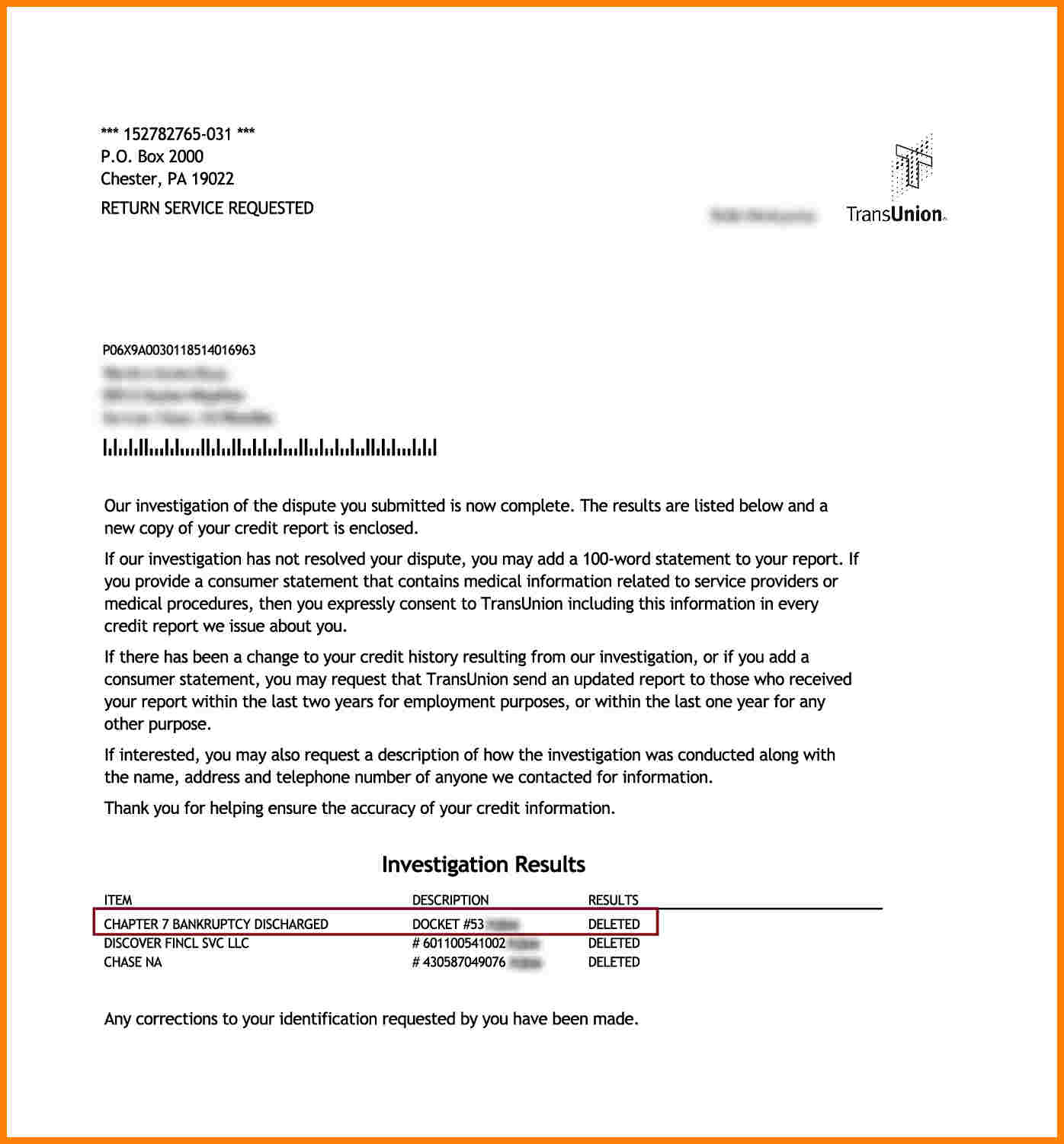

Write A Letter To The Credit Bureau

Write a letter to the credit bureau whose report you dispute. Clearly identify and circle the items in a copy of the credit report. The reporting bureau will carry out investigations to ascertain your claims. They will do so by collaborating with the information provider to weed out the errors. This should be completed within 30 days, after which they are supposed to remove the items in question. The removal will depend on whether your claims are found to be true, if not the items will remain in your report.

The above steps give you a 2-pronged approach to having hard inquiries removed from your credit report. One is by requesting the company whose inquiry you dispute, to contact the credit reporting agencies and notify them of the mistake. The other is by writing to the credit bureaus and having them investigate the inquiries in question; both of which are within your rights.

For assistance with removing hard inquiries and other negative items from your credit report to increase your credit score quickly, contact Credit Absolute for a free consultation.

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

Exceptions To The Impact On Your Credit Scores

If you’re shopping for some types of loans, such as a mortgage loan, multiple inquires for the same purpose within a certain period of time are generally counted as one inquiry. The timeframes may vary, but range from 14 days to 45 days, depending on the credit scoring model being used. All inquiries will show on your credit reports, but generally only one within the specified period of time will impact your credit scores.;This exception does not apply to credit cards.

Recommended Reading: Does Having A Overdraft Affect Credit Rating

Review Your Credit Reports

You should make it a habit to regularly review your credit reports from the three major consumer credit bureaus Equifax, Experian and TransUnion. The may not know which information is incorrect unless you flag it.

To check for incorrect hard inquiries on your credit reports, look for a section labeled something like

- Requests viewed by others

- Regular inquiries

There may also be a separate section for soft inquiries, which should be labeled something like requests viewed only by you. Unlike hard inquiries, soft inquiries wont affect your credit scores.

Not sure how to read the information your credit reports? Learn more about whats on your credit reports and how to read them.

Locate The Hard Inquiries Listed On Your Report

Locate the section in your report containing the Hard Inquiry information.

Equifax and Experian make it incredibly easy for you. You will see a header titled Hard Inquiries.

With TransUnion, you will want to look for the Regular Inquiries section.;

Take a look at all the inquiries listed. Pay close attention did you authorize this lender to access your information?

If you arent sure if this is worth your time to review your report, believe me, it is.

There are over 1.3 billion transactions monthlybeing reported to the credit agencies. Its very possible a mistake could occur!

If they are not legitimate, then you have recourse. Once youve identified the unauthorized hard inquiry, then its time to dispute it.

You May Like: Which Information Can Be Found On A Person’s Credit Report

How Long Do Hard Inquiries Stay On Your Credit Report

Hard inquiries stay on your credit report for two years. Each time a hard inquiry is made, it is recorded by each of the three major credit reporting agencies Equifax, Experian, and TransUnion. And each time a hard inquiry is logged, it can potentially impact your credit score.

What Is A Hard Inquiry

A hard inquiry occurs when you apply for a new loan or credit card. It involves the lender checking one or more credit reports to determine whether you meet its creditworthiness criteria. This is also sometimes called a hard credit check or hard pull.

Hard inquiries differ from soft inquiries in two major ways. First, hard inquiries occur when you apply for a loan, credit card or other financing.

Soft inquiries, on the other hand, can happen upon your requestsuch as when you want to check your credit reportor even without your knowledge, which happens when lenders check your credit before sending you a preapproval offer.

Second, soft inquiries don’t affect your credit score at all, while each hard inquiry typically knocks a few points off your credit score. The more hard inquiries you have on your reports, the riskier you’ll be viewed by prospective lenders. Why? Because applying for different types of credit relatively often could indicate financial instability, and that translates to risk in a lender’s eyes.

Hard inquiries stay on your credit reports for two years before they fall off naturally. If you have legitimate hard inquiries, you’ll likely need to wait until the 24-month period is over to see them disappear.

Read Also: What Does Charged Off Account Mean On My Credit Report

How Do Credit Inquiries Impact My Credit Score

They all check your credit, and by signing the application, you authorize them to do so. Credit scorers understand this is simply a consumer out shopping for the best rate they can get.

They allow for this activity and dont deduct points for each individual hard inquiry when this occurs. Instead, as long as the credit inquiries are all made within a 45-day window, they group them together and count them as one inquiry.

But if you take too long and shop around, the resulting credit inquiries can affect your score negatively.

Remove Inquiries From A Credit Report In 24 Hours Or Less

Whether you want FAST results to fix your own credit OR youre a Credit Hero who runs a profitable credit repair business and you want FAST results for your clients – the question is the same, is the 24 hour inquiry removal method legit, legal, AND does it actually work?…

And the answer may shock you!

The 24 hour inquiry removal method is a strategy that aims to remove hard inquiries from a credit report within one single day.;

Now if you have sirens going off in your head blaring, If it seems too good to be true, it probably is!, I get it!;

But thats not necessarily the case.;;

Just to make sure were all up to speed on inquiries:;

When you or your client has their credit pulled for any reason, it could be a loan, car, mortgage, phone application or sometimes even when applying for a job, getting insurance or if youre trying to rent an apartment – an inquiry is placed on the credit and each inquiry dings the credit score.;

So by removing the inquiries, you can easily increase the credit score.;;

Which is exactly what we all want, right?

So heres how you do it.;

This strategy is so simple but it WORKS!

To get an inquiry removed within 24 hours, you need to physically call the companies that placed the inquiries on the telephone and demand their removal.;

This is all done over the phone, swiftly and without ever creating a letter or buying a stamp.;;

So is the 24 hour inquiry removal method real, effective, legit and legal?

YES, YES, YES, and YES!;

Also Check: Is 666 A Good Credit Score

Type Of Credit Inquiry

- A hard inquiry;occurs when you applied for new credit, like a credit card, or submit a loan application for a car or home. A hard inquiry;can affect your credit score.

- A soft inquiry;occurs when an existing creditor pulls your credit to see what your current credit situation is or when a potential creditor pulls your credit to pre-approve you for credit that you have not actually applied for yet. Pulling your own credit is also considered a soft inquiry. A soft credit inquiry;does not affect your credit score.

What Is A Hard Credit Inquiry And How Does It Affect Your Credit Score

When you apply for a credit card, loan, mortgage, or any other type of financing, a credit check is almost always performed by the lender, typically a bank or credit card company. This triggers a hard inquiry into your credit history to see if you’re qualified.;

Hard inquiries have a relatively small impact on your credit score. They typically only shave a few points off of your score, and only count for 10% of your FICO score.

So let’s say you’re on a hunt for a new credit card. It may be easier to apply for a bunch of credit cards at once and see which ones you qualify for. But is that smart?;

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

How To Remove Hard Inquiries

Wondering how to remove hard inquiries from your credit report? Unlike most things in the world of credit, there actually is a simple formula to follow once you have identified a removable hard pull:

- Take note of the characteristics of the pull, including its date and source;

- Write this information, along with an explanation of how it is mistaken, in a letter;

- Submit the letter to the department of your financial institution dedicated to disputing hard credit inquiries ;

- Monitor your pending verdict if your argument is accepted, your institution will remove the hard inquiries you contested.

If you are unsuccessful in your attempt, it is typically for good reason. However, if the challenge youre submitting is really a mistake, then you are not out of options. Under the FCRA, you can submit an additional statement to supplement your original one. This acts as somewhat of an appeal. Your challenge will be reconsidered taking into account any new information you provide. However, because you are given a small limit on the number of words this appeal can contain, use them wisely. Concentrate on hard evidence that the mistake is not your fault.

Why Hire Credit Repair Co For Hard Credit Inquiry Removal

When you sign up for a credit repair service like Credit Repair Co, you are allowing professionals with years of experience in the field of financing and budgeting to take charge of working with credit bureaus and creditors on your behalf. Not only does this help you step-by-step in improving your credit score. It also helps you resolve financial issues. They even offer a 3 year warranty for making sure that your credit remains clean.

You May Like: What Is Cbcinnovis On My Credit Report

You Did Not Authorize The Hard Pull

Can you remove hard inquiries from your credit report if you did not authorize it? The answer is YES.;

A company can only perform a hard pull on your credit report if you give them permission to do so. Even if you recognize the company or if you have a current account with the lender, they are not legally allowed to do a hard inquiry unless you give them your authorization.

If you believe that the hard inquiry was done without your permission, you can dispute this inquiry. The lender or the credit bureau can then remove it from your credit report.

A Credit Inquiry Is A Record Of When A Lender Or Creditor Requests Your Credit File

While a single hard inquiry, also known as a hard pull, is unlikely to impact your eligibility for new credit products such as a new credit card, it can affect your credit scores for up to two years.

When reviewing hard inquiries on your credit reports, you want to make sure that they are legitimate. What does that mean? For each hard inquiry line item you see, did you authorize the creditor or lender to pull your credit? If you did, you dont need to take any action.

But its possible that when youre monitoring your credit reports that youll flag instances of unauthorized hard inquiries. If you find one of these, youll want to file a dispute with the credit bureau that generated the report and ask the bureau to remove the unauthorized inquiry.

Heres how to dispute inaccurate hard inquiries from your credit reports.

Also Check: How To Get A Detailed Credit Report

Hard Vs Soft Inquiries

First, lets define which inquiries count. There are two kinds, known as soft and hard inquiries.

Soft inquiries, as their name suggests, do not disturb your credit score. This includes a person checking their own credit report. Along those same lines are inquiries pulled by insurance companies or employers.

Employers use credit reports when deciding whether to hire or promote a person. So, with no credit being granted or extended, the inquiry is soft and there is no scoring damage. Landlords can go either way hard or soft. Many landlords use a service that generates a soft pull to get them the information they need to decide if a person is likely to pay their rent and be a responsible tenant.

Also included in the soft category are those pulls for preapproved offers of credit. None of these count against your score. The key differentiator is whether the inquiry is for the purpose of deciding whether to extend or increase credit.

Hard inquiries can be generally defined as those that are made in order to extend new or additional credit. FICO says that on average a consumer will see a 5-10 point drop in their scores for each hard inquiry .

Fat files ;those with decades of information in them ;will drop less and for a shorter period of time than for someone with a short history . Its important to know that a hard inquiry counts, whether any credit is ultimately extended or not. Its the intent that matters.

How To Contact The Credit Bureaus To Remove Inquiries

The easiest way to remove questionable inquiries is by contacting the credit bureaus. You can contact any, or all the three bureaus, to remove the inquiries from your credit report.

Removing Inquiries on Experian:

- Experian does not allow for inquiries to be disputed online through their dispute center. The other ways to contact Experian to dispute inquiries are as follows:

- 1-714-830-7000 then press 1, 8 am 10 pm CST weekdays, 10 am-7 pm CST weekends,;

- Experian, P.O. Box 4500, Allen TX 75013

- ;1-972-390-4925

Removing inquiries on Equifax:

- Equifax is the only bureau that allows you to dispute inquiries online, by mail, and by fax. Their phone, mail, and fax details are also given below.

- Online:;Equifax Online Dispute Portal

- ;1-800-846-5279, goes to live agent

- Equifax, P.O. Box 740256, Atlanta, GA 30374-0256

- ;1-888-826-0598

Removing inquiries from Transunion:

- Although Transunion does not allow inquiries to be disputed online, you can reach them via call, mail, or fax.

- 1-800-916-8800: then press;0,;8 am-11 pm EST, Monday through Friday

- Transunion, P.O. Box 2000, Chester PA 19016

- 1-610-546-4657

- 1-800-916-8800:; 8am-11pm EST, Monday through Friday

Also Check: When Does Citi Card Report To Credit Bureaus

Do Not Dispute An Inquiry Linked To An Account You Opened

You should always make sure that you do not dispute any inquiries on your credit report that refer to any illegitimate accounts. If you dispute such an inquiry, the credit bureaus will reach out to the creditor and notify them of your dispute. The creditor would then suspect you to be involved in fraudulent activities and would close the account.

Would You Like To Find Out How You Can Remove Most To All Of Your Inquiries From Your Transunion Credit Report

Follow these important steps for a quick do it yourself approach to removing hard and soft inquiries reporting to your TransUnion credit report.

Keep in mind this will ONLY work for TransUnion inquiries.

Step One.

You will need to pull and obtain an official copy of your credit report. In this case Credit Karma and FreeCreditReport.com

will not work for this process. I recommend using ScoreSense or to monitor and pull an accurate credit report.

Step Two.

After listing the inquiries reported on your TransUnion credit report you will need to call the TransUnion 1-800 to speak to a representative and tell them that you have been a VICTIM of their inquiry issue. Make sure to keep the list of inquiries from your credit report close, as you will need to list off the inquiries to the representative; they will remove them for you.

Step Three.

Remember now, the bureaus are not here to help, rather then keep you as a victim of poor credit because they PROFIT from BAD CREDIT. You may or may not run into the conversation with the representative stating that you were NOT a victim of their faults with the misreported inquiries.

Step Four

Step Five.

Once you have completed steps 1-4 check back to your credit monitoring site in about 5 days and

VUA LAA!

You May Like: Is 779 A Good Credit Score

Understanding Hard Inquiries On Your Credit Report

Reading time: 3 minutes

Highlights:

- When a lender or company requests to review your credit reports after you’ve applied for credit, it results in a hard inquiry

- Hard inquiries usually impact credit scores

- Multiple hard inquiries within a certain time period for a home or auto loan are generally counted as one inquiry

Some consumers are reluctant to check their credit reports because they are concerned that doing so may impact their credit scores. While pulling your own credit report does result in an inquiry on your credit report, it will not affect your credit score. In fact, knowing what information is in your credit reportand checking your credit may help you get in the habit of monitoring your financial accounts.

One of the ways to establish smart credit behavior is to understand how inquiries work and what counts as a hard inquiry on your credit report.

What is a hard inquiry?

When a lender or company requests to review your credit report as part of the loan application process, that request is recorded on your credit report as a hard inquiry, and it usually will impact your credit score. This is different from a soft inquiry, which can result when you check your own credit or when a promotional credit card offer is generated. Soft inquiries do not impact your credit score.

Recent hard inquiries on your credit report tell a lender that you are currently shopping for new credit. This may be meaningful to a potential lender when assessing your creditworthiness.