What Is Rapid Rescoring

Rapid rescoring may be useful if youre trying get approval for a credit product, typically a mortgage, and your credit score is close, but not at a lender requirement. If youve recently made positive credit moves but theyre not yet reflected on your reports, lenders can request the information be added. This can result in your report and score being updated within a few days instead of having to wait for the next cycle. Its important to note that:

- You arent able to request a rapid rescore on your own.

- A lender must request one on your behalf and theres usually a fee for the service.

- A rapid rescore cant fix previous mistakes or make negative information disappear.

If youve been working hard to improve your credit health, it can be frustrating to feel your positive progress hasnt been recognized. Ultimately, you may just need to wait for your lender to provide the updated information. In the meantime, keep that momentum going with additional healthy credit habits. If youre looking for other ways to improve your credit health, gives clear, actionable recommendations based on your credit data to help you earn the credit score you want.

What You Need to Know:

There are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions. The credit score you receive is based on the VantageScore 3.0 model and may not be the credit score model used by your lender.

*Subscription price is $24.95 per month .

Paypal Business Loan Requirements

- At least nine months in business

- Minimum of $42,000 in annual revenue

- 550 credit score or higher

In addition to meeting the minimum requirements above, you will need to fill out an online questionnaire or call 800-941-5614 to determine your eligibility. As we mentioned earlier, a PayPal Business account is also a requirement, but its free to sign up.

Ineligible businesses

PayPal Business Loans are not available to numerous industries and positions, which include:

- Attorneys

You can find a full list here.

Shopify Capital Project Qualifications

To qualify for Shopify Capital, you dont need to meet any specific qualifications regarding time in business, revenue, or personal credit score:

| Time In Business | |

| Business Revenue | N/A |

Instead, Shopify will evaluate your cash flow based on your Shopify activities. The company does not disclose the criteria it uses to determine whether you receive an offer. To be eligible for funding, however, youll need to:

- Be located in the United States, Canada, or the United Kingdom for merchant cash advances and the United States or the United Kingdom for loans

- Have a profile that is considered low-risk

- Process a certain amount of sales

- Have Shopify Payments or another third-party payment provider enabled

Be aware that you cannot apply for Shopify Capital;instead,;Shopify will monitor your account and alert you if youre eligible. For more information, check out the Application Process section below.

Recommended Reading: When Do Credit Cards Report Late Payments

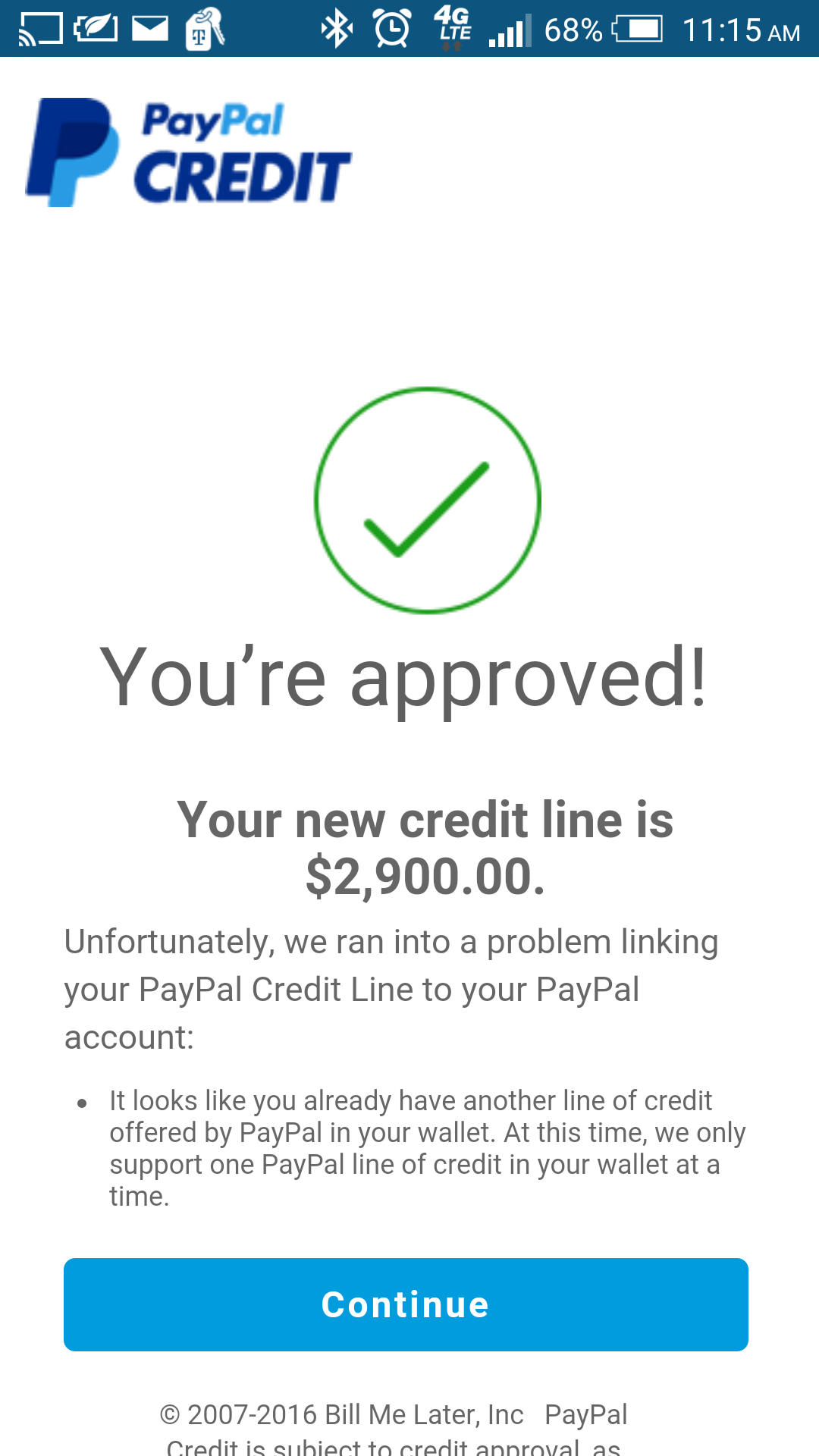

Who Is Eligible For A Paypal Working Capital Loan

In order to be eligible for a PayPal Working Capital Loan, youll need to have either a PayPal Premier account or a PayPal Business account open for at least 90 days. In addition, youll need to make the equivalent of at least $15,000 per year in sales if youre using a PayPal Business account, or $20,000 per year in sales with a PayPal Premier account. Youll also need to have paid off any outstanding PayPal Working Capital loans.

You can still use cash or other non-PayPal payment options to sell, but that income wont be counted in the amount available to borrow, nor will it be used to repay your PayPal loan.

Our Take On Paypal Working Capital

PayPal Working Capital could be a good option for PayPal users who need emergency financing for their small business that they can pay off quickly. Many small business owners can get approved and funded in less than an hour with little or no paperwork and no credit check. And businesses that chose the highest repayments have received fees equivalent to around to 1% APR in the past.

But PayPal has become a lot less transparent about what it offers since 2020 when most business lenders changed their products due to the coronavirus outbreak. When I first wrote this PayPal Working Capital review, PayPal provided a calculator to let potential borrowers see an estimate of their fees. But as of June 2021, it doesnt even disclose the minimum and maximum loan amounts available.

If you need fast funding and meet the minimum requirements, its worth checking your rate. But there are likely less-expensive options out there even through PayPal.

Read Also: How To Get Charge Offs Off Of Your Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

What Are Examples Of Loans Requiring No Credit Check

One example of a no-credit-check loan is PayPal Working Capital. Small businesses that use a PayPal business account to process at least $15,000 in annual payments can apply for working capital loans. Right on its website PayPal states:

No credit check. Your loan is based on your PayPal sales, so no credit check is required, and it doesnt affect your credit score.

Square Capital is another popular example that does not require a credit check. Square Capital is open to businesses using the Square payment processing device. The way it works is that Square knows your history of payments received, and can estimate how much you will receive in the future. Your loan amount is based on your volume. Repayment will be automatically deducted from future sales, according to the Square website.

A third example of a no-credit-check option is Stripe Capital, for businesses using the Stripe online payments system.

There are many others. Check for online lenders that provide cash advances without a credit check.

For Paypal Business Loans You Need To Know That:

Your borrowing amount, terms, and weekly payment size depend on your businesss overall financial health and your personal credit score.

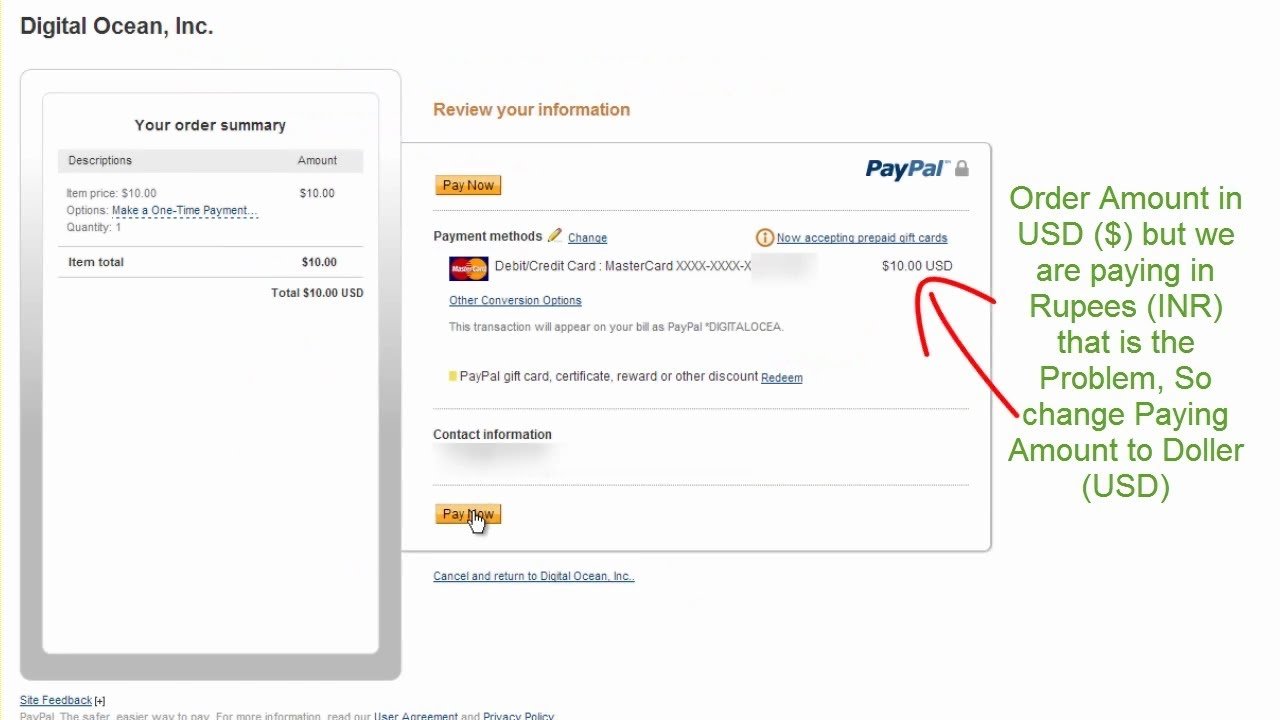

Instead of a traditional interest rate, the business loan has a fixed fee that is factored into weekly repayments. These payments will be automatically deducted from your business bank account or PayPal account, depending on which one you use to collect sales. You can choose the day of the week on which payments are deducted.

You can pay off the loan in full at any time, but youll have to pay the full fee based on the original term of the loan.

Collateral is not needed, but you will need to sign a personal guarantee. This means that in the event of a default, PayPal can seize your personal assets to make up for the lost funds.

Payments for PayPal Business Loans are reported to the business credit bureaus but not the personal credit bureaus. Thus, your payment history will boost your business credit score but not your personal credit score. Your business credit could be just as important as your personal credit when applying for loans with some business financing companies.

Services That Fund Your Small Business When You Need It

No matter how savvy you are with budgeting and saving money in your business, there might come a time where you find yourself in a crunch. Maybe its due to a summer slump in sales, or maybe it was an unexpected expense. No matter what the reason, if you find yourself in need of quick capital for your business, there are services that can help.

Is Paypal Working Capital The Same As A Merchant Cash Advance

PayPal Working Capital has the same general repayment structure as a merchant cash advance. However, several circumstances could cause your daily payment to rise, even though your sales have not. For instance, if you dont have enough money to cover the previous days sales, PayPal will take catch-up payments from your account until you reach this point.

With PayPal Business Loans, PayPal automatically deducts your payments each week.

Do You Need Extra Security On Your Device

When using PayPal Credit or any other online payment method its smart to keep your security programs current and refrain from using public networks or computers.

- Enable PIN, fingerprint or facial recognition if your device offers it, says Velasquez. That way, if someone walks away with your device, they wont immediately have access to your financial accounts.

- Turn on two-factor authentication, says John Breyault, vice president of public policy, telecommunications and fraud for the National Consumers League. That way, potential crooks will need to do more than get your email address and guess your password.

- Dont share accounts. If you do, lenders and financial institutions could hold you responsible for another persons charges even ones you didnt authorize.

- Use unique and strong passwords for each financial or shopping account, says Velasquez. And dont save the password on your device, she adds.

- Log off from your account after each transaction. And clear your history and cookies for additional security.

Contact Us Customer Service Account Log In Synchrony Can Be Fun For Everyone

Was it a rip-off or triggered the problem . However just closing the account like this is bad business. Preferred OutcomeCorrection to a credit report I wish to have my account reinstated/ or any bad credit reports removed from closing my account. *************************************************************** November 3, 2020 Sent through Better Service Bureau Site Case Number: ******** Lender: Synchrony Bank On behalf of Synchrony Bank, I am responding to your query we received from the Better Business Bureau on October 28, 2020.

In regard to how our credit limit are managed and developed, Synchrony Bank assesses credit accounts based on a sound credit rating system . This system occasionally creates a rating, which is an outcome of point worths designated to numerous items discovered on a customers credit bureau. In our experience, this score assists predict the probability an account will be paid in accordance with its terms.

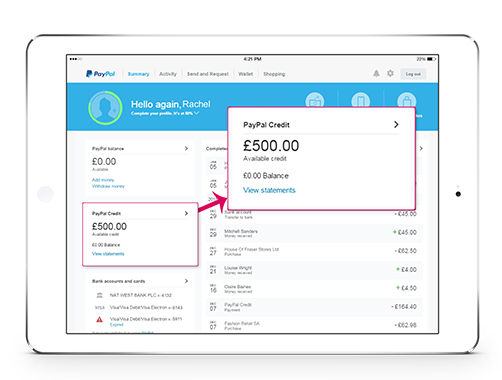

More About Paypal Credit Line Of Credit Faqs Paypal Us

You can dispute with aid from a credible credit repair company like Credit Glory. The customer service number for Syncb/ppc is 295-2080. Prior to you call and confess to any financial obligation, you must confirm that its actually real . If it isnt, you can partner with Credit Splendor to dispute and remove the record from your credit report.

Sync/PPC is a legitimate business, however sometimes they report incorrect info on your credit syncb/ppc credit card. What can you do? Easy, partner with Credit Glory and dispute the record and give your score a boost!In some cases, we advise speaking to a Credit Repair expert to examine your credit report.

Not Known Factual Statements About Does Paypal Credit Report To Credit Bureaus Smartsavvylife

Lots of business operate with a hybrid model, using reselling or combination services in addition to handled services. You only spend for your purchases, appropriate taxes, and shipment charges. Louis Park, MN. NOR. It doesnt matter if you process $5,000 each month in cards or $5,000,000 monthly. 100% satisfaction ensured.

NCO DIN SER MSP. Even alter your password and do 2FA security on your PayPal account settings. An included advantage of QuickBooks Payments is our instant or next-day deposits syncb/ppc credit card. ONLINE BR. $28 for 24 months with PayPal Creditopens an installment calculator layer * $28 for 24 months. 4 SNF-332. I.

In essence it implies that you made a misc. All non-credit-card orders are subject to a 10-business-day hold syncb/ppc credit card. Frequently asked questions; Comparing to PayPal; Merchant Solutions Contrast: PayPal merchant service is a terrific service for the right merchants, however most merchants who are processing at least $5k $10k monthly will save money by processing with Dharma, while likewise getting access to advanced features.

Paypal Working Capital Review: The Basics

PayPal Working Capital has a physical address at:;

2211 North First Street

San Jose, California 95131.

San Jose is the home of PayPal Working Capitals corporate headquarters.

You can call them at: 221-1161. Their contact page is here: . They have been in business since 1998 but that is actually how long PayPal itself has been in business.

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Customer Service & Technical Support

You can reach PayPal via phone or email. The company also has an active presence on social media sites, including a Twitter account dedicated to customer assistance.

Unfortunately, as many large companies do, PayPal suffers from inconsistent customer service. Working Capital;customers are especially susceptible to;unhelpful customer service because the loan approval process is completely automated. If you run into problems,;customer service may not have a whole lot of helping power. Even so, if youre having problems getting approved, its still worth it to call up customer service; they might have more insight regarding what youre doing wrong than you do.

Additionally, PayPal has a large and very helpful community forum. Any problems you run into have likely been encountered by somebody else, so its worth checking out if youre experiencing difficulties.

How Do I Get A Paypal Working Capital Loan

You can get a PayPal Working Capital loan by going to the PayPal Working Capital website and logging into your account. PayPal will confirm your information and let you know if you’re approved.

At that point, you’ll have the chance to choose your loan amount and repayment percentage. You’ll have a change to you review your offer before accepting. After you’ve accepted, PayPal will deposit the funds into your PayPal account.

This process can take a matter of minutes for many users if you’re approved. But many users have reported having to apply multiple times before they were approved. And in some cases, it can take as long as seven days to get that initial approval.

Not Known Facts About Paypal Msp Charge

Some of the factors a lending institution might decrease your credit line consist of:: The loan provider may have spotted a variety of missed out on or late payments, suggesting that you might be experiencing financial difficulties.: Your credit reports may show that youre using a substantial quantity of credit. This is reflected in your credit utilization ratio, or the quantity of revolving financial obligation youre using.

Is There A Minimum Credit Score For A Business Loan

Technically, there is no minimum credit score for a small business loan. Every lender has its own requirements.

That said, there are some general rules of thumb in the industry. In practice, a personal score of 620 is widely recognized as the minimum. More than likely you will need a score of 720 or above for good business loan terms.

Paypal’s Working Capital Vs Square Capital

- on Square’s secure website

Similar to PayPal, Square isn’t necessarily a lender but provides small-business loans for customers who use its platform. Also similar to PayPal, Square has relatively lenient eligibility requirements and qualifies borrowers mostly on their sales transactions through Square. We recommend PayPal over Square in this case, as they both have similar costs per dollar but PayPal offers significantly larger loans. Ultimately, however, this will depend on which platform you process transactions through.

How Do I Apply For A Paypal Working Capital Loan

If you want a PayPal business loan, you can start an application on PayPals website . Heres how:

PayPal doesnt say how long this takes. Typically, though, online lenders get back to you within a few days at most.bureaus when you make payments. So you wont take a hit to your credit

Once youve approved, you can get money in your PayPal account in just a few minutes. Your loan repayment will start 72 hours after that.

Syncb/ppc Account Just Appeared Out Of Thin Air On My Credit Fundamentals Explained

You might likewise consider submitting a statement with the bureaus requesting notice to you prior to any new accounts are opened or any existing accounts are changed in your name. This might uncover illegitimate attempts to open additional accounts in your name Credit Report: 1-800-685-1111Report Scams: 1-800-525-6285 Credit Report: 1-888-397-3742Report Fraud: 1-888-397-3742 Credit Report: 1-800-888-4213Report Fraud: 1-800-680-7289 Request and regularly evaluation copies of your credit report from each credit bureau.

Regular evaluations will assist you verify that the asked for modifications have actually been made and if your report has actually been altered without your knowledge. A free copy of your credit report is readily available every year, at http://www . annualcreditreport.com.

Validate with your banking organization that the payment has cleared syncb/ppc credit card. If it has, contact us at the phone number showed on your card and/or statement. Or, you can call 877-295-2080. Have your payment details all set, consisting of: Payment date, type , amount, account number and how payment was made .

If cashed, get a copy of the cancelled check from your bank. Consult your bank to discover if they sent the payment to Synchrony Bank. If they did, get the information from them of where and how it was sent out to us, including if the check was sent by mail or if the payment was sent electronically .