Why It Is Important To Understand The Highest Credit Score

Most peoples credit score falls into the fair category or worse, with an average of less than 621. Of 30-year olds, 38% have a score below 621, with 29% achieving a score between 621 and 680, but only 2% have a score of 780 or more. This makes it very clear that people can do a lot to improve their scores.

If you understand what the max credit score is and where your score is related to it, it helps you make improvements. It cannot be emphasized enough that you need a higher score if you want lower interest rates.

How To Improve Your Credit Score:

Another common question when dealing with credit scores is What can I do to improve my score? There are many ways to improve your credit score to the higher end of the scale. Some of these methods include:

- Cleaning up your credit report

- Paying down your balance

- Negotiating outstanding balance

- Making payments on time

Credit.org offers consumers help in managing multiple payments. With a Debt Management Plan, you have the possibility of joining these payments into one lump sum with a lower interest rate. Learn more by reaching out to one of our today!

Average Credit Score By Year

The average U.S. credit score can tell us a great deal about the health of consumers and the economy more broadly. Thats especially true when you examine credit-score averages over time.

For example, the average VantageScore credit score improved by 11 points from 2007 to 2015, reflecting our rebound from the Great Recession. And in more recent years, average credit scores have stabilized along with the economy.

Average Credit Score by Year

You May Like: How To Self Report Utilities To Credit Bureaus

What Is A Good Vantagescore Credit Score

A good VantageScore credit score is any score between 661 and 780. Higher scores are considered excellent.

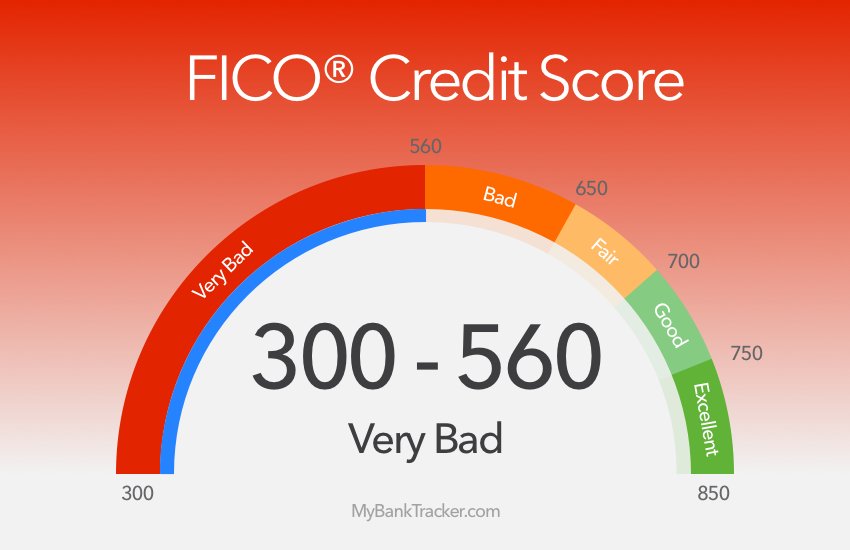

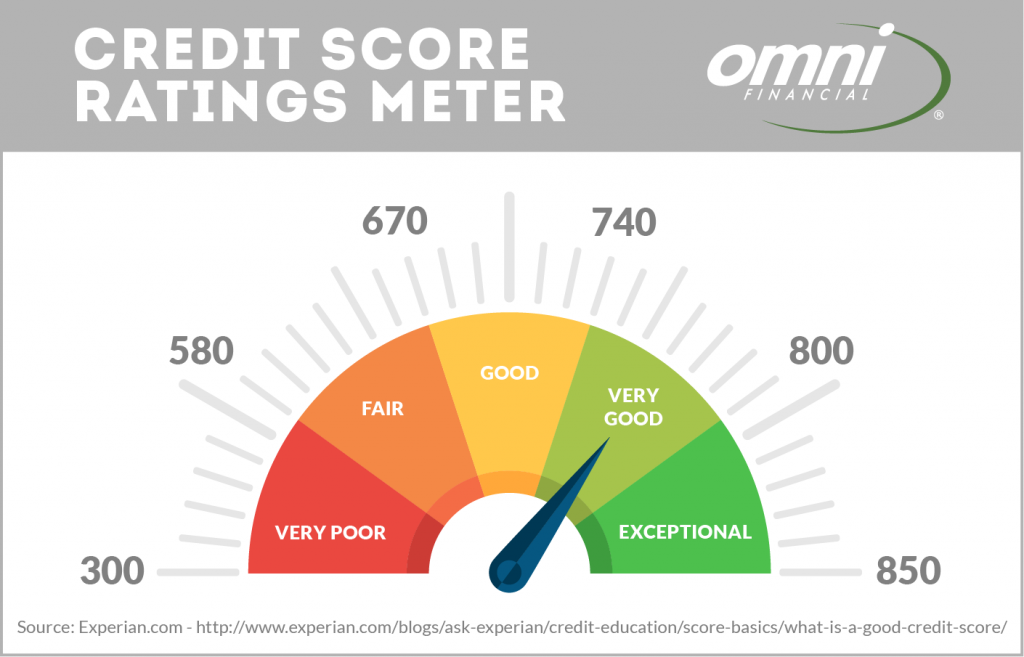

Like FICO scores, credit scores in VantageScores newest models also range from 300 to 850 and fall into the following categories:

| Very Poor | |

|---|---|

| 661 to 780 | 781 to 850 |

While VantageScores range for good credit scores is wider than FICOs, the average VantageScore in the U.S. is lower than the average FICO score, standing at only 694 as of July 2021.7

Nevertheless, most people still have a good credit score in VantageScores model 55% of people have a score above 700.8

How do you know if you have good credit?

The best way to find out the status of your credit is to check your credit report, which you should do at least once a year by visiting AnnualCreditReport.com. Youre usually entitled to get a free copy of your credit report from each credit bureau once every 12 months, but you can currently get your reports once per week due to the COVID-19 pandemic.

How To Boost Your Score If Its Lower Than You’d Like

If your credit score is lower than others in your age group, don’t fret. Your credit score can vary from month to month. Plus, getting your score at or above that average mark can be relatively simple by following a few credit score tips.

It’s not all about constantly increasing your score, either. You want to maintain a good credit score by avoiding mistakes that can lower your score.

Good credit builds a solid financial base, but its just one aspect of a healthy credit profile. Here are some ways to boost your credit score.

You May Like: What Credit Score Does Usaa Use For Credit Cards

Maintain A Good Payment History

Your payment history makes up 35% of your FICO Score and 41% of the latest VantageScore 4.0 model. Because it holds so much weight in both scoring models, its important to keep your monthly debt payments rolling in on time.

Remember, if you fall behind, your creditors cannot report your debt as late until its 30 days after the due date. As long as you pay within those 30 days, you will not get a late payment mark on your credit report.

This Is Why A Good Credit Score Is Important

A good credit score is important, because it helps you get access to credit. That means qualifying for the best credit cards with the best rewards and perks. Or getting a great interest rate on a mortgage or a car loan.

But it may surprise you to know that your credit score goes beyond getting loans. Your mobile phone company may review your credit, especially if youre using a postpaid plan. If youre a renter, your landlord will almost certainly look at your credit. When applying for insurance, insurers may review your credit. Employers, the government, and even retailers may also want to see your credit report or credit score.

This means that a good credit score isnt just about getting approved for a loan or getting a lower interest rate on an auto loan or mortgage. It may mean lower car insurance rates, getting an apartment rental application approved, or getting a mobile phone contract. It can even make a difference in getting hired for a new job. Yes, its true: Many employers in Canada use your credit report as part of their hiring process.

Simply put: Your credit history is important for a lot of reasons!

You May Like: How Often Does Discover Report To Credit Bureaus

Catch Credit Report Errors Early

Credit report errors can quickly turn a good score into a bad credit score, so its important to stay on top of your credit report. You can get a free credit report every year from all three major credit bureaus Experian, Equifax and TransUnion via AnnualCreditReport.com.

If you find any reporting errors that negatively impact your credit score, you can dispute them.

You can also monitor your credit more regularly through a wide range of free credit score and monitoring sites, like and .

Is A 736 Credit Score Good

A 736 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Recommended Reading: Remove Transunion Inquiries

Healthy Mix Of Credit Account Types

Having a mix of different types of credit boosts your credit score because it demonstrates your ability to manage different types of debt.

Specifically, a good credit score reflects a mix of these two types of credit accounts:

- Installment loans: This is a type of debt that you repay in installments, usually over a fixed repayment period. Installment loans can be secured loans or unsecured loans. The most common types of installment loans are auto loans, personal loans, mortgages, and student loans.

- Revolving credit accounts: This is a type of credit that you can repeatedly withdraw from up to a certain limit. Credit cards are the most common type of revolving account, although store credit and home equity lines of credit also fall into this category.

Open accounts are another type of credit, but they dont contribute to your . Although credit mix is one of the least influential categories that contributes to your credit score, having at least one revolving and installment account will still give your score a boost.

In general, how many credit cards and loans you should have depends on your financial situation. Its best to only open accounts that you actually need to keep your finances simple and avoid missing payments.

Opening New Bank Accounts

Banks may run a soft credit check when you apply for an account. Your credit score doesnt typically make a difference, but factors including payment history could.

More often, banks use a service called ChexSystems to check your bank account history. Thats mostly to make sure you dont have a habit of overdrawing accounts and walking away. Other marks on your credit report dont factor into that check.

Read Also: Procedural Request Letter To The Credit Bureaus

You’re Not Labeled For Life

There’s lots you can do to make sure you have a good credit score. Most important, make your credit card and loan payments on time. Thirty-five percent of the FICO score is based on your payment history. Check our other tips.

Those with thin or subprime credit histories might consider signing up for one or both of the new credit improvement programs, Experian Boost and the Fair Isaac Corporation’s UltraFICO. Boost, which launched in March, includes utility payments in the score calculation, and UltraFICO, expected to roll out nationally later this year, reviews banking history. For more information, check these new ways to improve your credit score.

Keep in mind that a major downturn in your luck or behavior could drop your credit score by 100 points, but it’s unlikely to dip it into the 300 range.

Indeed, McClary says he’s never actually seen a 300 FICO scoreor an 850 score, for that matter. The lowest score he’s ever seen was 425, he says, and in that case the holder had already been in bankruptcy and was delinquent with several creditors.

“Obsessing over perfecting your score might be a waste of time,” Ross says. “Your efforts should be more focused on maintaining your score within a healthy range.”

Challenge Mistakes On Your Credit Report

There may come a time where you discover an error on your credit report. Unfortunately, reporting mistakes can take a good credit score and put it into a lower range. In fact, significant enough mistakes could cause a bad credit score. This makes it essential to check your report for errors a couple of times a year.

So if youre wondering if your credit score can be wrong, the answer is yes if the credit bureaus have faulty information.

There is also the possibility that something fraudulent could take place on your account. If you find any errors or fraud, you need to file a dispute with the credit agencies right away. Getting credit report problems corrected will help ensure you maintain a good credit score.

If you wonder why credit scores go down, it is because you dont follow the practices mentioned here for getting the best results.

Read Also: Does Affirm Report To Credit Bureau

Why A Good Credit Score Matters For Your Money

A good credit score is a strong measure of your financial health, even if its not the whole picture. Its a quick, however imperfect, way to gauge your ability to manage money and keep up with major financial obligations.

Your credit score comes into play throughout your financial journey, including:

How An Excellent Credit Score Can Help You

An excellent credit score can help you receive the best from lenders and give you a higher chance of being approved for credit cards and loans.

Many of the best cards require good or excellent credit. If you want to benefit from competitive rewards, annual statement credits, luxury travel perks, 0% APR periods and more, you’ll need at least a good credit score. And if you have an excellent credit score, you can maximize approval odds.

For instance, if you’re looking to earn generous rewards on groceries and dining out, the American Express® Gold Card offers cardholders the chance to earn 4X Membership Rewards® points when you dine at restaurants and shop at U.S. supermarkets but you’ll need good or excellent credit. Terms apply.

And if you want to finance new purchases or get out of debt with a balance transfer card, such as the Chase Freedom Unlimited®, you’ll also need good or excellent credit.

Take note that even if your credit score falls within the excellent range, it’s not a guarantee you’ll be approved for a credit card requiring excellent credit. Card issuers look at more factors than just your credit score, including income and monthly housing payments.

Check out Select’s best credit cards for excellent credit.

Recommended Reading: Affirm Hard Credit Check

Things That Dont Influence Credit Scoring

The law prevents scoring formulas to consider any of the following information:

- How old you are.

- Your race, color, religion, national origin, sex, or marital status.

- Where you live.

- Your occupation.

- Who employs you, and how long you have worked for a company.

If you feel that you are not being treated fairly by a lender, you can reach out to The Consumer Financial Protection Bureau. This US government agency ensures that lenders, banks, and other financial institutions do not discriminate.

Dont Cancel Old Cards

Some credit card holders think that they should cancel their old credit cards to get that last push toward a perfect score. After all, more cards mean more opportunities to overspend right?

The truth is that closing old lines of credit can harm your credit score. When you close a credit line, you give yourself access to less credit and automatically raise your utilization. For example, imagine that you have a couple of credit cards and they each have a $1,000 limit. You put $300 on one card each month your total utilization is 15% . You dont use one of the cards at all, so you decide to close it. Even if you still spend $300 a month, your utilization is now 30% because you only have $1,000 of available credit.

Is a certain card tempting you to overspend? Keep it in a locked safe or desk drawer instead of closing it to maintain your score.

Recommended Reading: 641 Credit Score Credit Card

Applying For A Mortgage And Loans

Lenders use your credit score to determine your interest rate and loan amount when you apply for a mortgage or other kind of loan. The better your score, typically, the more you can borrow and at a lower interest rate.

Even though interest rates might only vary by a few percentage points, a lower rate can mean thousands of dollars of savings over the life of a loan, especially for bigger loans like mortgages.

Apply For Insurance And Credit Cards

Insurers can and will check your credit in most states, and theyll use your credit score to determine how much to charge you for your insurance policy. This is because insurance companies view your credit score as a good indicator of the risk that youll file a claim in the future.

A good credit score also gives you access to credit cards with low-interest rates and rewards. These cards can help you save money in the long term if used responsibly.

Takeaway: A good credit score is 670739 according to FICO and 661780 according to VantageScore

- Whats considered a good credit score varies depending on the scoring model used and the lender.

- A good credit score reflects a well-rounded credit history with a history of on-time payments and a low credit utilization rate.

- Having a good credit score can save you money on loans and credit cards by getting you the best interest rates. It can also save you money on insurance, and makes it easier to rent an apartment.

Article Sources

Don’t Miss: How To Unlock My Experian Account

You Dont Need A Credit Score Of 850 To Have An Excellent Credit Score

Experts agree that a credit score above 760 is considered an excellent credit score.

In fact, if you already have a score of 770 and are looking for a way to get your score to 800, you are wasting your time.

You are better off making sure you are contributing to your jobs 401k plan or learning how to invest your money.

Having a bullet proof budget wouldnt hurt either.

Heck, almost anything would be a better use of your time than trying to get your score up to 850.

How Can I Fix A Bad Credit Rating

You may be able to improve your bad credit rating by practicing responsible lending habits such as making payments on time. It could be worth consolidating debts to make your payments easier, which may improve your credit score in the long run.

There are also credit repair services that offer guidance and counseling to help improve your credit score. Keep in mind that credit repair services charge money and it may not be worth it depending on your circumstances.

Recommended Reading: What Does Syncb Ppc Stand For

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons: