Rick Bormin Personal Loans Moderator

Yes, Navy Federal Credit Union does allow cosigners on personal loans, which means that a second person can serve as a guarantor on the loan. Because the cosigner promises to pay the loan back if the primary applicant cannot, Navy Federal Credit Union takes the cosigners credit score and income into account during the application process. As a result, people who wouldnt normally qualify for a loan can apply with a cosigner who has a better credit score and income in order to boost their approval odds.

Does Paypal Offer One

PayPal may not offer buyers a comprehensive financing option, but several such providers should be considered. Affirm is an online lender that has something specific: it only offers financing directly through partner companies. You can apply for a loan when you pay online and repay it in 3, 6 or 12 months.

Navy Federal Offers Expert Pointers On How To Make Sure Your Next Car Purchase Is A Success

Last year brought unprecedented changes across nearly every industry, and automotive was no exception. In fact, the auto market continues to exceed expectations. Compared to March 2020, TrueCar estimates vehicle sales were up 42% in March 2021. So, if youre in the market to buy a car, youre in great company.

Navigating a new and ever-evolving automotive landscape can be tricky, but these four tips will help you be successful with your car-buying journey in 2021 and beyond.

Set a realistic budget

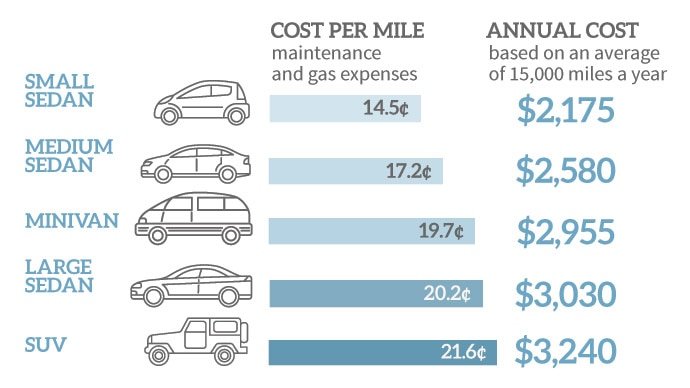

Before you start the process of financing and looking around for a car, you should understand your budget. That includes taking into account not just the sticker price of the car, but the total cost of owning a vehicle.

Make sure you can afford the monthly loan payment, in addition to other costs that come along with car ownership, personal property taxes, registration fees, insurance, fuel costs and maintenance, said Joe Pendergast, vice president of consumer lending at Navy Federal Credit Union.

Car affordability calculators can also help you figure out how much money you can reasonably allocate toward a vehicle each month. It may even be a good idea to open a separate savings account for your car. By automatically transferring money into this account on a consistent basis, youll be prepared to cover any unexpected future costs, too.

Get preapproved for an auto loan

Ultimately, a preapproval can make the overall process simpler and easier.

Research to find the best deal

Read Also: How To Report A Death To Credit Bureaus

Cons Of Navy Federal Auto Financing

- Membership required. Not everyone qualifies for membership with Navy Federal.

- Getting the check may not be instant. If you want your preapproval or your actual check in-hand before going to the dealership, you could get the check through the mail or by visiting a branch.

- Lack of branches. Navy Federal only has a few U.S. branches, so it might not be the best option if you prefer to do banking in person.

Pros Of Navy Federal Auto Financing

- Competitive rates. Navy Federal offers very competitive rates.

- Direct deposit discount. Active-duty and retired military members with direct deposit could get a 0.25% APR discount on a new auto loan as an additional amount off the advertised as low as APR.

- Refinance cash back. If you refinance your auto loan with Navy Federal, you could recieve $200 cash back after 65 days and once youve made your first scheduled payment.

- Many ways to apply. Navy Federal lets you apply for an auto loan three ways: by phone, online and in person.

- Overseas auto-buying program. Navy Federal offers an overseas auto-buying program. You could buy a car with Navy Federal whether youre on a boat or in a foriegn nation and have the car delivered to you stateside or overseas.

Read Also: How To Remove Repossession From Credit Report

Cons Of A Navy Federal Auto Loan

- Strict membership requirements: If you dont have a connection to the U.S. armed forces, you might not be eligible to join.

- Not instant: In a world of near-instant gratification on the internet, it seems odd that you have to go to a branch in person or wait to get your auto loan check in the mail. Other lenders will overnight a check to you or arrange for electronic delivery.

How To Get A Personal Loan With Bad Credit

- Clean your credit, reduce your debt. Before applying for a personal loan, get a copy of your credit report to see what the lender can see.

- Add a co-signer or warranty. A faster solution could be to select a lender that you can add a partner to.

- Create a depreciation plan. Choose a lender that reports your loan payments to the credit bureaus because it can help you get the loan, Ross says.

- Compare the lenders. By comparing offers from online lenders, banks and credit unions, you can find the best rate and features for your situation.

You May Like: What Time Does Speedy Cash Open

Is It Easy To Get A Loan With Bad Credit

It is very difficult to qualify for a bank loan if you have bad credit. However, alternative sources of personal loans are specifically designed for low-cost borrowers. The most effective way to obtain this type of loan is by using an online lender search service.

Navy federal digital investorHow to invest in the Federal Navy Financial Group?Choose from 5 ready-made theme packages or customize the packages to your own theme. Now invest 1 USD per or ETF. Just use your existing login Navy Federal digital bank details. Enjoy a fixed fee. How to contact a Navy Union Digitalis Investor?Contact one of their r

Navy Federal Credit Union Car Loans Q& A

Get answers to your questions about Navy Federal Credit Union Car Loans below. For more general questions, visit our Answers section.

We work hard to show you up-to-date product terms, however, this information does not originate from us and thus, we do not guarantee its accuracy. Actual terms may vary. Before submitting an application, always verify all terms and conditions with the offering institution. Please let us know if you notice any differences.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offerâs details page using the designation Sponsored, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Editorial and user-generated content on this page is not provided, commissioned, reviewed, approved or otherwise endorsed by any issuer.

You May Like: How To Print Out My Credit Report

Navy Federal Credit Union Full Review

Headquartered in Vienna, Virginia, Navy Federal Credit Union was founded in 1933 and now serves more than 10 million members with 344 branches worldwide. It received an above-average rating in J.D. Powers 2020 U.S. Primary Mortgage Origination Satisfaction Study and offers a full suite of banking services for its members, including mortgages, auto loans, checking and savings accounts, student loans, and more.

Some of Navy Federals home loans come with zero down payment, no private mortgage insurance, and benefits for service members and their families. But youll need to join the credit union before applying for a mortgage. To become a member, you or a family member will need to be associated with the armed forces, national guard, or the Department of Defense. If youre eligible, heres what to know about the lender.

Is It Possible To Get A Loan With No Credit

Fortunately, there are ways to get a loan without a loan. It is possible, and while it may require work, the benefits go far beyond authorization. Some loans that do not require a loan offer even more options. However, some of these types of loans have a lot of paperwork and therefore require collateral.

Recommended Reading: Unlock Credit Experian

Where Navy Federal Stands Out

Wide range of loan amounts: Borrowers can choose loan amounts from $250 to $50,000 when applying for a personal loan at Navy Federal. This is an especially wide range among lenders and could make the loan a fit for a small expense like an emergency repair or something larger like a home improvement project.

Term availability: For most loans, repayment terms range from one to five years, but borrowers funding a home improvement project have more choices. With a $25,000 minimum loan amount, you could qualify for a term from five to seven years, and with a $30,000 minimum, you could qualify for a term up to 15 years.

» MORE:Best home improvement loans

Co-signed, joint and secured loans: Members can add a co-signer or co-borrower to their application. Adding someone with better credit or higher income can help your chances of getting a lower rate or a higher loan amount. Co-signers will not have access to the funds but are responsible for any missed payments.

Borrowers can also secure their loan with a Navy Federal savings account or CD, which could help you qualify for an especially competitive rate. Depending on the account you choose, your APR would be your share rate or certificate rate, plus 2% to 3%.

| N/A |

Long auto loans

Re: Navy Federal Auto Loan

UPDATE

Ok so Navy Federal countered my request for the $12000 loan with a maximum loan amt of $7800. Fortunately I was still able to recieve the car I wanted by putting more $ down, about $8000. What I dont understand is that now that I have given NFCU the vin year/make/model the loan still has to be approved again!!? I dont get it? Why would they call to tell me I could borrow up to $7800 if now they must review the request again? Either way, they let me drive home in the car, the dealership seems to think its just a formality, and that I will be given the green light in a few days. i hope so Pretty stoked.

UPDATE

Ok so Navy Federal countered my request for the $12000 loan with a maximum loan amt of $7800. Fortunately I was still able to recieve the car I wanted by putting more $ down, about $8000. What I dont understand is that now that I have given NFCU the vin year/make/model the loan still has to be approved again!!? I dont get it? Why would they call to tell me I could borrow up to $7800 if now they must review the request again? Either way, they let me drive home in the car, the dealership seems to think its just a formality, and that I will be given the green light in a few days. i hope so Pretty stoked.

Congratulations!

In the end, you’ll be glad you made a large down payment. So many of the folks on these forums are upside down on their cars. Way to go…

Read Also: Does Paypal Credit Report To Credit Bureaus

Is A Credit Union Loan A Good Option

If you are looking for an alternative to a bank loan for individuals, a loan from a credit union is a good option. Credit unions are not-for-profit financial institutions that aim to help their members save money through low-interest loans. You are also more likely to get approval from the credit union for a personal loan.

How Do Auto Loans Work From Credit Unions

Most credit unions that offer auto loans require loan applicants to have at least one stable career with the company they work for. By definition, this means that you have worked for a certain company for at least 12 months. Credit unions with gross monthly income are also exploring the possibility of hiring a loan applicant.

Don’t Miss: Does Barclaycard Report To Credit Bureaus

Review: Navy Federal Credit Union Auto Loan

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

Are you shopping around for your best auto loan rates before you buy a car? If not, you should be.

It helps to get an idea of the type of loan you could be approved for before you make a trip to the dealership. Plus, credit unions like Navy Federal Credit Union may offer some of the best rates compared to traditional banks. Navy Federal auto loan rates range from 1.79% to 17.99% for those eligible for membership, including active-duty military members, veterans, retirees and their families.

What Credit Score Do You Need For Navy Federal Mortgage

620 or betterMinimum borrower requirements Navy Federal Credit Union generally follows Fannie Maes underwriting guidelines for conventional mortgages. That means youll typically need a credit score of 620 or better, a down payment of at least 5 percent and a debt-to-income ratio of no more than 43 percent.

Don’t Miss: When Does Usaa Report To Credit Bureaus

Applying For A Loan W/ Navy Federal Credit Union

Whether you’re applying for an auto, mortgage, or personal loan, Navy Federal Credit Union has extremely competitive rates. The problem? You need great credit to get those loan terms . Your first step to determine if you’re eligible for top-tier rates is to pull your Credit Report.

You can review your Credit Report and find every inaccurate , or contact a Credit Repair company, like Credit Glory, to walk you through that entire process.

You can schedule a free consultation with Credit Glory, or call one of their Credit Specialists, here 412-6805″ rel=”nofollow”> 412-6805 â).

Do Credit Unions Give Loans

Few banks offer these types of loans, but credit unions often do. If you have a secured loan, you usually have to make a deposit in the form of savings or a certificate of deposit as collateral. The cash deposit is usually 100% of the loan amount, but can be less depending on the credit union and loan type.

Credit score for personal loanHow high does your credit score need to be for a personal loan? Look for a peer-to-peer loan if you don’t have a minimum credit rating for personal loan products. Here other people lend money to people like you. This is a type of personal loan and you need a credit score of 640 or higher to qualify.What credit score do I need to get a personal loan?There are many types

Also Check: How To Get Credit Report Without Social Security Number

What Does That Mean For You

In general, it means that although different lenders use different measures, people with exceptional credit scores may qualify for the lowest rates, while people with lower credit scores will often qualify only for loans with higher rates.

High Credit Score Low Interest Rate Lower Credit Score Higher Interest Rate

What Credit Score Do You Need To Buy A Car

Your credit score influences your auto loans interest rate and total cost. Learn how you can lower the rate for your next car.

Posted May. 25, 2021

For many of us, owning a car is more than getting where we need to go. Its also about relaxing on the open road, listening to our favorite tunes and seeing the sights. Maybe youve already started looking at ads and reviews and figuring out what you can afford. But, is there more you should know besides features and sticker price?

Read Also: Does Getting Married Affect Your Credit Score

Do Credit Unions Check Your Credit Score

Some banks or credit unions may see your credit report when you open a new account. They generally do a “soft check”, that is, they verify your creditworthiness, but this does not affect your creditworthiness. Some banks may conduct “forced demonstrations” or “serious investigations,” although lenders typically only use these when applying for a loan or loan.

How To Apply For A Navy Federal Credit Union Personal Loan

Applying for a personal loan typically involves prequalifying for a rate, submitting a formal application and awaiting loan approval. Follow these steps to apply for an NFCU personal loan:

Don’t Miss: What Is Syncb Ntwk On Credit Report

What Are The Top 10 Credit Unions

- Personnel fund 254

- Federal Marine Credit Union 231

- Federal Credit Union of America First 110

- Mountain America Federal Credit Union 82

- Federal Security Credit Union 72

- US Federal Credit Union, Alaska 70

- Suncoast Credit Union 58

- Space Coast Loan Association 56

- Members of the 1st Federal Credit Union 52

- Teacher’s pool 51