The Free Credit Score

Before you can determine whether you have good, bad or excellent credit, you will get to check your credit score online.

Companies such as Credit Karma are offering free credit scores to users that sign up for their online service. Currently they offer the VantageScore credit score from TransUnion for free. This is one place to start.

You may also be familiar with the Free Annual Credit Report that is available under the Fair Credit Reporting Act. This allows consumers to check their credit report from each of the three major credit bureaus each year for errors – for free. To qualify for a free credit report you must visit annualcreditreport.com.

A credit report will list your current loans, credit cards, lines of credit as well as your payment history. Typically banks and other creditors use this information to determine your creditworthiness. In addition, credit bureaus like Experian, Transunion and Equifax use a sophisticated formula to turn your credit report into a credit score.

It is important to note that your credit score is different from your credit report. The federal government allows you to check your credit report from each of the three major credit bureaus each year for free, but not your credit score. You must pay to access your credit score which usually costs around $15.

What Is The Difference Between Fico Vs Vantage Scores

One way the two main credit score models differ is through their representation of your credit history. This is based on the method each model uses to pull your credit history.

A FICO credit score is determined by a snapshot of all the available credit history data when your score was originally created. A VantageScore focuses more on your credit history and informs lenders of your credit behavior.

Both types of credit scores use a variety of similar factors to generate your credit score. However, the defining difference is how much these factors influence your score. While both scores look at your credit history to examine your credit usages, balances, payment history, and inquiries, each score is influenced differently by each factor.

Why A New Credit Scoring System

So why did the three credit reporting companies, Experian, Equifax and Transunion, develop the new system in the first place? They say one reason is for consistency – FICO scores frequently vary when reported by the three different bureaus. They also say the new system is easier to understand; every hundred point range in the VantageScore system corresponds to a letter grade – A, B, C, D or F – that gives the consumer an instinctive feel for where their credit stands.

However, skeptics note that the main reason FICO scores vary among the three credit bureaus is because lenders don’t always report the same information on a borrower to all three – some lenders and creditors may only report borrower performance to one of them, for example. The new system doesn’t fix that.

A bigger reason is likely because the three credit agencies have to pay FICO’s parent company, the Fair Isaac Co., licensing fees for using the FICO system. Since they developed the VantageScore system, they don’t have to pay another company for using it – provided they can get lenders to embrace it instead of FICO as the primary system for evaluating consumer credit worthiness.

That doesn’t seem likely to happen, at least in the immediate future. Fannie Mae, Freddie Mac and the FHA all use rely on FICO scores for evaluating credit, and as they go, so goes the mortgage industry. At the same time, you may still encounter the VantageScore system from time to time, so it helps to understand how it works.

Recommended Reading: Which Credit Score Matters The Most

Keep Your Credit High

Regardless of the differences between FICO and VantageScore, the essential advice for keeping your credit score high remains the same:

- Avoid late payments. Pay your bills, and pay them on time.

- Keep your credit balances low. Dont max out your credit cards, and try to keep your cumulative balance to less than 30% the lower the better.

- Apply for new credit only when you have to. Dont open a bunch of new cards in a short period of time, and dont close old accounts without good reason.

What Determines My Vantagescore

Under the VantageScore model, the main factors for determining your credit score include:

- Total credit usage, including total balances andremaining available credit

- Payment history

- Age of credit history

- Number of recently opened accounts and creditinquiries

In general, the lower your credit utilizationratio is, the bettermeaning, dont carry much of a balance on your cards everymonth. Lenders also like to see that youre able to handle a mixture ofdifferent debts and that you make timely payments over the long term. And whileapplying for new credit can slightly drop your score temporarily, the number ofrecently opened accounts is the least important factor in determining yourVantageScore.

Also Check: Does Klarna Affect Your Credit Score

Who Can See My Vantagescore

Any lender who uses the VantageScore model tocheck the creditworthiness of potential clients or applicants can see yourVantageScore if you give them permission. This is usually done when you signthe application for a loan or another debt.

Other people who may be able to see yourVantageScore include landlords, employers or other entities who do backgroundchecks that include credit scores. Again, you generally have to give the otherparty permission to check your credit reporting and get access to your score.

Are Fico Scores And Vantagescore Different

Reading time: 3 minutes

- FICO;and VantageScore;are two different companies

- Both companies create credit scoring models

- Their models give different levels of importance to different information in your credit reports

Did you know you dont have only one credit score? There are many different credit scoring companies and credit scoring models, or differing methods of calculating credit scores. Credit scores are calculated based on the information in your credit reports.

Depending on which model, or even which credit bureau furnishes the information used in calculations, your credit scores may vary. Lenders and creditors may use your credit scores to help determine whether to approve your application for credit. Before approving you, they want to know: Whats the likelihood youll pay your bills on time? Lenders generally also have their own lending criteria, which may include other factors, such as your income.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation, or FICO, and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus Equifax, Experian and TransUnion.;

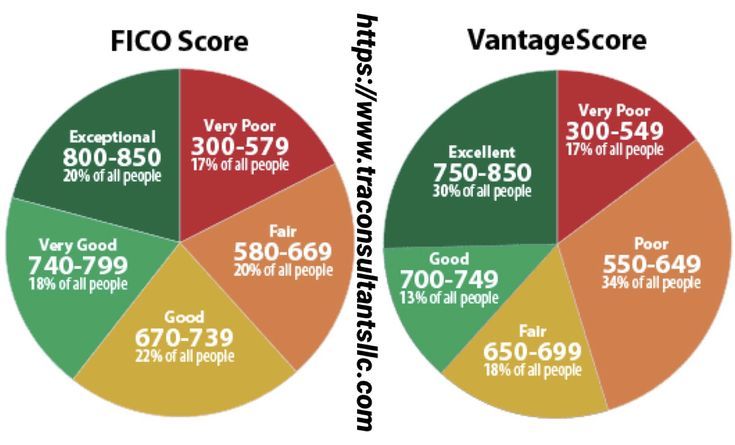

Both FICO and VantageScore assign higher credit scores to consumers deemed as lower-risk borrowers, and both currently range from 300 to 850.;

FICO scores are generally calculated using five categories of information contained in your credit reports, with varying weight given to each:

Recommended Reading: Does Experian Affect Your Credit Rating

The Complete Guide To Your Vantagescore

by Kailey Hagen | Oct. 11, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

This three-digit number shapes your life in ways you probably don’t realize.

VantageScore is a credit scoring model that lenders use to assess your financial responsibility. It’s essentially a grade, ranging from 300 to 850, with a higher number indicating a greater degree of financial responsibility.

Equifax Fico Vs Vantagescore Comparison Chart

I have been tracking my Equifax VantageScore with Credit Karmas free credit monitoring services.;

In addition, I have purchased MyFICOs credit monitoring service, which provides me with FICO scores for all three of the major credit bureaus; Equifax, Experian, and TransUnion.;

In the FICO vs Vantage comparison chart above you can see that Vantage in the blue line reacts much more extremely to credit report changes than the FICO credit score, represented by the orange line.;

Generally, the lines go up and down around the same time reacting to the same information, it is just that the VantageScore 3.0 is more volatile.;

Interestingly, the early large dip in March was due to me disputing my Equifax credit reports.;

You can read more about how my Equifax Dispute lowered my credit score almost 70 points around March 12, 2019!;

Also Check: Does Checking Your Credit Score Affect Your Credit Rating

How Does The Vantagescore Credit Model Work

Before credit scores were created, a lender would have to read through a borrower’s credit history and make an individual determination of an applicant’s likelihood of repaying a loan. This took not just a lot of time, but also a significant amount of training and skill. Credit scores streamline this process by summarizing a person’s entire credit history to a single number, and therefore lenders are able to automate a portion of the process of approving a loan while ensuring a consistent, objective formula is always being used to make these decisions.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Read Also: What Is My True Credit Score

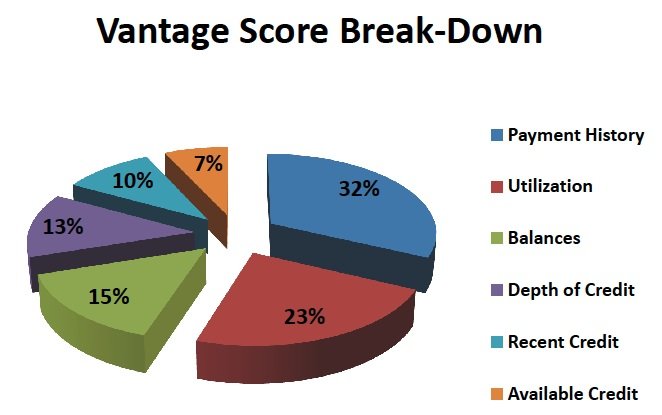

How Is Your Vantagescore Calculated

The way your VantageScore is calculated depends on which version of the score you’re using. The VantageScore 3.0 is the best-known version, but the credit bureaus released the VantageScore 4.0 in 2017. The new model considers your credit reports in a slightly different way.;

Here are the factors that make up your VantageScore 3.0:;

| Factor |

Data source:VantageScore Solutions.

Payment history looks at whether you pay your bills on time. This is where late payments hurt your score. The later the payment and the more late payments you have, the more serious the impact on your VantageScore. How recently you made a late payment also matters. They stay on your credit report for seven years, but their effect diminishes over time.

Depth of credit looks at the age of your credit accounts. This includes your average, oldest, and youngest account age. Older account ages help your VantageScore because they give lenders a longer-term view of how you manage your money. This helps them make more educated decisions about whether or not to lend to you.

The depth of credit category also looks at the type of credit accounts you use. There are two main types: revolving and installment debt. Revolving debts have a monthly spending limit, but your actual bill could vary. are the most common type of revolving debt.

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

How To Make Sure You Get The Right Score

So with so many credit scores floating around, how can you make sure youre looking at the right one?

Well, the first thing is to recognize that when you get a free credit score from issuers or third-party services like Credit Karma, youre likely getting whats called an educational credit score.

This credit score is pulled using a soft inquiry, which doesnt give a full, up-to-date picture of your current credit score. Your educational score is just for you to have a general idea of your creditworthiness so you know where you can improve its not the score most lenders use when assessing accessing whether to approve you for a line of credit.

FICO is by and large the most commonly used type of score pulled by lenders. So when you are checking your credit score, thats the type of score that will give you the number most similar to the score lenders are likely seeing. This is especially true for mortgage lenders, who have been slow to adopt any other scoring methods outside of FICO.

While VantageScore models are becoming increasingly popular , they are mostly used for educational purposes, prequalification screenings for credit cards and non-financial score checks .

For credit cards, specifically, issuers may pull your VantageScore alongside your FICO score when looking at your application. However, your FICO score is still going to be the most commonly looked-at score overall.

What Is A Good Credit Score The Credit Score Range

As I explore below there is no exact definition as to what is a good credit score. However, I do have some guidelines to go by that should serve to answer your questions about what is a good credit score, a bad credit score and everything in between.

Scores at the high end of the range will typically qualify for the lowest interest rate loans. Borrowers with excellent credit will usually get approved for credit cards and loans because they represent a low risk to the lender. On the other hand, borrowers with poor credit may not get approved because their credit report shows signs of missed payments, defaults or high credit utilization.

Read Also: How To Remove Items From Your Credit Report Yourself

How To Get Your Free Vantagescore

Many credit card issuers, like Chase and Capital One, give their cardholders free and easy access to their VantageScore.

You can also access your free VantageScore from the below two resources, whether or not you are a cardholder.

Check out this list of other free VantageScore providers through personal finance websites like Credit Karma.

Variance In Scoring Requirements

If you dont have a long history of credit, VantageScore is the score you want to monitor. Before its able to establish your credit score, FICO requires at least six months of credit history and at least one account reported to a CRA within the last six months. VantageScore only requires one month of history and one account reported within the past two years.

Because VantageScore allows a shorter credit history and a long period for reported accounts, its able to issue credit ratings to millions of consumers who wouldnt qualify for FICO scores. Considering how everyone from employers to landlords wants to see your credit score these days, if youre new to credit or havent been using it recently, VantageScore might be able to prove your trustworthiness before FICO has enough data to issue a rating.

Recommended Reading: Does Capital One Report Credit Limit

Only Open Account When You Need To

And keep them open as long as youre able to maintain them. Its best to minimize hard inquiries on your credit report, as each one causes your score to drop several points. If one credit account is dragging you down, you might want to consider closing it once its in good standing. However, keeping an account open can give your score a boost, even if youre using the available credit conservatively.

Similarities Between Vantagescore And Fico Score

Both VantageScore and FICO place the greatest weight on two metrics payment history and .

Both agencies use models of statistical analyses in order to predict the likelihood of the borrower paying a loan back on time or defaulting on it. In order to operate their models, they collate data from the consumer credit files compiled and maintained by the three credit rating agencies.

Both the credit rating services models numerically represent the risk of loan defaults by assigning three-digit scores. A higher score indicates a lower risk for the lender and vice versa.

Also Check: How To Unlock My Experian Credit Report

How Vantagescore Is Calculated

VantageScore 3.0 primarily considers overall payment history which is the most influential factor when generating a score as well as the age of each account, type of credit used and the percentage of a borrowers total credit limit thats been used. The amount of debt owed by borrowers is also considered to be moderately influential while available credit and recent credit behaviors are considered to be less influential.

Unlike FICOs older models, VantageScore also considers utility and rental payments, provided they appear on the borrowers credit history possibly helping people with little to no credit bulk up their reports.

See related: Adding rent payments to your credit report could help lift your credit score

The latest model VantageScore 4.0 also looks at trended data and considers your borrowing behavior patterns rather than just a snapshot of your credit in time. Additionally, it places less value on medical accounts in collection.

Tip: The credit bureaus hold reporting of medical debt for 180 days to allow time for insurance issues to be resolved. This means that scoring models wont use medical debt less than 180 days old.