool combines offers from several different credit card issuers, so you wont have to check on multiple websites.

Heres a look at some major credit card issuers and whether they offer preapproval via a soft pull:

| Issuer | ||

| Previously available via U.S. Bank website, but currently unavailable | ||

| Wells Fargo | Mostly unavailable | Online prequalification unavailable on the Wells Fargo site; however, you may receive a prescreened offer or find a match via CardMatch |

Tip: The Apple Card partially qualifies as a soft pull credit card. You can apply with only a soft pull of your credit report and see Goldman Sachs approval decision before you decide to move forward. Only after you accept an Apple Card offer will Goldman Sachs perform a hard pull of your credit.

Recommended Reading: What Does Frozen Credit Report Mean