What To Do If Youre A Victim Of Credit Card Fraud

Contact your financial institution immediately if your credit card is lost or stolen. Contact it if you find payments on your credit card statement that you didnt make or approve.

If you think youre a victim of credit card fraud:

- write down what happened and how you first noticed the fraud

- contact your credit card issuer to tell them about the fraud

- take notes of who you talked to and when you spoke to them

- keep all documents that you think might be helpful when the police investigate the fraud

- contact your local police service to file a complaint

- contact other accounts that could be tampered with by the person

Identity Theft Victim Checklist

This checklist can help identity theft victims clear up their records. It lists the actions most identity theft victims should take to limit the damage done by the thief. For more information, see the Web sites of the Federal Trade Commission at , the Identity Theft Resource Center at www.idtheftcenter.org, and the Privacy Rights Clearinghouse at www.privacyrights.org

Protect Your Information Online And Off

Shred any piece of paper that has your credit card number on it, and don’t write down your card number anywhere that thieves might be able to access it.

Also, be vigilant about protecting your card use online by only filling out card information on websites you trust. You can look for the lock icon in your browser’s address bar to be sure you’re buying from a secure site.

Don’t Miss: How To Increase Credit Score To 800

How To Use Donotpay To Learn About Police Investigations Of Credit Card Fraud

DoNotPay was designed to level the playing field and make important information available to the masses. If you have been victimized by a credit card fraudster and you need some further information on the matter, just follow these easy steps on the DoNotPay identity theft product page.

DoNotPay can help you

Getting the ball rolling with the local police

And that’s it. DoNotPay will make sure your issue gets sent to the right place. We’ll upload confirmation documents to your task for you to view, and if the contacts need more information, they will reach out to you personally via email or mail.

How Does Debit Card Fraud Happen

Debit card fraud can happen when a thief skims or swipes the information off the magnetic stripe on the back of your card to create a duplicate copy of your card. They also have to capture your PIN to access your account and withdraw money or make purchases.

Debit card fraud can also happen if your card is lost or stolen and you haven’t taken steps to protect your PIN.

Don’t Miss: Does A One Day Late Payment Affect Credit Score

Tips When Filing A Police Report

With luck, filing a police report will go smoothly. You can then concentrate on taking steps to recover from identity theft.

But some police departments may not be fully prepared to take your report. For instance, officers may be preoccupied with other crimes or unfamiliar with how to handle identity theft cases.

Here are some tips that can help.

- Be firm, but calm when seeking to file a police report.

- Try to remain flexible. The police may send you to a website to fill out a form, instead of taking your information in person.

- Contact your state attorney generals office if the police are unable or unwilling to take your report. States may have different processes for filing a report. An attorney generals office or website may be able to provide the details.

- Be specific. When you make a police report, give detailed information about the identity theft, such as dates accounts were opened in your name or who might have committed the fraud.

- Make copies of your identity theft police report and your FTC complaint. Youll need these to resolve any disputes with companies where the identity thief used your name.

Bottom line: Reporting identity theft to the police or the FTC is a smart step to take. It could save time and money as you recover from identity theft.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Start your protection now. It only takes minutes to enroll.

You May Like: Can Police Find Your Location On Cell Phone

How Does Credit Card Fraud Happen

A person can steal your credit card or credit card information by:

- Going through your garbage or mailbox to find credit card statements or other banking information

- Swiping your credit card through a device that copies the information stored on the magnetic stripe of your card

- Hacking into the computers of companies and stealing credit card information

- Installing small devices on payment terminals that record your credit card information

- Phishing, that is, sending you an email that looks like it comes from a real business asking for credit card information and/or

- Asking you to use your credit card on an illegitimate website to make a purchase.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Contact The Card Issuer

As long as you report credit card fraud quickly, you have no additional financial responsibility for unauthorized charges, and your maximum liability for each lost or stolen card is $50, according to federal law. In addition, youre never responsible for any charges if only your card number is stolen and used.

Heres how to report credit card fraud to your card issuer:

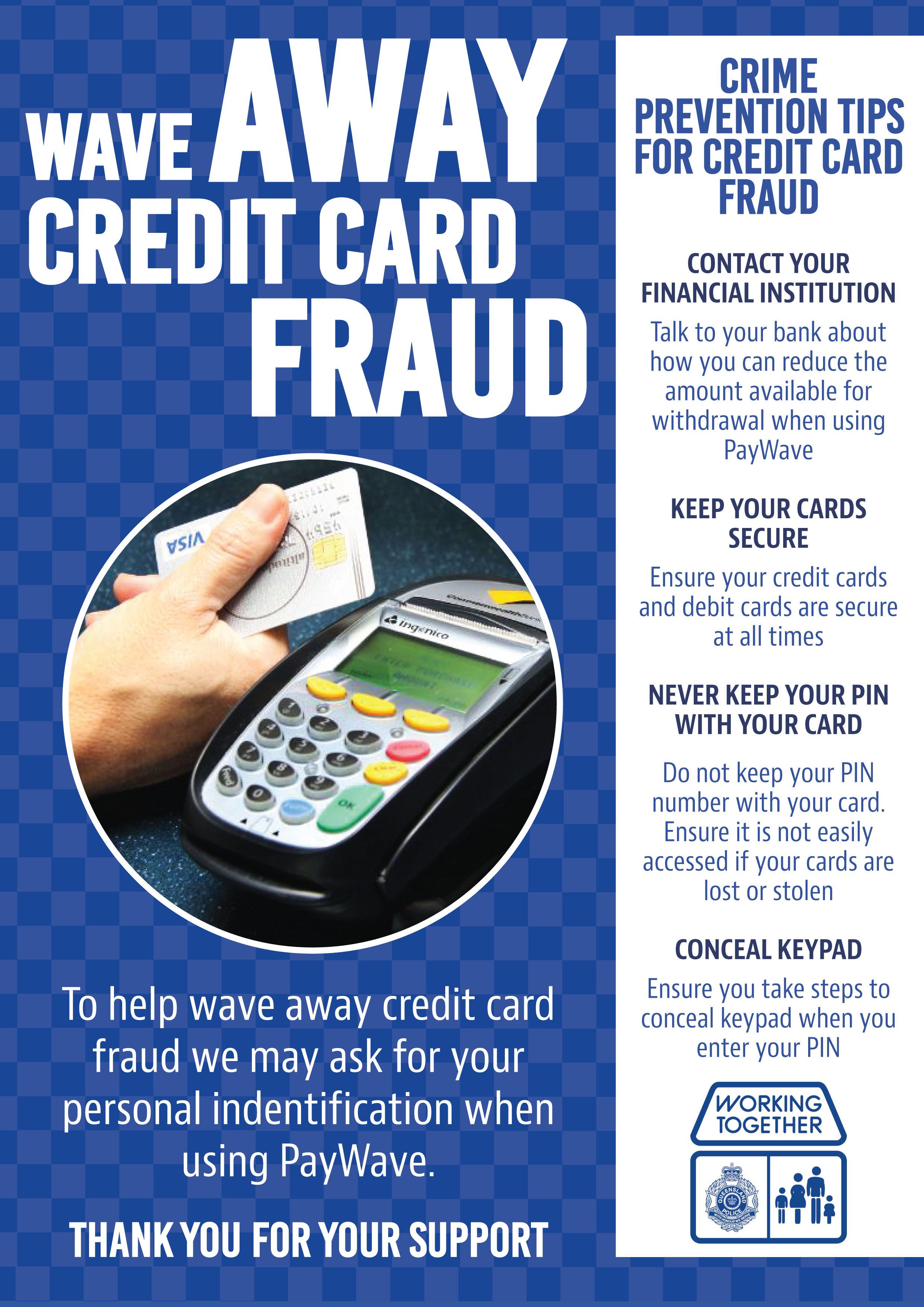

Tips To Prevent Credit Card Fraud

Remember these tips when using your credit card in public places or at places of business:

- keep your credit card in a safe place

- limit the number of credit cards you carry with you

- cover the keypad with your hand or body when entering your PIN so no one can see it

- keep your credit card in sight at all times when making a purchase

- report anything you think is suspicious about a credit card device at a business or ATM to the businesss head office and your credit card issuer

At home

Protect yourself from credit card fraud at home by doing the following:

- lock your mailbox if you can to prevent someone from stealing your credit card statements or replacement cards

- sign the back of a new credit card immediately after you get it

- destroy old credit cards that are no longer valid by cutting them up

- keep your credit card statements in a safe place

- shred credit card statements when you no longer need them

Online

When banking or shopping online, look for websites with addresses starting with https or ones that have a padlock image on the address bar. These are signs that your information will be secure.

Protect yourself from credit card fraud online by also doing the following:

Over the telephone

Legitimate credit card companies dont ask for personal information over the phone. Use the telephone number found on the back of your card when you want to contact your credit card issuer.

Protect yourself from credit card fraud when on the telephone by also doing the following:

In general

Read Also: Does Checking Credit Score On Credit Karma Lower It

How To Report Credit Card Fraud

If you spot unauthorized transactions on a card, the best way to report credit card fraud is to call your credit card issuer. Its safe and easy to use the number on the back of your card, since you know this is the official phone number. But, if you dont have your card, you can usually find the issuers phone number on a recent billing statement or by logging in to your online account.

Youll want to use the phone number associated with your account if possible, as this will reduce the number of security questions you need to answer. Once you get a representative, tell them that youve detected an unauthorized transaction on your account.

This same advice holds true if your card has been lost regardless of whether it has been used. Report it immediately in order to prevent that loss from turning into fraud.

What Is Considered Credit Card Fraud

The FBI defines credit card fraud as the unauthorized use of a credit or debit card, or similar payment tool , to fraudulently obtain money or property. In other words, if someone steals your credit card information or otherwise uses your credit card account for purchases or transactions you didnt authorize, thats credit card fraud. Credit card fraud usually happens in one of two ways:

- You lose your credit card, or your credit card is stolen, and then it is used to make purchases or other transactions either online or in-person.

- Your credit card account number and security PIN are stolen and used to make unauthorized purchases or transactions without your physical card.

Don’t Miss: Does Refinancing Hurt Credit Score

If You Are Contacted By A Debt Collector

Tell the debt collector that you are the victim of identity theft. Say that you dispute the validity of the debt. Say that you did not create the debt and are not responsible for it. Send the collector a follow-up letter saying the same things. Include a copy of your police report and of any documents youve received from the creditor. Write in your letter that you are giving notice to a claimant under California Civil Code section 1798.93, subsection that a situation of identity theft exists. Send the letter by certified mail, return receipt requested. If the debt collector is not the original creditor, be sure to send your letter within 30 days of receiving the collectors first written demand for payment.

Protecting Yourself From Credit Card Fraud

The growing prevalence of credit card fraud means there’s no surefire way to avoid becoming a victim, but common-sense precautions can help you avoid it:

- Guard your wallet or purse carefully when you’re out and about, and don’t leave credit cards unattended.

- Keep credit cards you don’t use in a safe place at home, instead of carrying them with you, and never carry your Social Security card unless you must , and put it back in safekeeping when you’re done using it.

- When shopping online, make sure the website is secure , and skip the option of storing your card number at the website.

- If asked to provide a credit card number, Social Security number or other personal information over the phone, verify you are talking to a person or company you trust. If the request comes from someone who called you, ask yourself if the organization they claim to represent should already have the information they seek. If in doubt, insist on calling them back and use a verifiable number.

- Take a look at the Experian Fraud FAQ and Fraud Alert Center for more information and tips on protecting yourself from credit card fraud. Experian will offer support by providing a free copy of your credit report, investigating disputed credit report information, and if fraud is verified, remove the information from your credit report.

You May Like: Why Is My Credit Score Dropping

What To Do Next

Keep copies of all reports you file, both with the police and with the FTC, as they may be needed again to combat new or reappearing fraudulent charges. You may want to provide copies to the credit reporting bureaus as part of your fraud alert file.

Tips

-

If you’ve experienced fraud, your first step is to protect your finances by putting a fraud alert on your credit report and freezing or closing your bank accounts and credit cards. You can freeze your account by contacting your bank. To place a fraud alert on your credit report, contact one of the three credit reporting companies â Experian, TransUnion or Equifax. After you’ve secured your accounts and credit, report the fraud to the Federal Trade Commission, then file a police report.

References

First Report To The Ftc

The first step after you lock down your accounts and credit is to file a complaint with the Federal Trade Commission online at ftc.gov. Fill out the FTC ID Theft Complaint form, which will grant you some protection against fraudulent information on your accounts and credit report. The FTC will provide you with guidance as to how you can stem the negative effects of the fraud and what steps you should take next. The FTC recommends filing a police report.

Read Also: How To Add Utilities To Credit Report

How To File An Identity Theft Report Online

Head over to IdentityTheft.gov and choose the prompt that best describes your situation.

Continue to click the appropriate responses, and the online wizard will automatically fill out your Identity Theft Affidavit .

According to the FTCâs privacy policy, you can choose how much personal information you feel comfortable providing. Everything you share will be entered into a secure online database.

Important Steps To Take If You Notice Any Red Flags

- Request a free credit report.

- Visit AnnualCreditReport.com which has data from the major credit bureaus: Experian, Equifax, and TransUnion.

- File an Identity Theft Report with the FTC.

- Report the Identity Theft to the Credit Bureaus.

- Consider a credit freeze.

- Notify your cellular carrier to prevent SIM swapping.

- Consider canceling all your bank accounts and credit cards.

- Immediately change the usernames and passwords to your online accounts.

Read Also: What Is The Best Credit Rating

Why You Should Use Donotpay

DoNotPay is your information hub for many services you may need. Look at these three reasons to trust the team at DoNotPay.

- DoNotPay is Fast

- DoNotPay is Easy

- DoNotPay is Successful

The number of identity theft/credit card issues resolved by DoNotPay continues to rise every day. Turn your credit card fraud problem into a success story using DoNotPay.

Immediate Steps To Take

- File a report with the police/sheriff in the jurisdiction in which you live and get a copy of the report for the credit reporting agencies, banks and credit card companies. You can file the report at the police station or file online.

- In Denver, you can file at www.denvergov.org/policereport.

- You can also complete the ID Theft Affidavit provided by the Federal Trade Commission at www.ftc.gov.

- Consider placing a Security Freeze or Fraud Alert on/in your credit reports. See below.

Also Check: How Many Years Does Something Stay On Credit Report

Reporting Credit Card Fraud

I am sorry if this not the appropriate place to ask my questions.

My ex-wife has obtained credit cards in her mother, father and brother’s name.

I was dropping of our child off at her house one day in February and there were mail addresses to her parents on the coffee table. She immediately said that her parents where moving and they are forwarding all the mail to her address. I didn’t think anything of it at the time. Edit: The parents did NOT move. They did NOT forward their mail to her address.

A few weeks later, she wanted to meet at a local grocery store for the drop off. She wanted to get some groceries as I kept our child occupied. When she was checking out her billfold dropped and I saw multiple credit cards with her mother’s name on them. The ex-wife said her mother was letting her use them to help pay some bills. There have been a few times where we changed the drop off at a store and every time she used a card that had her mother’s name on it. Last week, during a nightly video session with my son I heard a loud conversation between my ex-wife and her mother. In the conversation my ex-wife apologized to her mother about the credit cards, admitted that she open some in her brother’s name and told her mother to tell the credit card companies that it was fraud. I do not know if her mother did report it as fraud.

My questions.

Am I under any legal obligation to report this to law enforcement?