How Can I Check My Credit Score

Its easy to review your credit scores, although you might have to pay a fee. Experian offered a free FICO score and credit report in June 2020, as well as a free credit report, if you created an account with the company. Equifax was charging $15.95 for a report and a score at that time, and TransUnion was offering unlimited score and report access plus credit monitoring for $24.95 per month.

You can view your each year under federal law, but credit bureaus arent required to provide free credit scores.

You might be able to get your credit scores from other sources as well:

- You can ask the lender about your score during the application process when you apply for a loan.

- VantageScore maintains a list of partner sites that sometimes offer free access to your score.

- You can purchase FICO credit scores on the FICO website.

Your credit score depends on the information in your credit report, so your report might actually be more important. Get your credit reports from each reporting agency, review the information, and fix any errors to be sure that your score accurately reflects your borrowing history.

How Credit Scoring Works

Credit scoring models may differ slightly in how they score credit. Fair Isaac Corporations credit scoring system, known as a FICO score, is the most widely used credit scoring system in the financial industry, employed by more than 90% of top lenders. However, another popular credit scoring model is VantageScore, which was created by the top three credit-reporting agencies: TransUnion, Experian, and Equifax.

A persons credit score is a number between 300 and 850, with 850 being the highest score possible. Credit scores for small businesses, such as the FICO Small Business Scoring Service , range from zero to 300.

An individuals credit score is influenced by five categories:

- Payment history

- Public filings

- Payment history and collections

- Number of accounts reporting and details

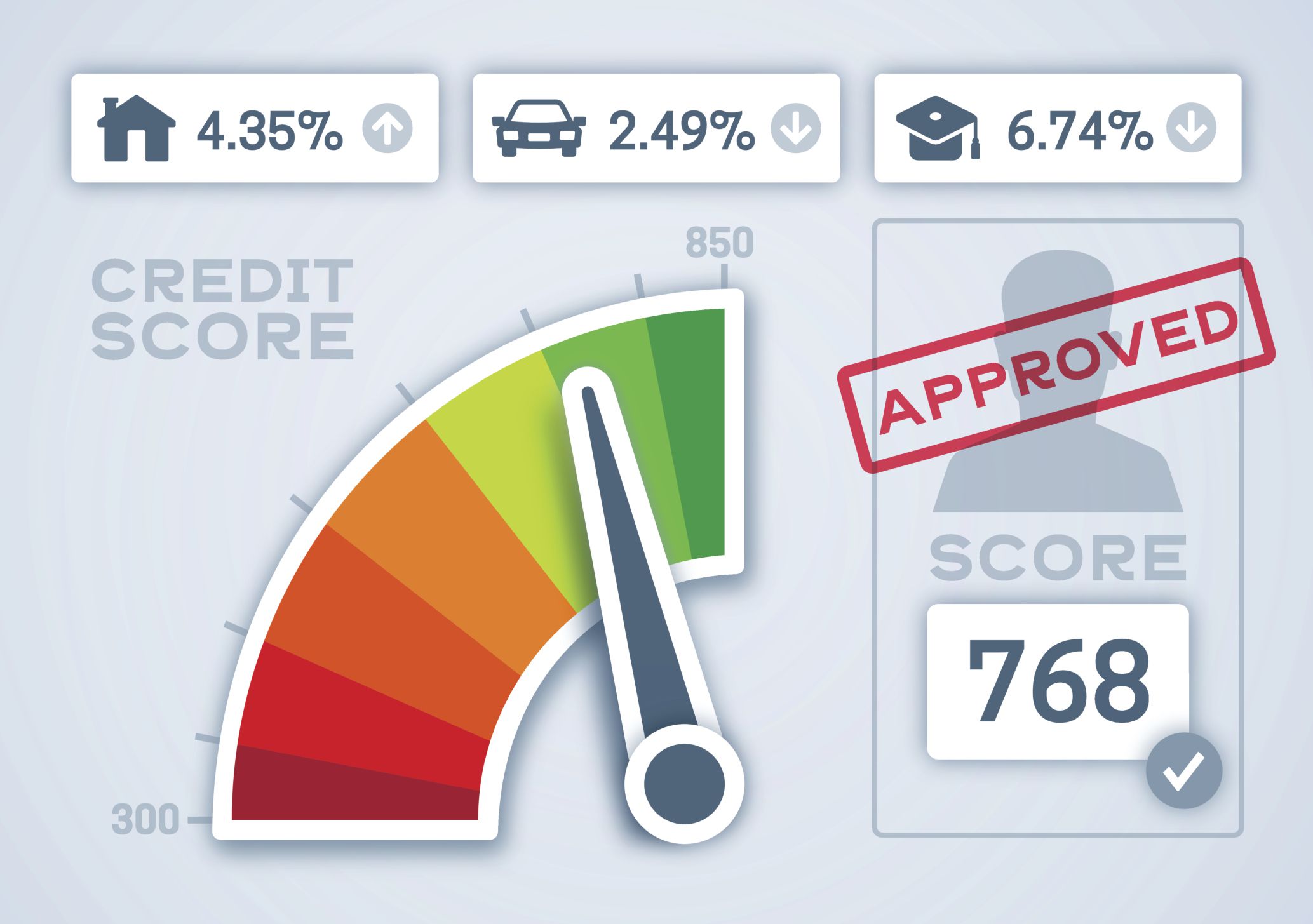

Lenders use credit scoring in risk-based pricing in which the terms of a loan, including the interest rate, offered to borrowers are based on the probability of repayment. In general, the higher the credit score, the better the rate offered by the financial institution.

The higher your credit score, the better your interest rate will be.

What Can I Do To Improve My Credit Score

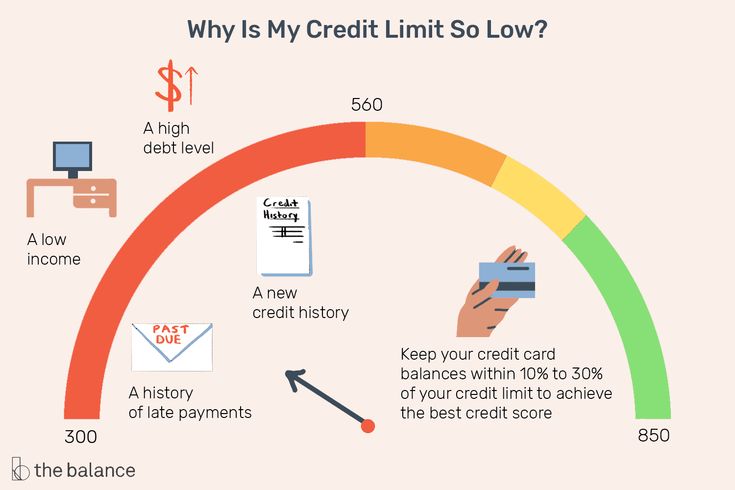

When you get your credit score, you might get information on how you can improve it. Improving your score a lot is likely to take some time, but it can be done. Under most scoring systems, focus on paying your bills in a timely way, paying down any outstanding balances, and staying away from new debt.

Recommended Reading: Does Opensky Report To Credit Bureaus

Ready To Learn More About Fico Scores

Head over to the myFICO Forums for in-depth, community-led discussions about FICO Scores. Ask questions and get answers from thousands of experts and others that have been through similar situations.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Understanding Who Becomes A Subprime Borrower

Lenders rely on to provide credit reports and credit scores on which to base their lending decisions. Credit scores are calculated using a variety of methodologies, and the higher the score, the better the person’s credit is assumed to be. The most widely used credit score is the FICO score.

Experian, one of the three major national credit bureaus, breaks credit scores into five tiers. The top three tiersknown as “exceptional,””very good,” and “good”are reserved for individuals with credit scores of 670 and up.

Subprime borrowers fall into the bottom two tiers, the “fair” and “very poor” categories. Fair credit involves scores ranging from 580 to 669 very poor credit is anything lower than 580.

Their low credit scores make it hard for subprime borrowers to obtain credit through traditional lenders. When they are able to obtain loans, subprime borrowers will generally receive less favorable terms, compared with borrowers who have good credit.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

How Hard Inquiries Affect Your Credit Score

A credit check triggered by an application is called a hard inquiry. You may have heard that hard inquiries can ding your credit score, and thats trueto an extent. If you apply for multiple new credit lines in a short period, you may be seen as a higher risk, and your score may take a slight hit temporarily.

How your score is affected by a hard inquiry depends on the type of loan that’s generating the inquiry. If its the kind that typically involves rate shoppingsay, a student loan, auto loan, or mortgageFICO and VantageScore will treat all inquiries for that same type of loan as a single inquiry. They will assume you were just looking for the best rate. If you apply for multiple credit cards in a short period of time, however, these hard inquiries will be considered separately, because you’re not looking for the single best lender.

FICO will consolidate all rate-shopping hard inquiries if they fall within a 45-day window. VantageScore uses a smaller time period: 14 days.

Hard inquiries have a much smaller impact on your credit score than other factors, such as the timeliness of your loan payments and your total debt burden. FICO considers hard inquiries from only the prior 12 months when determining your score, and says each hard inquiry should take off less than five points.

How Ficos Services Are Used To Assess Credit Risk

FICOs scoring algorithms are designed to predict consumer behavior. For example, when FICO gives a consumer a credit score of 600, which is considered subprime, it is predicting that the customer is likely to have trouble repaying a loan based on the data it has on that consumers past repayment activity. Many companies rely on FICOs products and services to reduce risk.

The FICO score is so widely used and there is so little competition in the credit scoring industry that if the company becomes unable to provide credit scores, or if its scoring method were found to be significantly flawed, then there could be negative effects throughout the economy. Most mortgage lenders, for example, use the FICO score, so any problem with FICO or its scoring model would have a major impact on the mortgage industry.

As consumer behavior and usage of credit change, there has been some debate on how new and future lenders might use FICOs services. For example, there has been some perception that recent generations are aiming to use credit cards less than older generations. Furthermore, there may be other types of financial indicators that lenders may use to assess potential borrowers.

Don’t Miss: Does Speedy Cash Report To Credit Bureaus

What Type Of Credit Card

Category: Credit 1. All the Different Types of Credit Cards Explained WalletHub Types of Credit Cards · General Consumer: What most people consider normal credit cards, general-consumer cards comprise the largest segment of Feb 2, 2021 · Uploaded by WalletHubTypes of Credit Cards by Feature · Types of Credit Cards

What Does My Credit Score Mean

Your credit score is a three-digit number that sums up all the information on your credit report into one tidy number. It follows you around for your entire life, its value moving up and down depending on whats happening in your financial life.

This three-digit score goes by two different names, FICO or VantageScore. The FICO score is named after the company who invented this three-digit scoring system in the mid-1980s, Fair Isaac, Inc. Many lenders use the FICO scoring system.

More recently, the three major credit reporting agencies created their own scoring system, called the VantageScore, designed to produce a more consistent score across all three credit reporting agencies.

So what does a score mean? Whats a good credit score? Or a bad one?

Don’t Miss: How To Check Itin Credit Score

What If Im Denied Credit Or Insurance Or Dont Get The Terms I Want

Under federal law, a creditors scoring system may not use certain characteristics for example, race, sex, marital status, national origin, or religion as factors when figuring out whether to give you credit. The law lets creditors use age, but any credit scoring system that includes age must give equal treatment to applicants who are older.

You have the right to:

Know whether your application was accepted or rejected within 30 days of filing a complete application.

Know why the creditor rejected your application. The creditor must

- tell you the specific reason for the rejection or

- that you are entitled to learn the reason if you ask within 60 days.

Learn the specific reason the lender offered you less favorable terms than you applied for, but only if you reject these terms. For example, if the lender offers you a smaller loan or a higher interest rate, and you dont accept the offer, you have the right to know why those terms were offered. Read to learn more.

If a business denies your application for credit or insurance because of information in your credit report, federal law says the business has to

- give you a notice that includes, among other things, the name, address, and phone number of the credit bureau that supplied the information.

- include your credit score in the notice if your credit score was a factor in the decision to deny you credit or to offer you terms less favorable than most other customers get.

If you get one of these notices:

If You Dont Have Credit But Are Looking To Build It

-

Become an authorized user on the account of a trusted family member or spouse who has a long, responsible credit history. By having your name attached to their line of credit, you can reap the benefits without worrying about the responsibility of payment.

-

If you cant get a credit card because you have limited or bad credit, try a secured card. These cards require an upfront deposit, and lenders can take that deposit back if you dont pay the balance in a timely manner. After youve established a history of paying on time, you can look into upgrading to an unsecured card.

-

Try a credit-builder loan, where lenders hold the money you pay in an account until the full amount is repaid, then release it back to you.

Don’t Miss: What Credit Score Does Carmax Use

How Does Credit Work

A bank loan is a common form of credit. The rate of interest you pay for a loan is based on how creditworthy you are. And for lenders, creditworthy is synonymous with trustworthy.

If you borrow money and pay it all back on time, lenders will view you as trustworthy. If you pay late or dont pay at all, however, you will be considered a credit risk. In a sense, credit is a way of measuring how trustworthy a person or company is.

Take your close family, for instance. Are you more likely to lend money to your sister Sally that has a track record of paying you back or your brother Joe that still hasnt paid you back from the last time he borrowed money? Because you have grown up with them and know them very well, you have an idea of how trustworthy they are.

Most lenders arent as familiar with your family as you are, so they have to rely on what they do know, which is your credit historya record of your outstanding debt, late payments, collections, bankruptcies, hard inquiries , previous addresses, employment history, and public records.

In the United States, lenders report your outstanding debt and repayment history to three independent credit bureaus: TransUnion, Experian, and Equifax. After these credit bureaus collect your information, they generate a personalized credit report and a three-digit credit score.

The most common credit score used by lenders, however, is your FICO Score.

How Do I Improve My Credit Score

The single most important thing you can do to improve your score is pay your bills on time, every month. Getting and keeping your paperwork organized can help you improve your credit score. By keeping your monthly bills in a To Pay folder with due dates highlighted and marked on your calendar, you become less likely to miss a payment, or even lose track of a bill because its hiding in a stack of unorganized papers.

Here is how FICO and VantageScore view your financial behavior and assign percentages to each behavior to determine your credit score. The higher the percentage, the more important that behavior becomes in determining your credit score.

As you can see, both FICO and VantageScore place a high importance on your payment historywhether or not you pay your bills on time, every month.

Read Also: How Do I Unlock My Credit

Why Dont I Have A Fico Or Vantagescore Credit Score

If you have a credit report but arent able to generate a score, the accounts on your credit report are too new. You might also be ineligible for a credit score if the information on your credit report isnt recent enough. This may happen to consumers who havent used credit in a long time or have opted to avoid credit altogether.

In either of these cases, you would likely see a notice of insufficient credit history instead of receiving an actual credit score.

Insider tip

Youre allowed one free copy of your from each of the three consumer credit bureaus a year . Its worth checking at least one before making any decisions that involve credit.

How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

Also Check: Is Creditwise Score Accurate

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Length/depth Of Credit History

How long youve been using loans and lines of credit is important to the predictiveness of a credit score. For example, a good credit score based on years of information has a better chance of accurately forecasting a borrowers risk than a good score based on a month or two of information. Years of positive information also make the occasional mistake less damaging.

Bear in mind, however, that its not when you first used credit that really matters. Rather, credit scores generally use the age of the oldest open account on your credit report or the average age of your open accounts.

This, along with the types of credit you use, makes up the Depth of Credit portion of a VantageScore.

You May Like: Does Paypal Credit Report To Credit Bureaus

Whats A Good Credit Score Or A Bad Credit Score

The question of who determines a good or bad score has all sorts of incorrect answers. Its not the credit bureaus, its not FICO, and its not VantageScore. None of these companies use credit scores to lend money.

Lenders use credit scores to help predict risk, and their opinions are the ones that matter most in the end. Every lender is going to have a slightly different definition of a bad, fair, good, and excellent credit score.

This is a breakdown currently used by FICO:

| No credit history | Limited/No Credit |

For basic FICO scores, good typically starts at 670 for VantageScore, good scores start at 700.

Scores below 670 arent necessarily bad, but theyre unlikely to score you the best available credit card deals. The best interest rates are reserved for consumers who have great credit history. So, even if youre approved for a card you may get better terms if you have better credit.

Excellent credit scores can lead to:

- Easier approval for loans

- No down payment on utilities

- And much more

If your scores are below 660, which is the generally recognized dividing line between prime and subprime, then youre in a position to either be denied credit or find yourself saddled with very high interest rates. If you have poor or no credit, consider using secured credit cards to help build up your credit history.

Why Are Fico Scores Important

FICO Scores help millions of people like you gain access to the credit they need to do things like get an education, buy a first home, or cover medical expenses. Even some insurance and utility companies will check FICO Scores when setting up the terms of the service.

The fact is, a good FICO Score can save you thousands of dollars in interest and fees as lenders are more likely to extend lower rates if you present less of a risk for them.

And overall, fair, quick, consistent and predictive scores help keep the cost of credit lower for the entire population as a whole. The more accessible credit is, the more lenders can loan and the more efficient they can be in their processes to drive costs down and pass savings on to the borrowers.

Recommended Reading: Syncb/ppc Account