How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Offer Pay For Removal

Pay for removal is when you request that the debt collector removes a collection entry from your credit bureau for payment. Theres nothing that requires the debt collector to agree to this. Whether a debt collector agrees to this usually depends on the debts age and the amount, and your previous account history.

Before you request this, make sure youre aware that by offering pay for removal, youre agreeing to pay the full amount owing to the debt collector, plus any interest and fees. If you were in the position to do this, you probably wouldnt have ended up in collections in the first place, so this isnt always feasible.

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behaviour so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.

Don’t Miss: How To Gain Credit Score

Determine The Accounts Legitimacy

Is the collection account legitimate a past-due debt that you actually owe? If it is, youre going to have a tough time getting it removed from your credit reports. However, if the account is actually incorrect, or should have been removed from your reports by now, then you may be able to get it removed through the dispute process.

How To Decide If You Should Pay A Debt Collection Agency

There’s no silver bullet in a debt collection case. While ignoring a debt collector may be an option in some cases, it’s not available to some debtors.

Here are some general considerations.

If you refuse to pay a debt collection agency, they may file a lawsuit against you. Debt collection lawsuits are no joke. You can’t just ignore them in the hopes that they’ll go away. If you receive a Complaint from a debt collector, you must respond within a time frame determined by your jurisdiction. For most areas in the US, that time frame is 14-30 days.

If a debt collection agency wins their lawsuit, they have several options available. For example, debt collectors may garnish earnings to collect a debt. A garnishment is a court order that takes money directly from a debtor’s earnings. This money goes towards repaying the debt they owe. Consider this possible outcome before ignoring a debt collector’s payment demands.

Here’s one more thing to keep in mind. Interest on your unpaid debt will continue to pile up as time passes. If you don’t pay a debt collection company, the amount of money you allegedly owe will keep increasing.

A piece of advice: pay the right person. If you receive a letter from a debt collector demanding money, do your research. Often, debt collection agencies sell debt to one another. Don’t just assume you’re paying the right debt collector. Make sure your debt hasn’t changed hands.

Consider these factors and situations

You may want to pay a collection agency

Don’t Miss: How To Get My Own Credit Report

What Impact Does A Collections Account Have On Your Credit

An account that ends up in collections may well have damaged your credit already. Late payments;can significantly hurt your score.

How much the collections account will impact your credit depends on your . A collections account will have a more significant impact on a credit score in the 700s than one in the 500s.

Some newer credit scoring models either ignore paid collections accounts or weight them less heavily. Unpaid medical accounts are also treated less harshly than other late bills. However, most creditors are still using older credit reporting models when making lending decisions.

How Does Paying Off A Collection Account Affect Your Credit Report

If you pay an account in collections in full, its impact doesnt go away immediately. Youll have to wait until it reaches the statute of limitations before its removed from your credit report, which is normally around seven years. The good news is that the older the information, the less impact it has on your credit score.

While paying off collections may not improve your credit score, there are still a few ways it can benefit you:

- Avoid a debt collection lawsuit for unpaid medical or credit card bills.

- Dodge interest fees from debt collectors. Debt collectors constantly buy and sell accounts and can continue to charge you interest and fees on purchased accounts.

- It will show up on your credit report as paid in full or settled. This could positively influence lenders who might look beyond your score to your credit history. A person who pays back a severely past due account shows more financial responsibility than someone who never paid it.

- Eventually benefit from the new . FICO 9 is rolling out very slowly, but eventually it will be used by most lenders. This model gives less weight to medical bills and ignores paid accounts in collections entirely.

Read Also: How Long Does Debt Settlement Stay On Your Credit Report

Bottom Line: Bankruptcy And Credit

I have personally seen the impact of the bankruptcy petition on some debtors five to seven years later and most are doing fine, says Arnold Hernandez, an attorney in Tustin, Calif., who handles bankruptcy cases. Bankruptcy is not forever.

How Do Collections Affect Your Credit

Most accounts end up in collections after being 120 to 180 days past-due. During this time, the original creditor may stop contacting you about the debt.

For many people, renewed collection activity comes as a nasty surprise when their debts are turned over to third-party collection agencies that use aggressive tactics.

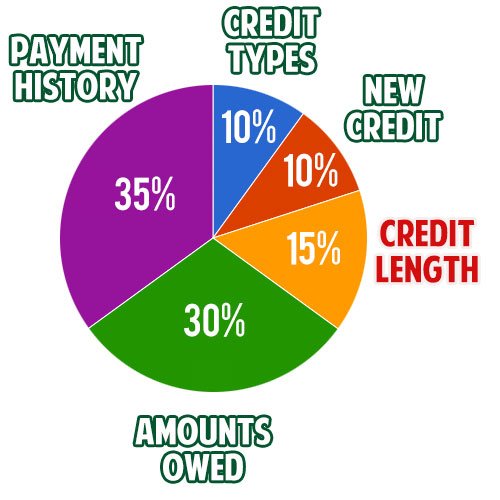

When collections on your credit report first show up, you can expect your credit score to drop anywhere from 50 to 100 points depending on how high your credit score was to start. The reason is that payment history has the most significant impact on your credit score.

In general, the better your credit, the worse the hit will be. Over time, the collection account will impact your credit less and less. Before your account is sent to collections, you should receive a final notice from the original creditor.

Its best to try and make some type of payment arrangement at that time so you dont end up with such disastrous effects on your credit score.

Also Check: How To Boost Credit Score 100 Points

What If I Decide To Not Paying Back My Debt

Of course, you can also decide not to pay off your debts and they will be removed from your credit report in about 6 or 7 years, depending on which province you live in. While this is an option, its not one what we would recommend. Its always in your best interest to pay back what you owe so that you know for sure you wont have any issues with that particular account in the future.

Want to know more about how long information stays on your credit report? .

Also, if the collections agency decides to pursue legal action against you because youre not repaying your debts, a judge could begin to garnish your wages to pay them off. Generally, it is a much better idea to simply pay the collections account and request that the demerit is taken off of your credit report before things get much worse than they need to. Even if you are unable to get them to wipe the account from your credit report instantly, paying it off is still a step in the right direction.

Also, while paying off these old debts that have gone to collections will help, dont expect them to completely turn your credit score and credit report from bad to great. Improving your credit as a whole takes a lot of time and effort in multiple areas, but paying off your collections accounts will at least ensure things dont get any worse for you.

Collection Agencies Dont Always Play By The Rules

Collection agencies can sometimes be pushy, and some may even violate the Fair Debt Collection Practices Act, which prohibits debt collectors from using abusive or deceptive practices in an attempt to collect from you.

If you suspect youre being harassed or treated unfairly, its important to know your legal rights. We recommend consulting with a legal professional as a matter of course, but you can start by checking out our guide to your debt collection rights.

Recommended Reading: Does Experian Affect Your Credit Rating

Three Ways To Remove Collections Accounts From Your Credit Report

The first step you need to take is to order from the three major bureaus: Experian, TransUnion and Equifax. Collections may be reported to only one or two bureaus. There are a few different ways you can try to remove collections from your account, some with more success than others. We review these options below.

Bear in mind that the results of these methods vary and not every consumer will have the same outcome. However, its always worth exploring and your credit score may improve as a result.

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

Also Check: How To Remove A Delinquency From Your Credit Report

What Happens When An Account Goes Into Collections

Step by step, here’s what happens when you have an account go into collection:

Virtually any type of unpaid debt can be sent to collection, including:

Remove Derogatory Items From Credit Reports

So what happens if the negative information on your account is legitimate? Removing that information is much harder, but not impossible.

Negative information typically lives on your credit report for seven years for old credit accounts. Bankruptcies last even longer, with a 10-year period before they fall off your credit report.

| How long do derogatory marks stay on your credit report? | |

|---|---|

| Missed payment | |

| 7 years | |

| Civil judgment | 7 years |

You can always wait seven years until the information goes away, but you can try to get it removed sooner. The method to have negative information removed from old accounts is simple: call and ask.

If you call and ask a creditor to remove a late payment or other negative information from your history, remember that they are under no obligation to do so. Essentially, theyre doing you a favor if they proceed.

Ask very nicely, and consider using a few points below to get sympathy from the call center representative you speak with.

- Explain that you were going through a tough financial time and have since made all on-time payments.

- Tell them that you learned your lesson, changed your ways and always make payments on time now.

- Discuss how your credit mistakes from years ago are holding you back even though you are currently making on-time payments.

You can also summarize these points in whats called a goodwill letter, which can call to the creditors sympathies.

You May Like: Is 524 A Good Credit Score

Ways To Scrub A Collections Stain Off A Credit Report

Your credit scores take a hit if you fall behind on payments to a creditor, and again if an;account is sent to the creditors collection department or sold to a third-party collector. You may be able to repair some damage to your scores by resolving a collections account on your credit reports.

Collections accounts generally stick to your credit reports for seven years from the point the account first went delinquent. You may want them off sooner than that; unpaid collections always hurt your scores. And while newer versions of FICO and VantageScore credit scores ignore paid collections, many lenders still use older formulas that count even paid collections against you.

There are a few ways to get a collections account off your credit report, depending on your relationship with the creditor and the account status.

First, do your homework

Get information on the debt from two places: your credit reports and your own records.

You can get a free credit report every 12 months from each of the three major credit reporting bureaus by using AnnualCreditReport.com. Some personal finance websites offer free credit report and score information.

Gather your own records for details on the account, including its age and your payment history.

Between the two, verify these details:

- Account number

- Account status

- The date the debt went delinquent and was never;again brought up to date

Once you have the details straight, you can decide which approach works for you.

Hire A Credit Repair Service

A reputable company like may be a viable solution if your report is riddled with inaccuracies that further complicate the repair process. can help you with the following items:

- Cleaning up credit report errors

- Disputing inaccurate negative entries

- Handling creditor negotiations

If you decide to hire a credit repair service, know that laws govern how they operate and what they can do. The establishes the following regulations governing credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the service

- They cannot receive payment for the performance of any service until said service has been entirely performed

- There must be a written contract detailing the services to be performed, the time frame during which these services will be performed, and the total cost for those services

- They cannot promise to remove accurate information from a credit report before the term set by law

- The consumer will have three days in which to review the contract and cancel without penalty

Also Check: Why Is My Credit Score Not Going Up

How Long Does Negative Information Stay On Your Credit Report

The length of time negative information can remain on your credit report is governed by a federal law known as the Fair Credit Reporting Act . Most negative information must be taken off after seven years. Some, such as a bankruptcy, remains for up to 10 years. When it comes to the specifics of derogatory credit information, the law and time limits are more nuanced. Following are eight types of negative information and how you might be able to avoid any damage each might cause.

Derogatory Mark: Missed Payments

If you are at least 30 days late, expect a derogatory mark on your credit report. Missed payments typically stay on your credit reports for 7½ years from the date the account was first reported late. The later the payment goes moving to 60 days late, 90 days late and so on the greater the damage to your credit scores.

What to do: Pay your bill as soon as you can afford to. If youve never or rarely been late before, you might be able to get the creditor to drop the late fee. Call the customer service number, explain your oversight and ask if the fee can be removed. You can also write a goodwill letter. If paying the bill is not an option, call your creditor and let them know about your financial situation to see if you can work out a hardship plan.

The negative effect on your credit scores will fade over time. Try to stay on top of all your; payments so positive information in your credit reports dilutes the effect of the missed payment.

Read Also: Which Credit Score Is Correct