How Long Does Information Stay On Your Reports

The FCRA limits how long a credit reporting agency can report negative items in your credit report. Items that aren’t negative but are neutral or positive can be reported indefinitely. Review the rules below and then check your credit report for negative items that are too old to be reported.

No Negative Credit Reporting If You Make an Agreement Due to Coronavirus

Under the federal Coronavirus Aid, Relief, and Economic Security Act, if you make an agreement with a creditor to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or get any other assistance or relief because COVID-19 affected you, the creditor must report the account as current to the credit reporting agencies if you weren’t already delinquent.

Ways To Remove Old Debt From Your Credit Report

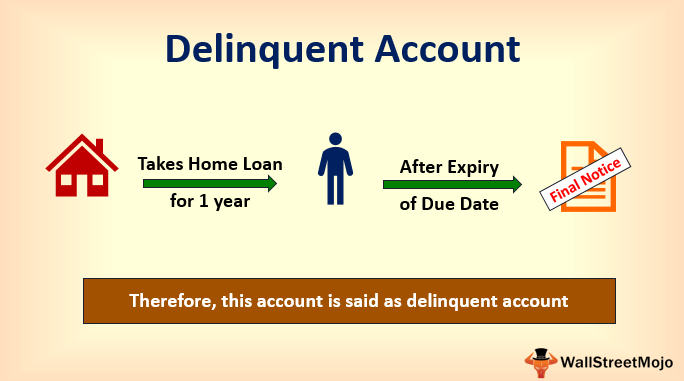

Having an accurate and up-to-date credit history without old collections or delinquent accounts is important when youre applying for loans or other new credit.

If youve noticed old debts on your credit report, its best to act as soon as possible to remove these items. Here are a few steps you should take.

Get A Copy Of Your Credit Report

If you’ve paid a bill late, suspect you have, or want to know the impact a late payment has on your credit, your first step is to get a copy of your credit report and check it out thoroughly.

You can get a free copy of your credit report once a year from annualcreditreport.com, which will send you a copy of your credit report from all three major credit scoring agencies – Transunion – Get TransUnion Report , Experian , and Equifax – Get Equifax Inc. Report . It’s also possible to get your credit reports on the cheap from any of the above credit reporting agencies. Just go to the agency’s web site where you’ll find directions to get a free credit report sent to you directly.

The single act of getting your credit report won’t eliminate any late payment listed on a report, but it’s the primary tool needed to erase a late payment from your credit report and avoid harsher financial penalties. The main goal is to use your credit report to check for late payments so you can start the process of getting rid of them.

Don’t Miss: What Credit Score Does Navy Federal Use For Auto Loans

Beware Of Debt Settlement Or Consolidation

In general, be very cautious when pursuing debt settlement or debt consolidation as there are risks involved with both options. Some of these may not even have any contact with your original creditor. Worst case scenario: you pay the company, never hear from them again, and the negative item is still on your report. If youre considering going with one of these companies, youll want to keep a few things in mind:

- Fees and rigid contracts: Most of the time, theyll charge you a fee for settling. Worse, if you miss a payment as part of your settlement or consolidation plan, you could lose all of your moneynone of it will go toward paying off your debt.

- Taxes: When you settle for a lower amount, that means a portion of your past debt is forgiven. And anytime your debt is forgiven, youll owe taxes on the amount forgiven if its over $600.

- Longer terms: You can actually pay more over time with debt consolidation. All it does is stretch out the length of your debt. Your monthly payments are smaller, but at the expense of paying more interest over time.

Theres also an important distinction to be made here: debt settlement and consolidation are not the same as credit counseling. The former options, along with the , promise to simply erase your delinquenciesand usually at quite a costwhile the latter helps you build better habits to improve your credit over time.

Why Do I Have So Many Student Loans

Student loans may be reported as multiple entries on a credit report based on disbursements. A disbursement may occur for each school semester attended. The numbers added before and after the account number indicate that an additional disbursement was made. These extra numbers also help differentiate between the entries.

Student loans are often sold to other lenders and can be reflected on the credit report as transferred. Because they are not considered duplicates, we will continue to report the accounts separately.

Please contact the creditor directly if you want to dispute this information or need additional information.

Read Also: Centurylink Collections Agency

Sample Letter: Credit Bureau Late Payment Dispute Request

You can use this sample letter to dispute information in your credit report. Just insert the appropriate information, like your name and address, the credit bureau name and address, and specific details in the body of the letter. If youre disputing more than one item, youll need to adjust the language to refer to multiple accounts.

Only include copies of documents, not the originals. If you choose to provide a copy of your credit report, circle the delinquent account in question.

Send your dispute request by certified mail, with a return receipt requested, so youll be sure that they receive it.

Enclosures:

Rebuilding Your Credit Rating

Since the charged-off account will still show up on your credit report, it will continue to impair your credit score. But the good news is that as charge-offs and other negative information ages, its overall impact can lessen.

In the meantime, you can work on rebuilding a positive credit history by doing things like paying your bills on time, keeping your low, and limiting how often you apply for new credit.

Read Also: How To Get Credit Report Without Social Security Number

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

Don’t Miss: Sync/ppc On Credit Report

Request A Goodwill Adjustment

This is an ideal option if you generally have a good payment history with your creditor and have been a customer for a while.

To do this, write a goodwill letter to the credit card issuer or lender and explain your situation. Credit card companies have some flexibility when it comes to reporting late payments. They can remove late payments from your credit report under the right circumstances.

Did you have an unexpected expense arise last month that made you late? Are you trying to perfect your credit score so you can get a mortgage or an auto loan?

Include your personal story in the goodwill letter so that the customer service representative reading your letter understands why this would be helpful.

Many people succeed with this method because creditors dont want to risk losing your account because of a single disagreement.

The Credit Repair Option

Another option is to work with a legitimate company to try to get charge-offs or other negative information removed from your credit file. While this can save you time, there’s typically a fee involved, and in most cases, the credit repair company can’t do anything for you that you couldn’t do by yourself.

Worse, some credit repair companies are just thinly disguised scams whose only goal is to defraud people who need credit help.

Don’t Miss: Which Credit Score Does Carmax Use

Dispute Incorrect Negative Information

If you find a derogatory account that is incorrect, you can file a dispute with the credit bureau to have it removed.

| A real-life example of how to remove derogatory items from credit report |

|---|

|

In 2009, I found such an item on my credit report and filed an online dispute with TransUnion. That was the credit bureau that furnished the report with incorrect information. I filled out a short online form explaining the error and a few days later got a response that they had contacted the institution, verified the information, and it was removed. Talk about a piece of cake. Eric Rosenberg |

You can file a dispute from a link provided in your credit report from AnnualCreditReport.com, or through any of the links below.

Keep in mind, you may need to create an account with the credit bureau to complete the process. But you dont need to sign up for any subscription or other paid service with these companies in order to remove a derogatory mark.

You can also file disputes by mail. However, the online dispute process is much easier for anyone comfortable using a web browser.

The reporting bureaus are required by law to handle disputes in a timely manner, typically 30 days or less, according to the Federal Trade Commission. Removing inaccurate negative information from your credit report is one of the fastest ways to quickly improve your credit score.

How I Got 4 Late Payments Removed From My Credit Report And Increased My Score By 84 Points

All of us may eventually forget to pay a bill on time. I am guilty of this too. A few months ago, I had to get a new bank account because of fraudulent activity. I updated all of my auto pay accounts, or so I thought I did. However, I completely forgot about an online-only store card from Amazon.

I also had an annual fee charged on a credit card I thought was closed, but had an annual fee. I didnt find out about it until I had a 90-day late payment. So, I contacted the creditor, Capital One. And voiced my displeasure with the 3 late payments, but nothing was done.

A few weeks ago, I decided to try this same advice and removed 4 late payments from my credit report.

One took me all of 5 minutes.

5 days later, I got a letter in the mail stating the late payment would be removed.

The other three were 30,60, and 90 day late payments from Capital One for a credit card I thought was closed but charged an annual fee.

I got all 3 deleted by the credit bureaus a few weeks later.

My credit score skyrocketed! Increasing my scores by up to 84 points on all three Credit Bureaus.

Also Check: How Long Does A Voluntary Repossession Stay On Your Credit

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also call, but you may not be able to complete your dispute over the phone. Heres information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

After A 2 Minute Chat They Agreed To Remove The Late Payment

About 5 days after telling Capital Ones customer service department, the late payment was inaccurate I received a letter in the mail stating that the late payment would be removed from my credit report within 30-60 days. Easy enough. Thats why I suggest contacting the creditor directly is the first and best option you have when it comes to removing late pays from your credit report.

Read Also: 676 Fico Score

Removing Old Debts After Credit Reporting Time Limit

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Credit reports sometimes contain errors that are serious enough to affect your credit score. One such error might be the inclusion of outdated debts. Fortunately, there’s a fairly simple way to remove old accounts from your credit report once the reporting time limit is up.

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

Recommended Reading: 626 Credit Score Credit Card

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

How To Remove Items From Your Credit Report In 2022

Your credit report is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

Read Also: Is A 524 Credit Score Good

Ask For A Goodwill Deletion

If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. This usually involves sending the debt collector or collection agency a goodwill deletion letter explaining your mistake, asking for its forgiveness and showing them how your payment history has improved.

With this option, theres no guarantee your collection will be removed from your credit report, but its worth a shot. If the account is removed, it may help you qualify for better terms on personal loans, mortgages and credit cards.

If Your Credit Reports Contain Errors Or Outdated Information Heres How To Dispute Those Items With The Credit Reporting Bureaus

By Amy Loftsgordon, Attorney

A “credit report” is a detailed record of how you’ve managed your credit over time. Credit reporting agencies, like Equifax, Experian, and TransUnion, collect data from creditors, lenders, and public records to produce the reports. The agencies then sell the reports to current and prospective creditors, and anyone else with a legitimate business need for the information. For example, lenders use credit reportsor the that results from the data in itto help them decide whether to grant you credit and, if so, under what terms. The better your credit report, the more likely your credit request will be granted, and the lower your interest rate will be. Many landlords, employers, and insurance companies will also consider your credit history when making a decision.

So, your credit report is either a valuable asset or a liability, depending on its contents. The Fair Credit Reporting Act requires credit reporting agencies to adopt reasonable procedures for gathering, maintaining, and distributing information. It also sets accuracy standards for creditors that provide data to agencies. Even with these safeguards, credit reports often have errors and inaccuracies.

In this article, you’ll learn:

Don’t Miss: Paypal Credit Inquiry

Why Doesn’t The Dollar Amount On My Public Record Match The Balance Due

The dollar amount reported on a public record does not reflect the balance due rather, it is the total amount owed prior to any payments. The amount reported on the public record remains the same regardless of whether payments are being made. However, if the item has been paid, it should reflect Paid Civil Judgment if a paid Judgment, or Released if a paid lien.