Keep Your Balances Low

Keeping your balances low on your credit cards can help your credit utilization rate, or how much of your available credit youre using at any given time.

The usual advice is to keep your balance below 30% of your limit. Thats a good rule of thumb and a nice round number to commit to memory. But if you can manage to keep your utilization rate lower than 30%, thats even better.

Theres no credit-building benefit to carrying a balance on your cards if you can afford to pay off the full balance each billing cycle. When it comes to credit-building strategies, its best to make consistent charges to the account while keeping the total amount owed under 30% of your credit limit. If you can, pay your statement balance off in full and on time each month so you arent charged interest on those purchases.

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

What Credit Card Can I Get With A 603 Credit Score

You might have a hard time getting approved for a credit card with poor credit scores.

The good news is, Credit Karma can help. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds arent a guarantee that youll be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

Recommended Reading: How Long Do Late Payments Stay On Your Credit Report

How Can I Get A Good Credit Score

To get a good credit score, you need to know first what your credit score is. It might already be good! You can find out what your credit score is by signing up for your Free Credit Report with TotallyMoney. It only takes a few moments, wonât harm your credit rating, and doesnât cost a penny. If you already know what your credit score is, and it could do with improving, you need to convince lenders that youâre a responsible borrower and that you can you can be relied upon to pay back what you owe. For more on how to get a good credit score, read our guide: â11 tips on how to improve your credit score.â

Credit Score Personal Loan Options

While this credit score range isnt the lowest on the totem pole, it is still below average. While you should be able to secure a personal loan, your interest rates and terms will definitely be less than favorable. Interests will often vary anywhere from sixteen to eighteen percent, with most leaning towards the higher end of that range. If youd like to secure a lower rate, a cosigner is a good option while you work to build your credit. Guide on poor credit loans

You May Like: How To Get My Free Credit Score

Reasons Why Outstanding Debt Spells Bad News For Your Credit Score:

1. It maximises your credit utilisation ratio:

- A good credit utilisation ratio is 30% or lower.

- A high ratio means you are using too much credit and can, as a result, reduce your credit score

2. It makes repayment of future loans difficult:

- If you have outstanding debts, it means that you could already be paying high EMIs.

- Borrowing more loans in the future with outstanding debts can create a major repayment burden and even cause bankruptcy.

How Your Credit Score Is Determined

All the leading credit rating agencies rely on similar criteria for deciding your credit score. Mostly, it comes down to your financial history how youve managed money and debt in the past. So if you take steps to improve your score with one agency, youre likely to see improvements right across the board.

Just remember that it may take some time for your credit report to be updated and those improvements to show up with a higher credit score. So the sooner you start, the sooner youll see a change. And the first step to improving your score is understanding how its determined.

Here are some of the factors that can harm your credit score:

- a history of late or missed payments;

- going over your credit limit

- defaulting on credit agreements;

- bankruptcies, insolvencies and County Court Judgements on your credit history;

- making too many credit applications in a short space of time

- joint accounts with someone with a bad credit record

- frequently withdrawing cash from your credit card

- errors or fraudulent activity on your credit report thats not been detected

- not being on the electoral roll

- moving house too often

Recommended Reading: How To Read A Transunion Credit Report

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters;

| Installment; | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan.; | |

| Open; | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving; | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R.; | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M.; |

Numbers;

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

What Counts Towards Your 603 Credit Score

In essence, your credit score tells you whether YOU have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 603 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Recommended Reading: Does Joint Account Affect Credit Rating

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

How To Raise Your Credit Score

If you can wait to take out a loan, spending some time improving your credit score first could help you qualify for lower interest rates and better loan terms.

Keep in mind that having a lower interest rate could help you save money on your loan over time.

Here are several ways to potentially build credit:

- Pay your bills on time. Your payment history accounts for 35% of your credit score. Paying all of your bills such as utility and credit card bills on time could help improve your credit over time, especially if youve missed payments in the past.

- Reduce existing debt. Your credit utilization makes up 30% of your credit score. If you can pay down the balances on your accounts, you might see a boost to your credit.

- Dispute issues on your credit report. One in five people have errors on their credit reports, according to the Federal Trade Commission. If youre one of these people, you could end up with less favorable loan terms or even damaged credit. Take some time to review your credit report and dispute any issues with the major credit bureaus.

What credit score should I aim for?

If you want to improve your fair credit score, aiming for a score anywhere from 670 to 739 is a good place to start this will put you in the good credit range and will likely qualify you for better rates and terms.

Keep Reading: No Credit Check Personal Loans

Also Check: Does Opensky Report To Credit Bureaus

How To Obtain Your Credit Report

In Canada, there are two credit bureaus: Equifax®* and TransUnion®â;. These credit bureaus can administer your free credit report, which is a comprehensive report that illustrates how much you owe, when you opened accounts, and contains personal information such as name, date of birth, social insurance number and more.

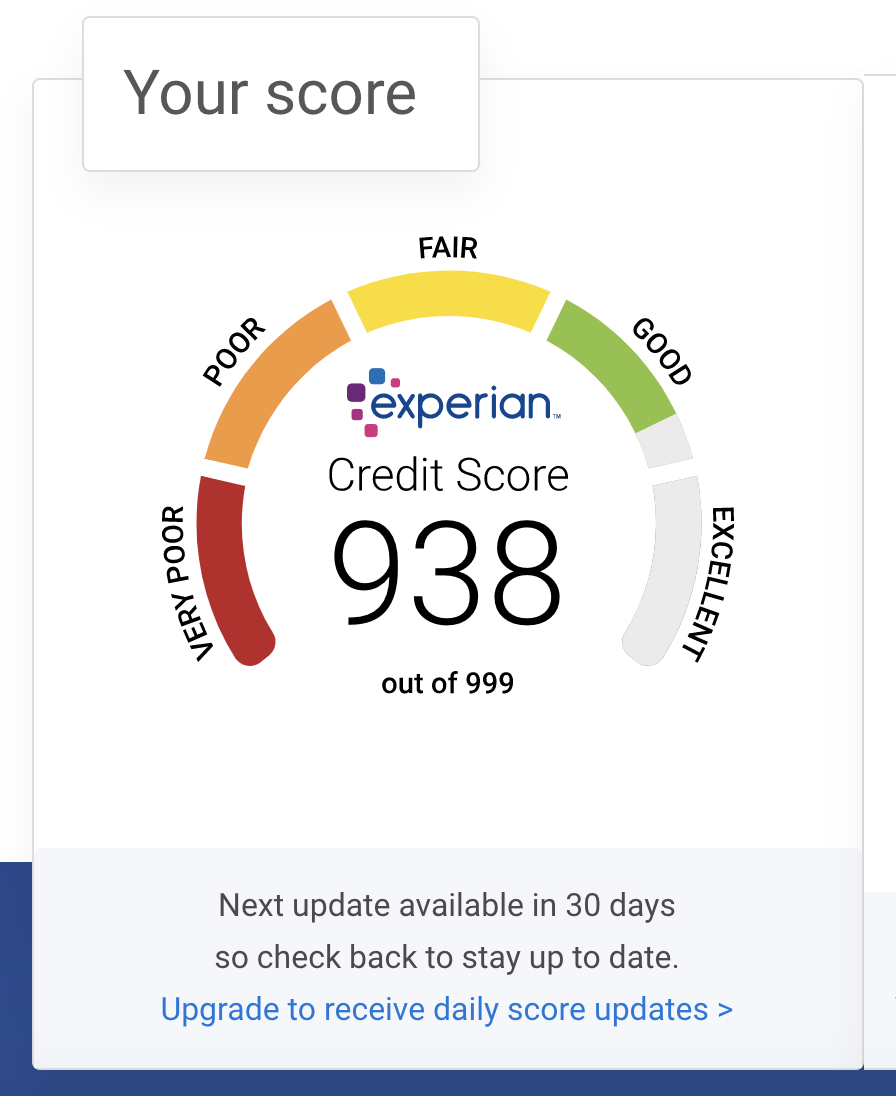

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Recommended Reading: How To Get Collections Off My Credit Report

What Makes Up Your Credit Score

The FICO credit score takes into account the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score ismade up of the following:

- Payment;history:;35% of your total score

- Total amounts;owed:;30% of your total score

- Length of credit;history:;15% of your total score

- New;credit:;10% of your total score

- Type of credit in;use:;10% of your total score

Based on this formula,the largest part of your credit score is derived from your payment history, andthe amount of debt you carry;versus the amount of credit available to you.These two elements account for 65% of your FICO score.

To put yourself in thebest position to qualify for a mortgage, focus on these areas first. Payyour bills on-time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilizationratio compares the total amount of credit available to you against your currentbalances; try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

How To Establish Or Maintain A Good Score

If you’re trying to build credit from scratch, there are a few ways to get started. The first, and most common, is to open a credit card. That can help you establish an official line of credit and begin building a good credit history, which is reported to the three credit bureaus.

If you’re just getting started, you may not be allowed to open a new card on your own, in which case you could, with permission, use someone else’s. This process is called credit card “piggybacking” and involves becoming an authorized user on someone else’s card: The primary cardholder agrees to add you as a secondary user so you can reap the benefits of good credit.

The card’s payment history then becomes part of your own credit report, NerdWallet explains: “So, even if you were 19 years old and couldn’t qualify for credit on your own, you could have a credit card.”

This method is useful if your goal is to gain experience using plastic, or if you lack enough credit history for a specific goal. It isn’t intended to dispel or rehabilitate poor credit.

Another option: Getting a , which is intended to teach young adults and children good credit habits by allowing them to use a card connected to an adult’s account.

Any misstep on behalf on the junior cardholder is reflected on the adult’s account, though. And charge-offs, late payments and debts sent to a collection agency remain listed for seven years.

Also Check: Does Changing My Name Affect My Credit Rating

Average Credit Score By Region

Want to know what your neighbourâs credit score looks like? Experian released the average credit scores by location. The worst credit scores in the UK on average are:

1);Kingston-upon-Hull;- 696;;

2);Blaenau;Gwent â 702;

3) Blackpool â 709;

4);Merthyr;Tydfil;â;712;

5) Middlesbrough â;713;

6);Northeast;Lincolnshire â;717;

7);Knowsley;â 722;

9) North Ayrshire â 737;

10);St. Helens â 744;

And the best average credit scores can be found in:;

1) Isles of;Scilly;â 881;

2) Wokingham â 877;

7);St Albans â 871;;

8);South;Cambridgeshire;â 867;

8);Brentwood â 850;

10);West;Oxfordshire;â 844;

You can find out what the average credit score is where you live by heading over here.

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Read Also: Is 584 A Good Credit Score

How To Solve Common Credit Issues When Buying Ahouse

If your credit score orcredit history is standing in the way of your home buying plans, youll need totake steps to improve them.

Some issues like errorson your credit report can be a relatively quick fix and have an immediateimpact on your score. Other issues can take much longer to resolve.

You should start checking your credit early on, ideally 6-12 months before you want to buy a house. This will give you time to identify issues with your score or report and work on solving them before you apply for mortgage pre-approval.

Here are tips on solvingsome of the most common credit issues faced by home buyers.

Past Deeds Feed Your Credit Score

Late and missed payments are among the most significant factors to your credit score. More than one-third of your score is influenced by the presence of late or missed payments. Lenders want borrowers who pay their bills on time, and individuals who have missed payments are statistically more likely to default than those who pay their bills on time. If late or missed payments are part of your credit history, you can do yourself and your credit score a favor by developing a routine for paying your bills promptly.

Utilization rate on revolving credit is responsible for nearly one-third of your credit score. Utilization, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure your utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and multiplying by 100 to get a percentage. You can also calculate your total utilization rate by dividing the sum of all balances by the sum of all spending limits.

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts agree that utilization rates in excess of 30% on individual accounts and all accounts in totaltend to lower credit scores. The closer any of these utilization rates gets to 100%, the more it hurts your credit score.

Among consumers with FICO® Scores of 625, XX% have credit reports that include one or more pieces of public information, such as a bankruptcy.

Also Check: Does Paypal Credit Report To Credit Bureaus