How Long Does Bankruptcy Affect My Credit Report

There are two main credit reporting agencies in Ontario: Equifax and Trans Union. Information about your bankruptcy or consumer proposal is reported to these agencies by the Office of The Superintendent of Bankruptcy , not your trustee. The OSB will advise these agencies when you file a bankruptcy or proposal and when you receive your discharge.

If you file ANY of a bankruptcy, consumer proposal, debt management plan or do a debt settlement, a not will appear on your credit report that can negatively impact your credit. In general:

- a first bankruptcy will remain on your credit report for six years or seven years ;after you are discharged;

- a consumer proposal (or debt management or debt settlement plan will remain on your credit report for three years after all of your payments are completed.

Bankruptcy does not mean you cannot borrow for six or seven years. This just means that the note will remain on your report, however there are many other factors that affect your ability to get credit.

If you have a job, and if you have a down payment or security deposit, it is possible to repair your credit sooner. Many people are able to buy a car or a house in less than seven years after their bankruptcy ends, if they are able to save money and begin repairing their credit. Here are some ways you can improve your credit after filing for bankruptcy:

Pay For Delete Letter

Collection agencies and lenders may remove collection accounts if you negotiate with them. One tool is the pay for delete letter, which is a written request to have negative marks removed in exchange for your payment.

A collection agency is contracted to collect payment on a debt for the original creditor or lender. They receive a percentage of the amount collected. This means that in order for it to be an incentive, a pay for delete letter must offer an amount greater than the collection agency paid for your debt.

Your Pay for Delete letter should include relevant information such as:

- Dates

- Payment amounts

- Negotiation terms

Always make sure to receive the creditors agreement in writing first. If you want to learn more or are looking for a letter template to use, read about how to .

Not all creditors will accept Pay for Delete letters. Most banks and mainstream creditors are not open to negotiation, but small utility bills that go to collection might be more receptive to this strategy.

Removing Closed Accounts From Your Credit Report

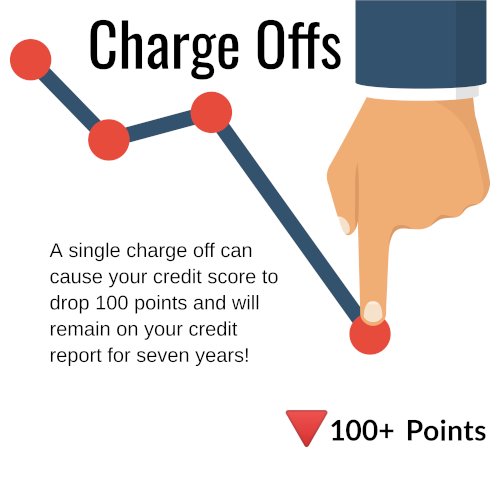

In some cases, a closed account can be harmful to your credit score. This is especially true if the account was closed with a delinquency, like a late payment or, worse, a charge-off.

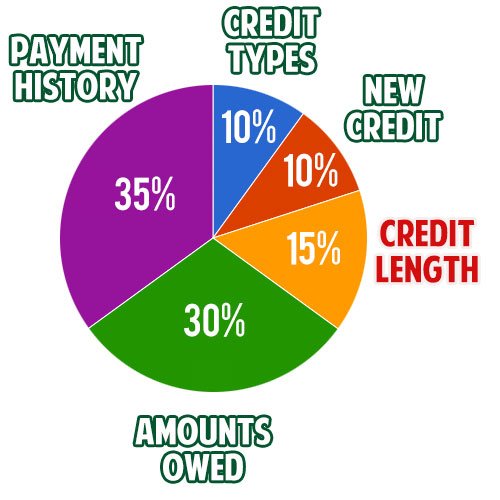

Payment history is 35% of your credit score, and any late payments can cause your credit score to drop, even if the payments were late after the account was closed.

Removing the account from your credit score could potentially lead to a credit score increase.

Removing a closed account from your credit report isn’t always easy, and is only possible in certain situations.

If the account on your credit report is actually open but incorrectly reported as closed, you can use the to have it listed as an open account. Providing proof of your account status will help your position.

Having a credit account reported as closed ;could be hurting your credit score, especially if the credit card has a balance. You can dispute any other inaccurate information regarding the closed account, like payments that were reported as late that were actually paid on time.

Read Also: How To Get Credit Report Without Social Security Number

Difference Between A Charge

Most people are familiar with debt collections, which is related to charge-offs, but is not the same thing. In short, debt collection happens after your account has already been charged-off.

Debt collections differ from charge-offs in that the original lender has sold the debt to a third-party agency to collect the debt from the borrower, says Annette Harris, founder of Harris Financial Coaching. When your debt gets sent to collections, it means the debt is no longer able to be settled with the original lender, she says.

When your debt is charged-off, its considered bad debt. Your lending company can sell your unpaid debt to a collection agency or a private debt collector to recoup the money they have lost on your loan.

Once your debt has been sent to collections, the agency will attempt to get the money back from you, just as your original lender did. The difference is, if you choose to ignore the debt collector, they can file a lawsuit and take you to court. If you still refuse to pay, the court can legally seize your assets, like your house or savings account, as a form of repayment.

Not only can debt collectors take legal action against you, but having your debt sent to collections can potentially ruin your credit. If you repay the debt after it goes to collections, the collections account, too, will remain on your credit report for seven years.

How To Remove Derogatory Items From Your Credit Report

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

*; ; ; ; ; *; ; ; ; ; *

Don’t Miss: Does Requesting A Credit Report Hurt Score

Negative Credit Report Entries That Impact Your Score The Most

Accurate items will stay on the credit report for a determined period. Fortunately, their impact will also diminish over time, even if they are still listed on the report. For example, a collection from a few years ago will bear less weight than a recently-reported collection. If no new negative items are added to the report, your credit score can still slowly improve.

How Long Do Late Payments Stay On Your Credit Report

Late payments remain on your credit reports for seven years from the original date of the delinquency. Even if you repay overdue bills, the late payment wont fall off your credit report until after seven years. And no matter how late your payment is, say 30 days versus 60 days, it will still take seven years to drop off.

Since payment history is the most important factor of your credit score, one late payment can make a big impact on your credit. However, the impact of a late payment lessens over time, especially if it’s only a one-time mistake and you counteract it with on-time payments. You have a 30-day window to repay a late bill before it appears on your credit report. Anything more than 30 days will likely cause a dip in your that can be as much as 180 points.

Here are more details on what to expect based on how late your payment is:

Late payments appear on your credit report under the account that you haven’t paid. So if you’re behind on a credit card, there will be a note in that section of your report saying you’re 30, 60, or 90 days late .

Also Check: How To Raise My Credit Score 100 Points

How Do Late Payments Affect Credit Scores

People have multiple credit scores, and everyoneâs situation is different. So itâs impossible to say exactly how a late payment will affect your credit. But payment history is an important scoring factor for two of the most popular scoring companies: FICO® and VantageScore®.;;

FICO says it uses three criteria to judge late payments: severity, frequency and recency. That means a few things when it comes to its credit scores:;

- A payment reported 30 days late could have less impact than one reported 60 days late and so on.

- Being late multiple times, including across multiple accounts, could have a bigger impact than a single delinquency.

- A late payment that happened more recently could have a bigger effect than one from years ago.

Not All Accounts Are Listed On Your Credit Report

In Canada, there are two credit reporting agencies TransUnion and Equifax. While consumers assume that both credit bureaus report identical information, thats not the case. Business arent required to report their information to these agencies, they do so on a voluntary basis.

Some banks and lenders will report to one reporting agency, some to the other, and many to both.

Because of this mismatch in reporting, you need to;request both of your credit reports;to get a full idea of all of your accounts being reported. Keep an eye out for errors, too you could have settled or paid off a debt only to find its still registering on your report as an account in arrears.

Also Check: How To Get Charge Offs Off Of Your Credit Report

How Does A Closed Account Affect Your Length Of Credit History

So as to your question a credit score uses an algorithm that has been proven to be able to predict future delinquencies. As a backward-looking model that predicts the future, it relies heavily on past performance as well as other current factors such as credit utilization and .

Lets talk about how closing a card account affects your length of credit history, which makes up 15% of your FICO credit score.

While your score will continue to include account history from all closed, as well as open, cards for as long as they remain on your credit report, the credit bureaus remove closed accounts in good standing after about 10 years and closed accounts with a history of late payments after seven years from the date of the delinquency.

Tip: Once an account no longer appears on your credit report, its the end of the line for that account having any impact, good or bad, on your score. But again, as long as you retain at least a few open and active cards well into the future, any such long-term effect on your length of credit history will be zero to minimal.

Why seven and 10? Because thats what the customers of the credit bureaus want to see when underwriting consumers. If lenders suddenly wanted to see 20 years of history, the bureaus would do their best to provide it .

See related: How long does it take to go from bad to good credit?

Paid Or Not Paid Collections

A common assumption people often make is assuming that paying off a collection will instantly remove collections from your credit bureau.

Its important to remember that a collection entry wont disappear from your credit bureau even if you settle it and pay it off.

That means when a lender, whether its a credit card company or the bank, sees a collection entry on your credit bureau, it will likely impact their decision of whether to lend to you or not.

Even if your credit account application is approved, your interest rate will likely be higher than someone without a collection entry on their credit report. That being said, its certainly worthwhile to take the necessary steps to get rid of a collection entry on your credit report.

When theres a collection entry on your credit report, chances are pretty good that there are some late payments associated with it. This is likely due to the fact that you were late on your payments.

There is often a separate entry for this debt, apart from the collection entry. There are steps you can take to remove the late payments from your credit report too.

Read Also: How To Remove Items From Credit Report After 7 Years

How To Know If Youve Received A Charge

Your lenders should notify you when they charge off your account.;

When one of your accounts gets listed as a charge-off, youll generally receive communication via mail from the creditor, says Tayne. You can also see the charge-off on your credit report.

But charge-offs arent sudden, and should not come as a surprise. Having a credit card charge-off means that your lender has attempted to reach out and settle your debt for at least six months.

If you see a charge-off on your credit report, you should contact your lending company immediately. You may be able to negotiate with the lender to have the charge-off removed from your credit report, assuming you can repay the debt promptly.

Re: Do Consumer Finance Accounts Ever Drop Off Your Credit Report

The relevant provision is FCRA 605, which requires that any adverse item of information not specifically mentioned in FCRA 605- most drop from your CR after 7 years from the date of the derog information.;

You dont go back to the creditor for CR deletion matters to to aging of a derog..; Responsibility for CR deletion resides solely with the CRA.; If it appears in your CR after 7 years from the date of reported delinquency, you contact the CRA for their ;violation of FCRA 605.

Recommended Reading: How To Get My Free Credit Score

Rebuilding After A Charge

If your accounts have been charged off, theres nothing else you can do except start rebuilding your credit. There are several ways that creditors report a charge-off depending on whether the debt is still outstanding , has been settled , or has been paid in full . Remember, you are still liable for this debt. It hasnt vanished because its charged off. Keep in mind, this will stay on your credit report for 7 years from the original delinquency date leading to the charge-off, so the best thing you can do is work hard to get it paid off.

Review Your Credit Report For Answers

If you’re wondering when a specific collection account will fall off your credit report, pull a copy to review. You can get a free one from AnnualCreditReport.com once a year. Review the history for the original account to check the date of delinquency and add seven years to that date. That’s about when you can expect the collection account to drop off.

You May Like: How To Help Credit Score

What Does Credit Card Charge

When a credit card account goes 180 days past due, the credit card company must close and;charge off;the account. This means the account is permanently closed and written off as a loss to the company, although the debt is still owed.

You could find that reaching out to your credit card company is helpful. Many creditors may be willing to work with you.

You May Like: How To Remove Items From Credit Report After 7 Years

How Long Does A Collection Entry Remain On Your Credit Bureau

Regardless of whether you paid the collection amount owing or not, the collection entry;will stay on your credit report;for seven years. As a result of this, for seven years, the collection entry will impact your chances of applying for new credit.

The unfortunate part is that even if they approve your credit, youre almost always going to pay a higher interest rate. As the collection entry gets older, it will affect your credit score less and less.

Recommended Reading: What Does Charged Off Account Mean On My Credit Report

How Long Do Collections Stay On Your Credit Report

If a creditors information regarding an accounts delinquency is valid, the collections record will exist for seven years starting on the date it is filed.

Heres how it typically works: When a creditor considers an account neglected, the account may be handed over to an internal collection department. Sometimes, however, the accounts debt is sold to an outside debt collection agency. This often happens when you are about six months behind on payments.

Around 180 days after the original due date of the payment, the creditor might sell the debt to a collections agency, says Sean Fox, president of Freedom Debt Relief. This step indicates that the creditor has decided to give up on getting payment on its own. Selling to the collections agency is a way to minimize the creditors loss.

At that point, you will start to hear from a debt collector, who now has the right to collect the payment. Depending on the type of debt you have, a variety of countermeasures exist on behalf of creditors to prevent major financial losses.

Unsecured debts, like credit card debt and personal loans, are generally sent to a collections agency, or can even be handled internally. If you fail to pay a secured debt, like an auto loan or a mortgage, foreclosure and repossession are the most common approaches for creditors to begin regaining losses.