Focus On Small Regular Payments

Your payment history is the biggest single factor that makes up your credit score because it comprises about 35% of your scores calculation. This means that one of the quickest ways you can raise your score is to make minimum payments on all of your accounts every month. Ideally, you should also pay off each of your outstanding credit card balances before theyre due. This lowers your revolving utilization and helps you save on interest in the long-term.

Take control of your credit cards and create a plan to make minimum payments on all of your accounts every month. Most credit card companies allow you to set email or SMS alerts to get a notification when a minimum payment is due soon, and you can even schedule auto-payments in advance with most cards so you never miss a payment date again.

If you have cards open but you dont use them, resist the temptation to close them. Closing credit lines lowers your available credit and increases your revolving utilization percentage. Instead, charge a small item like a cup of coffee or a pizza dinner once a month and pay your bill off immediately.

A Guide To Credit Scores

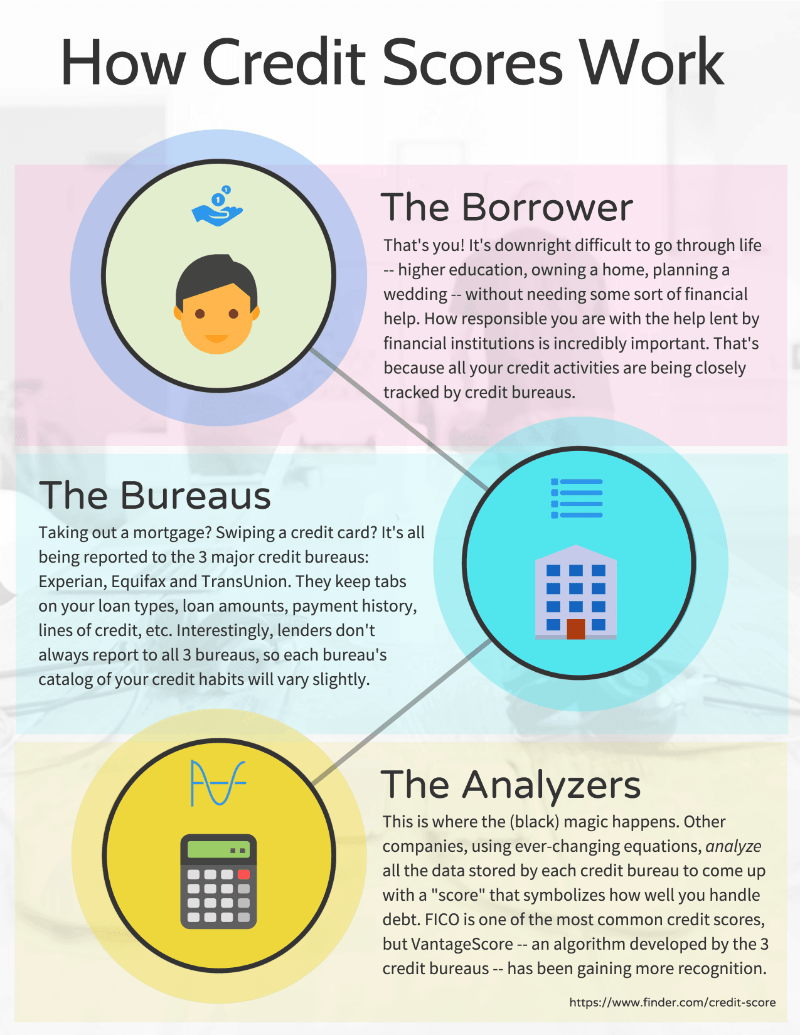

Your credit score three numbers that hold considerable sway over your financial life is often the first thing a lender wants to see before considering giving you a loan.

Your credit score can seem mysterious or even random, but you have more control over it than you may think. Understanding what a credit score tells lenders and how its different from a credit report is the first step to taking control. Here’s what you should know.

How Your Mortgage Rate Is Set

Interest rates are set partly based on your riskiness as a borrower. The riskier you are to a lender, the higher your interest rates will be. Mortgage lenders use credit scores to determine whether you qualify for the mortgage and to determine risk and the likelihood that you will default on your mortgage loan. The higher your credit score, the lower the risk that youll default on your loan, and the lower the interest rate youll qualify for.

A high credit score demonstrates responsibility with your previous credit obligations. Youve made your payments on time, youve kept your balances low, and youve avoided major credit blunders like debt collections and charge-offs.

A low credit score, on the other hand, is the result of falling behind on credit card payments, keeping high balances, and perhaps having major delinquencies on your credit record.

This chart illustrates the relationship between credit scores and interest rates, and how one impacts the other:

Also Check: How Long Does Debt Settlement Stay On Your Credit Report

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

You May Like: When Do Credit Cards Report Late Payments

Option 2: Apply For A Card Marketed Toward Consumers With Poor Or Average Credit

In addition to secured cards, there are some other credit card options for people with no credit or poor credit who don’t want to or are unable to put down a deposit. After you open a credit card, make sure you spend within your means and pay your balance on time and in full. In some cases, like with most Capital One cards, paying your bills on time for several consecutive months will automatically entitle you to a higher credit limit .

Here is our top pick for the best credit card for;building credit:

Raising Your Credit Score

There are several ways to improve your credit scores. Although, if youve have any negative information, such as several late payments or bankruptcy, repairing your credit can take some time. Still, the following tips can help anyone improve their numbers.

Also Check: Does Requesting A Credit Report Hurt Score

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Tip 1: Pay Bills On Time And In Full

Payment history is the most important factor making up your credit score. If you miss a payment, it will show up on your credit report, and multiple missed payments can make it impossible to achieve an excellent score. For this reason, you should always pay at least your minimum payment.

It’s also a good idea to pay off your bill in full each month to avoid potential;late payment fees, penalty;;and interest charges that often result from carrying a balance.

As a rule of thumb, set up autopay for at least the;minimum payment, so you can avoid forgetting a payment. You can also schedule email, text or push notifications through your card issuer.

If you struggle to remember to pay your bills each month , there’s an easy fix: autopay. If you’re not sure you’ll be able to pay your bill in full, you can set it so you just pay the minimum as a safeguard to avoid missed payments.

Here are some tips:

The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments, matter less as time passes. So start now and stay consistent.;

Some credit building credit cards reward cardmembers with an automatic credit limit increase after they make six on-time payments. An example is the;Capital One® Platinum Credit Card.

See our methodology, terms apply.

Also Check: What Does Filing For Bankruptcy Do To Your Credit Score

What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

Keep Old Accounts Open And Deal With Delinquencies

The age of credit portion of your credit score looks at how long you’ve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts youre not using, dont close them down. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. If you have an account with multiple late or missed payments, for instance, get caught up on the past due amount, then work out a plan for making future payments on time. That wont erase the late payments, but it can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to pay off those accounts in full or to offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsbankruptcies for 10.

Recommended Reading: How To Get Charge Offs Off Of Your Credit Report

Mortgage Rates By Credit Score

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance.;He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer.;His background in tax accounting has served as a solid base supporting his current book of business.

Your credit score is one of the most important factors when applying for a mortgage. It influences your monthly mortgage payment, the total amount of interest you pay on your mortgage loan, and ultimately the total amount you pay for your home. Because your interest rate is based on your credit score, you should make sure your credit is in the best shape possible before applying for a mortgage.

What Factors Affect Your Credit Score

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

How recently you have applied for credit:;When you apply for credit, a;hard inquiry on your credit report;may result in a temporary dip in your score.

Also Check: Does Bluebird Report To Credit Bureaus

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%;

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card can provide you with 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, that is not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out CNBC Select’s best credit cards for excellent credit.

Don’t Miss: Which Credit Score Is Correct

How To Check Your Credit Score For Free

Once you understand how your credit score is calculated, you should check your score. This will give you insight into what products you may qualify for and what interest rates to expect. If you have a low score, you can take steps to improve it. If you have a good or excellent score, you can work to maintain it.

Checking your credit score doesn’t hurt your credit, and even if you’re not applying for a new card or a loan, it’s smart to get into the habit of checking it regularly.;

Most credit card issuers provide free credit score access to their cardholders, making it easier than ever to check and know your score.

Some issuers, such as Citi and Discover, provide free FICO Scores, while others, such as Chase and Capital One, provide free VantageScores.

You can check your credit score in less than five minutes by logging into your credit card issuer’s site or a free credit score service and navigating to the credit score section. There will typically be a dashboard listing your score and the factors that influence it.;

FICO and VantageScore will pull your credit score from one of the three major credit bureaus, Experian, Equifax or TransUnion.

Here are some free credit score resources that you can access even if you don’t have a credit card yet:

- Chase Credit Journey: Free VantageScore from TransUnion

- Discover Credit Scorecard: Free FICO Score from Experian