Is A 626 Credit Score Good

4.9/5626 Credit ScoreGoodscorescores626 FICOScorescoresanswer here

The types of programs that are available to borrowers with a 626 credit score are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-prime loans. With a 626 score, you may potentially be eligible for several different types of mortgage programs.

Also Know, what can you do with a 626 credit score?

| Type of Credit | |

|---|---|

| Auto Loan with 0% Intro Rate | NO |

| MAYBE |

Similarly, is 626 a good credit score for a car loan?

A 626 FICO®Score is considered Fair. Mortgage, auto, and personal loans are somewhat difficult to get with a 626 Credit Score. Lenders normally don’t do business with borrowers that have fair because it’s too risky.

What is considered a good credit score?

For a score with a range between 300-850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most credit scores fall between 600 and 750.

Here are seven of the fastest ways to increase your credit score.

Steps Everyone Can Take to Help Improve Their Credit Score

How To Improve Your 676 Credit Score

A FICO® Score of 676 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 676 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

35% of consumers have FICO® Scores lower than 676.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

You Need A Mortgage Loan

You definitely dont need a mortgage loan to have good credit. However, if you want to max out your credit score, having a mortgage loan with good payment history is a must.

Since a mortgage loan is usually a relatively large loan and more difficult to get than other installment loans such as an auto loan, a mortgage shows creditors you have been responsible enough with your credit to get the mortgage in the first place.

Fair Isaac Corporation, which provides the FICO score, recommends you have a mix of different types of credit accounts. So along with credit cards and installment loans, a mortgage loan is the last piece of the pie to round off your credit mix.

I also want to note I didnt start seeing my credit score go up because of the mortgage loan until about a year later, so it definitely takes some time.

You obviously shouldnt take out a mortgage loan just to get a perfect credit score. But a mortgage loan is normally considered to be good debt, in that interest rates are relatively low and youre financing something that usually appreciates in value.

If you dont already have a mortgage, be sure to fix up your credit report before applying for a mortgage assuming youre ready for homeownership.

You May Like: Aargon Collection Agency Bbb

Tips To Get A Perfect Credit Score

The first thing to keep in mind is that obtaining a perfect credit score takes time.

Its rather easy to remove negative items from your credit report and get a better score, but a perfect score is another story.

Now, assuming you dont have any negative items on your credit report like late payments or a collections account, lets get into the more advanced credit behavior youll need to learn and put into practice.

Keep in mind that all of the steps outlined below are based on my personal experience, not random advice Ive read on the internet.

The Three Credit Reporting Agencies And Different Types Of Credit Scores

Equifax, Experian, and TransUnion are three major credit reporting bureaus. Each credit agency provides you with a credit score, and these three scores combine to create both your 626 FICO Credit Score and your VantageScore. Your score will differ slightly among each agency for many reasons, including their unique scoring models and how often they access your financial data. Monitoring of all five of these credit scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Also Check: How To Remove Inquiries Off Credit

How To Raise Your Credit Score

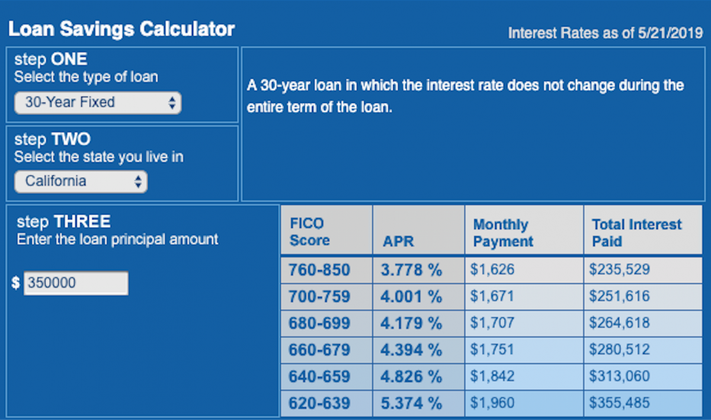

If you can wait to take out a loan, spending some time improving your credit score first could help you qualify for lower interest rates and better loan terms.

Keep in mind that having a lower interest rate could help you save money on your loan over time.

Here are several ways to potentially build credit:

- Pay your bills on time. Your payment history accounts for 35% of your credit score. Paying all of your bills such as utility and credit card bills on time could help improve your credit over time, especially if youve missed payments in the past.

- Reduce existing debt. Your credit utilization makes up 30% of your credit score. If you can pay down the balances on your accounts, you might see a boost to your credit.

- Dispute issues on your credit report. One in five people have errors on their credit reports, according to the Federal Trade Commission. If youre one of these people, you could end up with less favorable loan terms or even damaged credit. Take some time to review your credit report and dispute any issues with the major credit bureaus.

What credit score should I aim for?

If you want to improve your fair credit score, aiming for a score anywhere from 670 to 739 is a good place to start this will put you in the good credit range and will likely qualify you for better rates and terms.

Keep Reading: No Credit Check Personal Loans

Benefits Of A High Credit Score

- More favorable loan terms

- Lower interest rates, which can save you money

- A better chance of qualifying for loans and credit cards

The reason higher scores come with these benefits is because a high credit score shows a lender that youre good at handling your debt and are a responsible borrower. Lenders are able to offer better terms because youre seen as less of a risk.

You May Like: What Credit Report Does Comenity Bank Pull

Past Deeds Feed Your Credit Score

Late and missed payments are among the most significant factors to your credit score. More than one-third of your score is influenced by the presence of late or missed payments. Lenders want borrowers who pay their bills on time, and individuals who have missed payments are statistically more likely to default than those who pay their bills on time. If late or missed payments are part of your credit history, you can do yourself and your credit score a favor by developing a routine for paying your bills promptly.

Utilization rate on revolving credit is responsible for nearly one-third of your credit score. Utilization, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure your utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and multiplying by 100 to get a percentage. You can also calculate your total utilization rate by dividing the sum of all balances by the sum of all spending limits.

| Balance | |

|---|---|

| $20,000 | 26% |

Most experts agree that utilization rates in excess of 30% on individual accounts and all accounts in totaltend to lower credit scores. The closer any of these utilization rates gets to 100%, the more it hurts your credit score.

Among consumers with FICO® Scores of 625, XX% have credit reports that include one or more pieces of public information, such as a bankruptcy.

Correcting Credit Report Errors

You can and should check yourcredit report before buying a house. Consumers can get one free credit reportper year on annualcreditreport.com.

In the event that you find errors on your credit report, take steps to correct them as quickly as possible.

First, contact the creditbureaus about the errors. You should also contact whichever creditors haveprovided the erroneous information.

Under the Fair CreditReporting Act, each of these parties is responsible for correcting inaccurateor incomplete information in your credit report.

For simplicity, disputes canbe managed online. If all three bureaus report the same error, though, rememberto report the error to all three bureaus. Equifax, Experian, and TransUnion donot share such information with each other.

The law requires creditbureaus to investigate the items in question, usually within 30 days, unlessyour dispute is considered frivolous. Note that you;may need to includecopies of documents which support your position. Never send originals!

Within 45 days, the creditbureaus will notify you with the results of the investigation.

Then, youll want to obtain a new copy of your credit report in order to make sure that the errors have been corrected before applying for a mortgage.

Recommended Reading: What Credit Score Does Carmax Use

Is 626 A Good Credit Score For A Car Loan

626 a Good Credit Score626 FICOScoreMortgageautoloans626 Credit Score

Your score falls within the range of scores, from 580 to 669, considered Fair. A 626 FICO®Score is below the average . Some lenders see consumers with scores in the Fair range as having unfavorable , and may decline their applications.

Subsequently, question is, what is a good credit score for an auto loan? Average Needed to Buy a CarExperian uses a model of 300 to 850, with super prime borrowers at the top and deep subprime borrowers at the bottom. If your is inferior, you might still qualify for a loan.

Similarly, can I get a loan with a 626 credit score?

FHA Loan with 626 Credit Score. FHA loans only require that you have a 580 , so with a 626 FICO, you can definitely meet the requirements. With a 626 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Is 680 a good credit score to buy a car?

Your 680 credit score is right on the verge of being considered Good credit, as opposed to Fair . Someone with Fair is likely to get a 14.06 percent interest rate on a car loan, whereas someone with Good credit may see a rate around 7.02 percent.

Capital One Venture Card

If youre an avid traveler, the Capital One Venture can help you to save on your next adventure. A credit card for people with at least a 700 credit score, the Venture card allows clients to use Venture miles for any charge that has to do with travel. That means miles can be used for more than just airfare. They can be used for things like hotel or cruise reservations, train tickets, travel agent fees and more. Theres an annual fee of $95, but users can rack up savings quickly with 2 miles earned for every $1 spent. Theres typically an initial bonus when you sign up, too. At the time of this writing, new users can earn up to 100,000 bonus miles by spending $20,000 on purchases in the first 12 months.

Read Also: Does Paypal Credit Report To Credit Bureaus

How To Choose A Credit Card For Fair Credit

The best way to use a credit card for fair credit is to make a small amount of monthly purchases and pay your charges in full each month.

The interest rates on these cards may be higher than on credit cards designed for consumers with good credit, so youll want to avoid using them to pay off purchases over time.

As your credit improves, youll be better qualified to apply for a card with a lower rate or higher rewards in the;future.

Look for cards that offer lower annual fees or some rewards that can offset an annual fee.

Does Anyone Have An 850 Credit Score

The truth is, Americans with a perfect 850 FICO® Score do exist. In fact, 1.2% of all FICO® Scores in the U.S. currently stand at 850. Think of it as the alternateand perhaps slightly less glamorous1 percent. Of course, you dont need a perfect score to access credit at the best terms and lowest interest rates.

Read Also: Does Opensky Report To Credit Bureaus

How Your Fico Score Is Calculated

A FICO® Score is a three-digit number calculated from the credit information on your credit report at a consumer reporting agency at a particular point in time. It summarizes information in your credit report into a single number that lenders can use to assess your credit risk quickly, consistently, objectively and fairly. Lenders use your FICO® Scores to estimate your credit riskhow likely you are to pay your credit obligations as agreed. And it helps you obtain credit based on your actual borrowing and repayment history.

If you have a Sallie Mae private student loan, you may have access to your quarterly FICO® Score for free. Youll also have access to the key factor affecting your score and information to help you understand why knowing your FICO® Score is important.

to see your quarterly FICO® Credit Score for free.

Actions To Take To Get Approved For A Rental

Bottom line: a good credit score for renting an apartment is one over 620. So what should you do to get approved for a rental if your score is under that benchmark?

First, understand that improving your credit score takes time and diligent action. Paying your credit card balance off on time for two months won’t equate to a meteoric rise in your credit score. What will make a positive difference is consistent action over time.

Of course, when it comes to renting an apartment you may not have months to spend patiently coaxing your credit score higher and higher. Consider these actions that can help you get approved to rent an apartment even without the world’s best credit:

1. Review your credit report.;Before applying to rent an apartment, request a copy of your credit report. You can obtain a report for free once per year by visiting;www.annualcreditreport.com. Ensure your report doesn’t contain errors, which could drag your credit score down and contact one of the three credit bureaus to report a mistake if you do find one.

2. Don’t shop around.;Do research before sending in rental applications. Each time someone puts in a request for a hard credit check, that inquiry is recorded. Too many inquiries in a short span of time could push your score down further.

4. Provide additional references.;In addition to securing a reference from your current employer, you can also ask for references from past landlords to vouch for a history of paying your rent on time and in full.

Recommended Reading: Does Zzounds Report To Credit Bureau

Could Inaccurate Credit Information Be Hurting Your Score

The average credit score for Americans is 703 according to Experian, one of the three major credit bureaus. Experian contributes data to compile your FICO credit score.

On the credit score range, 703 is considered a good score. But its not good enough to have a full selection of loan choices when you need to borrow.

Your good credit could use some fine-tuning if you want a higher credit score.

So lets say youve already built a good credit mix, a good payment history, and an established length of credit history as I described above.

If this is true, you may be wondering whats holding you back from achieving a different credit score?

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Read Also: Does Klarna Report To Credit

Minimum Credit Scores By Mortgageprogram

The credit score needed to buy ahouse depends on the type of loan you apply for.

Minimum credit requirements forthe five major loan options range from 580 to 680.

- Conventional loan : 620 minimum FICO score

- FHA loan:;580 minimum FICO score

- VA loan: 620 minimum score is typical

- USDA rural housing loan: 640 minimum FICO score

- Jumbo loan : 680 minimum FICO score

Note that FHA loansactually allow credit scores as low as 500. But if your score is below 580, youneed a 10% down payment to qualify. Borrowers with credit scores above 580 onlyneed 3.5% down for an FHA mortgage.;

Other requirements to buy a house

Theres more to know than just credit minimums, of course;.

In addition to credit scores, lenders evaluate borrowers based on:

- Down payment: Most loan programs require at least 3% down

- Income and employment history: Most lender want to see at least 2 years of steady income and employment

- Savings: Youll need cash to cover the down payment, closing costs, and often cash reserves

- Existing debts: Your debt-to-income ratio compares pre-existing debts like student loans, auto loans, and credit card minimum payments against your monthly gross income. The lower your DTI, the better

- Loan amount: If you have lower credit, your loan amount will likely need to be within FHA loan limits or conforming loan limits

If your credit scoreis weak but you have stable income, a large amount ofsavings, and a manageable debtload, youre more likely to get mortgage-approved.