Send A Request For Goodwill Deletion

Like pay-for-delete, writing a goodwill letter seems like a long shot, but its an option for borrowers who want to exhaust every possible alternative. Write to the creditor and ask for a Goodwill Deletion. If you have taken appropriate steps to pay down your debts and have become a more responsible borrower, you might be able to convince the creditor to remove your mistake.

There is no guarantee that your plea will get a response, but it does get results for some. This strategy is most successful for one-off problems, such as a single missing payment, but it may be futile for borrowers with a history of missed payments and credit mismanagement.

When writing the letter:

- Assume responsibility for the issue that caused the account to be reported to begin with

- Explain why the account was not paid

- If you can, point out good payment history before the incident

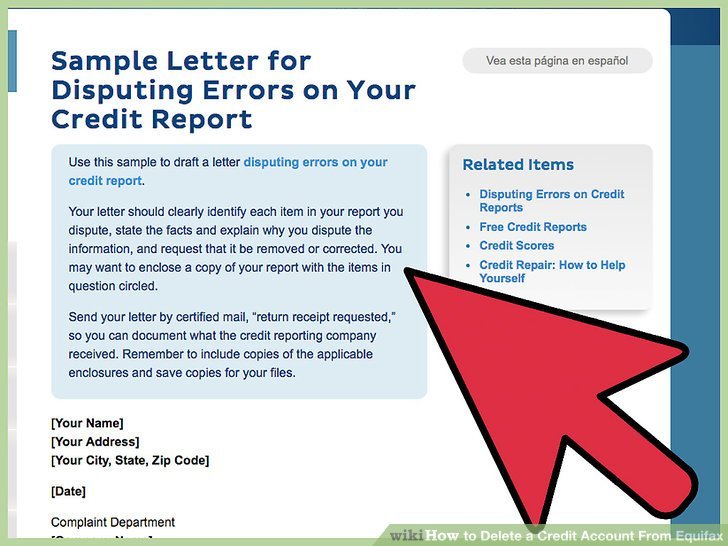

Can You Dispute A Collection With The Credit Bureaus

You can absolutely dispute a collection if you think its erroneous. Formal disputes must be filed individually with each credit bureau and can usually be done online through each credit bureaus website. You should also dispute the information with the company that provided the information.

can help you dispute errors on your TransUnion® credit report. We can also help you file a dispute with Equifax directly if you see an error on your Equifax® credit report.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Read Also: What Does Filing For Bankruptcy Do To Your Credit Score

Can A Settled Account Be Removed From Your Credit Report

Its good to be doing well financially and be able to settle your debts. You know that your debts are recorded in your credit report. Can it be removed when youve settled the account? Thats a common question.

Yes, you can remove a settled account from your credit report. A settled account means you paid your outstanding balance in full or less than the amount owed. Otherwise, a settled account will appear on your credit report for up to 7.5 years from the date it was fully paid or closed. However, if you had late payments or delinquencies before settling the account, the settled account will be removed from your credit report 7 years from the original delinquency date.

You can file a dispute with the major credit bureaus to have the settled accounts removed from your credit report if theyre already past the 7-year limitation. You can also get in touch with the collection agency and ask for a goodwill adjustment. Other than that, all you can do is wait it out because credit bureaus will only delete your settled account once theyre required to do so by law.

Look At All Of Your Credit Reports

If you find an item that is over seven years old on one of your credit reports, that doesnt mean the issue is universal. On the contrary, all three of the credit bureaus work with their own information, and each of their reports can vary in multiple ways.

Get your free annual copy of your credit reports;from all three bureaus and review them. As you do so, check to see whether the debt is consistently;sticking around on all of them.

Chances are, if the debt is over seven years old, it wont be on all three. If thats the case, you can then target your item removal efforts toward the specific bureaus with the inconsistency.

Read Also: Does Bluebird Report To Credit Bureaus

Gather Materials To Dispute Errors

Your goal is to make it as easy and quick as possible for investigators to confirm that your complaint is valid. Depending on the error,;the things you gather to support your case could include:

-

Copies of credit card statements or loan documents

-

Copies of bank statements

-

Copies of birth or death certificates, or a divorce decree

-

If you’ve reported identity theft, include a copy of your FTC complaint or police report.

Remove Derogatory Items From Credit Reports

So what happens if the negative information on your account is legitimate? Removing that information is much harder, but not impossible.

Negative information typically lives on your credit report for seven years for old credit accounts. Bankruptcies last even longer, with a 10-year period before they fall off your credit report.

| How long do derogatory marks stay on your credit report? | |

|---|---|

| Missed payment | |

| 7 years | |

| Civil judgment | 7 years |

You can always wait seven years until the information goes away, but you can try to get it removed sooner. The method to have negative information removed from old accounts is simple: call and ask.

If you call and ask a creditor to remove a late payment or other negative information from your history, remember that they are under no obligation to do so. Essentially, theyre doing you a favor if they proceed.

Ask very nicely, and consider using a few points below to get sympathy from the call center representative you speak with.

- Explain that you were going through a tough financial time and have since made all on-time payments.

- Tell them that you learned your lesson, changed your ways and always make payments on time now.

- Discuss how your credit mistakes from years ago are holding you back even though you are currently making on-time payments.

You can also summarize these points in whats called a goodwill letter, which can call to the creditors sympathies.

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

Consult With A Professional

There are many independent credit repair agencies in Canada. These agencies use the aforementioned techniques along with a deep knowledge of the Canadian credit system to help you remove negative items from your credit score.

However, the buyer should beware there is no guarantee that your credit repair agency will succeed in removing negative items.

If you dont know where to start when rebuilding your credit, it can be a good idea to partner with a credit agency, but make sure you do your research, and pick a Canadian credit repair agency with a history of good outcomes and great customer feedback.

Wrapping Up: How To Remove A Negative Item From Your Credit Report

Removing a negative item from your credit report is essential. It takes patience, time, and plenty of follow-ups.

Start with a dispute with the credit bureaus and see what happens. You may be pleasantly surprised to learn that you win the dispute. You wont know unless you try.

If the dispute fails, choose another method and be consistent in your efforts.

Consider hiring a credit repair company.

Your credit is an important part of your life. Not only does it affect what loans you may get, but it also controls your insurance premiums, deposits required for utility and/or cellphone packages, and sometimes even the job you get!

Once you remove a negative item, you can finally begin to improve your credit and enjoy a financially free life.

Why worry? Let solve your credit problems.

Also Check: Which Credit Score Is Correct

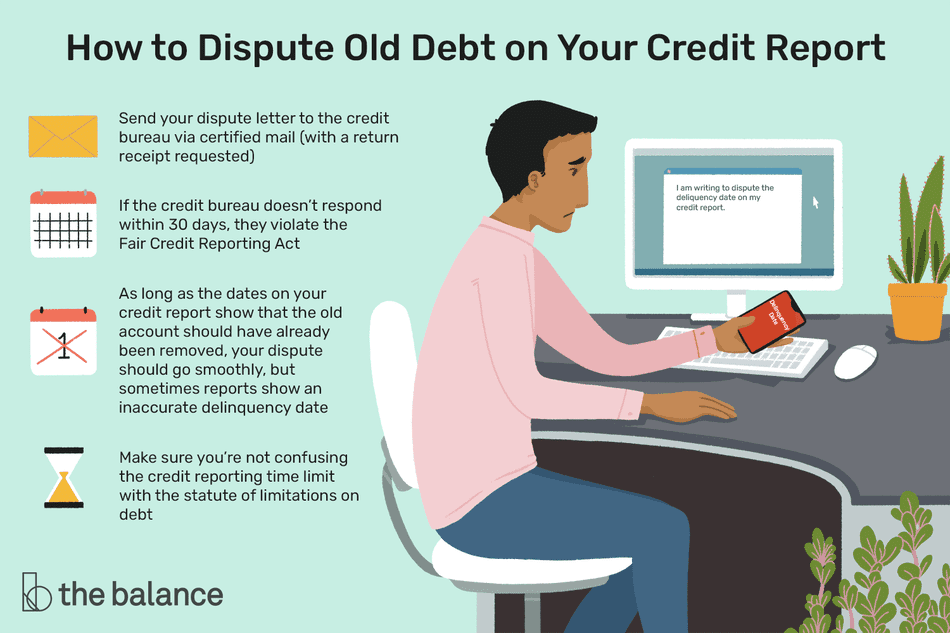

How To Remove Outdated Information From Credit Reports

Depending on the credit bureaus to automatically remove outdated information from credit reports is a mistake. The credit bureaus deal with billions of pieces of information daily and sometimes items get left on credit reports that should have been removed years ago.

Removing outdated information from credit files is the simplest way to improve your credit profile, and possibly credit scores.

The Fair Credit Reporting Act determines how long negative credit can remain on credit files. The date which an account must be removed from a credit report is often referred to as the FCRA compliance date of first delinquency. Depending upon the item, the credit reporting statute of limitations can differ. However, a majority of the negative items on a consumers credit report must be removed after about 7 years.

Get Your Negative Items Professionally Removed

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Don’t Miss: Which Credit Score Matters The Most

How Long Do Inquiries Stay On A Credit Report

Inquiries don’t fall neatly into either the positive or negative information categories. Inquiries are either neutral or negative to your credit scores, but do not indicate mismanagement or the default of a credit obligation, and don’t always result in a lower credit score.

Inquiries are simply a record of access into your credit reports by a third party, like a lender. Inquiries will remain on your credit reports for up to two years, and are considered either “soft” or “hard.”

A soft inquiry results when you or someone else views your credit report for non-lending purposes, such as a credit card preapproval. Soft inquiries don’t affect your credit scores. A hard inquiry will appear as a result of applying for credit or debt. Hard inquiries are visible to anyone who views your credit reports, and too many can lower your credit scores.

Dispute Incorrect Negative Information

If you find a derogatory account that is incorrect, you can file a dispute with the credit bureau to have it removed.

| A real-life example of how to remove derogatory items from credit report |

|---|

|

In 2009, I found such an item on my credit report and filed an online dispute with TransUnion. That was the credit bureau that furnished the report with incorrect information. I filled out a short online form explaining the error and a few days later got a response that they had contacted the institution, verified the information, and it was removed. Talk about a piece of cake. Eric Rosenberg |

You can file a dispute from a link provided in your credit report from AnnualCreditReport.com, or through any of the links below.

Keep in mind, you may need to create an account with the credit bureau to complete the process. But you dont need to sign up for any subscription or other paid service with these companies in order to remove a derogatory mark.

You can also file disputes by mail. However, the online dispute process is much easier for anyone comfortable using a web browser.

The reporting bureaus are required by law to handle disputes in a timely manner, typically 30 days or less, according to the Federal Trade Commission. Removing inaccurate negative information from your credit report is one of the fastest ways to quickly improve your credit score.

Read Also: Which Business Credit Cards Do Not Report Personal Credit

What Happens To A Debt After Seven Years

Seven years is a well-known time limit when it comes to debt. It’s referred to so often that many people have forgotten what really happens to credit cards, loans, and other financial accounts after the seven-year mark.

Seven years is the length of time that many negative items can be listed on your credit report, as defined by the Fair Credit Reporting Act. This includes things like late payments, debt collections, charged-off accounts, and Chapter 13 bankruptcy. Certain other negative items, like some judgments, unpaid tax liens, and Chapter 7 bankruptcy, can remain on your credit report for more than seven years.

S To Remove Collection Accounts From Your Credit Report

If youve had collections listed on your credit report, then you know it can drop your FICO score significantly.

In This Article

But how do you remove collection accounts from your credit profile?

This article provides some proven strategies to help you get collections removed from your credit report and increase your credit rating.

Recommended Reading: Is 524 A Good Credit Score

Hire A Credit Repair Company

If you have more than one negative account on your credit report, hiring a company maybe your best option.

In fact, it is the primary option we recommend for consumers to remove negative items from their credit report.

Writing letters, managing phone calls, and tracking all the information can be time-consuming, confusing, and downright overwhelming. You may not know who to contact or what to say, but a credit repair company knows.

Do your research and hire a reputable company with a proven track record. They typically charge a setup fee plus a monthly fee, but you only pay as long as you need them. If it takes two months to fix your credit, then you pay for 2 months.

Each credit repair company offers different services. Some send dispute letters, while others also provide debt validation, debt settlement, and even cease and desist letter.

There is no guarantee that will have more luck than you could, but their expertise gives you a better chance. Plus, you save the time and stress of managing it yourself.

is the best credit repair company.

To date, they have removed thousands of negative items and are the most affordable. It truly is a bang for your buck.

>> Want to Learn More? Check out our

What Is A Charge

When a creditor gives you a loan or line of credit, it assumes you’re going to pay back what you borrow. If you fall behind or stop making payments altogether, your account can become delinquent. Once an account has been delinquent for an extended period of timetypically meaning it’s 120 to 180 days latethe creditor may charge it off.

A charge-off means your account is written off as a loss. At this point, the account may be assigned or sold to a debt collection agency. The debt collector can then take action against you to try to get you to pay what’s owed. That can include calling you to ask for a payment, sending written requests for payment, or even suing you in civil court to try and obtain a judgment.;;

You May Like: Does Paypal Working Capital Report To Credit Bureaus

How Do You Get A Collection Removed From Your Credit Reports

Lets begin with the brutal truth. If theres an accurate collection account on your , the odds that youll be able to get it removed before its been there for the maximum allotted time seven years from the date of the original delinquency are slim.

Even so, there are a few steps you can take to try to get it removed faster. Theyre just unlikely to work.

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Don’t Miss: How To Read A Transunion Credit Report

How Do Collection Reports Impact Your Credit Score

While a collection report usually causes serious damage to your credit score, how much it impacts it depends on which credit scoring model you use to calculate your score. It also depends on whether the collection account is paid or unpaid. For example, FICO Score 9the latest version of the FICO credit scoring modeldoesnt report paid collection accounts.

Earlier versions of this credit scoring model, however, do include paid collection accounts. If a lender uses an earlier model to assess the likelihood you can repay a loan, its likely that it will see a lower credit score if you have a paid collection account listed on your credit reports.