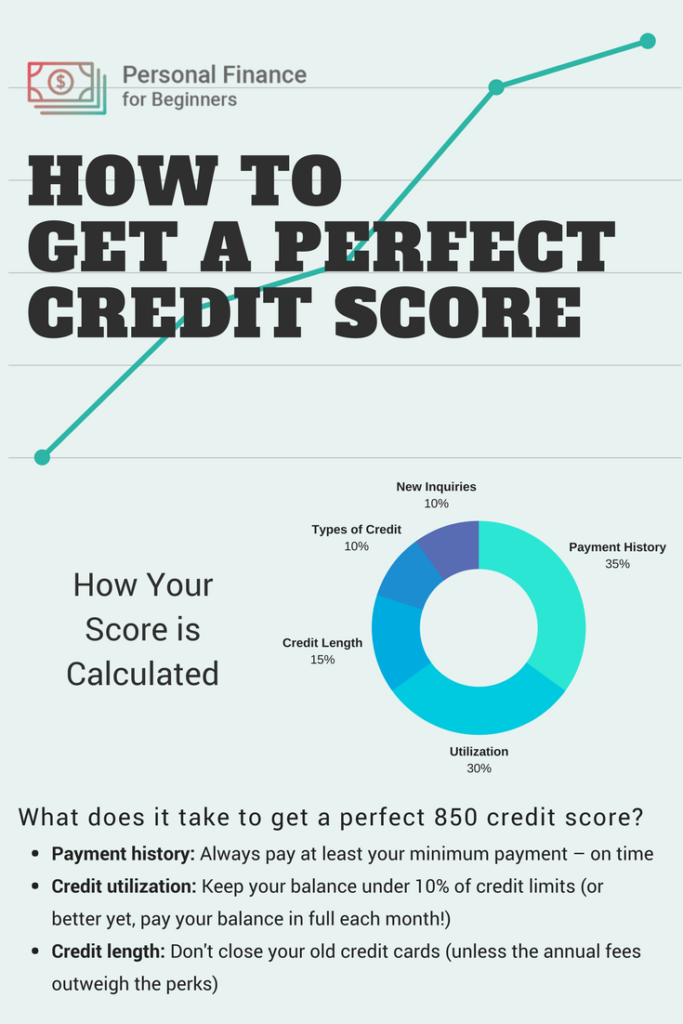

How Your Score Is Calculated

Whether you want the perfect credit score or increase your score just enough to qualify for better interest rates, it is helpful to understand how your credit score is calculated.

After you understand what factors influence your score, you can take specific actions to increase your score.

There are five major factors that impact your credit score :

- Payment history

- Types of credit

- Recent credit inquiries

Each of these factors tells some type of story about the potential risk you offer to a potential lender.

Do you forget to make your payments?;Did you just open your first ?;Are you seeking a new credit card because youve maxed out your existing ones?

What To Focus On When It Comes To Your Credit Score

If a lender provides you with a credit score when you’ve applied for a loan, or if you obtain a free FICO® Score from Experian, the score will come with a report, based on your unique credit history, that indicates the top credit scoring factors benefiting your credit score and the top factors preventing it from being higher than it is. You can use this personalized information to help focus your efforts as you work toward a better credit score.

The report will detail which factors matter most to you, but the following factors, listed in order of influence, play a large part in determining everyone’s credit scores:

How Does It Work

Although there are many different , your main FICO score is the gold standard;that financial institutions use in deciding whether to lend money or issue a credit card to consumers. Your FICO score isnt actually a single score. You have one from each of the three credit reporting agenciesExperian, TransUnion, and Equifax. Each FICO score is based exclusively on the report from that credit bureau.

The score that FICO reports to lenders could be from any one of its 50 different scoring models, but your main score is the middle score from the three credit bureaus, which may have slightly different data. If you have scores of 720, 750, and 770, you have a FICO score of 750.

A perfect score of 850 will give you bragging rights, but any score of 800 or up is considered exceptional and will give you access to the best rates on credit cards, auto loans, and any other loans.

Recommended Reading: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

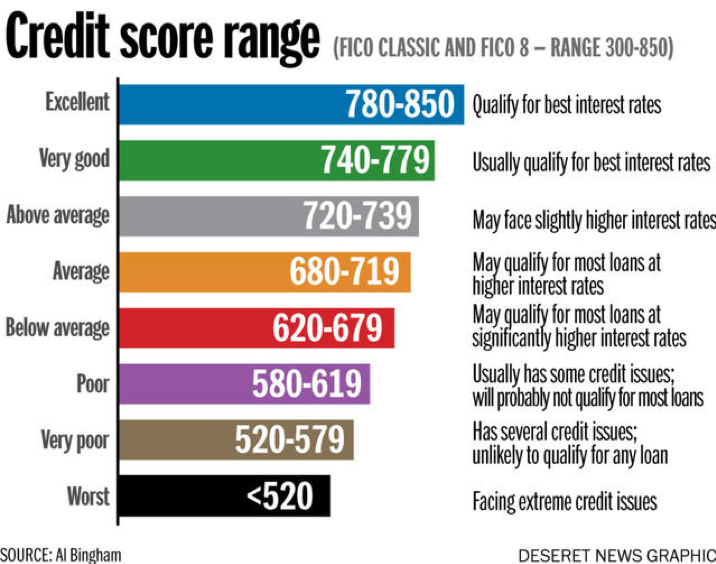

Whats The Range For Fico Scores

Your FICO®;Score will be a three-digit number, ranging from 300 to 800+.

But most lenders arent looking for one specific number, but rather an overall feeling for how you handle credit. Therefore they group them so you can look at the scale and see where you fall. While aiming for the top is important, you are likely still able to get credit with a very good score, while some lenders might even dip down into the good designation. Here is how they group the scores on a scale:

- Exceptional:;800+

How To Get An Excellent Credit Score

You likely have dozens, if not hundreds, of credit scores, all with somewhat different criteria for excellence. Achieving perfection on all of them is likely impossible. But fortunately, decisions that lead to score improvements under any scoring system will tend to boost scores under all of them.

There are no magic formulas that will give you an exceptional credit score overnight, but by focusing on the factors that contribute to your credit scorewith particular attention to any specific factors called out in your credit score reportcan help you make steady progress toward credit scoring excellence, and even perfection.

Want to instantly increase your credit score? Experian Boost helps by giving you credit for the utility and mobile phone bills you’re already paying. Until now, those payments did not positively impact your score.

This service is completely free and can boost your credit scores fast by using your own positive payment history. It can also help those with poor or limited credit situations. Other services such as credit repair may cost you up to thousands and only help remove inaccuracies from your credit report.

Also Check: How Long Does Debt Settlement Stay On Your Credit Report

Average Credit Score By Income

The higher ones income level, the higher their average credit score tends to be.

While debt-to-income ratio doesnt play a direct role in determining one’s credit score, it does have an indirect one. One of the factors lenders consider when modeling an individual’s credit risk is their credit utilization the percentage of total available credit a consumer is using month to month.

To improve one’s credit score, credit utilization should generally be kept below 30%. The lower one’s income is, the more a consumer may rely on their credit for their expenditures.

Another way income may play into credit utilization, and ultimately one’s credit score, is by determining one’s . Credit issuers look at borrowers incomes when deciding on the amount of revolving credit that should be issued.

The lower one’s income, the lower their line of credit is likely to be.

In turn, by having significantly lower credit limits, it becomes easier for lower-income individuals to eat up a larger portion of what’s available, increasing their credit utilization.

The graphic belows shows that median credit scores are highly correlated to income.

For context:

- Low income: Up to 50% of the area median income

- Moderate income: Greater than 50% and up to 80% of the area median income

- Medium income: Greater than 80% and up to 120% of the area median income

- High income: More than 120% of the area median income

Do You Need Excellent Credit

No, you don’t need excellent credit. It doesn’t hurt, but a good credit score can be more than enough.

A FICO® Score of at least 720, which is within FICO’s good credit score range, will get you most of the same benefits as excellent credit. You should have no trouble passing a credit check or securing low interest rates on a loan. Your credit score will also be high enough to qualify for any credit card on the market. Keep in mind that a high credit score never guarantees an approval.

The only area where a higher credit score can help is a mortgage. To get the lowest mortgage interest rates, it typically takes a FICO® Score of 760 or higher. That’s still below the threshold for excellent credit, though.

Read Also: What Credit Score Do You Need For Paypal Credit

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Review Your Credit Reports

Credit report errors happen. If a creditor reports negative information thats inaccurate or incomplete to the credit bureaus, it can damage your credit score. To catch and fix reporting errors, review your credit reports at least once a year.

You can view all three of your credit reports for free by visiting AnnualCreditReport.com. Normally, you can only view them for free once per year. However, due to the Covid-19 pandemic, you can receive free weekly reports until April 20, 2022.

Don’t Miss: When Does Citi Card Report To Credit Bureaus

Why Check Your Credit Score

You may still find it useful to check your score before applying for credit, as it could give you anindication of how creditworthy a lender may find you. When you make an application for credit, a lenderwillcheck your history to see if your borrowing habits suggest that youll be able to make the repayments.Thesechecks are recorded as credit searches, and leave a footprint on your credit history. Hard searchescan beviewed by other lenders.

The more applications you make, the more searches could be recorded on your borrowing history. Too manycould suggest to a lender that youre financially overstretched and may not be able to pay them back.Checking your credit score before you apply can help indicate how creditworthy a lender may find you.Thisway, you can also take steps to try to improve yourscore before making an application for credit. Thiscould help to minimise the number of unnecessary searches that appear on your report.

Your Equifax Credit Report & Score is free for thefirst 30 days, then £7.95 monthly. It gives youunlimited online access to your borrowing history and credit score.

Related Articles

How To Get An 850 Score

But what if I really want to get that 850 score?

If you are reading this post wanting to know how to get perfect credit in six months, you will be disappointed. To earn the highest credit score, you dont have to be perfect, but you do have to be patient.

Even if you already have excellent credit, it may take several years to reach that magical 850 score.

There are certain benchmarks you will need to hit in each of the main factors to get the highest score:

Read Also: Will A Sim Only Contract Improve Credit Rating

How Do You Get The Highest Credit Score

A high credit score will make it easier to qualify for mortgages and car loans, start a business, and, in some cases, secure a job.

More importantly, a good credit score reflects a secure financial standing, meaning you have fewer money problems to worry about.;

Striving for a good credit score is one of the most important financial goals to have. But what exactly is a good score and is there a perfect one?

Does It Matter If I Don’t Have The Highest Credit Score

If you don’t have a perfect score, there’s no need to fret. Most people don’t. According to Experian, only 1.2% of Americans have the highest credit score.;

So does that mean that only 1.2% of people qualify for the best interest rates? No. You don’t need an 850 credit score to qualify for prime interest rates. But you will want your score to fall within a certain range.

- Very Good: 740-799

- Exceptional: 800+

Working towards a credit score in the “Good” range would be a great initial goal. And if you’re able to build a score that falls within the “Very Good” or “Exceptional” range, you can expect to receive some of the best interest rates currently available.;

It’s also possible to have no credit score whatsoever. If you’ve never applied for credit before or haven’t used credit in more than 24 months, you could find yourself in this situation.

In its 2015 report, the Consumer Financial Protection Bureau found that 26 million people were “credit invisible.” While having no credit isn’t the same as having bad credit, it still makes it difficult to qualify for the best rates on loans.

Read Also: Is 524 A Good Credit Score

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?;

First, let’s answer the question you are here to find out:

Use A Credit Monitoring Service

Another way to stay on top of your credit score is through the use of a credit monitoring service. The best credit monitoring services give you access to your credit score and often come with other helpful features like identity theft protection and access to credit reports.

Some credit monitoring services are free to use, while others charge a monthly or annual fee. Most services offer a mobile app, giving you 24/7 access to your score from anywhere in the world.

You May Like: What Credit Report Does Paypal Pull

Boost Your Credit With Experian

Not only is Experian one of the three major credit bureaus, but it also offers a free service called Experian Boost, which can help increase your credit score. Experian Boost uses other recurring bills, like utilities, phone and internet services, and Netflix to build your credit history. Theres no guarantee that your score will get a boost, but the average FICO score increase was 12 points for those who did see a credit score lift. The process takes less than 10 minutes a solid time investment for a significant credit score increase.

What Is A Good Credit Score In Canada

To have what is considered a good credit score in Canada, you want to aim for a credit score above 700. Even though good technically starts at 660, getting your credit score above 700 is going to open up many new options for you. People with a good credit score in Canada have access to far better interest rates across all credit products, plus a better chance of getting approval for the credit products you apply for.

You May Like: When Do Credit Cards Report Late Payments

Improve Your Credit Score Limits

Its also possible to decrease your credit score utilization by asking bank card issuers for a credit score restrict improve. Remember this may require a tough credit score inquiry, which might drop your credit score rating briefly.

You possibly can all the time ask if the creditor can improve your restrict with out that step. Some card issuers may be prepared to work with you, particularly in case your revenue has elevated because you opened the account.

Do I Need A Perfect Credit Score

Achieving a good credit score can be likened to reaching the top of Mount Everest. Youve finally reached that coveted peak, and you are surrounded by nothing but snow-capped peaks in every direction.

Imagine if someone told me they wanted to climb just one mountain when theres so many waiting for them over here!

Make a noble pursuit of 850? Think again. Theres little difference between an 800 and 850 when it comes to getting the best rate from lenders, so why not go for gold with that 760+ score instead? You dont need thousands in savings or increased rewards points to feel like youre doing something good: just get those credit card balances down!

If you want to get the best, most competitive rates on credit cards and loans in other words if youre looking for a perfect score of 800-850you need to follow these three steps:1) Stay current with your bills. Owing more than $10k will lower your credit rating below 700 which is considered unacceptable. 2) Pay back any major debts before applying for new ones as this can make up 50% of ones total score 3) Keep balances low; dont use over 30 percent or around 10 grand worth of their available limit because that calculates into roughly 20% of someones overall FICO Score.

You May Like: How To Get Rid Of Inquiries On Your Credit Report

Myths That May Stop You From Getting To The 800 Club

1st Myth: Bankruptcy will ruin your credit forever and ever.

The truth is you can see a 800 credit score after bk. Bankruptcy will hurt your credit in the short term. In general cases, a BK7 can be on your report for about 10 years.

But this does not mean you cant rebuild credit, fix current inaccuracies and continue to practice good financial habits.;

If the BK itself cant be removed, you still can take actions elsewhere to counteract the negative effect its having on your credit report.

And, if you get ahead of it, you can speak to an attorney about what a bankruptcy will do to your credit so as to minimize any damage.;

Related: Nolo helps consumers and small businesses find answers to everyday legal questions. Visit Nolo.com today for your legal needs

2nd Myth: ALL Bankruptcy info will stay on your credit report for ten years

Actually, only the public record of a BK7 lasts for ten years. Other bankruptcy references stay on your report for seven years, like:

- Trade lines that state account included on bankruptcy

- Third-party collection debts, judgments and tax liens discharged through BK

- Chapter 13 public record items;

3rd Myth: You will have poor credit as long as the bankruptcy information stays on your CR;

Actually, you can expect a lower score after your bankruptcy. But you can rebuild your credit with proper management and smart tactics.;

You can make moves to 800 credit score after bankruptcy. It may take 2-4 years depending on your situation, still, it can be done.;

Monitor Your Credit History

The worst thing that could keep you from reaching a perfect credit score is identity theft or credit report errors. In the blink of an eye, all of your hard work and strategic credit use could be flushed away by the careless actions of a thief or recording accident.;

Fortunately, there are many ways to check your credit score for free online. Checking online is perfect if youre on the verge of a big purchase like a home or car. Otherwise, you should consider checking your credit monthly or semiannually to avoid having to make any unnecessary hard inquiries.;

Also Check: How To Up Credit Score