Do You Need Good Credit To Buy A Mobile Home

Michael BrownMichael Brown

Do you need good credit to buy a Mobile Home?

I’ve been selling Mobile Homes at the Beach for 15 years. In that time I’ve had dozens of people tell me their credit score does not matter because they can pay cash for the home. Unfortunately they are wrong. To live in the local leased land Mobile Home communities you must pass pretty stringent credit and background checks.; Most of the local leased land Communities are owned by big businessmen in far off cities like Chicago and Atlanta, they don’t care what your story is, they are like robots with set rules. If your numbers meet their criteria you get in, if they don’t you won’t.;

Remember that we here at Coastal Mobile are just REALTORS, we are not the Community Managers or Community Owners and have no say whatsoever in who is or is not approved.;

If your credit scores are low, but you have $20,000 to $40,000 to spend on a Mobile Home at the Beach, I hate to be the one to crush your dream. Even though you can afford the cash to buy the house, the community management won’t let you move in without good credit.;

There are companies out there that can help you improve your credit and claim to increase it significantly in just six months to a year.;

Can I Get A Manufactured Home With Bad Credit

If you have bad credit or a semi-recent repossessions, foreclosures, or bankruptcy, a manufactured home may be a good choice. It should be cheaper than a traditional home, depending on the local market. Since you need to borrow less money it may be easier to get a loan. Bad credit borrowers deserve to be homeowners and of course, need a second chance to move into the good credit class of borrowers. Purchasing a manufactured home can allow you to own a home and improve your credit score.

FHA Home loans may be helpful for individuals who have bad credit, especially when buying a manufactured home. If you are seeking an FHA loan, you will need to find a financial institution that offers them. With FHA loans, you dont need a huge 20% down payment. FHA loans are often approved with a down payment as low as 3.5%, depending on credit score. Interest rates are fixed for the entire term of the loan, usually 20 years. A fixed interest rate means you know exactly how much you will be paying each month for 20 years and you can budget accordingly.

The maximum loan amount for a manufactured home is $66,678. The maximum loan amount for a manufactured home and a lot to put it is $92,904.Even borrowers with scores below 640 can finance a house, but you would have to pay higher interest rates, higher down payments, and more. This is why manufactured homes may be a better option for those with bad credit.

Professional Friendly Mobile Home Financing Help

Did you find your dream home, but are worried that;mobile home financing;wont come through? Is this your first time buying a home and you arent familiar with the banks? Have you bought before but had your credit score take a slide with the recent recession? Then Texas Built Mobile Homes is the place for you to find a team willing and able to walk with you through the financing process. We have;in-house financing;available right now, including;T.I.N. financing;on 3 & 4 bedroom homes.;No credit? No problem!;We value you as a customer regardless of your credit score or credit history, and are excited for the opportunity to help you and your family find a home!

We can help you with standard manufactured or modular home financing options, land home packages, and we even offer a program for;zero down if you own your own land.;Even if you dont own your own land free and clear but have equity, you can use the equity with your financing package. Let our team help you maneuver through the difficulties of finding mobile home financing from your choice of lender and navigating through all the required paperwork. Our team has done this before and we are happy to do it again to help you get in the home you want! Contact us today for more help from our team, or give us a call right now at;!

Read Also: Does Having More Credit Cards Help Your Credit Score

Cons Of Manufactured Homes

- Financing can be difficult to secure: Not all manufactured homes qualify as real property, which means you might not be able to secure a traditional mortgage or manufactured home loan. You may end up having to pay higher interest rates to finance a manufactured home purchase.

- There are location limitations: Manufactured homes dont come with their own lot to stand on. To live in your home, youll also need to secure a plot of land for it, whether thats in a manufactured home community or standalone lot. And that means added costs on top of the home.

- Negative stigma: There is still a negative connotation to manufactured homes and parks, even though the safety and aesthetics are miles above what they were several decades ago.

Save Up For Additional Costs

When purchasing a home, its important to remember there can be additional costs involved beyond the down payment. Prepare by saving up for items like closing costs, which can vary based on the price of the home youre purchasing and the loan you choose. Also, if you currently have a manufactured home you want to trade in, talk to lenders about how your trade-in could help with the down payment amount for your new manufactured or modular home.

Read Also: What Is The Highest Credit Score You Can Get

What Lenders Look At Besides Your Credit

A mortgage lender will look at more than just your credit rating; they look at the whole credit picture. Negative credit history, such as late payments, collection accounts, or excessive debt, could cause your loan to be denied.

- 36 month waiting period after a bankruptcy or foreclosure

- Limited unpaid debt in collections

What Is A Mobile Home Loan

A mobile home loan is a loan for factory-built homes that can be placed on a piece of land. Styles may vary from modest trailers to dwellings that look like houses attached permanently to the land upon which they sit.

Mobile home loans differ from a traditional property loan because most lenders and counties do not consider them real property, but rather personal property. In fact, in many counties, a mobile home is taxed by the department of motor vehicles rather than the property tax assessor. In most cases, if you want to buy a mobile home and place it on land that you lease, your loan will more closely resemble a personal loan, with higher interest rates and shorter terms than a traditional home mortgage.

There are exceptions, however, and weve included them in this list. Some home lenders do have loans for mobile homes if they are attached to the homeowners land. Others, and there are fewer of them, will lend on a mobile home even if it sits on land you lease.

Recommended Reading: How To Remove A Delinquency From Your Credit Report

What Credit Score Is Needed To Buy A Home

Tony MariottiTony Mariotti

Have you ever asked yourself, What credit score is needed to buy a house?

The short answer is: Lenders typically want to see a minimum FICO score of 620.

The long answer is: It depends.

Lenders weigh more than just your credit score to determine what interest rate they’ll offer. Other factors like your income, employment history, assets and size of your down payment also play a role.

In fact, if you have enough cash on hand for a downpayment of 20% or more, you might be approved for a loan with a credit score below 620. If youre a first time home buyer with only a 3% to 5% down payment, youre not as likely to catch a break.

You can find your credit score within a . Pulling a report is one of the first things your loan advisor does after receiving your loan application.

Three major credit reporting agencies keep tabs on consumer financial activity; Equifax, Experian, and TransUnion. All three companies provide data for credit reports, thus reports bear the nickname “tri-merge.” You might hear someone in the mortgage industry say, “Hey, Charlie, can you pull a tri-merge for my customers loan file?

Ever wonder whats inside a credit report?

What Is Considered Bad Credit When Looking For Manufactured Home Financing

Because a manufactured home loan is usually secured by the home or property or both, you may be able to qualify for financing with a bad credit score. A bad credit score usually is within the range of 300 to 629. The next step up is fair credit which usually ranges from 630 to 689. If you are in the bad or fair credit range you may need to use programs to find financing for a manufactured home, but you should have some options available. If your credit score is below 500, you may not have any options available.

Also Check: Can You Self Report To Credit Bureaus

Can I Finance A Manufactured Home

Yes, you can finance the purchase of a manufactured home. In fact, it can be much easier to get financing for a manufactured home than for a traditional frame or block house.

Financing terms depend on the lender, but the minimum credit scores for the options we discuss below range from 580-650. Scores higher than 650 may get slightly better terms. Scores lower than 580 may not qualify for a loan at all.

Chattel loans for manufactured homes are often smaller than standard home loans because youre not buying the land. This can make financing easier for some people because theyre borrowing less money.

However, the repayment periods are shorter 15 or 20 years which could lead to higher monthly payments. But youll own the home a lot quicker than with a 30-year mortgage on a standard home.

Another downside is that interest rates can be higher on chattel loans. A study by the Consumer Financial Protection Bureau found that the annual percentage rate, or APR, was 1.5% higher on chattel loans than standard mortgages. Loan processing fees, however, were 40-50% lower.

Loans Other Than Real Estate Loans

- Chattel loan: A fancy word for a loan;secured by both the personal property and the creditworthiness of the buyer. Chattel;loans are usually for mobile homes on non-permanent foundations.;Expect to put 5 10% down depending on your credit rating.;Chattel loans made by dealers or manufacturers are usually for 20-year terms.

- Personal;loans: Expect to put 20% down, more with poor credit. Loan terms are 15 years or less.

- Owner financing: With persistence and;a bit of luck you may find a;mobile home owner who is not only willing but even eager to extend credit to you.

- A personal or secured loan from a friend or relative.

Rent to Own Contracts

These are available for both real estate and chattel loans. After a period of time specified by the landlord/owner, and at a price agreed to by the landlord/owner and renter, the renter may opt to purchase the mobile home. The renter will then need to secure a loan. If you decide to go this route, be sure to search for and carefully read one or more rent to own agreements.

Make sure to research what your states maximum interest rate for rent-to-0wn and owner-financing contracts. Here in WV, it is 8%.

Recommended Reading: Is 643 A Good Credit Score

Home Possible / Homeready Loans

Fannie Mae and Freddie Mac created low down payment home loan programs for low-income first-time homebuyers. To be eligible for the HomeReady or Home Possible mortgage programs your income must be below 100% of the area median income. They require just a 3% down payment with a minimum 620 credit score.

Pros Of Manufactured Homes

- Typically more affordable: Manufactured homes are often much cheaper than stick-built homes. Its also easy to customize a home to fit your particular budget and lifestyle needs. Today, its possible to buy a manufactured home that has all the amenities and comfort of a traditional home for a fraction of the cost.

- Pose efficiency: Manufactured homes can be built and installed quickly. The construction process is also streamlined, allowing for fewer mistakes, damage and delays. Manufactured homes are also highly energy efficient thanks to the HUD code, which requires them to be constructed with energy-saving features.

- They are versatile: Manufactured homes make great starter homes that you can always expand later. As your needs change or family grows, its possible to add on modules. And though most manufactured homes are no longer meant to be mobile, it may be possible to move yours to a different location in the future.

Don’t Miss: How Long Do Late Payments Stay On Your Credit Report

Modular & Manufactured Home Financing

Florida Modular Homes has teamed up with a handful of lenders who understand our product, market, and most importantly our customers.

Most people will require some sort of financing when they are purchasing a new home. With this in mind, Florida Modular Homes has teamed up with a handful of lenders who understand our product, market, and most importantly our customers. The team at Florida Modular Homes are experts in financing and in many cases can get individuals financed that may have been previously turned down.

Fortunately, in todays market there are many options available for factory built home buyers with both good and challenged credit. Most of the loan programs that are available for traditional stick built housing are also available for factory built homes.

Florida Modular Homes and the lenders we have teamed up with offer financing for both mobile and modular homes. For both home only financing with no land involved in the transaction and land / home financing where the land purchase or payoff is financed in the same payment as the home.

Do You Have To Own Your Land When Buying A Mobile Home

When you purchase a mobile home, it is not necessary to own the land, but it will open up more loan options for you.

Mobile homes are sometimes located in a mobile home park where the park owner holds title to the land and you lease it. In these cases, the homeowner leases a plot of land but owns the mobile home itself. Many lenders will require you to sign a three-year lease minimum for the land before they will lend on the mobile home.

Alternatively, owners of mobile homes can place mobile homes on land they own or land they are buying in conjunction with the mobile home. When you own the land and the home, your loan rates and terms will be better, and youll have more lending options.

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

Evaluate How Much You Can Afford

Look at your monthly income and calculate how much you can put toward a monthly payment and homeowners insurance. Its also a good idea to factor in any other costs that commonly occur when you own a home. For example, if you currently live in an apartment without a yard, remember there may be additional upkeep costs for lawn care to factor in your budget.

Being realistic about your finances will help you figure out what home price range you should be searching in. We suggest you start budgeting for a couple of months as if you were already making these payments to get used to any changes compared to your current costs and see how comfortable you are financially. If you feel like money is a little tight, you may want to reevaluate what you can afford or make some adjustment to your budget.

We also recommend avoiding adding any extra debts or credit inquiries that come from making big purchases like a new car or applying for a new credit card while youre actively trying to buy a home. These can affect your credit score and limit your home buying budget.

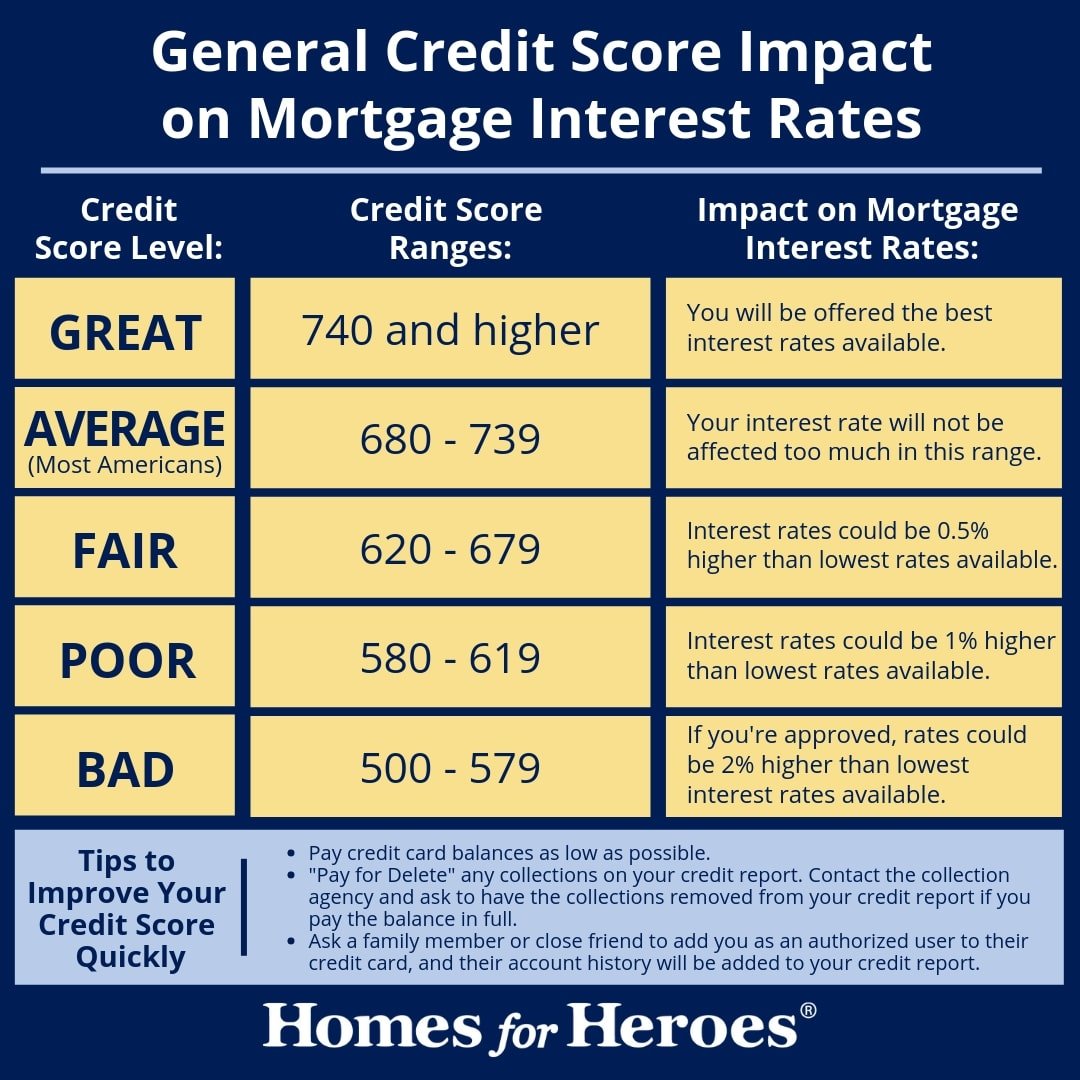

How To Improve Your Credit Score

So, its clear that a good credit score is one of the more important factors when trying to gain mortgage approval. Since its also a factor in calculating the interest rate youll be given, a favourable score can also save you thousands of dollars over the course of your amortization. Therefore, its best to get your credit score in the best shape you can manage before you apply with any lender. If your score is lower than 600-650, or you would simply like to improve it as much as possible, there are a few simple tricks you can use.

- Paying bills on time and in full

- Do not carry a large amount of unpaid debt

- Use no more than 30% of your available credit card limit

- Dont apply for too much new credit in a short amount of time

- Review a copy of your credit report for mistakes or signs of identity theft

- Consider a secured credit card if youre building from the ground up

Recommended Reading: How To Get Fico Credit Score

How To Boost Your Credit Score For A Home Loan

Heres what you can do to boost your credit score if homebuying plans are in your future. Even a few of these tweaks could have a big impact on your score.

- Clean up your credit card usage. Credit cards can be a friend or a foe, depending on how you use them. Try to follow these tips:

- Dont charge more than 30% of your credit limit

- Dont ever be late on your payments

- Remove yourself as an authorized user on credit accounts to avoid surprises caused by other users