Your Mortgage Credit Score Might Not Be What You Expect

Many home buyers dont realize they have more than one credit score. And the score a mortgage lender uses may be lower than the one you see when you check it yourself.

Finding out late in the game that you have a lower mortgage credit score could be an unwelcome surprise. You might end up with a higher interest rate and/or smaller home buying budget than youd planned.

So before you apply, its important to understand how lenders look at credit and what score you need to qualify.

Option #: Check Your Credit Scores With Credit Monitoring

- New hard inquiries

- Late or missed payments

- Collection actions

Thats helpful, especially if youre worried about identity theft or fraud. A credit monitoring service could alert you right away if a new credit account is opened in your name that you didnt authorize.

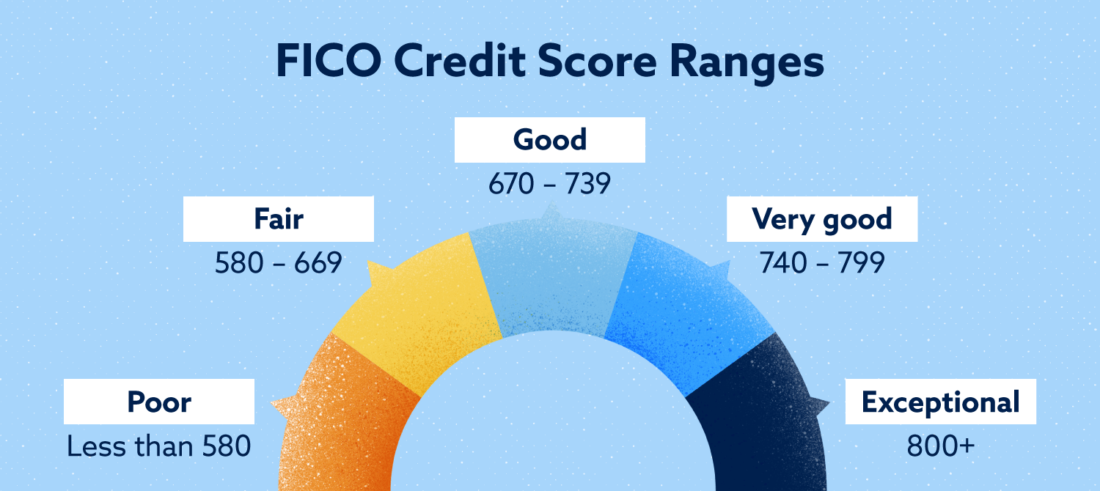

But theres a catch. Credit monitoring services dont always furnish FICO Scores. They may offer VantageScores instead.

VantageScores are an alternative scoring model that are used by a growing number of lenders. But they arent as widely accepted as FICO Scores. So if youre interested in getting your FICO Score, a credit monitoring service may not be much help.

Checking Your Own Credit Score Wont Lower It But Other Credit Checks Might Have An Effect On Your Score

Ever wonder if checking your own credit scores will lower them? Great question! The short answer is noâchecking your credit scores yourself wonât hurt them. However, other types of credit checks could cause your scores to dropâthough the drop could just be temporary and only by a few points.

Read on to learn more about the two kinds of credit checksâsoft checks and hard checksâand how only hard checks can lower your scores.

Don’t Miss: Credit Score Of 626

How To Avoid Hard Inquiries

Heres how to avoid hard inquiries and help protect your credit score from taking a hit.

Dont apply for too many credit cards

The easiest way to avoid hard credit inquiries is to not apply for too many credit cards. Every time you do apply for a credit card, a hard inquiry will show up on your credit report, potentially damaging your credit score.

Think carefully before applying for a new credit card. Do you really need another credit card, or do you instead need to better manage the credit you already have?

If you are rate shopping, do it over a short period of time

Shopping among several different lenders for the best interest rate wont have too big of an impact on your score. Thats because when you receive several different hard inquiries from the same type of lender say auto lenders or mortgage lenders during a short period of time, those inquiries are counted as just one total hard inquiry. Thats because its obvious that you are weighing the offers of several different lenders, but for just one loan.

If you are shopping for a mortgage loan, then, make sure to apply with these lenders during a short period of time, within 14 to 45 days, depending on the FICO® scoring model being used. That way, the hard inquiries that these lenders pull wont each be counted separately.

Take your loan out quickly

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Also Check: Does Speedy Cash Report To Credit Bureaus

How Long Does It Take For A Credit Score To Improve

The time it will take to boost your credit score depends on several factors. If youre wondering how to get credit at 18, you probably have little or no credit history. In this case, you can improve your score within months with good financial behavior.

If your score is low because of debt or bad financial history, however, it might take years to recover.

Generally, its up to lenders to report your payments, so there might be a slight delay between paying your bills and seeing a decreasing balance.

How long does it take to establish a credit score? If you start building a credit score at 18, youll need at least one opened account regardless of account types wait at least six months for a FICO score to develop. A VantageScore generates faster as all it needs is an opened account.

| DID YOU KNOW? Certain financial events can affect your credit score for years! For example, bankruptcies stay on credit reports for an average of seven years. |

You Can Check Your Own Credit With No Impact On Your Score

When you check your own credit whether you’re getting a or a it’s handled differently by the credit reporting agencies and does not affect your credit score. If you are applying for a mortgage and haven’t already checked your credit report for errors, do so now. You can get a free copy of your credit report at www.annualcreditreport.com. If you find any errors, get them corrected as soon as possible.

Recommended Reading: Does Removing An Authorized User Hurt Their Credit Score

Become An Authorized User

To add payment history to your credit report, youll either need to get a credit card on your own or become an authorized user on someone elses. If someone adds you as a cardholder to their account, youll start accumulating a track record as every payment will be added to your credit report even though youre not the primary cardholder.

The downside is that the credit card company ties your credit activity to the primary cardholder. This means that any late payment, whether its yours or the card owner, will reflect on both of you.

Why Your Score Matters

If you have no idea what your credit score is, it will make it harder for you to make smart decisions when it does come time to apply for a student loan, mortgage or new credit card.

“You could find yourself applying for a card thinking you’ll get a 15 percent rate and get a 25 percent rate,” said Schulz. “That’s an unpleasant surprise.”

Because credit scores and soft pulls are readily available online, it has never been easier for consumers to find out where they stand, Schulz said. It’s the first step towards bettering overall financial health.

For those looking to improve their credit score, it’s important to remember that the score is basically a number grade for your credit worthiness.

Your credit report, a detailed history of your debts, is a very important tool, Schulz said.

“It can be intimidating and that can keep people from diving in,” said Schulz, “But it’s really important that you take the time at least once a year to make sure that everything is ok.”

Read Also: How To Remove Repossession From Credit Report

How To Dispute Hard Credit Inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, youll want to look into it and understand whats going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If youve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

Why Do I Have So Many Different Credit Scores

In addition to multiple score models and versions, there are also three Experian, TransUnion and Equifaxthat collect the information your credit scores are based on.

FICO® develops scores specific to each bureau, so your FICO® Score 8 may be slightly different depending on the bureau. VantageScore, on the other hand, was developed cooperatively by the three credit bureaus, so scores that use the same VantageScore iteration will be the same no matter which agency you use.

There are some differences in the way VantageScore and FICO® calculate your score. For example, you likely will not have a FICO® Score if you don’t have a credit account that’s older than six months. You can get a VantageScore, however, if you have at least one account in your nameno matter its age.

Additionally, while both scoring models heavily weight , or the amount of credit card debt you carry relative to your credit limit, the VantageScore 4.0 also takes into account your utilization over time. So if you usually pay your credit card bill in fulleven if you carried a balance a few timesyou’ll be given credit for typically bringing your utilization to 0%. The most common versions of the FICO® Score, on the other hand, will assess your credit utilization based only on the time when your score was checked. The FICO® Score 10 T model does consider utilization over time, but it’s yet to be widely adopted by lenders.

Recommended Reading: Does Opensky Report To Credit Bureaus

Why Is Knowing Both Equifax And Transunion Score Necessary

Is TransUnion more important than Equifax? I wouldnt say so. Same question goes for is Equifax more important than Transunion.

Which credit score matters more Transunion or Equifax?

Since they can vary so much, if youre applying for credit sometime soon , you might wonder if knowing but your Transunion vs Equifax score is necessary or would it be considered overkill. Personally, it would be good to know both your Equifax and Transunion score.

So to answer the question, Transunion or Equifax which is better

At least you should check both Transunion and Equifax credit reports periodically, in case you need to check with the particular credit card bureau to fix something between the landlord and tenant. For me, I check about every 6 months or more frequently, when I apply for a new credit card .

If youre not applying for credit any time soon, its still nice to know because knowing your credit score is like a vanity metric LOL. This is somewhat reminiscent of the days when you want to get as high a grade as possible in school, right?

Getting an 800+ credit score is not hard to do and its nice to have.

Its also good to check your credit score for both credit bureaus because when you close a credit card that you have applied for recently you will want to double check and make sure the account is closed. This happened recently to me.

How To Check Your Credit Scores Safely

Ordering or checking your own credit score will never result in a hard inquiry, only a soft one. You wont have to worry about your credit score dipping when you order it on your own. Here are several ways to view your credit score.

Check with your bank

Banks often provide free credit scores for their customers. This can be a way to view the status of your credit without having to pay for a score. Remember, though, that the score your bank sends might not be the FICO® credit score that mortgage and auto lenders use. The score that banks and other financial institutions send, though, should be similar, and will give you an idea of how strong your credit is.

Check with your credit cards

You can also pay for your FICO® score from any of the three national credit bureaus of Experian, Equifax or TransUnion. Prices vary but should cost about $15.

You May Like: Paypal Credit Credit Bureau

What Is A Credit Inquiry

Credit scores are based on information that comes from your . That includes things like account balances and payment history, as well as new credit inquiries.

An inquiry simply means someone requested a copy of your credit report. That could be you or anyone whos authorized to view your credit file like a lender, landlord, debt collector, etc.

Why Do Credit Scores Matter

Ultimately, your credit score is important in many ways. To give just a few examples:

- Your credit score determines the types of loans you can get

- It determines the mortgage interest rates you pay

- It affects how large of a house or how expensive of a car you can afford

- Insurers in most states use credit scores to set premiums for auto and homeowners coverage. Policyholders with bad credit scores often pay more

- Landlords use credit scores to decide who gets to rent their apartments

- Cell phone companies might require a deposit if your credit is too low

Whether youre looking for a mortgage or any other financial product, your credit score makes a big difference. Thats why its so important to know yours before you apply.

Don’t Miss: Does Capital One Report Authorized Users To Credit Bureaus

How Your Credit Score Affects Your Mortgage

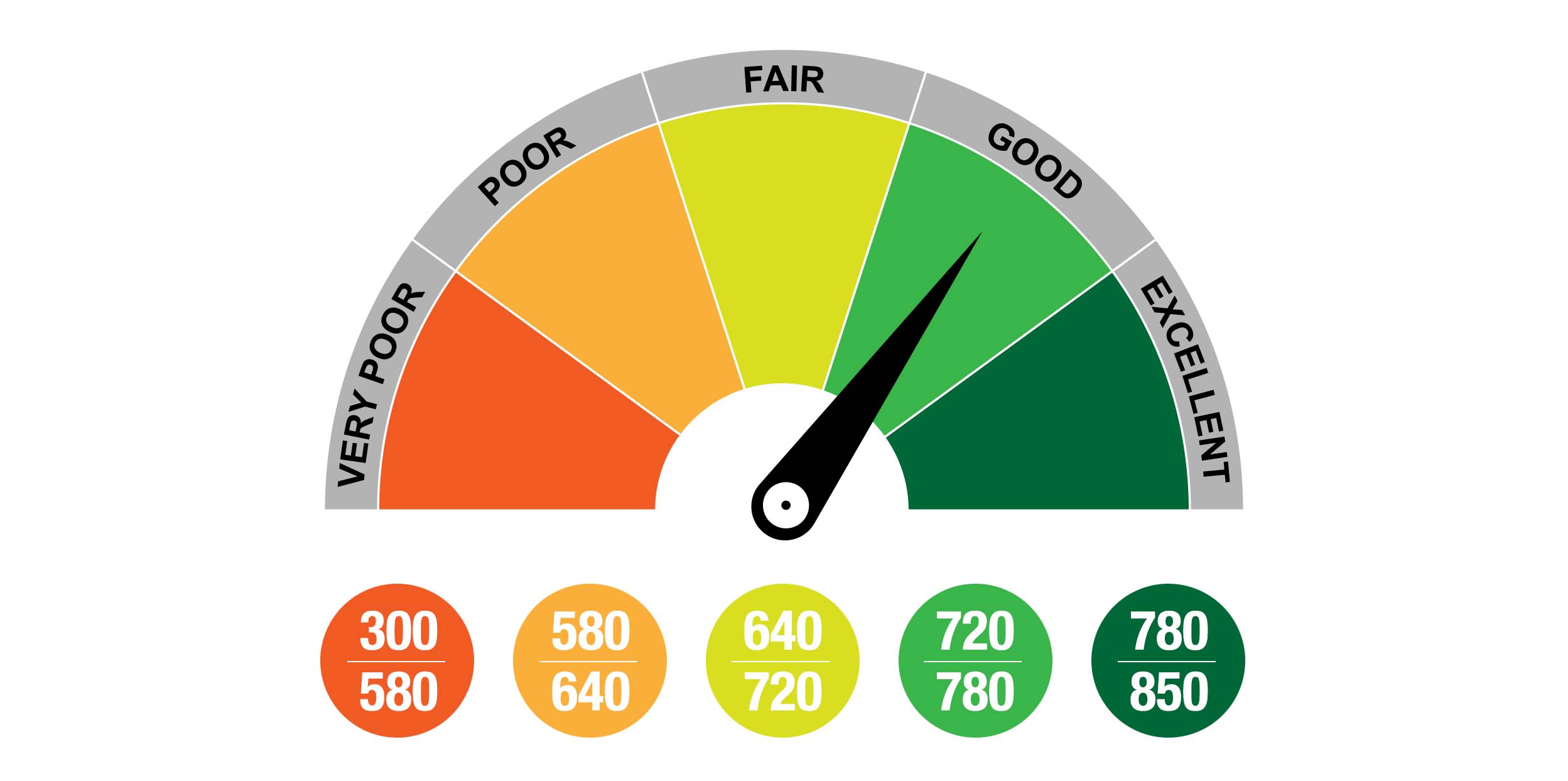

Your credit score is important because it affects which lender you can get your mortgage from, and what your interest rate on that mortgage will be. Prime lenders, such as major banks, will definitely give you a mortgage if your credit score is above 700, and they will consider applications with credit scores between 600 and 700.

If your score is between 600 and 700, the rest of your application will need to be strong in order to get approved. The lower your score the greater risk you pose to the lender. To compensate for that risk, some lenders, such as trust companies and private lenders, will charge you a higher interest rate. And some lenders wont lend you money at all, if your credit score is too low.

Here is a table showing which lenders you can get a mortgage from in different credit score range scenarios.

| Description |

|---|

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Examples Of Hard Credit Inquiries And Soft Credit Inquiries

The difference between a hard and soft inquiry generally boils down to whether you gave the lender permission to check your credit. If you did, it may be reported as a hard inquiry. If you didnt, it should be reported as a soft inquiry.

Lets look at some examples of when a hard inquiry or a soft inquiry might be placed on your credit reports. Note: The following lists are not exhaustive and should be treated as a general guide.

How Long Do Inquiries Stay On Your Credit Report

The reason the credit bureaus list inquiries on credit reports is because the Fair Credit Reporting Act requires them to do so. Why is this a credit reporting requirement? Its because you have the right to know who accesses the personal information on your credit report and when they do so.

Per the FCRA, most inquiries must remain on your credit report for 24 months. Some can be removed sooner, at around the one-year mark.

However, FICO and VantageScore only factor inquiries into your credit score for 12 months. Once a hard inquiry is over a year old, it will no longer have any affect on your credit score.

Read Also: How To Make Your Credit Score Go Up Fast

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

What It The Highest Credit Score

Most credit scoring models follow a credit score range of 300 to 850 with that 850 being the highest score you can have. However, there can be other ranges for different models, some of which are customized for a particular industry . While the majority follow the 300 to 850 range, there are some scores that range from 250 to 900 and others that may use other score ranges. For more information on the different scoring models, view Understanding the difference between credit scores.

Recommended Reading: How To Remove Repossession From Credit Report

Can You Start Building Credit Before Youre 18

Yes, you can start credit building before you or a loved one turns 18! Some credit card issuers allow parents or legal guardians to add minors as authorized users to their credit cards. Note that not all credit cards report minors credit history, but as a parent, you should be able to report yourself to credit bureaus.

Other financial products, like credit cards and , have a minimum requirement age of 18 or 21.