Do Rent Payments Affect Credit

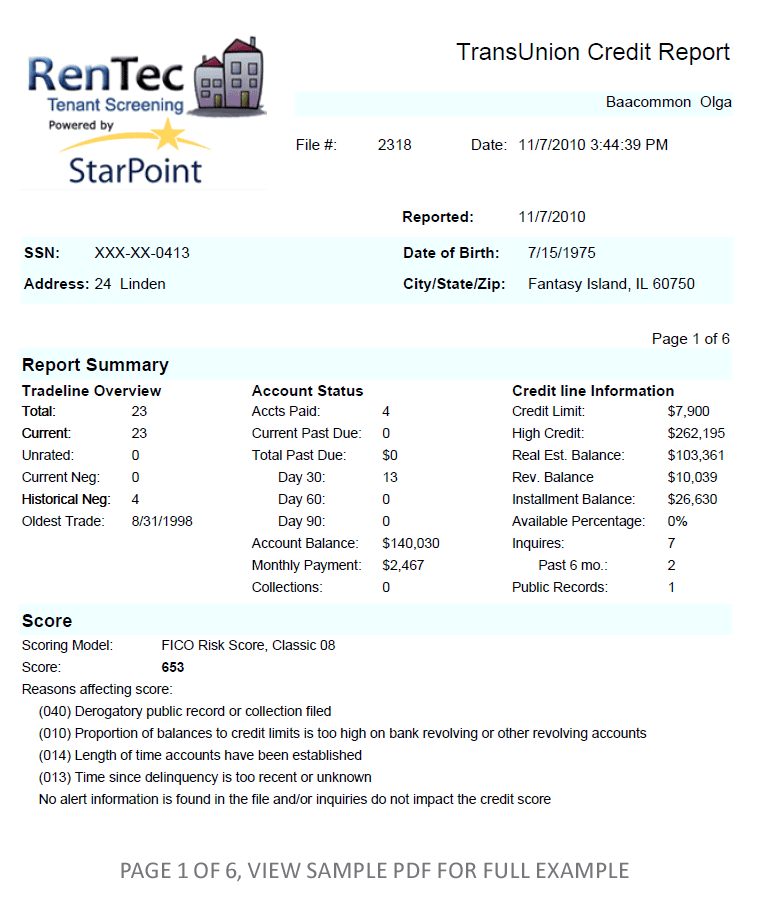

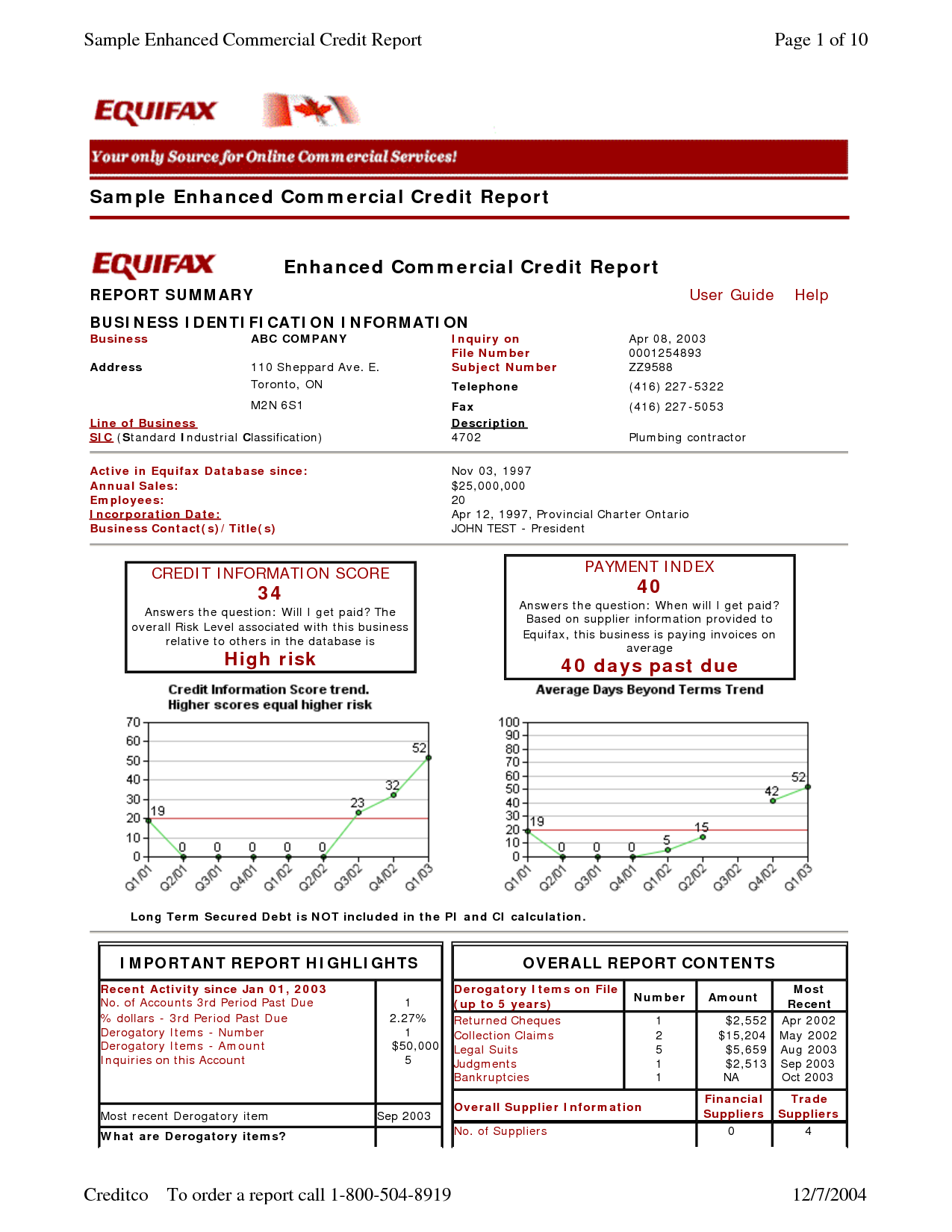

All three major credit bureaus Equifax, Experian and TransUnion will include rent payment information in credit reports if they receive it.

-

The most commonly used versions of the FICO score dont use rental payment information in calculating scores.

-

Newer versions of FICO, such as the FICO 9 and FICO 10, do consider rental information if it is in your credit report.

-

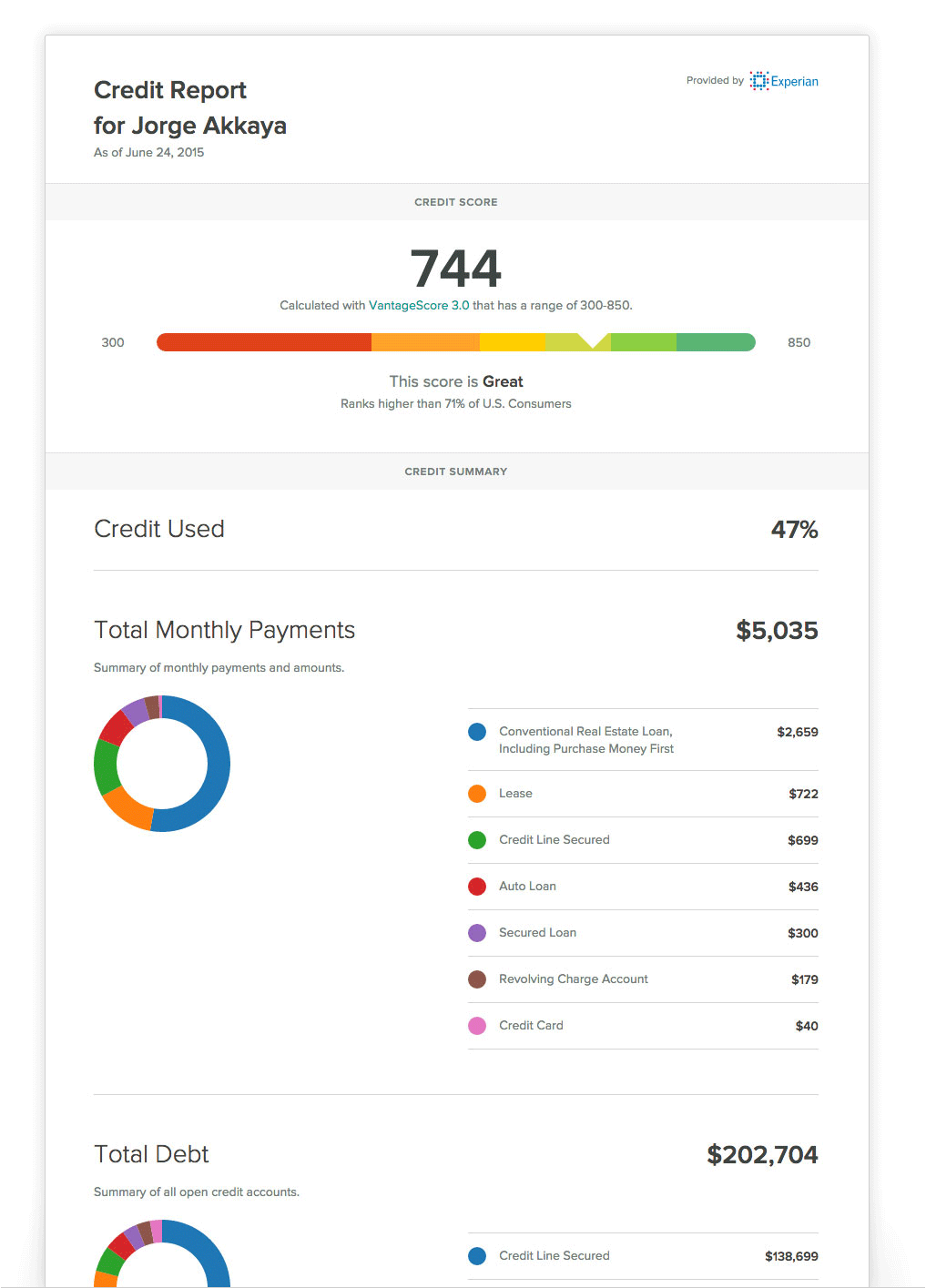

VantageScore, FICOs competitor, also considers rent payment information. .

Do Rent Payments Show Up On Your Credit Report

Usually, no. This is particularly frustrating because mortgage payments do show up on credit reports. This felt very unfair for many years to renters, who are often working to build up their credit to one day get a mortgage. Luckily, the credit bureaus recognized this gap and came up with rent-reporting services.

Rent-reporting services fall under the alternative credit data category. Alternative credit data refers to data thats not typically collected by traditional credit reports. Individuals with poor or thin credit reports might turn to alternative credit data, such as rent reporting, to boost their credit.

However, it should be noted that only some versions of credit scoring systems take rent payments into account once theyre on a credit report. All three major credit bureaus will accept rent payment data if they receive it.

From there, the credit bureaus send the credit report data to credit scoring systems, which take that data and assign a credit score.

The two major credit scoring companiesFICO and VantageScoreapproach rental payment data differently. For example:

- Most versions of the FICO score dont consider rental payment data when calculating credit scores.

- The newer versions of the FICO score, FICO 9 and FICO 10, do consider rental data thats included in your credit report.

- VantageScore considers rental payment data for credit scores.

How To Start Reporting Rent Payments On Credit Report

You can improve your credit score up to 26 points over 12 months when you report your monthly, on-time rent payments to the TransUnion credit bureau.

You May Like: Why Is There Aargon Agency On My Credit Report

What Happens If You Break Rent

If your item stops working and requires off-site repair, Rent-A-Center will provide a comparable loaner at no additional charge while we fix the original item. Sometimes products break from a manufacturing defect. If that happens, and youre up-to-date on your payments, well fix or replace the item right away.

Why Is It So Hard To Buy A House

Limited inventory makes it harder for buyers to find adequate homes, said Lee. This means a lot of people have to compromise. Buyers are pulling from retirement funds, selling off stocks and bonds, or asking for gifts from family to get a chance to buy, said Lee. Some are even offering full cash payments on homes.

Recommended Reading: How To Check Credit Score Without Social Security Number

How Is A Lease Different Than A Credit Transaction Financing Or A Loan

Progressive Leasings lease-to-own option is not credit. With a credit transaction, financing or a loan, you make a purchase with borrowed money that must be repaid, often with interest. With a lease-to-own agreement with Progressive Leasing, we purchase the items you select from the retailer. Then, you sign a lease-to-own agreement to lease that merchandise from Progressive. Progressive owns the merchandise, and you can take ownership after making all standard lease payments or through an early purchase option.

Standard agreement offers 12 months to ownership. Early purchase options cost more than the retailers cash price . To purchase early call 877-898-1970.

How To Get The New Acima Leasepay Card

Customers can now pre-register now for the new Acima LeasePay card.

Starting this summer, consumers will be able to use the Acima LeasePay card at participating merchants across Acima’s mobile app, marketplace and web browser extension.

While Acima says that customers don’t need to have a good credit score in order to be approved for a lease, the website states that eligibility requirements include a 3-month income history, monthly income of $1,000 or more and a checking account for at least 90 days in positive standing . Consider applying if you have low or no credit but a source of income.

There is also a welcome offer for consumers: Get instant approval for a lease transaction by applying through the mobile app and, if eligible, receive access to up to $4,000 through the Acima LeasePay card. This $4,000 limit can be used to complete lease transactions at participating Acima merchants for any qualified goods in the U.S.

Once approved, customers can instantly access their Acima LeasePay card directly through the mobile app so lease transactions are quicker than ever. While there is only the virtual card option at the moment, Acima plans to issue a physical payments card in the future.

The Acima LeasePay card is currently not available in MN, NJ, WI or WY.

Also Check: When Do Companies Report To Credit Bureaus

Which Credit Scores Do On

While VantageScore®3.0 and 4.0 and FICO® Score 9 use rental payments in their evaluation of a borrower’s credit history when generating their most widely available credit score, they also provide lenders different types of scores. For example, if you are looking for an auto loan, FICO® Scores will use the factors of your credit history that typically suggest that you can fully repay an auto loan: and rent may not be one of those factors.

Likewise, those requesting the credit scores pay to receive your credit score as they evaluate your application. But they may not be requesting VantageScore® 3.0/4.0 or FICO® 9: so even if you are enrolled with a rent-reporting service, the requester won’t see rental payments on your credit report, minimizing the benefit of your reported rental payments.

Will I Receive A Monthly Billing Statement

No, but you will receive a letter welcoming you to Progressive Leasing with basic information about your lease to-own agreement, including your payment amount and frequency, 12-month lease-to-own total and early purchase options. Your account can also be accessed online 24 hours a day 7 days a week at: .

Standard agreement offers 12 months to ownership. Early purchase options cost more than the retailers cash price . To purchase early call 877-898-1970.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How To Report Your Rent To Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A lot of people who dont have much of a credit history do have a history of paying rent on time. But that information doesn’t show up on their credit reports, and doesn’t help their .

You cant report rent payments yourself. But rent-reporting services can get your credit reports to reflect your rent payments fairly easily, at a cost that ranges from free if your landlord pays it to more than $100 a year.

To use a rent-reporting service effectively, youll need to know which credit bureaus it will report your payments to and which credit scores take those payments into account.

It’s also important to understand that this may not be the most cost-effective way for you to build your credit with all three credit bureaus and to understand your alternatives.

Yes: Enrolled With Rent

When you are looking at VantageScore® 3.0/4.0 or FICO® 9 and you are enrolled in a rent-reporting service, your on-time rent payments could increase your credit score with each on-time rental payment . Keep in mind that your credit utilization ratio may be impacted by using a rent-reporting service, but these affects may be minimal, depending on your recent history. Typically, credit scores look at the past two years of credit history, so you can build up two years of positive payments through a rent-reporting service that can contribute to your growing credit score.

Also Check: How To Remove Hard Inquiries Off Credit Report

Use A Rent Reporting Service

There are several companies that will report rent payments on your behalf. Monthly fees vary between services, and some charge an initial enrollment fee to get started. In some cases, your landlord may have to verify your rent payments for them to be included in your credit report. Note that even when rent payments are included in your credit report, they may not be included in your credit score calculation.

How To Report Rent Payments To The Credit Bureaus

Reporting your rent payments to a credit bureau is fairly simple. You can either have your landlord manually report your rent for you, or you can do it yourself using a rent reporting platform like *. Most renters prefer to report their rent payments to a credit bureau themselves since they have more control over the process. But its important to note that your landlord will need to set up an account in order for you to take advantage of this tool.

helps you contribute to your FICO 9, FICO XD, and VantageScore by reporting your on-time rent payments. Your payments go directly to TransUnion, one of the three major credit bureaus, to make it easier to build your credit health.

Heres how to start reporting your on-time rent using CreditBoost: :

Create an account or log in to your tenant dashboard today to get the process started.

Don’t Miss: How To Get Credit Report With Itin Number

What Are Rent Reporting Services

There are rent reporting companies that will report your rent payments to the credit bureaus on your behalf. Most rent reporting services charge a fee, but there are free options available. Note that your landlord will likely have to verify your rent to the rent reporting service before reporting can occur.

Some of the most popular rent reporting services are:

- Rental Kharma: Rental Kharma will add up to six months of your previous rental payments to your credit report. Theres a $50 one-time start-up fee and an ongoing monthly fee of $8.95. You dont sign a contract, and you can cancel at any time.

- CreditMyRent starts with reporting one previous rental payment and then each additional months rental payment moving forward. Theres no start-up fee, and the monthly cost is $14.95. There are more expensive packages available if you want to include more months of previous rent.

- Rock the Score: Rock the Score requires a one-time setup fee of $48 and then charges $6.95 per month for monthly reporting of rent payments. Individuals can choose to pay $65 for up to two years of previous rental payments to be reported.

- Level Credit: Level Credit offers rent reporting services for as little as $6.95 a month. Individuals can pay a one-time fee to include reporting on the past two years of rental payments.

- Esusu: Esusu is free for tenants who have a landlord using the platform. Otherwise, customers can pay $50 for annual rent reporting.

Are Returns Allowed

To return your item, contact Progressive Leasing customer service at 898-1970. Progressive will evaluate the product to determine the proper course of action. The item could be returned through the retailer you select or sent directly to Progressive. You can cancel your lease at any time. You have the right to return the items to Progressive Leasing without additional charge or penalty, and you will owe nothing further except unpaid lease-to-own costs. To cancel your lease call us at 898-1970.

Don’t Miss: Does Les Schwab Report To Credit Bureaus

Is It Smart To Rent

When it comes to rent-to-own homes, the cons outweigh the pros. If you want to make a smart decision for your future, its simple: Avoid a rent-to-own situation, even if it means you have to wait to move. Trust usits worth it to buy a house the smart way. If you need time to clean up your finances, thats okay.

What Are Your Thoughts On Leasing Furniture

When I got my first apartment in college and looked at my empty living room, I felt bad. I caved and financed furniture but looking back, I wasnt going to die or be scarred for life had I went a few months without that stuff and saved up. Have you ever done business with Rent a Center or a similar store?

Read Also: What Credit Score Does Carmax Use

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Types Of Payments Can I Report To Credit Bureaus

Although you cannot self-report traditional credit account information to the credit reporting companies, there are types of payments you can request to have added to your Experian credit history:

- Rental payments: If you rent a home or apartment, your landlord or property management company can report your on-time rental payments to your Experian credit report through Experian RentBureau. You can also choose to enroll in a third-party rent payment service that will report your payments at your request. Having positive rent payments reported to Experian can be especially helpful for people who are trying to establish their credit history for the first time or who are trying to rebuild after credit difficulties.

- Cellphone, utility and streaming service payments: By signing up with Experian Boost, you can add your positive cellphone, utility and streaming service payments to your Experian credit report going back up to 24 months. Adding this payment information can instantly boost your Experian credit score.

Also Check: Do Lending Club Loans Go On Your Credit Report

Can I Build My Credit History With Rentredi

Yes! When you start reporting rent to the TransUnion credit bureau, you choose to use all on-time rent payments youve made through RentRedi to help build your credit score.

You will be able to report all your rent payments made through RentRedi as long as you are a tenant using RentRedi.

If youre interested in getting started with reporting your rent payments to boost your credit score, get started by downloading the RentRedi tenant app!

How Credit Scores Are Calculated

There’s a general credit formula that the bureaus use when calculating your score. These include:

- Payment history is 35 percent.

- Pro tip: Pay your bills on time.

- Pro tip: Lenders look at how long you’ve had credit, so even if you’re not using your old credit cards from back in the day, don’t close them because it’ll hurt your credit history.

- Pro tip: Try to keep your utilization below 10 percent.

- New credit is 10 percent.

- Pro tip: Don’t open too many credit cards at once because it dings your score.

- Type of credit is 10 percent.

- Pro tip: Having a mix” of different types of credit is looked upon favorably. For instance, you have a few credit cards and a car loan.

Read Also: Experian Boost Paypal

Should I Report Rent Payments To Credit Bureau

rent paymentsreportspaymentsrent payments reported

Reported rent can help or hurt youAll three bureaus will list any reported rent payments on your reports. While you can guarantee that reported rent will show up on your report, it may not always affect your .

how do I report a payment to the credit bureau? You can’t directly add things to your , even if they’re bills you actually pay each month. Instead, you must depend on your creditors and lenders to send updates to the based on your account history. There are three major in the U.S.: Equifax, Experian, and TransUnion.

Just so, when can Landlord report to credit?

Large Landlords Can Report DirectlyThe three major , Experian, Equifax and TransUnion, allow high-volume landlords to report their rental payments directly to the each month. However, you need to generate a high number of payment records to begin reporting.

Does rent a center report to credit bureaus?

No. Rent-A-Center does not report your information to the three main , Equifax, Experian, and TransUnion. After all, you’re not shopping with when you come to Rent-A-Center. A rent–to-own agreement is more like a lease, not a loan, and doesn’t accrue interest.