Can A Chapter 7 Be Removed From Credit Report Before 10 Years

A chapter 7 bankruptcy can only be removed from your credit report before the 10 year period if there are any inaccuracies in the information thats reported. You cannot remove a bankruptcy from your credit report simply because you dont want it to be there. Most people will have to wait the 10 years before the bankruptcy falls off their credit report on its own.

Some Accounts Fall Off Sooner

When a debtor includes accounts in a Chapter 7 or 13, they can remain on the debtors credit report for up to 7 years, even though the bankruptcy itself is reported for 7 to 10 years depending on which bankruptcy is filed.

Usually, those who file bankruptcy are already seriously delinquent on their accounts before they file bankruptcy. If a debtors account was delinquent before they filed bankruptcy, it will be automatically deleted from their credit 7 years from the date the debtor originally defaulted on the account .

When a person files bankruptcy, it does not extend the original delinquency date on an account; therefore, an account may be deletedbeforethe bankruptcy falls off the credit report so thats good news.

To find out if bankruptcy is right for you,;contact our firm;to meet with a Harrisburg bankruptcy attorney for free!

Considering Bankruptcy As A Debt Relief Option Get A Free Case Evaluation

Contact The Leinart Law Firm to request a free bankruptcy consultation.

Fill out the form on this page or contact our Fort Worth and Dallas bankruptcy lawyers;and discover how filing bankruptcy can help you get out of debt, improve your credit score and ensure your financial well-being.

Free Case Evaluation

Read Also: Which Credit Score Is Correct

Send A Dispute Letter

Send a dispute letter and ask them to correct the mistake and remove the bankruptcy.

If you cant find any inaccuracies, you might try sending them a dispute letter anyway.

Ask them to verify how the bankruptcy came to be on the report.

They will likely respond that they received the information from the court, and provide the relevant information.

You can then follow the same process with the court. The hope is that one of these steps will expose some kind of problem or technicality that occurred during the process and will ultimately be grounds for removal.

Im a firm believer in the notion that nothing is impossible.

It may be highly unlikely that youll be able to remove a legitimate bankruptcy from your credit report early, but that doesnt mean it isnt worth trying.

Its definitely a long shot. However, many people who have taken the time to go through the process have had success with removing a Chapter 7 from their credit report before the 10 years were up .

Ask The Courts How The Bankruptcy Was Verified

Next, you will need to contact the courts that were specified by the credit bureaus.

Ask them how they went about verifying the bankruptcy. If they tell you they didnt verify anything, ask for that statement in writing.

After you receive the letter, mail it to the credit bureaus and demand that they immediately remove the bankruptcy as they knowingly provided false information and therefore are in violation of the Fair Credit Reporting Act.

If all goes well, the bankruptcy will be removed.

Also Check: How To Boost Credit Score 100 Points

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Can You Rebuild Credit After Bankruptcy

Declaring bankruptcy is a major decision, and it can have a big impact on your credit profile. But, its effects wont last forever. To learn more about how you can improve your credit health, one step at a time, check out this blog on how to rebuild your credit history.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

Read Also: How To Get Credit Report With Itin Number

Are All Bankruptcies The Same When It Comes To Credit

Myth: Bankruptcy affects the credit of all consumers who file equally, regardless of the amount of debt or the number of debts included.

The truth: Bankruptcies are far from created equal. As already stated above, some stay on your credit longer than others.

Creditors also tend to prefer to see Chapter 13 bankruptcies over Chapter 7 bankruptcies. Thats because Chapter 13 bankruptcy requires you to make some;payment on your debt, so it demonstrates that you do try to pay your debts whenever possible. However, that doesnt mean Chapter 13 is the right choice for everyone and every situation.

How much debt you have and how much is included in the bankruptcy can also make an overall difference on how your credit is impacted. In short, your credit is going to suffer, but theres no single number that can be provided for how much it will drop.

How Does A Bankruptcy Affect Your Credit Score

Having a bankruptcy on your credit report can be devastating to your credit scores. According to FICO, for a person with a credit score of 680, a bankruptcy on your credit report will lower your credit score by 130-150 points.

For a person with a credit score of 780, a bankruptcy will cost you 220-240 points. That one event immediately drops you several categories lower and impacts your ability to access credit, and yes, the higher your initial credit score is, the more it falls.

You might not be eligible for future loans or credit cards, and if you are, youll most likely end up paying much higher interest rates. Not only that, the amount you can borrow will probably become limited.

While filing for bankruptcy may be the best financial decision at this point in your life, its still important to understand how and why it affects your credit score.

Read Also: How Long Does A Repossession Stay On Your Credit Report

Get Yourself A Secured Credit Card

These types of credit cards are specifically designed for people with bad credit scores. They often have high annual fees and interest rates, but they give you a chance to repair your low credit score.

But there are some rules you should follow if you go this route.

Dont just take your card and start spending. You should never spend any more than 30 percent of your limit. And whatever you spend, you should pay back each month to keep you from increasing your debt.

Accounts/creditors Involved In Bankruptcy

The creditors that are listed in your bankruptcy case and are later discharged in the bankruptcy will still appear on your credit report. These accounts will be marked Included in Bankruptcy.

- All delinquent accounts are deleted from your credit report 7 years from the original delinquency date

- Accounts included in the bankruptcy will be deleted after 7 years from the delinquency date

- Bankruptcy does not affect the delinquency date

- Accounts stay on your credit report even if you complete your Chapter 13 Plan

So if you file a Chapter 13, the accounts involved in the bankruptcy will be removed from the credit report after 7 years and the Chapter 13 bankruptcy will be removed from the public records section after 7 years. If your accounts were delinquent before you filed your bankruptcy case, they will fall off your credit report before the bankruptcy.

If you file a Chapter 7, the accounts involved in the bankruptcy will be removed from your credit report after 7 years and the Chapter 7 bankruptcy will be removed from the public records section after 10 years. The accounts involved in the bankruptcy will be removed from your credit report before the actual bankruptcy.

The accounts should be removed from your credit report automatically. It is important for you to continue to review your credit report to ensure accounts are removed and reported accurately.

You May Like: Does Checking Your Credit Score Affect Your Credit Rating

Is Your Credit Rating Really Worth Stressing About

Are you current on all your debt payments? Yes? No? Maybe?Â;

If youâre behind on any debt payments, your credit score could probably be better. So, rather than worrying about possibly making your already bad credit worse, think about how a bankruptcy discharge could help you build credit.

So, what happens to my credit score if I file bankruptcy?Â;

Like all negative information reported to the credit credit bureaus, filing any type of bankruptcy will have a negative impact on your credit score. Since a bankruptcy filing is public record, they will find out, even if theyâre not directly notified by the bankruptcy court.Â;

But, unlike other things that have a negative effect on your FICO score, a bankruptcy filing is often the first step to building a good credit score.Â;

Removing A Bankruptcy From Your Credit Report

As stated above, it is challenging to get bankruptcies removed from your credit report, but not impossible. The duration of a bankruptcy on your credit score depends on the type of bankruptcy.

Chapter 7 has a maximum of ten years, and chapter 13 has a maximum of seven years. But, these are only maximums. Since there is no minimum, it is possible to get it removed from your record sooner.

Here is how to remove bankruptcies from credit reports yourself:

This guide offers a possible way to remove a bankruptcy record from your credit report. However, it is always best to verify these facts beforehand. Ensure the court you contact doesnt verify bankruptcy information with credit bureaus and always consider getting expert advice.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

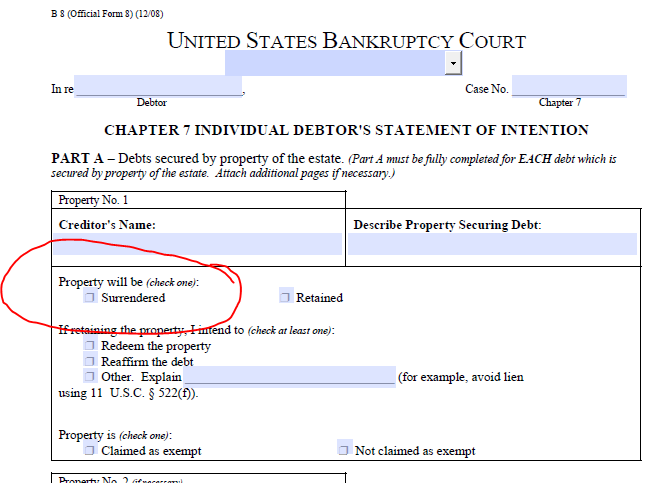

Removal Under Chapter 13

It may be possible to have a bankruptcy removed from a credit report as early as 7 years from the filing date if it was under Chapter 13.;Under Chapter 13, the debtor repays his or her creditors over an extended period of time, usually 3 to 5 years, in accordance with an established repayment plan. Although credit reporting agencies are not;legally obligated to remove a bankruptcy after only 7 years , they do so to encourage debtors to file Chapter 13.;This is because unlike with Chapter 7 wherein debts are discharged, with Chapter 13, creditors are repaid.

Checking A Credit Report For Accuracy

It’s prudent to review your credit report from time to time, even if you aren’t considering bankruptcy. One way to check is by taking advantage of the free copy from each of the three major credit bureausExperian, TransUnion, and Equifaxthat you’re entitled to once per year at no cost. The website for ordering your credit reports is www.annualcreditreport.com.

It’s important to review all three carefully because not all creditors report to all three agencies. A few months after filing your bankruptcy, each of your creditors should notate that the account was included in bankruptcy. If not, it’s a good idea to have that corrected because any line item that appears open but unpaid could lead a potential lender to believe that you’re still responsible for paying that debt.

Your credit report should also identify whether your Chapter 7 bankruptcy case was discharged or dismissed. A successful bankruptcy that leads to a discharge has a different effect on a potential lender’s decision to grant you credit than if the bankruptcy had been dismissed, leaving your account liability intact.

It’s a good idea to address any errors you see as soon possible. You can do this by disputing the item, either through the credit bureau’s website or by sending a letter directly.

Also Check: Does Requesting A Credit Report Hurt Score

How Long Does Information Stay On My Equifax Credit Report

The length of time information remains on your Equifax credit report is shown below:;;Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.;Closed accounts reported by the lender as paid as agreed can stay on your Equifax credit report for up to 10 years from the date it was reported by the lender to Equifax.;Accounts not paid as agreed can remain on your Equifax credit report for up to 7 years.;Late Payments;Remain on your Equifax credit report for up to 7 years from the original delinquency date the date of the missed payment. The late payment remains even if you pay the past-due balance.;Collection Accounts;Remain on your Equifax credit report for up to 7 years from the date of the first missed payment. The account remains on your Equifax credit report even if you pay the collection account.;;Bankruptcy

- Chapter 7 or 11 filed and discharged status bankruptcies remain for 10 years from the date filed

- Chapter 12 and 13 bankruptcies remain for 7 years from the date filed

- Dismissed bankruptcies remain for 7 years from the date filed

;New York State Residents Only;;

Consider Applying For A Secured Credit Card

After filing for bankruptcy, its unlikely that you will qualify for a traditional credit card. However, you may qualify for a secured credit card. A secured credit card is a credit card that requires a security depositthis deposit establishes your credit limit.

As you repay your balance, the credit card issuer usually reports your payments to the three credit bureaus. Repaying your balance on time can help you build credit. Once you cancel the card, a credit card provider typically issues you a refund for your deposit.

When shopping for secured credit cards, compare annual fees, minimum deposit amounts and interest rates to secure the best deal.

Read Also: How To Get A Bankruptcy Off Your Credit Report

Does Your Credit Score Increase After Filing For Bankruptcy

A bankruptcy does not increase your credit score. In fact, filing for bankruptcy almost always results in an immediate and significant decrease in your credit score. A bankruptcy can drop your credit score anywhere from 100 to 240 points depending on your credit score prior to filing for bankruptcy. Ironically, the higher your credit score pre-bankruptcy, the more it will drop.

That said, as the bankruptcy ages, its impact on your credit score will lessen. However, the biggest boost to your credit score will happen after the bankruptcy is removed from your credit report. So long as a bankruptcy remains on your credit report, it will decrease your credit score.

People often mistakenly believe that filing for bankruptcy will increase their credit score. However, this is completely wrong. The purpose of filing for bankruptcy is to provide you with relief by giving you a fresh start, not a better credit score. Filing for bankruptcy is the absolute worst thing that can happen for your credit score. That said, youll have a fresh start to begin building new credit.

How To Remove A Bankruptcy From Your Credit Report Quickly

Sometimes, finances can get the better of us. Debt can begin to accumulate, or the economy changes, and you end up in an impossible situation. Filing for bankruptcy can help get you out from underneath the worst of it, and it might seem like an easy solution. However, the record of bankruptcy can hang around.

As unfortunate as it is, bankruptcy can make it difficult to build back what you might have lost. Your credit score inevitably drops after filing for bankruptcy. The presence of it on your record can make it difficult to borrow in the future. However, it is possible to remove it.

Bankruptcy filings indicate personal information about youlike your official name or social security number. As such, any errors in the record can be a cause to expunge the record of bankruptcy.

While this can be difficult, this article explains the essential things you need to know about bankruptcy. We go over its effect on your credit score and how to get it dropped from your record.

Bankruptcy promises to give you a chance to start fresh. But, so long as the record prevents you from recovering your previous credit score, it can be challenging. These sections will outline how to remove bankruptcies from credit reports. With these simple steps, you can clear your record and start fresh.

Recommended Reading: What Does Filing For Bankruptcy Do To Your Credit Score