When A Collection Agency Steps In

Charge-offs don’t end your obligation to repay the debt.

Even if your original creditor no longer owns the account, you’ll still owe the debt to the collection agency that acquired it. Charge-offs and other negative account history, such as late or missed payments, can stay on your for up to seven years.

Does Paying Off Collections Improve My Credit Score

Topics:

Current accounts in good standing are not turned over to collections. For your account to wind up in collections, it must be past due, have missed payments, or otherwise be delinquent. Any kind of delinquency on your account can put negative marks on your credit report and unfortunately, simply making a payment to bring your account current does not erase the fact that your account was delinquent and reported to credit reported agencies as such. Negative marks, such as those from missing payments, can take up to seven years to fall off your credit report.;

Collections are reported to credit reporting agencies as payment history, a category that makes up thirty-five percent of your credit score. Therefore, having an account go to collections can affect your credit score by over one hundred points, which is enough to drop a fair credit score too poor. This mark on your credit report can deter potential lenders from working with you in the future because it shows that you are unreliable and may not repay the money loaned to you. Having a low credit score and negative marks on your credit report can also affect the repayment terms and interest rates with those lenders who decide to take a risk on you. Additionally, poor credit can affect your ability to take out student loans, your housing options, and it can even limit your employment opportunities.

Wait Out The Credit Reporting Time Limit

If all else fails, your only choice is to wait for those negative items to fall off your credit report. Fortunately, the law only allows most negative information to be reported for seven years. The exception is bankruptcy, which can be reported for up to 10 years. The other good news is that negative information affects your less as it gets older and as you replace it with positive information. The wait may not be as difficult;as youd think. Consumers can request their own credit report for free every 12 months from the three major reporting agencies. So, to be sure, you should request a report after the aging period to confirm.

It is important to note, however, that while the credit reporting agency will generally delete the negative information from the report after the seven-year aging period, information may still be kept on file and can be released under certain circumstances. Those circumstances include when applying for a job that pays over a certain amount, or applying for a credit line or a life insurance policy worth over a certain amount. Depending on where you live there may be more favorable regulations under state law, such as a shorter statute-of-limitations. You should contact your state’s Attorney General’s office for more information.

In the meantime, you can improve your credit by making timely payments on accounts you still have open and active.

Don’t Miss: Is 666 A Good Credit Score

How Does A Collection Affect Your Credit Score

Once a debt turns into a collection account and gets logged on your credit report, you will see a significant drop in your .

If you didnt have any other negative items on your credit report, this drop could be north of 100 points.

How far your credit score falls largely depends on how bad it was, to begin with.

In other words, a single collection account wont be a huge deal to someone who already has multiple delinquent accounts and a consistent string of late or missed payments, even on their up-to-date accounts. This person already had bad credit.

But if youve established a long history of making on-time payments, keeping a healthy credit utilization ratio, and maintaining a blend of different types of credit, a collection account will make a huge negative mark.

As the collection account ages, its impact on your credit score will lessen. But this wont help if you need new credit this month.

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

| Mail: Download, print, fill out, and mail to: |

| Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281 |

Equifax made headlines in 2017 due to a massive data breach, but it remains one of the top 3 services to get your credit report. The company provides a few different service levels if you want to monitor your credit score monthly . Monitoring packages start at $14.95 per month, and the $19.95 per month options include, ironically, a host of identity-theft protection options.

You May Like: How To Get A Debt Collection Removed From Credit Report

More Tips On Dealing With Transworld Systems Inc

Avoid the phone. NEVER talk to a debt collector on the phone. The less they know about you, the better.

Politely tell them its your policy to deal with everything in writing. Request a letter with the original debt information and then hang up. If they keep calling, send them a cease & desist letter.

Record their phone calls. If you must deal with a debt collection agency on the phone, record them. Thirty-five states and the District of Columbia allow you to record your phone conversations secretly.

In the other 15 states, you can record with the other partys permission. If you tell the debt collector you are going to record, and they keep talking, thats considered giving permission. They will usually hang up.

Dont believe what they say. Debt collectors are known to make false threats, lie, and tell you whatever they need to tell you to try to get you to pay the debt.

Dont try to hide money. Its considered fraudulent to hide money or assets from a legitimate collection agency if you owe them. However, its also best to avoid giving access to your bank account or credit card information.

Dont apply for new lines of credit. Its also considered fraudulent to apply for new lines of credit if you are unable to pay your current creditors.

Dont ignore them. You can do things on your terms, but ignoring the situation will not make TSI go away. Ignoring them sets you up for a possible lawsuit.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay them all off. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on the loan, you’ll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period during which they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 35% of the amount of your transfer.

Also Check: When Do Things Disappear From Credit Report

How To Find Out When Specific Items Are Due To Drop Off My Credit Report

The Fair Credit Reporting Act is your best friend when it comes to cleaning up your credit report. It controls when creditors must remove negative accounts from your report. Most negative accounts drop off seven years after the first reported delinquency, while others stay on for up to 10 years. However, even if the debt falls of your credit report, some state laws allow debt collectors to sue for a judgment for a longer period of time.

Keep Old Accounts Open And Deal With Delinquencies

The age of credit portion of your credit score looks at how long you’ve had your credit accounts. The older your average credit age, the more favorably you appear to lenders.

If you have old credit accounts youre not using, dont close them down. Though the credit history for those accounts would remain on your credit report, closing credit cards while you have a balance on other cards would lower your available credit and increase your credit utilization ratio. That could knock a few points off your score.

And if you have delinquent accounts, charge-offs, or collection accounts, take action to resolve them. If you have an account with multiple late or missed payments, for instance, get caught up on the past due amount, then work out a plan for making future payments on time. That wont erase the late payments, but it can improve your payment history going forward.

If you have charge-offs or collection accounts, decide whether it makes sense to pay off those accounts in full or to offer the creditor a settlement. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. Paying off collections or charge-offs might offer a modest score boost. Remember, negative account information can remain on your credit history for up to seven yearsbankruptcies for 10.

You May Like: Does Bluebird Report To Credit Bureaus

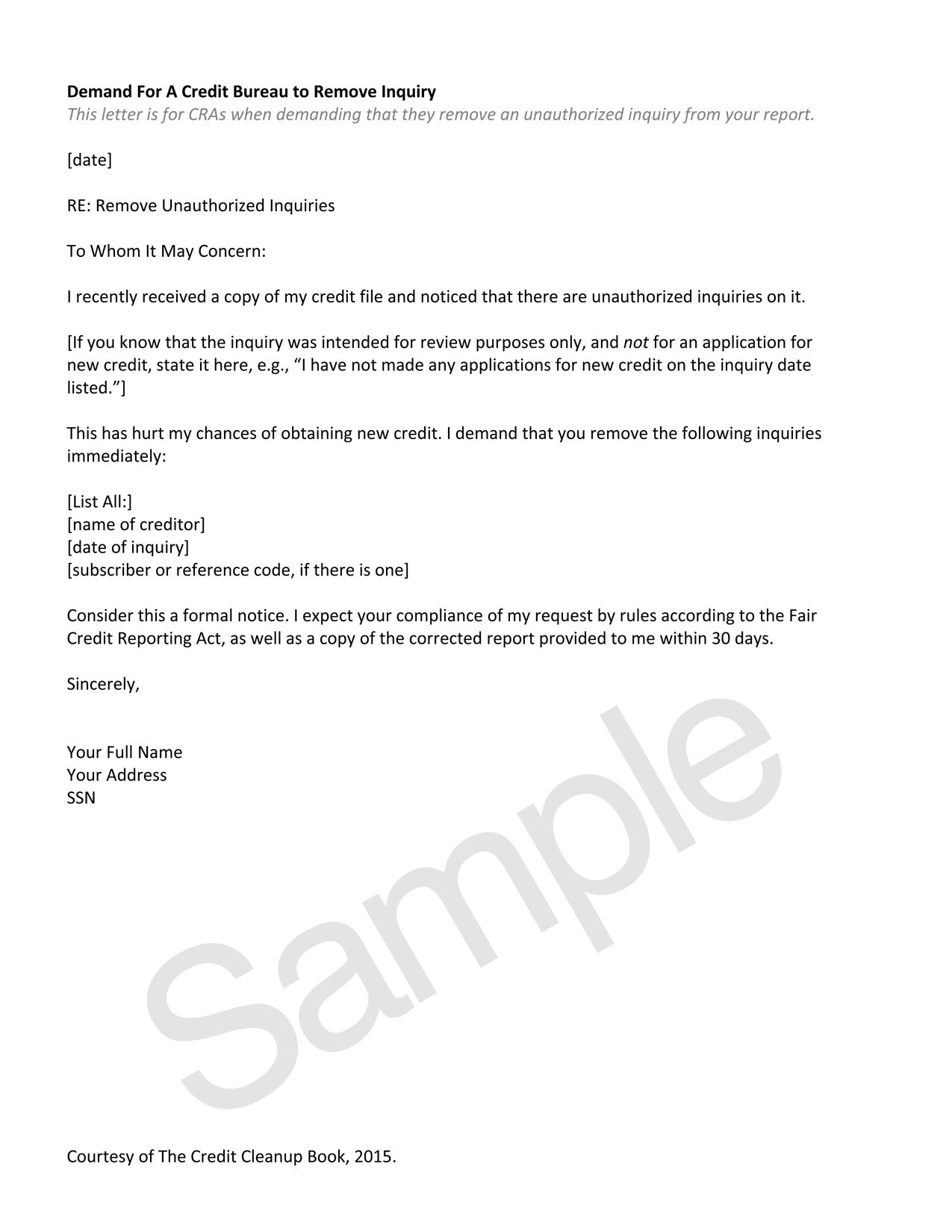

File A Dispute With The Credit Reporting Agency

Initiate a claim directly with the credit bureau by writing a dispute letter. The purpose of this letter is to notify them that you believe certain information in your credit file is inaccurate.

The Fair Credit Reporting Act requires creditors to report accurate information about every account. This means they have a legal obligation to review, investigate, and respond to your claim. This process is free and can take up to 30 days to complete.

You can begin a dispute with any one of the credit bureaus through their websites or via mail. The leading credit reporting agencies are Equifax, Transunion, and Experian. Its essential to have documentation and to be precise about the information you are challenging.

Each of the three major credit bureaus has an online section dedicated to walking consumers through the process of disputing a claim online. It would be best to dispute the entry with each credit bureau to make sure the removal is complete across the board. After receiving the initial claim, the credit bureau will contact the source of the erroneous information and dispute it on your behalf.

How to file a dispute letter:

How Do Collections Affect Credit

Some lenders use older versions of both credit scoring systems that still count paid collection accounts, however, and there’s no way to know ahead of time which credit scoring method a lender will use when deciding to approve a loan application. So while paid collections on your credit report may still hurt your chances of approval, paying off the account gives an opportunity to do the least possible damage.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.;

Hire A Credit Repair Company

You can probably get a collections entry removed from your credit report on your own, but youre not alone.

If you need some assistance, you should reach out to a credit repair company.

You can leave all the stress of mailing letters, seeking validation, and negotiating payments to the pros.

They will hold the agency to the standards of the FDCPA and help ensure that collections entries dont do more damage to your credit than they already have.

Moreover, they can help with a slew of trying credit problems, like:

- Bankruptcy

Also Check: How Bad Is A Judgement On Your Credit Report

In This Post We Cover:

- What collections are and how they affect your credit

- How to check your credit report for collections

- How to remove collections from credit report in Canada

- Tips to help manage credit going forward

Your credit reports and scores are an important part of your financial life. When collection items land on your it can cause your score to drop, making it harder to get approved for car loans or other types of credit. You might be wondering how to remove collections from credit reports and whether that could help your score. There are some steps you can take to minimize the impact of collections on a credit report. If youre successful, this could make it easier to qualify for a car loan and/or get a better rate when you borrow.

What Is A Collection Account

A collection account is a debt account that has been sold by the original creditor to a third-party debt collection agency. This happens when you are delinquent on payments long enough for the lender to charge off the loan, which means they consider the account to be a lossbut that doesnt mean youre off the hook for paying the bill.

Once the account has been charged off, the original creditor closes your account and often transfers or sells it to a debt collection agency or a debt buyer.

Also Check: Keyword

Ask An Expert: How To Dispute Inaccurate Debt Collection Information On Your Credit Report

Question: I have an original debt dating back 8 years. I refused to pay the debt due to overcharging my account. A few years ago, my debt was sold to a debt collector, and they are now reporting to credit bureaus as deliquent. We have agreed to terms on the settlement under the conditions they remove it from my credit report completely. They said they will update it as settled.

My question is as follows I read that after 7 years after the last payment was posted, a debt cannot be reported to my credit report, via original creditor, or the collection agency who bought my debt. If this is true, how can i get this removed? Its only showing up as 4 years on my credit report due to the collection agency reporting the debt.

Dear Reader,

You are correct, charged-off accounts and collections will stay on your credit report for up to seven and a half years after the date of the last reported activity. In this case, its the date when your account became delinquent. Debt collectors cannot legally re-age an account just because they bought it from the original creditor or another collection agency. The only circumstance in which this could happen is if the collection became current because you resumed payments and then it became delinquent again. If thats not your case and your debt is well over eight years old without any activity during that period, it should not be in your credit report.

Sincerely,;

Dispute The Collection Account With The Credit Bureaus

For quick and likely successful results, consider hiring a professional credit repair company to help you get Transworld Systems removed from your credit report for good.

The top credit repair companies have a legal staff that knows the FDCPA and other laws inside and out and can save yourself countless hours on the phone.

Lexington Law specializes in disputing Transworld Systems accounts. They have over 28 years of experience and have removed over 10 million negative items for their clients in 2018 alone.

You May Like: Does Collections Affect Credit Score

Can You Remove A Collection Entry From Your Report

If you have a collection entry, the simple answer is yes. Its possible to remove it in most cases. And thats something youll want to do. A collection entry appearing on your credit bureau can hurt your credit score and, in some cases, stop you from getting car loans and mortgages.

Before we discuss how to remove a collection entry, it helps to talk about what a collection entry actually means, how much it can lower your credit score and;how long it can remain on your credit report;if you dont do anything about it.

Can you use some help with your finances? Learn about credit counselling today.

Are Medical Collections Different

For years, medical collections were treated the same as all other collections.

But FICO has updated its scoring to treat medical collections differently. Medical collections now carry less weight when your credit score is calculated.

The newest FICO scoring model puts even less emphasis on medical debt.

Again, this doesnt mean a medical collection wont affect your ability to get a loan. Lenders dont just look at your credit score to make their loan decisions.

They usually pull your entire credit report and notice your past negative items. This, in turn, will affect your approval as well as the interest rate.

This is especially true when youre applying for a mortgage.

You May Like: Will Paying Off Collections Help My Credit Score