When Do Credit Card Companies Report To Credit Bureaus

One reason theres so much confusion about when report to credit bureaus is that theres no clear-cut, universally applicable answer .

The good news? There are trends to look at that can help inform us as consumers.

Your balances are normally reported to credit bureaus on your statement date, says Tina Endicott, vice president of marketing and business development at Partners Financial Federal Credit Union. However, she notes, it may take a few days or even a week for the bureau to update your information.

This may depend on the bureau. Experian, for example, claims that your credit report shows the balance on your credit card at the moment it is reported by your lender . But different bureaus may update at different speeds and frequencies.

And while you can generally expect that your credit card activity will be reported to the bureaus at the end of your billing cycle, its not a hard-and-fast rule.

How often credit card companies report to the nationwide consumer reporting agencies depends on the , explains Nancy Bistritz-Balkan, director of public relations and communications at credit bureau Equifax.

It can be anywhere from quarterly to daily for an individual consumers information, depending on the choices and practices of the lender or creditor, she says. Most lenders and creditors report information at least once a month.

Other Factors To Consider

Nobodys financial situation is perfect, so dont place too much pressure on yourself to achieve 100 percent credit before applying with Citi. A well-rounded financial situation, a solid credit report, and a credit score in the good-to-very good range sets you on the path to showing Citi that you and your credit are a financial force to be reckoned with .

Us Bank Business Cash Rewards World Elite Mastercard

The;U.S. Bank Business Cash Rewards World Elite Mastercard has a generous cashback welcome bonus as well as useful rewards for a small business owner with everyday expenses.

With this card, you can earn;$500 cash back after spending;$3,000 in;first 90 days. And you also get a rewards rate of;3% cash back at gas stations, office supply stores, and on cell phone/service providers, and 1% cash back on everything else. You can read our U.S. Bank Business Cash Rewards World Elite Mastercard review for more details.

On top of that, if you’re carrying other business credit card balances, this card could save you on interest charges. New cardholders get a 0% intro APR on purchases for 12 billing cycles and a 0% intro APR on balance transfers for 12 billing cycles.

No Annual Fee & 0% Intro APR

Recommended Reading: How To Get A Bankruptcy Off Your Credit Report

When Will Your Credit Card Issuer Report To Bureaus

I am a patient man. Yet I am becoming spoiled by the speed of customer service offered by the tech companies. When I pay my cellphone bill using my phone, I get a confirmation before I can tap the big red button to end the call. Im used to Amazon and Apple answering calls without having to hear how important my call is, but I still have to wait for the next agent.

So, if I can have stuff delivered in less than 24 hours, you would think that my credit file must be updated as soon as I make a charge or pay my credit card balance. If you did think that, you would be wrong. So when do they update credit reports? The problem with this question is that there is no set time frame for reporting.

This may seem strange to you. After all, there is no ambiguity in when your bill is due. The due date is clearly shown on your monthly statement and is something you must pay attention to if you are going to take care of the No. 1 factor in your FICO credit score, payment history. Paying your bills on time and as agreed is crucial to scoring the most points in this category. You have to know when the bill is due so you can make it on time.

Many card issuers report shortly after the end of the billing cycle. This date will likely be several days or even weeks before your payment due date. This puts another wrinkle in the system because your billing cycle is tied to when you opened your credit card account. Those dates can be all over the map .

What It Means To Report

If your business card activity not just the hard inquiry for opening the account, but your actual account activity on an ongoing basis appears on your personal credit report, it will have the same impact as the rest of your credit cards. For issuers that report business card activity to personal reports, theres one major exception to this rule: If you have employees and they have access to your business credit card as authorized users, it should appear on your credit report only, not theirs.

About two-thirds of your credit score;is determined by just two factors: Your payment history and what you owe. You can control the first by always paying your bill on time. You can somewhat control the second by paying your bill in full.;But even if you pay your bill in full and on time, the issuer may report your account status to the credit bureaus before your monthly payment clears, meaning your ;may be reported to be higher than you might think it is. The ratio basically the amounts you owe versus the total credit available to you could impact your credit score and your creditworthiness.

Also Check: How Long Do Late Payments Stay On Your Credit Report

When Does Capital One Report Credit Utilization To Bureaus

by Eric Volkman | Jan. 21, 2019

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Naturally, the three national credit bureaus — Experian, TransUnion, and Equifax — don’t calculate your credit score from thin air. In order to do that, they need fresh and consistently updated data from your credit issuers.

If you’re a Capital One credit card holder, you might be wondering when that occurs. Like many of its fellow creditors the company reports your information on a regular basis to the three bureaus.

In this article we’ll first nail down when the issuer does this, and what it reports. We’ll then zoom out to look at the hows, whens, and whys of issuer reporting. Finally we’ll explore what’s important about your credit utilization — and what you can do to improve it.

Which Credit Bureaus Banks Check

When you apply for a credit card, the issuer contacts a credit bureau to purchase a copy of your credit report. Included in your report are the five categories mentioned above.

Youll notice one credit-report category, which counts for 10% of your score, is called new credit. If you have too many credit applications opened within a short period of time, it may affect your credit score negatively.

Imagine the following scenario: Youve filled out several applications for new credit in the last 12 months. These applications show up on your credit reports as hard inquiries and could potentially damage your credit scores.

You then decide to apply for another new credit card. In addition to your score potentially taking a hit, you might experience another dilemma. The bank processing your application might be concerned about why youre applying for so much new credit in a short period of time. As a result, theres a chance you could be turned down for a credit card even if your credit score is in good shape.

Knowing which credit reporting agency card issuers use to pull reports might help you avoid this problem. By understanding this concept, you can time your applications in such a way that you improve your approval odds for the credit cards you want.

Unfortunately, credit card companies dont openly reveal which credit bureau they favor. However, there are online resources that gather customer feedback to gauge which issuer uses which credit bureau.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

Pull Back The Curtain On Your Business Credit To Find Better Financing

Ready to see your credit data and build stronger business credit to help your business get financing? Check your personal and business credit for free.

Have at it! We’d love to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and protect yourself. Refrain from posting overtly promotional content, and avoid disclosing personal information such as bank account or phone numbers. Reviews Disclosure: The responses below are not provided or commissioned by the credit card, financing and service companies that appear on this site. Responses have not been reviewed, approved or otherwise endorsed by the credit card, financing and service companies and it is not their responsibility to ensure all posts and/or questions are answered.

Calculating Your Credit Utilization

To calculate your CUR,;divide your total outstanding balances across all your cards by your total credit limit. Then, multiply by 100 to get the percentage.

For example, if you carried the average credit card balance;of $6,194 on your card and also had the average credit card limit;of $22,751, you would divide the first by the second and multiply by 100. This would give you a CUR of about 27%.

Whether you have a utilization rate near the average 27% or not yet below 10%, there are always small moves you can make to lower yoursand;see a boost in your score.

Recommended Reading: Does Requesting A Credit Report Hurt Score

Chip Lupo Credit Card Writer

The Citi® Double Cash Card 18 month BT offer reports to the credit bureaus monthly, within days after the end of a cardholders monthly billing period. Citi Double Cash Card reports the cards credit limit, account balance, payment history, and more to all three of the major credit bureaus: TransUnion, Equifax, and Experian. Citibank may use a specific credit bureau more than another, depending on the applicants home state, and other factors.

Once Citi Double Cash Card reports your account information to a credit bureau, it may take a few days before the updates appear on your credit report. New Citi Double Cash Card cardholders may not see any new credit account info on their credit report for one or two billing periods after getting a card.

If youd like to review your up-to-date and TransUnion credit report, you can on WalletHub. That way, youll be able to check every day to see if theres any new information about the Citi Double Cash Card on your credit report.

When does Citi report to credit bureaus?

Citibank reports to the credit bureaus once a month, typically 30 days from the statement closing date. So, if your billing cycle ends on the 15th of every month, Citibank will report information on your credit card balance on or around that date.

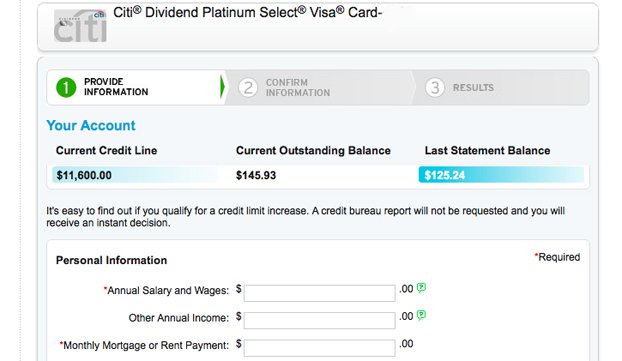

How do I get a Citibank credit card limit increase?

How to get a Citibank credit card limit increase online:

Citibusiness / Aadvantage Platinum Select Mastercard

The CitiBusiness / AAdvantage Platinum Select Mastercard is a great choice for small business owners that routinely travel with American Airlines.

It provides cardholders with a 65000-mile bonus for new cardmembers who spend $4,000 or more on the card within the first 4 months of opening the account.

It also has a generous rewards program offering 2X miles for many different kinds of spending companies commonly do, including American Airlines purchases, and purchases from telecommunications merchants, cable and satellite providers, car rental merchants, and gas stations.

Frequent American Airlines travelers will also benefit from a free checked bag on American flights, preferred boarding, and 25% savings on in-flight food, beverages, or WiFi purchases. This card also charges no foreign transaction fees. These perks more than make up for the card’s $99 annual fee. Check out our;CitiBusiness / AAdvantage Platinum Select Mastercard review for more details.

Double miles on American Airlines purchases

Also Check: How To Get Charge Offs Off Of Your Credit Report

This Card Is Best For

- Motivated to create positive credit historyCredit Builder

The Citi Secured Mastercard is best for people who don’t have an established credit history and want to increase their credit scores. It has no annual fee, so theres no cost to signing up for the card beyond the security deposit. And, Citi offers some useful tools, like the Citi Credit Knowledge Center, so you can learn about managing your credit.

If youre approved for an account, you can get a secured card with a $200 security deposit. If you graduate to an unsecured credit card within 18 months, or if you close your account, your security deposit will be refunded to you.

Lines Between Personal And Business Can Blur

When business credit card activity shows up on your credit reports, its treated the same as any other credit card debt by both the FICO and VantageScore credit scoring methods. Data from that account will affect your length of credit history, credit utilization and payment history, among other factors.

Assuming you have a card that reports to both commercial and consumer credit bureaus,;what should you expect?

-

If you pay on time and stay well under your limit:;The account may improve both your personal;and;business credit scores.;This could make it easier to qualify for loans on good terms;and negotiate government contracts.

-

If;you miss a payment;or use too much available credit:;The account could;hurt both your personal and business credit scores. Even if you close your card, its;history could stay on your personal credit reports for up to 10 years.

When you apply for a;new business credit card, it typically;shows up on your credit reports as a hard inquiry, regardless of how it reports afterward.;This could temporarily ding your credit, but it doesnt;necessarily indicate the issuer will report the card’s activity;to consumer credit bureaus.

» MORE:;Business credit score 101

Also Check: How Long Does Debt Settlement Stay On Your Credit Report

Which Credit Cards Help Authorized Users Build Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Adding someone to your credit card as an is a simple way to potentially buoy their credit scores, assuming youve paid the account on time and havent used too much of your available credit. But to make this strategy actually work, youll want to be sure that information about that account is included on their credit reports. Otherwise, adding someone to your card whether its a child, partner or parent wont do a thing for their scores.

Getting that same account to appear as a “tradeline” on your authorized users credit reports will depend on two major factors:

Ultimately, if you want to help someone establish a credit history by adding them to your account, you can save time and energy by knowing beforehand about how issuers and bureaus handle this information. After all, you dont want to add someone to an account in an effort to help their scores, only to find out months later that it had no effect.

» MORE:;View authorized user purchases with these credit cards

Bogdan Roberts Credit Cards Moderator

Citibank reports to the credit bureaus once a month, typically 30 days from the statement closing date. So, if your billing cycle ends on the 15th of every month, Citibank will report information on your credit card balance on or around that date.

But when the information Citibank reports to credit bureaus actually appears on your credit report is a different story. Credit bureaus, in theory, report the balance on your Citibank credit card as soon as it’s received. Realistically, it can take up to a week, or sometimes up to two months, or billing cycles, for a new account.

It’s important to know when Citibank and other banks report to the credit bureaus. If you’re trying to boost your credit score in order to make a major purchase such as a mortgage, you’ll want to make sure any positive information is reported. Also, if there’s a dispute on your Citi credit card account that’s been resolved, you’ll want to confirm that information is removed.

The problem is, not all issuers report your activity, positive or negative, to credit bureaus. Those that do, may not report to all three of the major credit bureaus. Citibank reports to all three of the major bureaus: Equifax, Experian, and TransUnion.

Also, consider paying your Citi credit card bill well before your statement closing date. That way, the snapshot of your balance will be lower when it’s reported. A low balance helps your , which in turn, boosts your credit score.

You May Like: How Long Does A Repossession Stay On Your Credit Report

A Quick Note On Credit Utilization

One way to improve your credit is to pay down revolving debt, such as credit cards, says Endicott.

You may pay down your debt and not see an improvement right away. Before applying for any new credit, you may want to make sure your lower balances are reflected on your credit. Keep in mind that many factors determine your credit scores, and paying down your revolving debt doesnt guarantee higher scores.