How To Start A Credit Lock

Youll need to contact the three credit bureaus directly to initiate a credit lock.

TransUnion: You can;sign up with TransUnions TrueIdentity service to gain access to credit monitoring services and;credit locks.

Experian: Sign up;for Experians credit lock service here.

Equifax: You can;register for Equifaxs credit lock services here.

How much does a credit lock;cost? The;cost of a credit lock will vary depending on the credit bureau. Experian;provides this service free for 30 days and then charges $19.99 a month after;the tree trial ends. Equifax provides this service at no cost. You can get your;credit locked for free at TransUnion, too, but youll first have to sign up for;the free version of the bureaus TrueIdentity credit monitoring service. If you;sign up for TrueIdentity Premium, which gives you free access to your credit;report and credit score, credit locks are included in the $19.95 monthly price.;Please keep in mind that the pricing listed herein is valid as of the date of;publication of this article, but is subject to change over time.

Will;a credit lock affect your credit score? Locking your credit will not help or hurt your credit score. You can also access your free credit reports from;AnnualCreditReport.com even if youve locked your credit.;

What Type Of Information You Can Report To Credit Bureaus

Paying Rent

Can pay the rent build credit? Yes. Rent is something that is usually not taken into account when updating your credit report, which is unusual because for many it can be the biggest monthly expense. Equifax, Experian, and TransUnion are willing to include rent payments in your credit reports if you report them. With that being said, not all credit scoring systems, such as FICO and VantageScore, take rental payments into consideration. For example:

- Newer versions of FICO do take rent payments into account;

- When reporting rent to credit bureaus, the most used versions of FICO dont consider rent payments;

- VantageScore does calculate rent payments as well

When choosing a rent-reporting service, there are a few aspects that you need to keep in mind, such as:

Does your property manager already use a service for reporting rent to credit bureaus? If so, it will save you a lot of time and money.

- Which credit bureaus do the service report to?

- Will you have free access to credit scores such as FICO or VantageScore?

- Are the overall costs within your budget?

- When can you expect the information to appear on your credit report?

- How are cases where your lease is disputed/broken handled?

Bills

DID YOU KNOW: A persons payment history makes up the biggest part of the credit score, so taking preventative measures such as paying bills in a timely manner is the easiest way to improve your credit score.

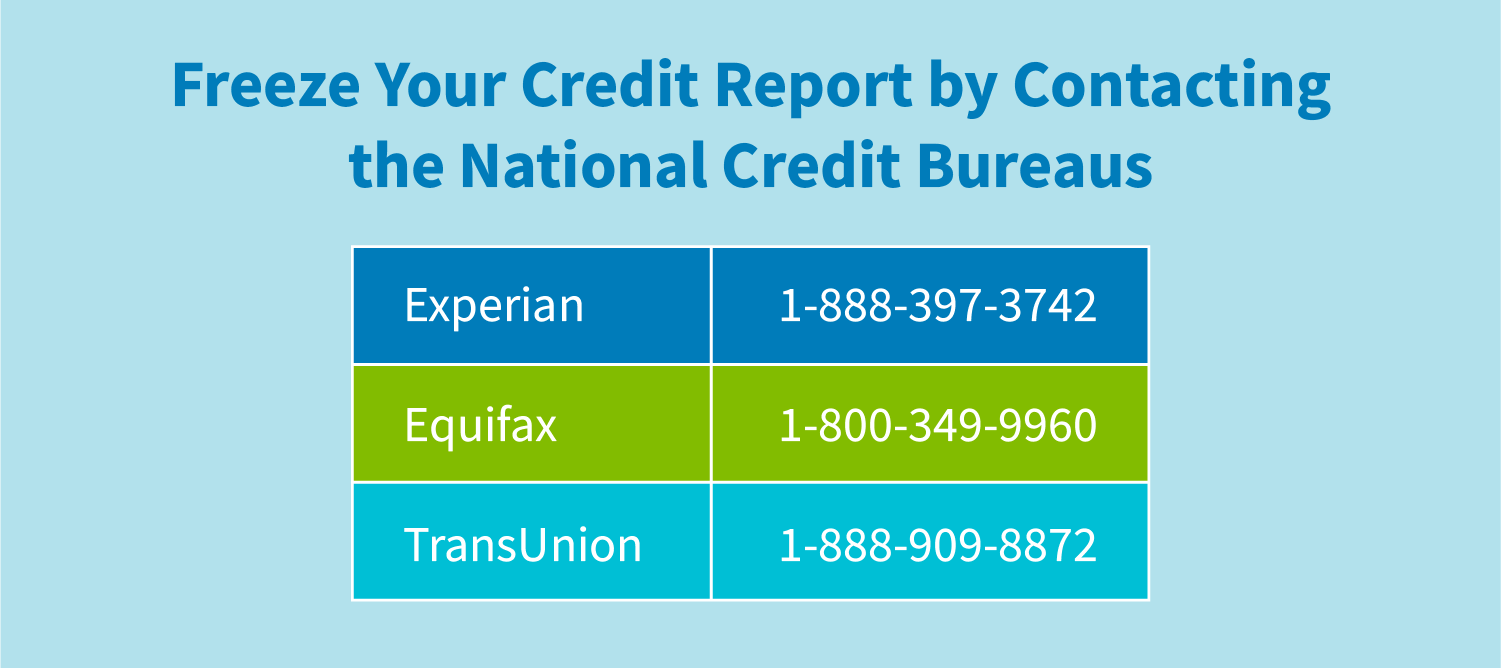

How To Start A Credit Freeze

You must freeze your credit at all three credit bureaus separately. The bureaus will provide you with a PIN that you can use to;freeze and unfreeze your credit. Dont lose that number. Note, though, that;Equifax no longer requires you to enter a PIN when freezing or unfreezing your;credit.

Experian: You can start your Experian freeze either online or by calling the bureau at 888-397-3742.

TransUnion: Start a TransUnion freeze online or by calling 888-909-8872.

Equifax: You can freeze your credit with Equifax online or by calling 888-298-0045.

How much does a credit freeze cost? There;is never a charge to freeze your credit. This is a free service.;

How;long does a credit freeze last? A credit freeze remains active until you ask the;credit bureaus to remove it. According to the FTC, if you request that your;credit be unfrozen online or by phone, the bureaus must lift your freeze within;an hour. Many consumers lift freezes temporarily when they are applying for new;credit or loans.;

How long does it take for a freeze to go into;effect? Different states have different regulations;regarding security freezes. In California, the credit bureaus are required to freeze your credit no later than three days after receiving your request. In New Hampshire, the bureaus must freeze your credit within five business days of;receiving your request. In New Jersey, that time limit is again three days.

Read Also: What Credit Score Do You Need For Paypal Credit

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.

Re: Transunion Charged Me $26 And I Don’t Even Know Why

Im assuming you called and cancelled the service already which is why you’re expecting a refund tomorrow?;;

Transunion has several different products offered on their website, only one of which is free.; I admit the way they set up the product info can be confusing so you have to read very carefully.;;But, if I recall correctly, a sign up isn’t required to review products.

One hint that they ; may charge you is when they ask for payment info like a credit or checking account number.;;When you see such a request, best to take the time to read through the terms and conditions of the service before proceeding to find out why your financial info is required . And if you can’t figure it out from the T&C, then contact the company and ask – never just hand them your payment info without understanding why.;

“Forget What You Feel, Remember What You Deserve”09/2017: EX 641 EQ 634 TU 64711/2020: EX 780 EQ 771 TU 78111/2020: EX 793 EQ 780 TU 778800sMy AAoA:My AoOA:Inquiries:Report Status:Without patience, we will learn less in life. We will see less. We will feel less. We will hear less. Ironically, rush and more usually mean less.

Also Check: Does Closing A Credit Card Hurt Your Score

How To Cancel Transunion Hassle

TransUnion is a global credit-reporting agency that acts as an intermediary between businesses and consumers. It collects information on over a billion consumers in more than 30 countries around the world, monitors credits, makes credit reports, and offers a variety of fraud protection products to its customers.

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Read Also: How Long Does Debt Settlement Stay On Your Credit Report

The Cost Of A Transunion Credit Report Error

An error on your credit report can not only lower your credit score, but it can also result in the following:

- Higher interest rates for your home mortgage, credit card, and private student loans

- Higher insurance premiums for your home and car

- Loss of a job opportunity

- Denial of loan and credit applications

In extreme cases, an error on your credit report could even affect your U.S. government clearance. In fact, TransUnion lost a class action lawsuit in 2017 after consumers were flagged as terrorists on their credit report.

American Express Mycredit Guide

Available even if you are not an American Express customer. All for free.

Not a Card Member?;

Why MyCredit Guide?

We believe everyone should know their credit score and have the tools to understand it better. That’s why we’re giving you;VantageScore® 3.0 by TransUnion, and the key factors that affect your score.

Using MyCredit Guide won’t hurt your credit score.;

Use it as often as you like, it wont affect your credit score.;

There is no cost to using MyCredit Guide.;

We provide a secure login that helps keep your information safe.;

MyCredit Guide offers you tools and information to help you take charge of your credit.

In addition to your credit score, get a detailed TransUnion credit report that helps you stay informed.

Alerts

We will let you know if there are any changes to your TransUnion credit report to help detect identity theft. Alerts include address updates, new inquires on your credit report, new accounts opened, and more.

See how different actions like paying down debt or opening a new account, could affect your score.

Don’t Miss: How To Get Fico Credit Score

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the;Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Should I Pay For Credit Monitoring Services

Every adult should monitor their credit reports and alert the credit bureaus;right away if mistakes are noticed. Yet whether you opt to build your own free approach to watch your credit reports or you prefer to pay for a more robust or convenient credit monitoring service is a personal decision.

Do you have the time and discipline to follow through with monthly credit monitoring on your own? If so, reviewing your three credit reports and scores individually might work well for you. Do you have a busy schedule or doubt that youll follow through and check your three reports as often as you should? In this scenario, subscribing to a service that alerts you to changes on your credit reports might be a better option, as long as you can afford the cost.

Only you can decide whether its worth it to pay for credit monitoring services. The good news is that when it comes to credit monitoring, the only wrong decision you can make is ignoring your reports.

You May Like: How To Get Rid Of Inquiries On Your Credit Report

How Can I Access My Credit Score

To access your credit score for a fee, you can contact the credit reporting agencies. There are also websites that offer a free Vantage Score. A Vantage Score is not the same as a FICO® Credit Score, and there are differences in how they are calculated. Some banks and credit card companies also provide credit scores to their eligible customers. Wells Fargo now provides access to FICO Credit Scores to eligible customers through Wells Fargo Online®. When comparing scores, be sure to understand what kind of credit score you are looking at , what score version it is, and when it was last updated. For more information, view: understanding the difference between credit scores.

You Have More Than One Credit Report

When you order your free TransUnion credit report, youll also have the option to order your free Equifax and Experian credit reports. The information in these reports can differ, so its good practice to review all three. For example, some lenders choose to report account data to only one or two credit reporting agencies, not all three. Or, when you apply for a loan, a lender may only pull your credit report from one credit reporting agency, which would result in a hard inquiry on your credit report from that agency only.

Recommended Reading: How To Get Charge Offs Off Of Your Credit Report

Escalate The Issue If Required

If you feel that a credit bureau has not treated you properly, you may file a complaint. This complaint can be made in writing to your provincial or territorial consumer affairs office. The federal government does not regulate credit bureaus.

In Quebec, these complaints must be directed to the Commission d’accès à l’information du Québec .

Pros And Cons Of Transunion

TransUnion offers robust credit monitoring services for a fee but also provides some protections with its TrueIdentity identity protection for free.;;

The pros of its service include access to scores and reports, as well as tools like CreditCompass and the credit score simulator, which can help you make informed decisions with credit.;

One of the main cons is that, to cancel your account, you have to call TransUnion’s customer service line at 681-3196.

The fee of $24.95 is also a bit higher than the other credit bureaus’ monthly subscription offerings. Equifax and Experian, the other two bureaus, have subscriptions available at $19.95 per month and $19.99 per month.;;

Also Check: Can You Have A Bankruptcy Removed From Your Credit Report

Does Transunion Offer Free Trials

Yes, TransUnion offers free trials as a way of attracting new customers. The terms of the free trials are specific to the products that are provided by it. You will need to provide your debit or credit card details before you are allowed to use your free trial. You wont be charged for anything you have access to until the trial expires. Note that you may be offered a payable upgrade to your trial while it lasts. If you accept, you will be charged for the upgrade, your trial will be terminated, and you will be on a paid subscription to TransUnion.

Right To Reject Arbitration

YOU HAVE THE RIGHT TO REJECT THIS ARBITRATION AGREEMENT, BUT YOU MUST EXERCISE THIS RIGHT PROMPTLY. You must notify us in writing within sixty days after the date you click-on to “Accept” the Agreement. You must send your request to: TransUnion Interactive, 100 Cross Street, Suite 202, San Luis Obispo, CA 93401. This request must include your current username and a clear statement of your intent, such as “I reject the arbitration clause in the TransUnion Interactive Service Agreement.”

In consideration for our willingness to provide you with access to TransUnion Interactive or any services or products through the Site as set forth in the Agreement, you and we agree as follows:

YOU UNDERSTAND AND AGREE THAT NO CLAIM, DISPUTE OR CONTROVERSY MAY BE CONSOLIDATED WITH A DISPUTE OF ANY OTHER PERSON IN ARBITRATION, OR RESOLVED ON A CLASS-WIDE BASIS BY A CLASS ACTION OR OTHER PROCEEDING AND YOU HEREBY WAIVE YOUR RIGHT TO COMMENCE OR PARTICIPATE IN ANY SUCH COLLECTIVE OR REPRESENTATIVE PROCEEDING. Unless a different procedure is required by applicable law, the arbitration will be conducted before a single arbitrator in accordance with the rules of the American Arbitration Association , including the AAA’s Supplementary Procedures for Consumer-Related Disputes.

The cost of any arbitration proceeding shall be divided as follows:

You May Like: Does Paypal Credit Report To Credit Bureaus

Stay In Touch With Your Credit

Enjoy UNLIMITED access to your Canadian credit score & report. Stay informed with alerts to key report changes and alerts sent anytime we find out someone is applying for credit in your name. Get personalized credit & debt analysis you can use to make smarter financial decisions.

Enjoy UNLIMITED access to your Canadian credit score & report. Stay informed with alerts to key report changes and alerts sent anytime we find out someone is applying for credit in your name. Get personalized credit & debt analysis you can use to make smarter financial decisions.

Keep on top of your credit with UNLIMITED access to your TransUnion Credit Report and score

Donotpays Virtual Credit Card Doesnt Let Companies Auto

our virtual credit card, you can prevent companies such as TransUnion charge you without you being aware of it. To the company, it will look like any other credit card, but they wont be able to collect any payments from you once the trial period ends. You will avoid being trapped in an unwanted subscription and save hundreds of dollars that would otherwise drip out of your pockets unnecessarily.;

Also Check: Which Business Credit Cards Do Not Report Personal Credit

Transunion Vs Equifax: Which Is Most Accurate

No credit score from any one of the credit bureaus is more valuable or more accurate than another. Its possible that a lender may gravitate toward one score over another, but that doesnt necessarily mean that score is better.

And while a lender may prefer credit reports and scores from a specific bureau, keep in mind that each situation and application is different, with multiple variables to take into consideration.

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus