The Importance Of Staying On Top Of Your Credit

One of the most important aspects of building a good credit score is consistency. To achieve and maintain a good score, you need to develop good credit habits and stick with them. Remember, building credit is a long-term endeavor and it’s important to always stay on top of what and how things can impact your score.

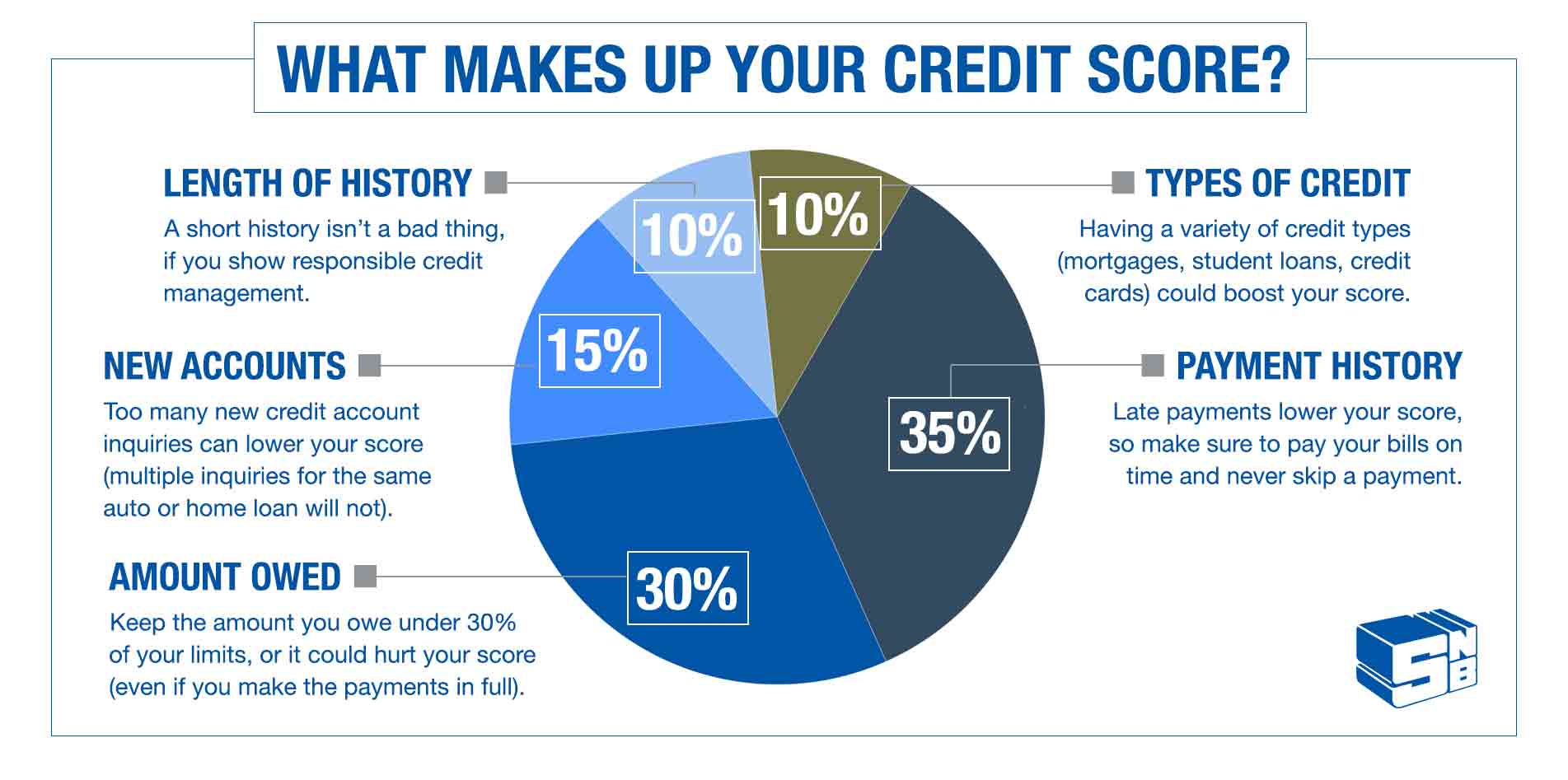

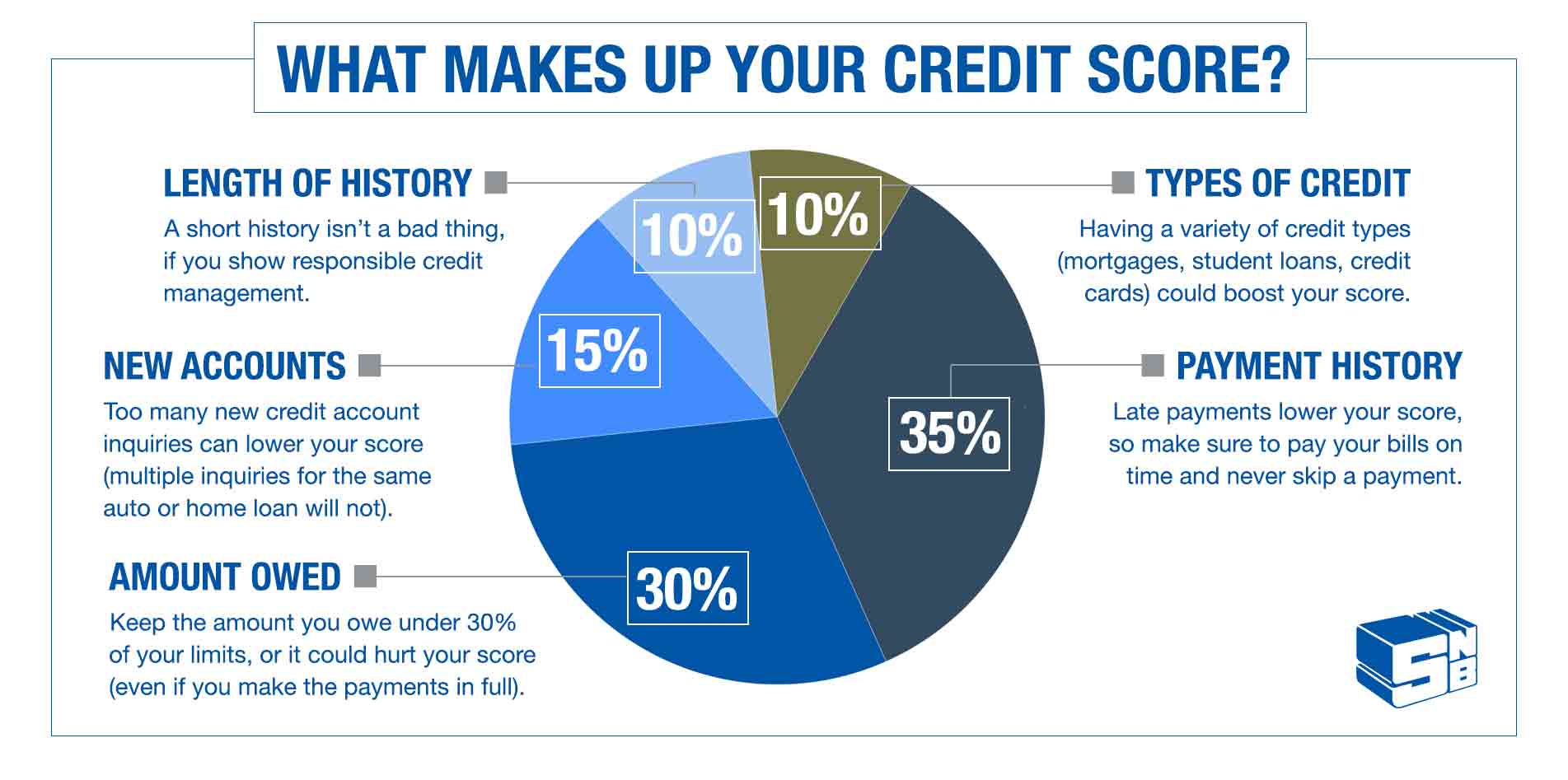

As you build your credit, understanding the factors that go into score calculations will allow you to monitor your behavior and ensure everything you do it’s helping, not hurting your score. Here are some of the key attributes of your credit scores and areas to watch as you build your credit.

Information on your credit report that can influence your credit scores includes:

- Payment history

- Types of credit accounts you have open

- How long you’ve been using credit

- Your debt balances

Raise Your Fico Score Instantly Its This Easy

For the first time ever, get credit for your Netflix®, Huluâ¢, Disney+â¢, HBOâ¢, phone and utility billsâonly with Experian Boost.

- 1Connect the bank account you use to pay your bills. Your information remains private.Connect

- 2Choose and verify the positive payment history you want added to your credit file.Verify

- 3See your boost results instantly.Boost

Connect the bank account you use to pay your bills. Your information remains private.

Choose and verify the positive payment history you want added to your credit file.

See your boost results instantly.

What Items Can Damage Your Credit Score

There are three areas where your credit scores may be impacted, outside of major negatives such as bankruptcies, foreclosures, and judgments. These common damaging items include:

- Delinquencies

- Collection Accounts

- Charge Off Accounts

As you can see by the charts below, there is wide room for improvement by getting inaccurate and negative information on your credit report removed.

You May Like: Does Opensky Report To Credit Bureaus

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

Make Your Payments On Time

Paying your bills on time is the most important thing you can do to help raise your score. FICO and VantageScore, which are two of the main credit card scoring models, both view payment history as the most influential factors when determining a person’s credit score. For lenders, a person’s ability to keep up with their credit card payments indicates that they are capable of taking out a loan and paying it back.

But your credit score isn’t just impacted by your credit card bills. You need to pay all your bills on time. That includes all your utilities, student loan debt and any medical bills you might have.

Read Also: Do Medical Bills Show Up On Credit Report

Avoid Credit Repair Scams

Some for-profit companies claim to be able to remove negative information from your credit report for a fee. But the truth is that no company can legally erase information from your file if it’s accurate. Avoid spending money on and take tried-and-true steps to improve your score instead, like lowering debt balances and paying your bills on time.

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. ;And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.;

So how can you get;credit scores? Here are a few ways:

Recommended Reading: How Are Account Numbers Displayed In A Credit Report

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Also Check: How To Get Fico Credit Score

Check Your Credit Score Regularly

Much like an athlete in training, you should use data to track your credit-improvement progress. You need to know how things are progressing, where theres still room for improvement, and when its time to trade up for a credit card with better terms. Thats where WalletHubs free daily credit-score updates come in handy. You wont find free daily scores anywhere else, and you dont want to live in the past when youre running from bad credit.

Whats more, we cant overstate the importance of signing up for credit monitoring. None of us have the time to keep constant watch on the contents of our credit reports. But with a free service that notifies you about any important change, youll be able to sleep much more soundly and take care of the problem right away.

Become An Authorized User On Your Parents Credit Card

Once you understand how credit works, you can use this knowledge to build your credit. One easy tip on how to establish credit is to ask your parents to add you as an authorized user on their credit card.

If your parents are responsible with their credit cards, pay their bills on time and dont max them out, then this is an easy way for you to start building credit fast.

The best part is you dont need to use the card. Instead, you can enjoy a budding credit score just by having your name on the account.

Read Also: How Long Do Late Payments Stay On Your Credit Report

Check Your Credit Reports

You may find it surprising to learn that you dont have just one credit score. You dont have just three credit scores either one from each credit bureau. Instead, hundreds of credit scores are commercially available.

You cant control which credit score a lender uses to grade and assess your credit report. Yet, you can exercise some control over;your credit reports, which your credit score is based on. There are many credit scores, but you have only three credit reports.

Its important to check your credit reports from Equifax, TransUnion and Experian. Fraud and credit reporting mistakes are known to happen. If errors occur, you might pay the price in the form of a lower credit score and all of the issues that can come along with it.

However, if you discover a credit reporting error, federal law lets you dispute the mistake with the appropriate credit reporting agency. If you dispute an incorrect, negative account and a credit bureau deletes it from your report, your credit score might improve as a result.

How Your Credit Score Is Determined

The two most popular types of credit scores in the United States are FICO and VantageScore. Lenders use these credit scores to help estimate the risk of doing business with you when you apply for a new loan or credit card.

Regardless of the brand, at its core a credit scoring model is a complex software program. It evaluates the details of your credit report and estimates the risk that youll pay an account 90 days or more late in the next 24 months.

A scoring model may consider the following when it calculates your credit score:

- Whether youve paid any bills late .

- The relationship between your credit card limits and balances .

- How long ago you opened your first credit account .

- Your experience with a mixture of account types .

- How often youve applied for credit in the past 12 months.

If your credit report shows years of on-time payment history, low credit utilization, and experience managing a variety of account types , your score will probably be in good shape. Youve handled your accounts well in the past, so youre more likely to keep doing so in the future.

You May Like: Which Credit Score Matters The Most

Dispute Any Errors Or Fraudulent Accounts

Even though your credit reports from each of the CRAs can vary, that doesnt mean you should ignore large inconsistencies. If you find that one or more of your credit reports is showing an error or a fraudulent account, immediately dispute it with the CRA showing the incorrect data.

Never ignore an error on your credit report. It could signify fraudulent activity or it could mean that someone elses data is being included on your report. Either of these situations can greatly damage your credit, so take care of it early.

How Does Borrowell Work

Free Weekly Credit Monitoring

Sign up in just 3 minutes for free access to your Equifax credit score and report, which we update every single week.

The first in Canada, our AI-powered Credit Coach helps you understand your credit score and gives personalized tips that may help you improve it.

Product Recommendations

Don’t Miss: Does Debt Consolidation Affect Your Credit Score

How And When Do I Pay Off The Card

You can pay off your Credit Builder charges in 3 ways:

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Also Check: Which Credit Score Is Correct

Avoid New Credit Card Applications

As long as you’re in credit repair mode, avoid making any new applications for credit. When do apply for new credit, the lender will often perform a “hard inquiry,” which is a review of your credit that shows up on your credit report and impacts your credit score.

How many credit accounts you recently opened and the number of hard inquiries you incurred both reflect your level of risk as a borrower, so they make up 10% of your credit score. Opening many accounts over a relatively short period can be a red flag to lenders that a borrower is in dire financial straits, so it can further decrease your score. In contrast, having few or no recently opened accounts indicates financial stability, which can boost your credit score.

How Can I Keep My Credit Score On Track

If you want to use a buy now pay later scheme, according to Norton Finance, one of the best ways to stay on track is to make payments on time. Heres how else you can maintain your credit score:;

- Try to avoid having too many credit accounts open at once. Having too many active accounts tells lenders that you might struggle to keep up with repayments. ;

- Manage your budget carefully. Make sure you know exactly how much you need to repay and set it aside each month.;

- Check your credit score regularly. If you spot any errors, or you dont recognise a debt, contact your lender.;

If youre worried about money or youre struggling to make your repayments, help is available from organisations like Citizens Advice.;

Read Also: How To Get A Bankruptcy Off Your Credit Report

Don’t Take Out Too Many Cards

Sometimes it seems like a good move to open a new credit card with a merchant to get a discount on an item. But try not to go overboard and take advantage of many discount offers over a short period of time. Each new card comes with a “hard inquiry” on your credit report by the merchant, which can have a negative impact on your credit score.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Does Checking Your Credit Score Affect Your Credit Rating

Consider Getting A Credit

If you have a poor credit history, you might want to think about getting a credit-builder credit card. These are cards designed for people who either have made little previous use of credit or who have a bad credit history. But credit limits on these cards are often low and the interest rates are high. This reflects the level of reassurance your credit file information provides to lenders.

Butbe aware that the interest rates charged are much higher than standard credit cards. Typically, youll be paying over 30% in interest a year, which is another reason to try to pay off any balance in full each month. Otherwise, you might end up in debt that you struggle to get out of, which could harm your credit rating even further.

Add Utility And Phone Payments To Your Credit Report

Typically, payments such as utility and cellphone bills wont be reported to the credit bureaus, unless you default on them. However, Experian offers a free online tool called Experian Boost, aimed at helping those with low credit scores or thin credit files build credit history. With it, you may be able to get credit for paying your utilities and phone bill even your Netflix subscription on time.

Note that using Experian Boost will improve your credit score generated from Experian data. However, if a lender is looking at your score generated from Equifax or TransUnion data, the additional sources of payment history wont be taken into account.

There are also services that allow rent payments to be reported to one or more of the credit bureaus, but they may charge a fee. For example, RentReporters feeds your rental history to TransUnion and Equifax; however, theres a $94.95 setup fee and a $9.95 monthly fee.

How much will this action impact your credit score?

The average consumer saw their FICO Score 8 increase by 12 points using Experian Boost, according to Experian.

When it comes to getting your rent reported, some RentReporters customers have seen their credit scores improve by 35 to 50 points in as few as 10 days, according to the company.

Also Check: What Credit Score Does Carmax Use