What Else Do The Cras Do With Personal Data

All of the CRAs have different business functions running through them.

As well as credit referencing, CRAs also operate other activities such as direct marketing and lead generating functions. The data they sell in this area of their business may include information which the CRAs have bought from local authorities about individuals who had not previously opted-out of the full or open electoral register and information from other sources, such as lifestyle questionnaires and competition entries.

Important Rules To Follow

First, debits must ultimately equal credits. While this may be confusing at first, and it may be tempting to simply use positive and negative numbers to account for transactions, ultimately the debit and credit relationship more accurately expresses what happens in a business.

Second, debits increase asset, expense, and dividend accounts while credits decrease them. It may be helpful to use the mnemonic D.E.A.D. to remember this. Debits increase Expenses, Assets, and Dividends.

Third, the opposite holds true for liability, revenue, and equity accounts. Credits increase these while debits decrease them. The mnemonic for remembering this relationship is G.I.R.L.S. Accounts which cause an increase are Gains, Income, Revenues, Liabilities, and Stockholders’ equity.

Because these have the opposite effect on the complementary accounts, ultimately the credits and debits equal one another and demonstrate that the accounts are balanced. Every transaction can be described using the debit/credit format, and books must be kept in balance so that every debit is matched with a corresponding credit.

Why You Should Check For Errors

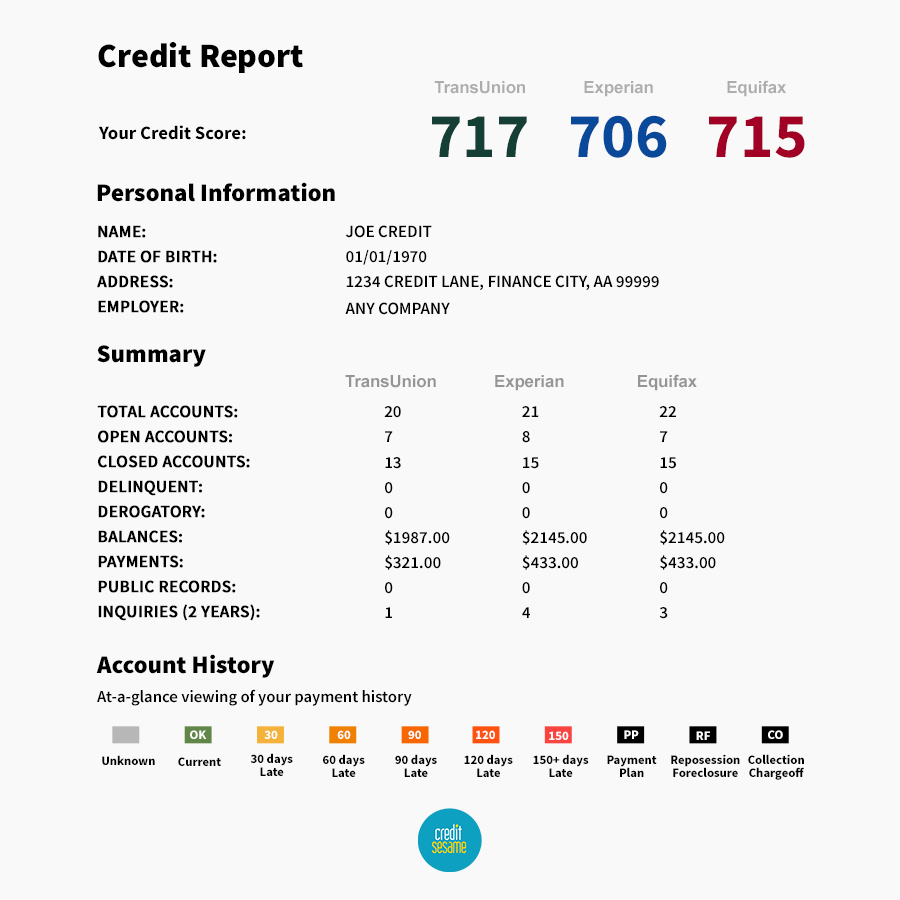

Once youve obtained your credit report, review it thoroughly to ensure all the information reported about you is accurate. If you spot errors on your credit report, like tradelines that are outdated or arent completely accurate, you can have them removed by writing to the credit bureau.

Tradelines you dont recognize could be a sign of identity theft. These fraudulent tradelines can be disputed with the credit bureaus.

Also Check: Does Closing A Credit Card Hurt Your Score

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

How To Remove Negative Information From Your Credit Report

As long as the information is accurate and verifiable, the credit reporting agencies will maintain it for the aforementioned timeframes. If, however, you have information on your report that you believe is incorrect, whether it’s positive or negative, then you have the right to dispute the information and have it corrected or removed from your credit reports.

The most efficient way to file a dispute is to contact the credit reporting agencies directly. And while Equifax and TransUnion have their own processes for consumers to dispute their credit reports, Experian makes available three dispute methods: You can do it over the telephone, via U.S. mail or online.

Also Check: Does Requesting A Credit Report Hurt Score

Maxing Out Revolving Credit

Revolving credit is the financial worlds way of talking about lines of credit and credit cards. These products work a little differently than the typical installment loan.

With an installment loan, typically what happens is that you receive a lump sum of money that starts accruing interest right away. Youll have a specific date by which youll have to repay the total loan, and youll have to reapply if you need more money.

Now lets compare this to revolving credit.

If you receive a line of credit, it will have a credit limit. With a typical line of credit, you may use as much or as little of this limit as you need, but youll only start to accrue interest on what you use.

Your use will usually show up on your bill or monthly statement as your total outstanding balance. Youll have to repay your balance by a certain date, and once you do, youll have access to your full limit again, usually without having to reapply again. Typically, you will be paying back the outstanding balance and any accrued interest through multiple minimum payments that combine outstanding principal and interest.

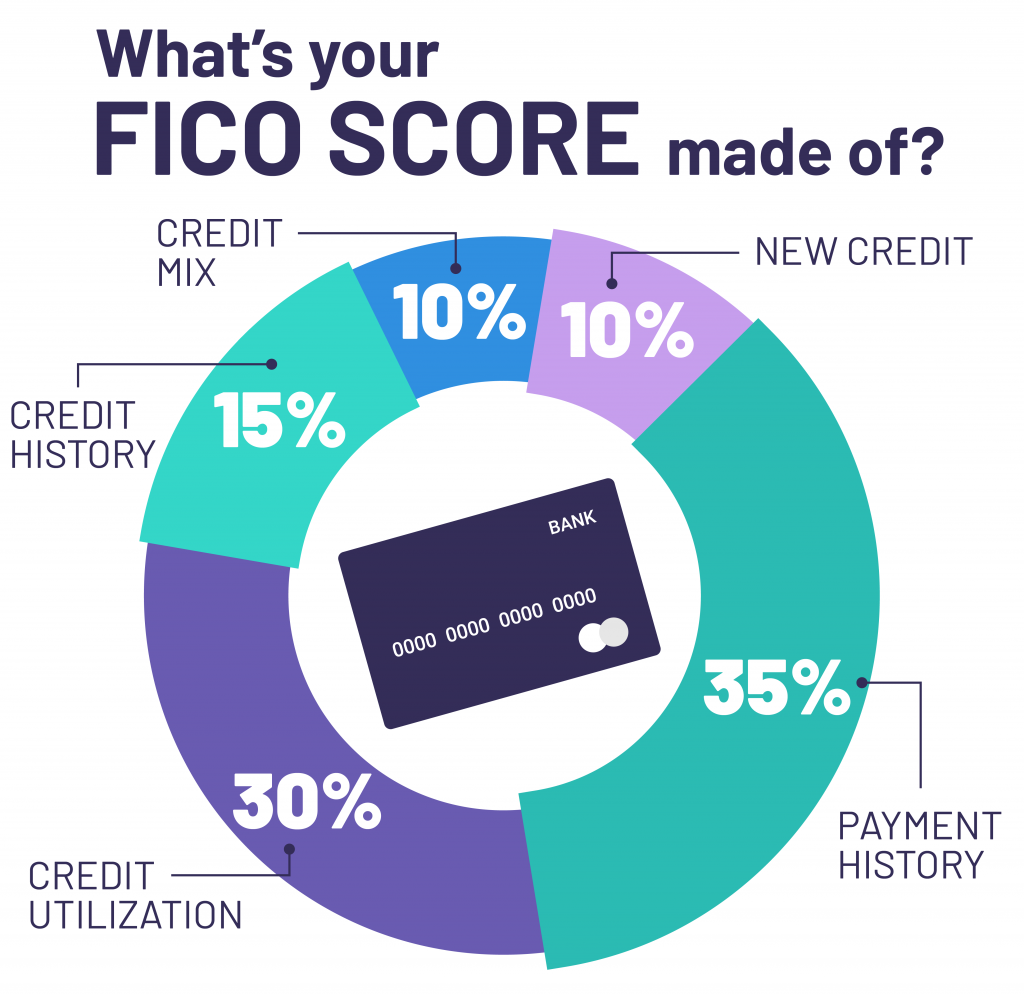

As a general rule of thumb, you want a low utilization rate. This means you use your available credit reasonably. A high rate, on the other hand, suggests youre frequently tapping into credit, which may suggest you have trouble managing your money.

Send Your Credit Dispute Letter

You shouldnt just throw these into an envelope and then toss them into the mail.

You need a way to verify if and when they received the letters so that you can be sure that the investigation was completed in a timely manner .

So be sure to take these to the post office and send these as Certified Letters return receipt requested.

Once they receive the items you will be notified that they have received the certified letters. This helps you keep track of things, as mentioned above.

What Happens Next

It will take about 30 days before you receive a response from the credit bureaus, although it could be less or more. Be patient, but dont lose track.

Your response will be that they deleted all the item, some of the items or none of the items. If they deleted all of them, youre done. You need not do anything more from here. Congratulations!

Youve completed the task and will only re-open the investigation if you do contact them regarding errors already deleted. We dont want that, obviously. No need to contact them again if they deleted all of the items.

If they deleted some of them or none of them, then its time to get back to work. Now we can send a new letter regarding the items that were not deleted .

Note: You can move directly to the Method of Verification letter or send out a similar letter to the original. The MoV will have more of a positive effect for you, but if youre patient enough sending out a second letter may be easier.

This right states that:

Full Name

Read Also: When Do Collections Come Off Credit Report

Not Checking Your Credit Report

Bringing an end to our tour of what hurts your credit score is failing to check in with your credit. Unfortunately, a lot of people are guilty of this bad habit. One survey shows 43 percent of Americans havent checked their score in the past year, while another shows 21 percent of adults have never checked it at all.; Many credit experts recommend taking advantage of your three free checks through AnnualCreditReport.com. If you time it right, you can peek at your report every four months, giving you regular coverage throughout the year.

Recording A Sales Transaction

Recording a sales transaction is more detailed than many other journal entries because you need to track cost of goods sold as well as any sales tax charged to your customer.

For example, on February 1, your company sells five leather journals at a cost of $20 each. After 7% sales tax, the customer is invoiced for $107.00. Here is how you would record these debits and credits in a journal entry:

| Date | |

|---|---|

| Sales Tax Payable | $; ; 7 |

You will increase your accounts receivable balance by the invoice total of $107, with the revenue recognized when the transaction takes place. Cost of goods sold is an expense account, which should also be increased by the amount the leather journals cost you.

Revenue will be increased by $100.

The inventory account, which is an asset account, is reduced by $55, since five journals were sold.

Finally, you will record any sales tax due as a credit, increasing the balance of that liability account.

Don’t Miss: What Does Frozen Credit Report Mean

New Credit Should Be Reported To Credit Bureaus

All new credit accounts should be reported to the credit bureaus. This is how you will improve your credit scores. In the event you only qualify for a secured credit card make sure it reports to the credit bureaus. The ideal scenario is to have the credit card company report the account the same way an unsecured credit card is reported. No one will ever know the credit account is secured.

How To Check With The Data Furnisher

When you file a dispute, the Federal Trade Commission suggests also informing the company that provided the data to the credit bureaus, such as a bank, lender or card issuer, in writing. These sources of information are known as furnishers. Notifying the data furnisher may cause them to proactively stop reporting the inaccurate information to the credit bureau, although that’s not guaranteed.

Send the letter to the company using the address it listed on your credit report. If there is no address listed, ask the company for one.

The FTC notes on its website: “If the provider continues to report the item you disputed to a credit reporting company, it must let the credit reporting company know about your dispute. And if you are correct that is, if the information you dispute is found to be inaccurate or incomplete the information provider must tell the credit reporting company to update or delete the item.”

Also Check: How To Remove Chapter 7 From Credit Report

The Consequences Of Negative Information

Negative information will hurt your ability to get the best credit cards and the best loan terms. Too many negative items or even one severely negative item can mean that you wont qualify for a credit card or loan at all. Negative information will eventually leave your credit report, but the amount of time it takes depends on the item. Foreclosures remain on your credit report for seven years, while completed chapter 7 and chapter 11 bankruptcies stay on your credit report for up to ten years, and chapter 13 bankruptcies stick around for up to seven years. However, having other accounts in good standing will reduce the impact of negative items over time, even before they drop off your credit report.

If your credit report contains negative information thats false or inaccurate, you should contact the credit bureau and try to get the negative information removed. You might find yourself in this situation if the credit bureau makes a mistake, if one of your lenders or creditors makes a mistake, if your identity is stolen, or if someone elses account gets mixed up with yours. If your credit report contains negative information thats a result of financial mistakes or hard times, a combination of positive items and the passage of time will improve your credit score. You also have the option to add a statement of explanation to your credit report that provides information about the circumstances related to that item or incident.

What Is Your Credit Score Used For

Lenders may look at credit scores to help them make loans and credit decisions and may also play a role in being approved or denied for apartment rentals, home loans, phone lines, student loans, credit cards and more. In addition to being used for approvals or denials for applications, your credit score may also determine interest rates and credit limits when it comes to regular credit cards and personal loans.

Don’t Miss: How Long Do Inquiries Last On Your Credit Report

Increase Your Credit Limit

You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. The higher your overall available credit limit, the lower your credit utilization rate . Before asking for a credit limit increase, make sure you won’t be tempted to spend more than you can afford to pay off.

If you are considering opening a new credit card, do your research beforehand. How often you apply for and open new accounts gets factored into your credit score. Each application requires the card issuer or lender to pull your credit report, which results in a hard inquiry on your report and dings your credit score a few points.

“Usually the negative impact of those factors is much less than the benefit to your score of reducing your credit utilization ratio,” Triggs says. Just make sure you don’t apply to too many credit cards over a short amount of time and send a red flag to issuers.

It’s more important now than ever to do your research before applying for new credit because issuers;may have stricter terms and requirements in wake of the economic fallout from coronavirus. Check to see what your credit score is beforehand.

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer,;bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

You May Like: What Is My True Credit Score

My Partner And I Are Financially Linked Because We Have A Joint Account And Are Both Named On The Mortgage If He Applies For Credit Will The Lender Look At My Credit File As Well As His Will I Be Notified Of This

In short, yes, the lender can have full access to your credit file in the same way it could if it were you applying for credit. This is because your financial situation may have a bearing on whether your partner is offered credit or not. Because you are financially linked they are, effectively, looking at your credit history and ability to repay the loan as a couple rather than as an individual.

You should only be linked to someone who you have a joint account with or in some situations, have agreed to act as a guarantor for . You should not be linked to anyone just because you live at the same address.

When a joint account is closed you can write to the CRAs to request a disassociation from that individual.

If you find a financial link to someone you dont know, or you believe to be inaccurate you should raise this with the CRA and ask that they investigate this for you.

A Derogatory Mark Is A Negative Item On Your Credit Report That Can Potentially Be Removed Or You Can Build Positive Credit Activity To Overcome It

Having a few items on your credit report dragging down your score can be incredibly frustrating, especially if you have a good financial record.

Because derogatory marks can stay on your credit report typically for seven to ten years, its important to know how to fix them.

Derogatory marks can affect your credit score, your ability to be approved for credit and the interest rates a lender offers you. Some derogatory marks are due to poor credit activity, such as a late payment. Or it could be an error that shouldnt be on your report at all.

Types of negative items include late payments , charge-offs, collections, foreclosures, repossessions, judgments, liens, and bankruptcies. Well cover what each one of these means, and how they can impact your credit reports.

Recommended Reading: Can Student Loans Be Removed From Credit Report

How Many Loans Is Too Many

This is a tricky question to answer because it depends on a lot of variables. Everyones finances are unique, so the number of loans and the size of someones debt may not have the same effect across the board.

In terms of hard credit checks, its all about timing.

Multiple inquiries in a short period may have a big impact. This is especially true if youre just starting to build your history, as you wont have enough entries to temper the negative impact these checks may have.

As for the number of open accounts, there is no magic number.

There is, however, something called your DTI ratio. It stands for debt-to-income, and its a ratio that compares your debt payments to your earnings. Some creditors look at this ratio to see how much of your income you use to repay debt.

Generally, the lower your DTI, the better. However, 40 percent is a common manageable amount for many people.

If your DTI is higher than 40 percent, it suggests that a fair amount of your income goes to debt repayment. This may affect a financial institutions willingness to lend you money. With your money tied up in existing debt, it may send along the message to financial institutions that you may not have enough cash in your budget to pay for additional loans.

Accept The Risk Factors You Cannot Change

Certain risk factors, such as “short account history” and “length of time accounts have been established” reflect the fact that longer positive credit histories represent less risk. The longer your positive payment history, the better your scores will become.

Similarly, a factor such as “amount owed on mortgage loans is too high” simply means you’ve got to keep making mortgage payments on time . If you persevere and avoid missed payments and other missteps, your score will tend to improve over time.

Recommended Reading: Does Loan Me Report To Credit Bureaus