What Are The Disadvantages Of Paypal Business Loans

While PayPal Business Loans can carry similar terms as a traditional business term loan, the repayment structure is different. Traditional business term loans carry monthly payments, whereas PayPal Business Loans automatically deduct payments each week. Its safe to say that weekly payments could pose more danger to your cash flow than monthly payments.

Like PayPal Working Capital, there is no benefit to paying off the loan early. You would still have to pay the same amount as if you paid on schedule.

Also, timely payments on business term loans usually raise your personal credit score. PayPal Business Loans only report payments to business credit bureaus, so your payments do nothing for your personal credit.

And though many business term loans carry personal guarantees, its not impossible to find a company that lacks this requirement.

How Experian Boost Works

Experian Boost is free to use and there are no existing membership requirements to sign up. To receive a boost, individuals create a free Experian account and navigate to the products page.

From there, users will be prompted to connect the bank account they use to pay their bills. For those wary of granting third-party access to their account, Experian explains that its product can access only read-only data from a bank, and doesnt have access to any of the funds. Once an account is connected, the feature scans transactions for on-time utility, cell phone and streaming video plans, including Netflix, HBO, Disney+ and Hulu payments. Experian needs at least three months of payments within a six-month window.

Experian Boost shows users which bills are pulled and when they were paid. The feature only pulls positive payment history, which means it wont report any negative information that could lower your credit score. Users also have the option to exclude any payments they dont want to be added to their file.

Read More: How to Review Your Credit Report

Does Paypal Credit Affect Credit Score

The first time I ever found out about credit scores, I was dumbfounded: my ability to take out a credit mostly relies on⦠this number?

I quickly started consuming as much content as I could on credit scores and researching tactics to get it as high as possible. I signed up for my first credit card, joined the electoral roll and fixed all the errors on my report.Â;

Why am I saying all this? The point is, I put in quite a bit of work to make sure a low credit score wouldnât be the reason I would get a bad rate on my future mortgage or business loan. Itâs possible that you have too, and thatâs why youâre now doing your research to make sure PayPal Credit doesnât undo the hard work youâve put in maintaining your credit score.Â;

Although PayPal Credit may seem like a good alternative to other credit methods, itâs still important to be aware of how it could impact your ability to take out credit in the future. Because yes, PayPal Credit will affect your credit score. Letâs dive into this a bit deeper⦠ð

Don’t Miss: When Do Credit Cards Report Late Payments

Use A Credit Repair Company

Depending on how complex your credit issues are, you might want to look into working with a credit repair company.

With one of these companies, youll get expert service tailored to your unique credit profile.

Theyll determine which issues are impacting your score the most and work to remove inaccuracies.

That means you dont have to worry about filing disputes yourself.

In addition to dealing with inaccurate entries on your report, they can assist you with:

The Bottom Line On The Paypal Cards

The PayPal credit and debit cards can certainly be useful, and the reward rates for the credit cards are competitive. But with more payment methods on the market than ever, you may find some other options that give you more value than the PayPal cards .

You can often get introductory interest rates with credit cards. Or you may want to score a sweet signup bonus after being approved, but the PayPal cards dont come with anything like that. Depending on what youre looking for, perhaps youd just rather go with a different .

So take the time to survey your choices, and dont apply until you find a card that fits neatly into your spending habits and lifestyle.

Also Check: Does Bluebird Report To Credit Bureaus

Anybody Else Get An Email About Paypal Changing Terms

My dh got email, I have not yet but there seems to be some changes coming.

Some highlights:

Late Payment Fee: We are increasing the dollar amount to $28.00 . See the Fees section for more information.;;Not that we are ever late

Minimum Payment Due: We are increasing the dollar amount used in calculating the Minimum Payment Due for Standard Purchases, Cash Advances, and No Interest if paid in full purchases to $28.00 . See the Minimum Payment Calculation section for more information.: Synchrony Bank may report information about your account to credit bureaus. Please refer to the Credit Bureau Reporting section for more information.Does anything think this means they may start reporting the tradeline? The reason I think this might possible; is because it is listed as “changes to your account”, I have a feeling these tradelines won’t be hidden much longer.

Does It Affect Your Credit Score

Yes, applying for PayPal Credit affects your credit score. Thatâs because every time you undergo a âhard credit checkâ, your credit score takes a hit.Â;Â;

PayPal is partnered with a bank called Synchrony Bank, which will review your application and then complete an audit. This hard check will appear on your credit report for 2 years and could lower your credit score by a few points. Since 2019, PayPal Credit now reports information to credit bureaus. This means that if you miss a payment or are late, it might also get published on your credit report, further lowering your score.Â;

Does this happen even if I get approved? Yes, even if you are approved for PayPal Credit, you will be going through a full hard check. The more loan products you apply for, the more âfootprintsâ this leaves on your report and the more your score may decrease.

This will make it harder to get approved for future products such as a mortgage, credit or loans. Although one hard check wonât hurt your credit score too much, applying for several loans in a short period of time could reduce it by quite a lot.Â;

Also Check: How To Get Charge Offs Off Of Your Credit Report

Paypal Business Loans: Post Funding

PayPal will deduct payments from your business bank account every week. Though you can change the day of the week in which payments are deducted, you cannot change the frequency.

Its unclear if PayPal business loans have conditions similar to the catch-up payments or the 90-day rule with PayPal Working Capital.

What To Do If Theres An Account You Dont Recognize On Your Credit Reports

A PayPal Credit account thats recently showed up on your reports and negatively affected your credit scores could be an unwelcome surprise. If its legitimate, its unlikely youll be able to get it removed, but there are steps you can take to help your credit bounce back.

If you still dont recognize this PayPal Credit hard inquiry or account, your identity might have been stolen. Its important that you act immediately if you suspect this is the case.

Its a good idea to regularly check your credit reports youre periodically entitled to one free credit report from each of the three main consumer credit bureaus, which you can request at annualcreditreport.com. And there are other steps you can take to help protect yourself from identity theft, like creating strong passwords.

About the author:

Read More

Read Also: How Long Do Late Payments Stay On Your Credit Report

You’ve Got Some Closed Accounts

Your PayPal Credit or Bill Me Later account will show on your credit report as either active or closed. Regardless of how old the accounts were, if they were closed before Synchrony Bank took over, they were likely being reported for the first time.

If your PayPal Credit was active and in good standingâas in, you didn’t owe any moneyâand now it’s suddenly closed, this could be the work of Synchrony Bank. Now that SYNCB owns the accounts, they can not only raise and lower your credit lines, but they can also close your account for inactivity. Â;

If you haven’t used your account for a year or more, the creditors won’t make any money off your transaction fees. That’s why they’ll close your account due to inactivity. It’s also the most common reason for closed accounts. Either way, it’ll affect your credit score, and if you want your account reopened, you’ll need to contact them right away.

Once again, if you see an account that you don’t recognize, whether it’s active or closed, you’ll want to contact SYNCB and follow the steps above for reporting fraudulent activity.

Why Is Syncb/ppc On My Credit Reports

Some people report that their old PayPal Credit or Bill Me Later accounts are now appearing on their credit reports for the first time. So why the change?

When PayPal Holdings owned these accounts, it was likely not reporting on them to the bureaus. Now that Synchrony Bank has taken the accounts on, it seems that theyre getting reported to the bureaus.

There are a few different areas of your credit reports where you might see SYNCB/PPC heres how it might be showing up and what to do about it.

Read Also: A Credit Score Tells A Lender How

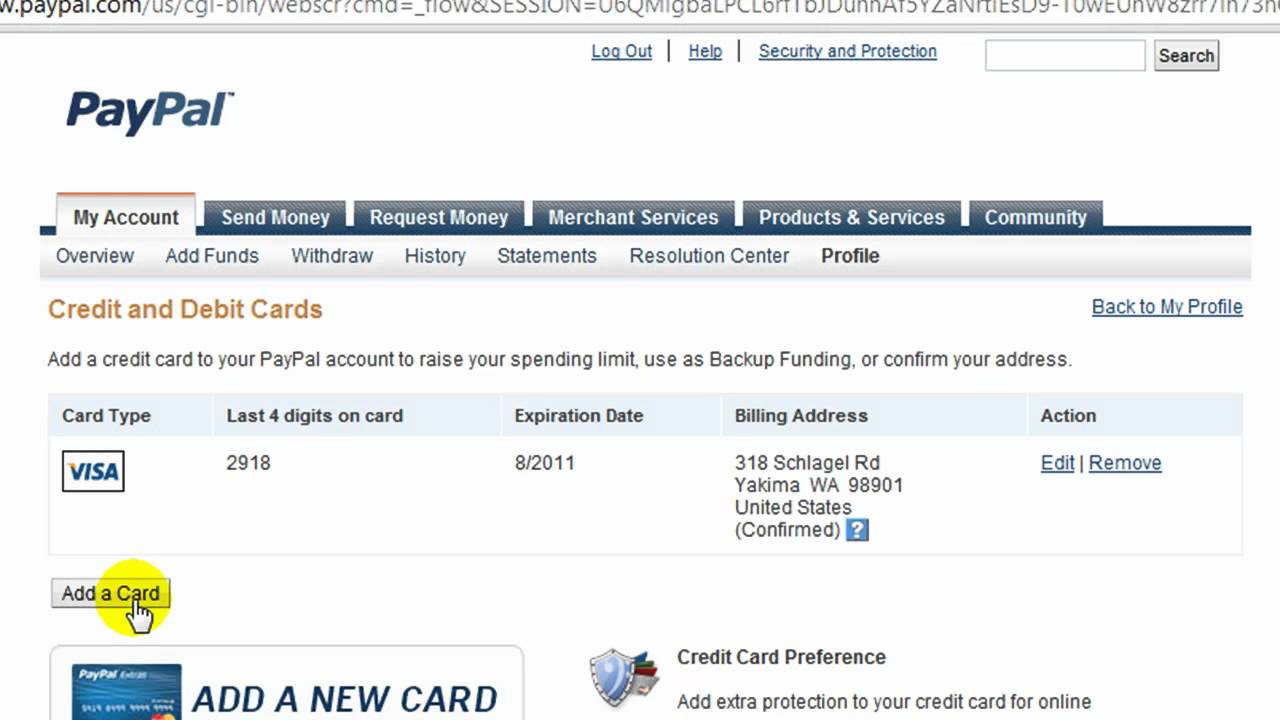

Applying For Paypal Credit

How do I apply for PayPal Credit?

When you apply for PayPal Credit, youll be asked to provide your date of birth, your income after taxes, the last 4 digits of your Social Security number, and agree to the Terms and Conditions. Youll know within seconds if you are approved. And heres the cool thing: your PayPal Credit account will be linked to your account with PayPal and youll see it as a payment option every time you check out with PayPal.

What if I do not currently have an account with PayPal?

What does Subject to Credit Approval mean?

Which Other Services Does Paypal Offer For Small Businesses

In addition to business funding, PayPal offers point of sale and checking account services. In other words, you can use PayPal to process payments, make payments, and store money . You can even get a PayPal debit card to make purchases from your PayPal account.

Businesses use PayPal mainly because its affordable, simple, and you dont have to maintain a minimum balance. PayPal also charges a flat fee of 30 cents per transaction plus 3% of the transactions total amount. This makes PayPal very advantageous for smaller businesses. PayPals top competitors include Stripe and Square, both of which use business models invented by PayPal.

Also Check: Does Requesting A Credit Report Hurt Score

Military Lending Act Disclosure Notice For Active Duty Military Members And Their Dependents

The following disclosures apply to you if, at the time your account is opened, you are a covered borrower as defined in the Military Lending Act, which includes eligible active duty members of the Armed Forces and their dependents.

Linking Paypal Credit And Paypal

How do I link my PayPal Credit account to my account with PayPal?

Linking your account is easy. You can link your PayPal Credit account to an existing account with PayPal if you have one. Don’t have an account with PayPal? Signing up for PayPal is free.

Why should I link my PayPal Credit account to my account with PayPal?

What if my account with PayPal is blocked or closed?

Read Also: What Does Filing For Bankruptcy Do To Your Credit Score

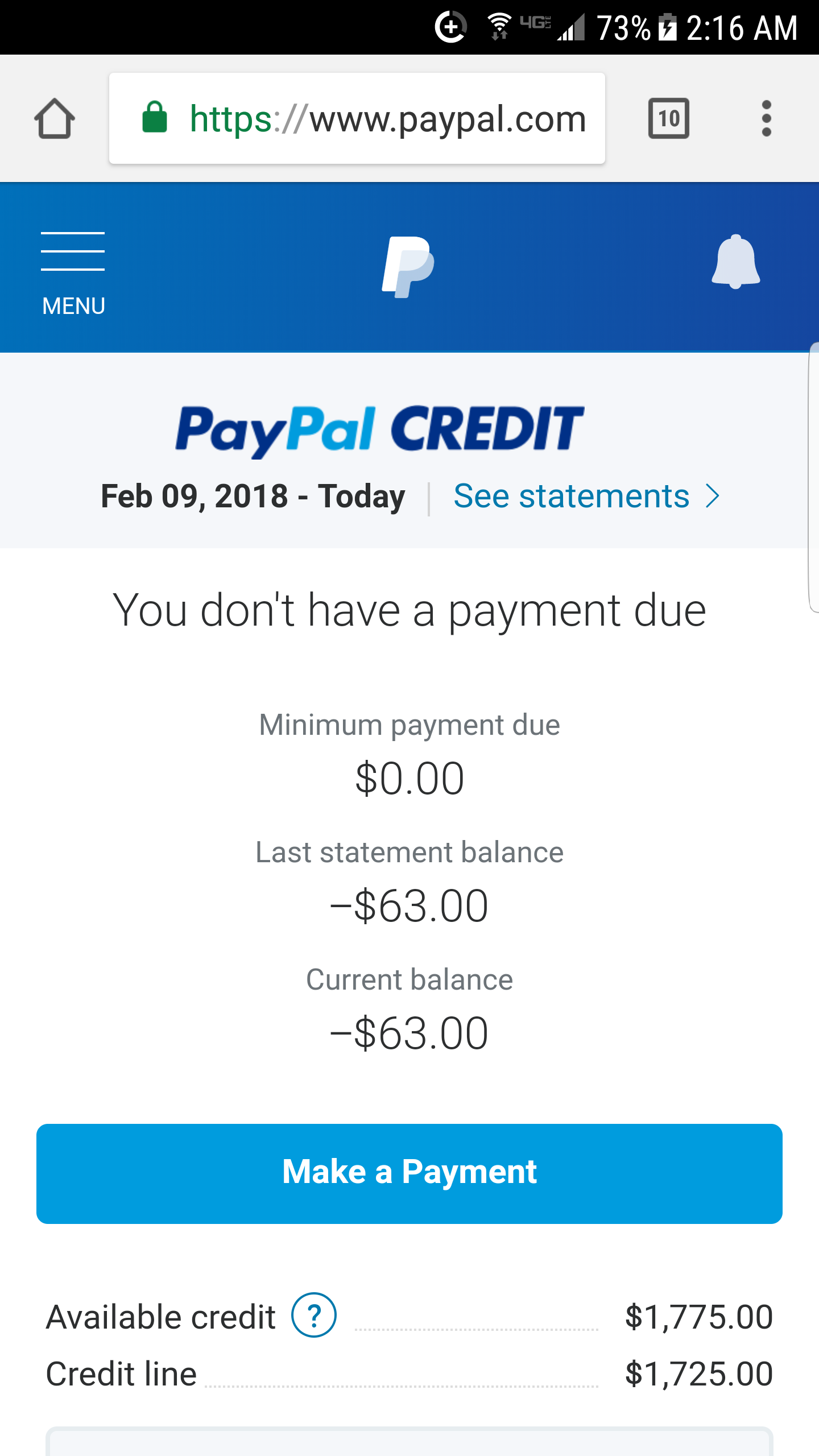

Paypal Credit Reporting To All Credit Bureau Only If You Don’t Pay High Clu On Paypal Credit

Does Paypal Credit Report your credit utilization ratio to the 3 major Bureaus?;

I ask because last year I had a Barcaly Card that I used to get zero apr for 18months on a 2800 dollar purchase, the card had a CL of 3000. That month my credit score dropped 20 points, I lost significant ground that month and the month after that untell I reached half and 30% utilization of that card by paying down the balance. Resently I paid off this balance but I would like to purchase my next credit building item, this time with out damaging my credit score.;

I have herd/read that paypal credit does not report high or full credit utilization to the credit bureaus? is this true?

I also herd that they only report if you don’t pay?

my reasoning for all of this is that I want to get a new item with out havig my credit score drop. Can I trust Paypal Credit to not drop my score with max credit utilization?

651730800Barclay 7250, AMEX 2000, Discover 6250, Cap OnePlat 3000, BestBuy 3000, Chase 3500, Paypal 4300, Walmart 1000, BOA 2000, Kohls 800, Target RED 500, Les Schwab 500, TOTAL 34900 OldestAc1.8 years

Dispute The Entry With Synchrony And The Bureaus

If youve never applied for a credit account with PayPal, it shouldnt be on your report. Theres a chance that the account could be there as the result of:

In either case, you should take immediate action by disputing the entry with the credit bureaus and Synchrony.

You can mail in a letter of dispute, which ensures you have documentation of your interactions with the bureaus.

You can also submit a dispute online or over the phone. If you didnt apply for an account or ever open one, your dispute should result in the removal of the account from your credit report.

With some disputes being time-sensitive, its important to stay alert to changes to your score as they occur.

To track your score, you should consider using a free credit monitoring platform. A service like Credit Karma can notify you anytime theres a change to your report or score, give you tips, and help you file a dispute.

You also get one full copy of your credit report per year from annualcreditreport.com for a more thorough look.

You May Like: What Credit Score Do You Need For Paypal Credit

Dealing With Delinquencys Aftermath

Once you become current on your bill, you will need to get to work on reversing the effects of delinquency. Delinquency is like a black eye on your because it signals consumer irresponsibility. However, the more you cover it up with positive usage information, the less glaring it becomes.

The best way to infuse positive information into your credit reports is to open a credit card, because information about credit card usage is reported to the credit bureaus on a monthly basis. Whether you make purchases and pay for them in full or simply maintain an open card with a zero balance, a credit card will provide you ample opportunity to demonstrate fiscal responsibility.

If your credit report contains a record of delinquency that did not occur, then you can send a credit report dispute to have it investigated and possibly removed.

Secured credit cards are particularly apt for credit improvement because to open one, you must place a refundable security deposit. This security deposit makes approval guaranteed, provides your issuer protection against default, and erases the need for an expensive fee structure. Additionally, since its also your credit line, the security deposit ensures that you cannot spend beyond your means.

What Is Paypal Working Capital

PayPal Working Capital provides additional working capital to businesses that use PayPal. The program is very similar to a merchant cash advance. Borrowers can receive up to 35% of their annual sales conducted via PayPal, with a borrowing limit of $125,000 and terms of up to 18 months. The debt is paid off via a percentage of daily sales towards the borrowers PayPal account.

Recommended Reading: Can You Have A Bankruptcy Removed From Your Credit Report

Knowing When Your Loan Is Reported

“Buy now, pay later” loans may or may not be reported to the credit bureaus, depending on the service you use. Its important that you read through the fine print to understand how the loan may affect your credit. If you use a service that does report to the credit bureaus, your payments will affect your credit score. Generally speaking, on-time payments will help your credit score, while late payments may cause your credit score to drop.

Having a newly opened account can also cause a drop in your credit score, because it lowers your average credit age. Over time, your credit score can rebound as the account gets older, as long as you handle your other credit obligations responsibly.

Check your credit report to verify that the payment plan is reported accurately. You can order a free credit report each year through AnnualCreditReport.com. You can also use a free service such as Credit Karma or Credit Sesame to watch how your installment plan is being reported. You can dispute errors with the credit bureaus or directly with the financing company by sending a letter.

Otherwise, if the loan isnt reported to the credit bureaus, your monthly payments will have no bearinggood or badon your credit score. Defaulting on the loan, however, can hurt your credit score if the lender ultimately sends the account to a third-party debt collector for payment.