Average Age By Credit Score Tier

| West | 687 |

The South has the worst credit, on average , whereas the Midwest has the best . In fact, three of the five states with the highest average credit scores are in the Midwest. With that being said, every region has at least one state whose residents boast good credit, on average.

So, while job opportunities, living costs and other local factors definitely affect credit-score averages, its also true that credit scores can flourish anywhere.

What Is Considered As A Poor Credit Score

According to Capital One, a FICO score that falls below 580 is considered to be a poor credit score. Lower credit scores can make it difficult to get approved for credit cards or loans as approximately 61 percent of those with low credit scores fall behind on their loans11.

Come up with a credit card debt or loan repayment plan to reduce debt and credit utilization, look for accounts that build credit, and find other ways like Experian Boost to improve your score if you have negative items contributing to your bad credit.

Experian also offers free credit score checks to help you stay on top of your score and payment history. Your credit card balance doesnt have to stop you from moving forward financially.

What Factors Influence Your Credit Score

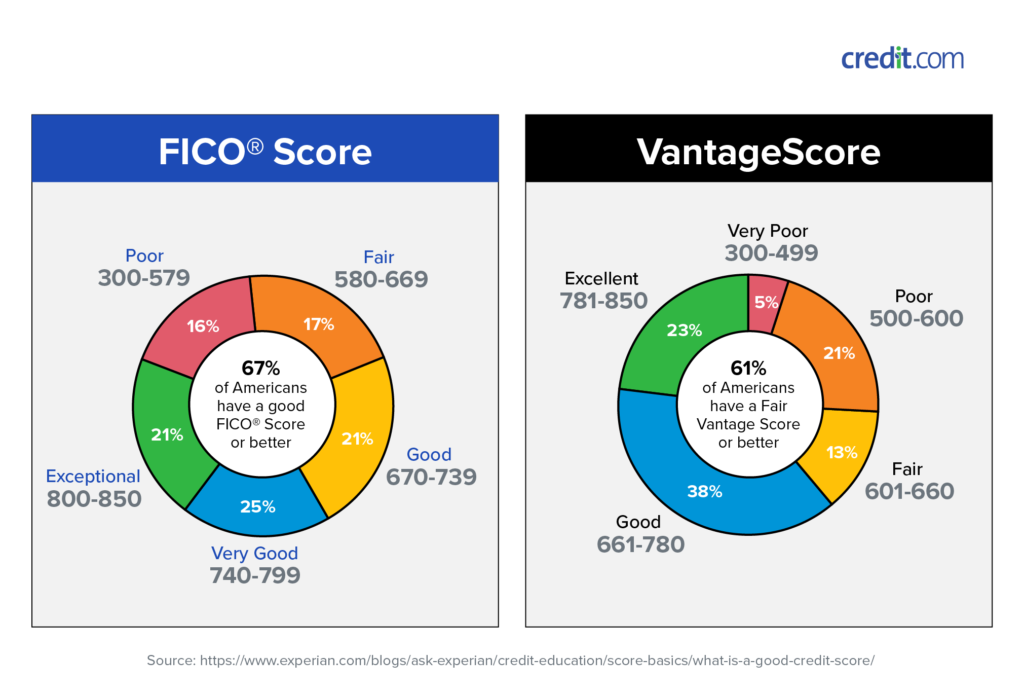

are calculated differently depending on the credit scoring model used. Here are the key factors FICO and VantageScore consider.

FICO Score

VantageScore

Recommended Reading: What Credit Score Does Carmax Use

Keep Your Credit Score In Tip

Should you stress if your credit score doesn’t hit the 800 range? Absolutely not. Many borrowers can get loans and adequate interest rates when in the lower credit ranges.

However, you may want to consider boosting your credit if you fall into the “poor” or “fair” categories to make sure you get the absolute best credit offers possible when you want to buy a car, buy a home or utilize credit in other ways.

If You Think The Uptick In Average Fico Score Is Coming From The Prime Lower Risk/higher Scoring Segments Guess Again

The upwards trend in the average FICO Score is actually most pronounced in the lower score ranges. For example, for those consumers who had a FICO Score value between 550-599 as of January 2020 , their average score has gone up from 581 as of April 2020 to 601 as of April 2021. In contrast, those consumers who had a FICO Score value between 750-799 as of January 2020 have seen virtually no movement in their average score between April 2020 and today.

Figure 2. Average FICO® Score During COVID-19 Has Increased More for Lower Scoring Population

Though it might sound obvious, the drivers of the continued improvement in the average FICO® Score are continued improvements in key metrics considered by the score: fewer missed payments, lower consumer debt levels, and reduced credit seeking behavior. Lets dive into each of these in a bit more depth:

Figure 3. FICO Scorable Population Shows Significant Improvement in Key Credit Metrics During the Pandemic

You May Like: Does Carmax Accept Bad Credit

How Are Average Credit Scores Increasing

Perhaps the most surprising finding from the report is that average credit scores have actually increased over the last year, despite financial troubles caused by the pandemic.

While the pandemic has created serious financial challenges for many, were seeing promising signs in terms of how consumers are managing their credit histories, Griffin said. In fact, Experian has seen a trend of slowly but steadily increasing credit scores over the last decade. Unlike the onset of the recession in 2008, when people were overleveraged and the economy was declining, people were generally in a stronger financial situation when the COVID-19 response forced the economy to a standstill.

Griffin noted that government assistance programs also appeared to help people further reduce credit card balances and maintain payments on other debts, putting some people in a better position to weather this chaotic situation.

However, it may be that credit scores are a lagging indicator. Its likely that the financial repercussions of the pandemic havent been fully realized. We may see that in 2021, the upward trend reverses if government assistance and stimulus programs run dry and more Americans rely on debt to survive.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Does Paypal Credit Report To The Credit Bureau

How Your Credit Score Affects Your Credit Card Interest Rates

Cut from the same cloth, a stable and reliable credit score will also benefit you when it comes to credit card applications. As an unsecured form of borrowing, lenders are wary of extending large credit limits to high-risk borrowers.

As such, maintaining a respectable score will not only lower your annual interest rate â but also allow you to qualify for options with higher minimum balances, lower annual fees, and greater rewards as well.

What Is The Average Credit Score In America

The average credit score in the U.S. is at an all-time high of 711. This coincides with what the Consumer Financial Protection Bureau defines as “prime.”

About 1 in 5 American adults either have no credit history or are unscorable. As a result, these individuals will have difficulty obtaining new lines of credit.

In the eyes of lenders, credit scores fall into several buckets, which indicate how risky it may be to extend credit to an individual. Outside of playing a role in approvals for a loan or credit, these scores can also impact an individual’s lending terms. Perhaps the most important terms among those are interest rates.

The higher an individual’s credit score, the lower their quoted APR will typically be.

FICO credit scores break down in the following manner:

- 800 to 850: Exceptional

- 300 to 579: Very poor

This means the average credit score of 711 is in the good range.

Though the average credit score has generally improved since 2005, slight dips were seen around the Great Recession that ended in 2009. A large number of people declaring bankruptcy or defaulting on their loans would have caused their credit scores to plummet, which in turn would have affected the overall average.

You May Like: Does Paypal Credit Report To Credit Bureaus

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

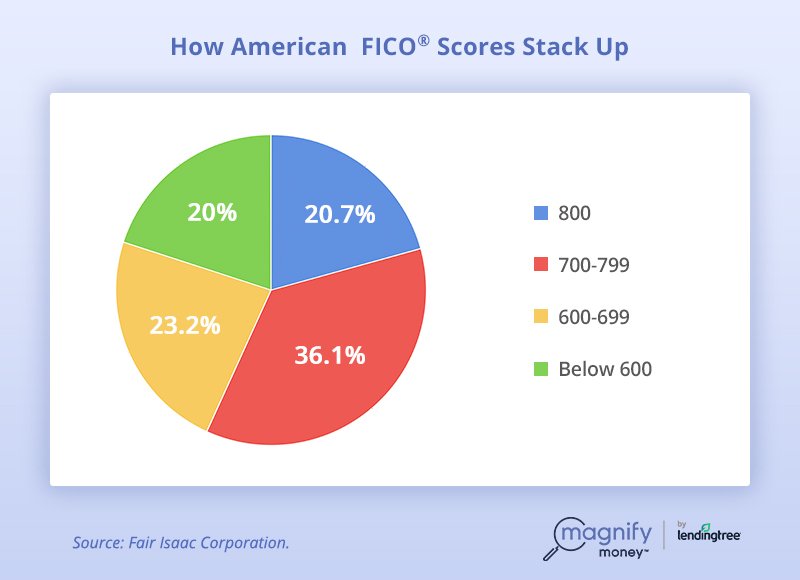

What Percentage Of The Population Has A Credit Score Over 800

In April 2018, about 21% of the population had a credit score between 800-850, which represents the higher echelons of credit score possibilities.

However, that doesn’t mean that most Americans don’t fall into those “upper ranges.” In fact, by 2020, 69% of Americans had a “good” credit score at 670 or above. Americans have worked to get their credit into a better position than last year and even increased their scores three percentage points compared to last year.

How’d they do it? reduced by 14% last year and credit utilization also dropped 3.5%, to 25.3% in 2020.

You May Like: Does Paypal Credit Report To Credit Bureaus

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Average Credit Score In America : Statistics And Key Findings

The average FICO score in America is 711.

The average FICO score is 5 points higher compared to a year ago. Then it was 706.

Since 2009, there has been constant growth, starting at 686.

The number of 711 falls in the scope of a good credit score.

Approximately 21% of Americans have a FICO Score that fell in the âgoodâ credit score range.

There is a positive correlation between peoplesâ age and their credit scores.

Generation Z , Millennials , Generation X , Baby Boomers , Silent Generation .

The Silent Generation has the highest average FICO score of 758, 47 points higher than the national average.

Generation Z has the lowest average FICO score of 674, 37 points below the national average.

In all 50 states and Washington, D.C., the average FICO Score has increased since 2019.

Minnesota is the state with the highest average FICO score of 739.

Mississippi is the state with the lowest average FICO score of 675.

The states with the highest FICO Score: Minnesota , Wisconsin , Vermont , South Dakota , Washington , North Dakota .

The states with the lowest FICO Score: Mississippi , Louisiana , Alabama , Texas , Georgia , South Carolina .

Men have an average credit score of 781.

Women have an average credit score of 774.

There is a positive correlation between peoplesâ income and their average credit score.

People with lower incomes have a lower credit score.

People with higher incomes have a higher credit score.

Asians have the highest average credit score of 745.

Read Also: Does Paypal Credit Affect Your Credit

Average Credit Score In The Us

Research by Experian shows that the average VantageScore in the U.S. in 2021 is 695, and the median is 707. This is a slight increase from the previous year, where the average score was 688, and the median was 697. And the average FICO score currently sits at 716.

Average credit scores have been trending upward since the Great Recession when many people were struggling with layoffs, underwater mortgages and other financial problems. Despite the pandemic and its associated unemployment rates, credit score averages in the U.S. are up 20 points from pre-COVID levels.

Drops In Delinquency Utilization Likely Driving Score Growth

The standout growth of the average FICO® Score in 2020 can likely be attributed to shrinking debt, decreased credit utilization and a drop in delinquencies . Since the onset of COVID-19 in January 2020, consumer debt management has trended in a positive direction.

FICO® Scores are calculated using information from consumer credit reports. And when features of consumers’ credit profiles improve, their scores typically do as well. Not all changes will have an immediate or visible impact, but improvement in key areas of credit reports will.

FICO® Scores are based on five types of information found in your credit report:

Since 2019, consumers have seen record improvement in utilization rates, debt amounts and number of delinquencies. The most significant changes between 2019 and October 2020:

Also Check: Does Klarna Report To Credit Bureaus

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible Individuals whose credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

Average Credit Score In The United States: 711

The average FICO® Score among American consumers is 711, according to myFICO. This is classified as a “good” score.

This is an increase of five points from 2019’s average score of 706. It continues a multi-year trend, as the average FICO score increased in nine of 10 previous years.

However, while most recent increases were one or two points annually, this year’s increase is the largest in a decade.

Also Check: Removing Repossession From Credit Report

The Credit Score Needed To Buy A House

Your FICO score plays a major role in your ability to secure a mortgage. The type of mortgage that youre looking to secure will determine what your score should be. According to QuickenLoans, these are the following credit scores you need to work with lenders14:

- Conventional Mortgage: 620

- FHA Loan With 3.5 Percent Down: 580

- FHA Loan With 10 Percent Down: 500

If you fall below these guidelines, ask yourself, how long does it take to build credit? Then, come up with a plan of action to help you work towards your goal.

Average Fico Scores By Age Group

Average credit scores vary by age groups, and generally, the older someone is and the more experienced with credit they are, the higher their credit score will be. Members of the silent generationthe oldest group in our analysis, age 75 and olderconsistently have the highest average FICO® Score of any generation. In October 2020, members of the silent generation have an average FICO® Score of 758 that’s 47 points higher than the national average, according to Experian data.

Conversely, the youngest generation of adultsGeneration Z, ages 18 to 23have the lowest average score. This group has an average score of 674, which is 37 points below the national norm in October 2020.

Regardless of age group, every generation saw its average FICO® Score improve since this time last year. The bulk of the improvement occurred for the middle generationsmillennials and Generation Xerswho each saw their average FICO® Score grow by 10 or more points.

| Average FICO® Score by Generation |

|---|

| Generation |

Recommended Reading: Apple Card Soft Pull

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.