Where Does Your Credit File Go When You Die

After you die, your Experian credit file will eventually be closed, but it doesn’t happen immediately. There are several ways the credit bureaus may be notified of your death:

- : When you pass away, your spouse or the executor of your estate should alert your creditors of your death. The next time the creditor updates your accounts with the credit bureaus, they will also report that you are deceased.

- : The SSA periodically sends a list of the newly deceased to the three major consumer credit reporting agencies: Experian, TransUnion and Equifax. This file isn’t comprehensive, however it only includes people who were receiving Social Security benefits and whose deaths have been reported to the SSA. Typically, the funeral home will report your death to the SSA. Your spouse or estate executor can also choose to notify the SSA themselves by calling 800-772-1213 or going to the local SSA office in person.

- : Your spouse or your estate’s executor may want to notify the credit bureaus of your death themselves. This can be faster than waiting for the SSA or lenders to do it. When the death is reported to one credit bureau, they will alert the others.

Any credit accounts showing the deceased indicator will be deleted after seven years. Over time, all your accounts will be deleted and the credit report will no longer exist.

What Happens To Your Credit File When You Die

When someone passes away, their credit file will close eventually. This does not happen right away, and thus creates a need for someone to submit a death notice to the bureaus.

There are several ways that a credit bureau can find out about a death. The first is when the deceased persons creditors update their credit files and marks that the individual is deceased. The creditors often find out directly through a surviving family member. The second source is the Social Security Administration , which routinely sends out a list of newly deceased individuals to the three major credit bureaus: Experian, TransUnion, and Equifax. However, this is not a reliable source. There are millions of social security fraud cases in which deaths are not reported. Finally, the surviving spouse or Executor of the estate can report the death directly to the major credit agencies.

When the credit bureau receives the death notice from one of the above methods, they will flag the deceased persons file. They do not close or delete credit files right away, in case of an error or mistake. However, this step helps prevent fraud and identity theft.

A deceased persons credit files are finally closed and deleted after being flagged for seven years. The credit report will no longer exist after this action.

Get Multiple Official Copies Of The Deceaseds Death Certificate

Obtain original death certificates from the county where the deceased lived. The funeral director who handled burial, cremation or other arrangements may also provide you with copies of the death certificate. Get more copies than you think you need its easier than going back for more later.

You probably will want to get one death certificate copy for each of the deceaseds credit cards, three for the three credit reporting bureaus, plus copies for other estate purposes. Some states have both long-form and short-form death certificates, and banks will differ on which they require.

You do not want to deal with identity theft of a loved one several years after they have passed away.

Recommended Reading: How To Remove Chapter 7 From Credit Report

You May Like: What Should My Credit Score Be To Buy A Car

Identity Theft Can Victimize The Dead

Identity thieves can strike even after death. An identity thief’s use of a deceased person’s Social Security number may create problems for family members. This type of identity theft also victimizes merchants, banks, and other businesses that provide goods and services to the thief.

What happens to your Social Security number after you die? The Social Security Administration maintains a national file of reported deaths for the purpose of paying appropriate benefits. The file contains the following information: Social Security number, name, date of birth, date of death, state of last known residence, and zip code of last lump sum payment.

The SSA generally receives reports of death from a family member or a funeral home. Sometimes delays in reporting can provide time for identity thieves to collect enough personal information to open credit accounts or take other fraudulent actions using the deceased’s information. To prevent this from happening, a surviving spouse or other authorized individual, such as an executor, can notify the credit bureaus. This will ensure that the deceased’s files are flagged with a “deceased” notation.

Signs of possible identity theft include calls from a creditor or collection agency on an account opened or used in the deceased’s name after death. If you discover such signs, contact the affected creditor or collection agency in writing, explaining that the account was opened or used fraudulently. See sample letter attached.

How To Make An Electronic Signature For The How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death In The Online Mode

Follow the step-by-step instructions below to design your transunion death notification:

After that, your notification of death letter to credit bureaus is ready. All you have to do is download it or send it via email. signNow makes signing easier and more convenient since it provides users with numerous additional features like Add Fields, Invite to Sign, Merge Documents, and many others. And due to its cross-platform nature, signNow works well on any gadget, desktop computer or mobile phone, regardless of the OS.

Recommended Reading: How To Get Credit Report Mailed

How Do I Request A Credit Report As A Legal Guardian

Legal representatives or court appointed guardians can request a copy of the credit report for their wards by mail.

Send the request along with the following information about the ward:

- Legal name

- A copy of the wards birth certificate

- A copy of the wards Social Security card

And information about yourself:

- Proof of your legal representation or guardianship

- A copy of your drivers license or other government-issued identity card with your current address

- A copy of a current utility bill

Make sure the drivers license and the utility bill have the same address.

You May Like: How To Get Credit Report With Itin Number

Work With Estate Executor To Close Out Credit Accounts And Pay Off Any Remaining Balance

Last but not least, close all of the financial accounts that are related to your deceased loved ones credit report. This can be done by the surviving spouse and the Executor of the estate. Create a checklist of accounts that need action, such as credit cards, utilities, and bank accounts. If any of the companies require a written notice, then you can likely modify the death notice you submitted to the credit bureaus and use it as a template.

Read Also: Is 736 A Good Credit Score

Hiring A Collection Agency Or Credit Reporting Service

Hire A Collection Agency

For either a flat fee or a percentage of the rent collected, you can hire a collection agency to chase delinquent rental payments and other tenancy-related debts. If the tenant does not pay, the collection agency can report the collection account on your behalf. When choosing an agency, make sure that it reports to all three credit repositories. Filing a collection account has a significant negative impact on the tenants credit score and may disqualify her from renting an apartment in the future.

Recommended Reading: How Long Does Debt Settlement Stay On Your Credit Report

Recommended Reading: How To Get Chapter 7 Off Credit Report

After The Death Of A Family Member Notifying The Credit Bureaus

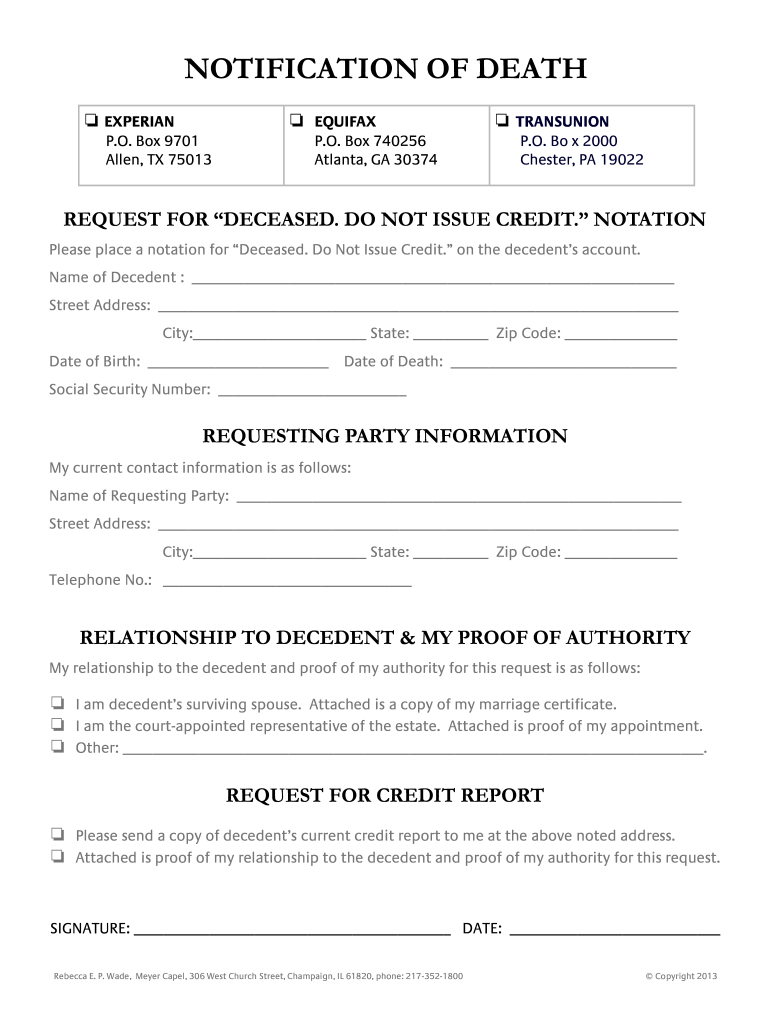

Request a current copy of the decedents credit report. 3. Send the notification letter and death certificate copy to the bureaus. Keep copies of your originals 2 pages

How Do I Notify Credit Reporting Agencies of a Loved Ones Death? Immediately contact all three national credit reporting agencies by telephone to report Rating: 4.5 · 46 votes

Sep 5, 2019 Should you notify credit bureaus of a death? Yes, you should notify the three major credit bureaus as soon as possible after a death to ensure

If youve been listed as deceased, well force the credit bureaus to fix your report without you having to pay us. We only get paid by them when we get a Should You Try to Fix Being Reported as Deceased Yourself?What If They Refuse To Correct Being Reported as Dead?

Settle Accounts Through The Estate

Family members arent responsible for a loved ones , except in the case of a joint account.

If the deceased was sole owner of the account and had a balance on their credit card, it will need to be resolved as part of the probate process. The creditor should petition the estate for any remaining balance. If there arent enough assets in the estate to cover the debt, creditors may not get paid, because credit card debt is unsecured debt.

Before you pay anything, ask the credit card company to submit a proof of claim for the estate, says John Caleb Tabler of Lau & Associates in Pennsylvania.

Make sure gets paid out of the assets of the estate if there are any, says Tabler. Keep in mind, if you waste estate assets as a personal representative, misuse them, or, in the case of Pennsylvania, disburse money from the estate before theres a formal accounting, as the personal representative you can be found liable for debts owed.

As the personal representative, avoid paying bills for the deceased yourself, and never commingle your money with that of the estate. You have no obligation to personally pay any debt of the deceased unless you were already a responsible party on the account.

Any protection a personal representative may have individually goes away if they enter into an agreement to pay the debt of the deceased, Tabler says.

Don’t Miss: How To Get Experian Credit Score

How To Report A Death To Credit Bureaus

After the death of a loved one, it can be difficult to think about anything else. At the same time, there are tasks that need to be taken care of and notifying credit bureaus of a death is one of the important ones. This article will discuss how to report a death to different credit bureaus and what information you need in order to do so.

Obtain The Death Certificate

First, you need to obtain your loved ones death certificate. The bureau requires a death certificate with the death notification to prove your loved one has indeed passed away.

Youll receive the death certificate within a few weeks after the death of your loved one, but you can also secure one from your local courthouse, the town or city clerk where the decedent passed away, or the states vital records department. Its always a good idea to have multiple certified copies of the death certificate.

Read Also: How To Add Rental History To Credit Report

Other Steps To Consider

Closing up financial loose ends after a loved one passes away takes time. Handling their credit report is important, but it is only one step. Youll need to contact their creditors to cancel their accounts and settle any balances and make sure that mortgages and loans have been settled. Youll probably also need to take care of your loved ones tax returns for one final financial year deal with their bank accounts.

It can seem overwhelming, but take it one step at a time. Handling these details calmly and carefully will ensure that your loved ones accounts will be settled and will remain safe from any attempted compromise.

What Are My Rights

Regardless of whether the debt will be repaid out of the estate or your own pocket, individuals have rights in manners of debt collection under the Fair Debt Collection Practices Act . This act limits who debt collectors can contact, what information they share, and how they present that information.

Dont Miss: Does Paypal Report To Credit Bureaus

Recommended Reading: How To Boost Your Credit Score 100 Points

Work With A Credit Reporting Lawyer

If you have been mistakenly reported as deceased by a credit bureau, our firm can help. For more than 25 years, the attorneys of Lyngklip & Associates have presented consumers with credit problems like yours and been a resource for Michigan consumers who need help to correct false reports of their death. No matter whether you need a little coaching or would like us to handle the problem entirely, our experienced credit attorneys can help.

To learn more or to schedule a free initial consultation with a lawyer to help with your Michigan credit reporting issue. contact our law firm today or call 208-8864.

Notify The Three Major Credit Bureaus

Send letters to each of the major credit bureaus Experian, Equifax, and TransUnion and include the deceased’s legal name, Social Security number, date of birth, date of death, and your full name and mailing address. You will need to provide a certified copy of the death certificate, a copy of your identification, and proof of your authority over the estate .

When you write to the three big credit bureaus, it’s a good idea to also request a copy of your loved one’s . This will ensure you know about all open accounts that need to be closed. While you may find credit cards in a wallet or statements in a desk drawer, the only way to know for sure that you’re canceling every single account in the deceased’s name is to order a copy of their credit report.

Spouses and executors of the estate can make this request when they write to each of the credit bureaus to let them know of the person’s passing. Just be sure to include the deceased’s last known address in your letter.

Tip: When managing the finances of a loved one who’s passed away, it’s important to start the process quickly to minimize the risk of fraud or identity theft.

You May Like: What Is The Maximum Credit Score

How To Make An Electronic Signature For The How Do I Notify Credit Reporting Agencies Of A Loved Oneamp39s Death On Android Devices

In order to add an electronic signature to a transunion death notification, follow the step-by-step instructions below:

If you need to share notification of death letter to credit bureaus with other people, you can easily send the file by e-mail. With signNow, you are able to design as many papers in a day as you need at a reasonable price. Start automating your signature workflows right now.

Call The Credit Agencies And Request A Credit Freeze

Next, call the credit agency to let them know that your loved one passed away. This is also a great way to obtain instructions on how to go about filing the written claim. In the meantime, the agency will put a note on the account, thus creating some notice in case fraudulent activities begin before you can file your claim.

Here are the phone numbers for each credit bureau:

-

TransUnion: 888-4213

-

Experian: 397-3742

Don’t Miss: When Does Bankruptcy Fall Off Credit Report

After A Relative’s Death Do I Need To Contact Each Nationwide Credit Bureau

Equifax understands that there can be a lot to consider following the death of a loved one. Notifying any one of the three credit bureaus — Equifax, Experian, and TransUnion — allows the individual’s credit report to be updated with a deceased notice, which may help prevent theft of their identity. When one bureau adds a deceased notice to the person’s credit file, it will notify the other two, eliminating the need for you to contact all three credit bureaus.If you are the spouse of the deceased person or a representative legally authorized to act on the person’s behalf, you can ask to have a deceased notice placed on a loved one’s Equifax credit report by mailing in a copy of the death certificate along with the following information about the deceased:

- Legal name

- Date of birth

- Date of death

Please also include your name, your mailing address to send final confirmation and a copy of your identification, such as a driver’s license or other government-issued identification.If you are not the spouse of the deceased, you will also need to include court documents authorizing you to legally act on their behalf.Mail the required information to:Equifax Information Services LLC