Can You Remove A Bankruptcy On Your Own

Like all negative item disputes, its entirely possible to complete the process on your own. However, removing a bankruptcy from your credit report early can be a lengthy and tedious process that doesnt guarantee results.

You can dispute the bankruptcy either by stating an inaccuracy of the information on your credit report or by asking the credit bureau how it verified your bankruptcy. As with any dispute, they must respond to your procedural request letter within 30 days.

In most cases, theyll say that they verified it with the courts, but this is unlikely. You must then contact the court to ask how they verified your bankruptcy.

If they respond that they never verified it, you should get that statement in writing, send it to the credit bureau, and ask them to remove the bankruptcy.

This method isnt guaranteed, but it might be worth trying. Otherwise, enlist the help of a credit repair company to navigate the process for you.

Credit repair companies are highly experienced at disputing negative items on your credit reports. They specialize in getting bankruptcies deleted from your credit report. They also work to remove other negative information included in the bankruptcy, like charge offs and collections.

Professional Help From A Credit Repair Company

Any time you try to dispute a negative item on your credit report, whether its a bankruptcy or a credit card late payment, its bound to be a long, arduous journey.

To save yourself a major headache, consider hiring a professional credit repair company. Theyll not only review your bankruptcy entries, but everything else on your credit report as well, so you can benefit from a holistic strategy for repairing your credit.

Can You Still Get A Loan Even With A Bankruptcy On Your Credit Report

Many people think that just because they filed for bankruptcy, then this means that they will not be able to get a loan or a new line of credit. The truth is, there are many different companies and lenders that specialize in lending to people who just filed for bankruptcy or with bad credit.

Of course, you will find that the interest rates and the fees are high compared to when you still had a stellar credit score. Thats why its important to be cautious and to not be blinded by the unbelievable offers immediately after your bankruptcy discharge. Make sure that you read the fine print and clarify all the details before going for a loan or a credit card. You dont want to end up in a more dreadful situation than you were in pre-bankruptcy.

So, what types of loans or credit are you still eligible for even after filing for bankruptcy? We listed down the credit options for you

Don’t Miss: When Does Citi Card Report To Credit Bureaus

Bankruptcys Impact On Your Credit Score

When you file bankruptcy and get relief from your bill problems, you no longer owe any money to your creditors. ;You no longer have to suffer with the continuing delinquencies.

If you take some simple steps to rebuilding your credit after bankruptcy, your credit score will start to rise pretty quickly. ;After as little as 18-24 months, your credit report will be a thing of beauty.

In fact, according to a report released by;the Federal Reserve Bank of New York in May 2015:

The individuals who go bankrupt experience a sharp boost in their credit score after bankruptcy, whereas the recovery in credit score is much lower for individuals who do not go bankrupt.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How Much Does Transunion Charge For Credit Report

Rebuilding Credit After Bankruptcy

You can work to improve your credit scores even while a bankruptcy is still listed on your credit reports. Establishing new credit can help. You shouldnt expect those positive accounts to fix everything, but they can be a step in the right direction if you manage them carefully.

Its true that qualifying for new credit after bankruptcy can be tricky. Yet if you apply for the right kinds of accounts, your odds of success should be higher.

Hire A Credit Repair Service

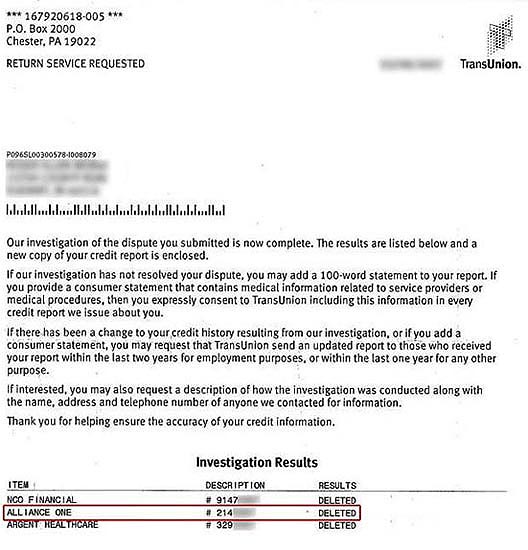

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Don’t Miss: Why Is My Credit Score Not Going Up

How Long Does A Bankruptcy Stay On My Credit Reports

Depending on the type of reportable credit event, the statutory reporting limit is either two years , seven years , or ten years . Bankruptcies are reported on consumer credit reports because they are credit-related public records. The length of time a bankruptcy remains on a credit report depends on the type of bankruptcy.

A Chapter 7, 11 or 12 bankruptcy is reportable for ten years and a Chapter 13 bankruptcy is reportable for seven years from the date of filing in bankruptcy court. Chapter 13 has a shorter reporting time than other bankruptcy types because it requires at least partial repayment of the debts the filer is attempting to have discharged. In this way, a Chapter 13 bankruptcy is treated like any other non-payment or payment delinquency, which also has a reportable timeframe of seven years.

On the expiration of the reporting period for a specific bankruptcy, the bankruptcy and all discharged accounts should be deleted automatically. An account listed for discharge in the bankruptcy, however, may be removed prior to expiration of the bankruptcy’s reporting period or even prior to filing the bankruptcy altogether. Since the date for removal of delinquent accounts is based on the date of delinquency, the delinquency will fall off a credit report seven years after the delinquency and will not be renewed merely based on its inclusion in the bankruptcy.

Get The Help You Need. Get It Now.

Please complete all required fields below.

Can I Remove A Legitimate Chapter 7 Or 13 Bankruptcy From My Credit Report Early

You can, but youll need to find an error or inconsistency in the bankruptcy listing on your report in order to file for removal.

The main thing to remember is that you always have the right to challenge anything that the credit bureaus are reporting.

If you can find anything thats not correct, then seize on it as an opportunity.

Also Check: Does Checking Your Credit Score Affect Your Credit Rating

Removing A Bankruptcy From Your Credit Report

As stated above, it is challenging to get bankruptcies removed from your credit report, but not impossible. The duration of a bankruptcy on your credit score depends on the type of bankruptcy.

Chapter 7 has a maximum of ten years, and chapter 13 has a maximum of seven years. But, these are only maximums. Since there is no minimum, it is possible to get it removed from your record sooner.

Here is how to remove bankruptcies from credit reports yourself:

This guide offers a possible way to remove a bankruptcy record from your credit report. However, it is always best to verify these facts beforehand. Ensure the court you contact doesnt verify bankruptcy information with credit bureaus and always consider getting expert advice.

Bankruptcy Reporting On A Credit Report

Most negative entries, like slow payments and charge offs, will disappear from your report after seven years. It works a bit differently for bankruptcy filings and depends on the particular chapter.

- Chapter 7 bankruptcy. The fact that you filed a Chapter 7 bankruptcy will stay on your credit report for up to ten years. At the ten year mark, the credit bureaus should stop reporting the bankruptcy.

- Chapter 13 bankruptcy. In this chapter, the filer pays into a repayment plan for three to five years. The Chapter 13 bankruptcy filing appears on a credit report for seven years from the filing date, which is only two years beyond the longest repayment plan. This benefit serves as an incentive to filers to choose the repayment option and to repay creditors something over time.

The immediate effect of bankruptcy on your credit score will depend on whether you initially had a high or a low score, and, in most cases, a higher initial score will take a bigger hit. The exact effect is hard to predict because scoring companies keep the formulas used to calculate scores somewhat secret. However, if you’re diligent, it’s not impossible for you to reach a credit score in the 700s just two or three years after you file your Chapter 7 matter.

Read Also: How To Report Unauthorized Credit Card Charges

Accounts Included In The Bankruptcy

After youve filed for bankruptcy, the accounts included in your bankruptcy will show up as included in bankruptcy on your credit report. Most of them will remain on your credit report for seven years. These include accounts like charge offs, collections, repossessions, and judgments. They can also potentially be removed from your credit report before the reporting limit of seven years.

Can You Speed Up The Removal Process

The FCRA lets the credit bureaus include bankruptcy filings on credit reports for up to 10 years in some cases. But there are other rules the credit bureaus must follow as well. Namely, any information a credit bureau includes on your credit report should be 100% accurate.

If you discover an error or questionable information on your credit report, you have the right to dispute the item. This rule applies to bankruptcies too. You can dispute a bankruptcy you disagree with on your own or with professional help.

Don’t Miss: Does Closing A Credit Card Hurt Your Score

Become An Authorized User

Another strategy for boosting your credit score is to become an;authorized user;on someone elses account.

If you know someone with good credit, ask them to add you as an authorized user on one of their credit cards.

If you choose this strategy, youll want to make some kind of agreement to pay your share of the card balance.

You should also make sure the creditor reports your payment history to the credit bureausyou can verify this by contacting the credit card company and asking if they report an authorized users payments to the credit bureaus.;

Correcting Misreported Discharged Debt

Disputing errors is relatively straightforward. You’ll do so by using the online procedure provided by each of the three major credit reporting agencies.

A creditor who repeatedly refuses to report your discharged debt properly might be in violation of the bankruptcy discharge injunction prohibiting creditors from trying to collect on discharged debts. If you take steps to remedy the misreporting, and the creditor refuses to fix the error, talk to a bankruptcy attorney.

Read Also: What Credit Report Does Paypal Pull

Different Types Of Bankruptcies

There are many types of bankruptcy. The most common for individuals and small businesses are Chapter 7 and Chapter 13.

The differences between the two are essential to note. They determine your options for how to remove bankruptcies from credit reports. Ultimately, its the different maximum duration on your records and the repayment plans that determine how much your credit scores drop.

In both cases, it might be prudent to consult a bankruptcy lawyer or consultant. Legal advisors can help you to understand the details of each plan. Knowing the details of the type of bankruptcy can help in understanding how to contest the procedure. Plus, it will help you assess how bankruptcy affects your credit score in the long run.

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually;charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off;removed from your credit reports, it’ll remove the risk;that youll be sued over the debt.

You May Like: Which Business Credit Cards Do Not Report Personal Credit

How Do You Get Something Removed From Your Credit Report After 7 Years

In theory, debts should be automatically removed from your credit report once they reach their legal expiration . If you see debts on your credit report that are older than that, youll want to contact both the creditor and the credit bureau by mail requesting a return receipt. In your letter, include all documentation about the debt, including any inaccuracies.

Is It Even Possible To Get A Bankruptcy Removed From Your Credit Report

We want to be upfront and transparent: its very hard to get a bankruptcy removed from your credit report. If all information is accurate and complete, it is not possible to remove a bankruptcy from your credit report. But if the bankruptcy entry contains any inaccurate or incomplete information, it may be possible to have it removed.

Recommended Reading: How To Get Charge Offs Off Of Your Credit Report

Removing Bankruptcy From Your Credit Report

The economic fallout from the COVID-19 pandemic looked like it was going to cause a flood of bankruptcy filings in 2020, but just the opposite occurred. Filings dropped from 774,940 cases in 2019 to only 544,463 in 2020, a 29.7% decline. That was the lowest since 1986.

Still, half a million filings represent a lot of financial pain and hardship and the pain could grow. Bankruptcy filings tend to escalate gradually after an economic downturn. Following the Great Recession of 2008, bankruptcy filings increased for the next two years, peaking in 2010 at 1.5 million.

If youve been forced into bankruptcy, you are far from alone. More than 500,000 Americans declared bankruptcy in 2020, some because of the fallout in the economy from the COVID-19 pandemic, others for the usual difficulty of managing personal finances.

One thing they all have in common: They want to get this financial red flag off their credit reports as soon as possible.

Can this be done? Eventually. But, its neither quick nor easy.

Assuming that the;bankruptcy;is legitimate rather than the result of identity theft or a clerical error, it will remain on your credit report for seven to 10 years. However, desirable it may seem to be, getting bankruptcy off your credit report shouldnt be the overriding concern.

Think of it as one part of repairing your credit and recovering from the financial damage related to it.

Strategies To Remove Negative Credit Report Entries

Negative details on your are unfortunate glaring reminders of your past financial mistakes. Or, in some cases, the mistake isn’t yours, but a business or credit bureau is to blame for credit report errors. Either way, its up to you to work to have unfavorable credit report entries removed from your credit report.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for. To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

Also Check: Can You Have A Bankruptcy Removed From Your Credit Report

Learn How Long Chapter 7 Bankruptcy Will Stay On Your Credit Report

By Carron Nicks

Most people file a bankruptcy case when they need to put financial problems behind them and get a fresh start. Part of that fresh start often involves improving a credit score, and filers can take positive steps by paying bills on time and keeping credit balances low. Even so, it can take up to ten years for the bankruptcy to fall off your credit report, depending on the bankruptcy chapter that you file.