How Does An Evictionaffect My Credit

Evictions canresult in negative marks that bring down your creditscore.

If you didnt pay the full amount due, your landlordcan bring you to court. Once youre sued for unpaid rent and the landlord winsthe case, youll have a civil judgment against you. The civil judgment is what will be reported on your credit history.;

A civil judgment is a very serious negative mark and stays on your credit report typically up to seven years, even if youve paid off the amount. A potential employer or landlord may review your credit reports and learn of the civil judgment.

What Is An Eviction In Legal Terms

While the situations above describe reasons for a tenants removal from the property, eviction from a technical standpoint entails the landlord suing a renter for refusal to leave.

A few places allow landlords to employ self-help eviction tactics, like changing the locks on the property, but this is illegal in most places. If your landlord does this to you, make sure you check to see if this is legal. Otherwise, its time to contact the authorities.

Instead of locking you out, the landlord must usually go through the court system to file a lawsuit against you and obtain a writ of possession.

A law enforcement officer then posts the eviction notice on the property, giving a specific deadline of when it must be vacated. If the tenant is still there on the posted date, the law enforcement officer will physically remove the tenant and their belongings.

You May Like: How Long For Things To Fall Off Credit Report

Do Evictions Show Up On A Background Check

Evictions do not show up on criminal background checks unless there was an associated charge or misdemeanor that had to be settled in civil court. Evictions will show up in an eviction history check for as long as they are on record with the courts; these files are typically on file for seven years.

You May Like: Paypal Working Capital Phone Number

How Can I Rent If An Eviction Is Still On My Public Record

You can still rent if you have an eviction on your public record, but itll be more difficult. There are a few things that may improve your chances of getting a rental agreement.

- Explain the eviction: Be honest and upfront. If the landlord understands what happened, they might give you a better chance. If youve rectified the situation with your previous landlord, make sure the new landlord knows that.

- Provide references: To show youre a trustworthy renter, offer references in addition to the background check.

- Offer to pay more upfront: Consider paying the security deposit, first months rent and even second months rent at the time of signing a rental agreement.

- Get a co-signer: A co-signer reassures the landlord that you have someone legally and financially backing you.

- Improve your credit: A good credit score can be evidence of your ability to pay bills on time.

- Show youre financially viable to pay your rent: Provide proof of income and other successful payments, like payments on an auto loan.

Once youre accepted as a tenant, continue to prove yourself with timely payments and by properly caring for the property. You can rebuild your rental history and make it easier to rent in the future.

Do Evictions Show Up On Credit Karma

If youve experienced an eviction, the removal process and judgement wont appear on your credit reports. These judgments wont appear on consumer credit reports such as the VantageScore 3.0 you see on Credit Karma, as they were removed from consumer credit reports in 2017 and are no longer reported.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Will A Notice Of Eviction Appear On My Credit Report

Evictions do not appear on your credit report. A notice of eviction is your landlords declaration that they intend to evict you unless you take corrective action.;

The most common eviction notice is a notice to pay or quit, given when a tenant misses a rent payment. It tells the tenant to pay within a certain number of days or the landlord will seek a court order. If you either pay what you owe or move out voluntarily, the eviction process ends.

In some situations, the eviction notice will not give you an opportunity to fix the problem. For example, if you damaged the property, the landlord may want you out as soon as possible. This still may not appear on your credit report as it is only the start of the legal process.

Is It Possible To Remove An Eviction From Your Record

Anything on your record thats true stays on your record for seven years. But if theres a mistake, you can dispute it.

If you can prove to the agency reporting the error that it made a mistake, theyll remove that error from your record. Or if you were served an eviction notice but you won, show that to the reporting agency. Some landlords try to evict people when they dont have a valid reason for doing so.

You May Like: Does Klarna Report To Credit

Protect Your Credit And Your Reputation As A Tenant

When facing an eviction, finding a new place to live is just one challenge. While an eviction may not directly hurt your credit, it could lead to problems down the line. To learn more about your legal rights, how to approach your landlord, or how to respond to an eviction, ask a lawyer.

This article contains general legal information and does not contain legal advice. Rocket Lawyer is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.

What Happens To Your Credit Score If You Get Evicted

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

If you lease a property and violate the terms of your agreement, your landlord may decide to evict you. Aside from leaving you with no place to live, an eviction can seriously damage your , which can make it harder to eventually secure a mortgage or even get a credit card or car loan.

Though an eviction itself doesnt get reported to the credit reporting bureaus , the fallout from an eviction could be.

For example, if your landlord sells your debt to a third-party collection agency or files a civil lawsuit against you, those actions will likely appear on your credit report, thus impacting your credit scores.

A good credit score is key to securing new loans, some types of employment and even future rental properties, so anything that might negatively affect your credit report is cause for concern as that data is fed into an algorithm that makes up your credit scores.

Read Also: Paypal Working Capital Forum

Can An Eviction Make It Harder For Me To Rent In The Future

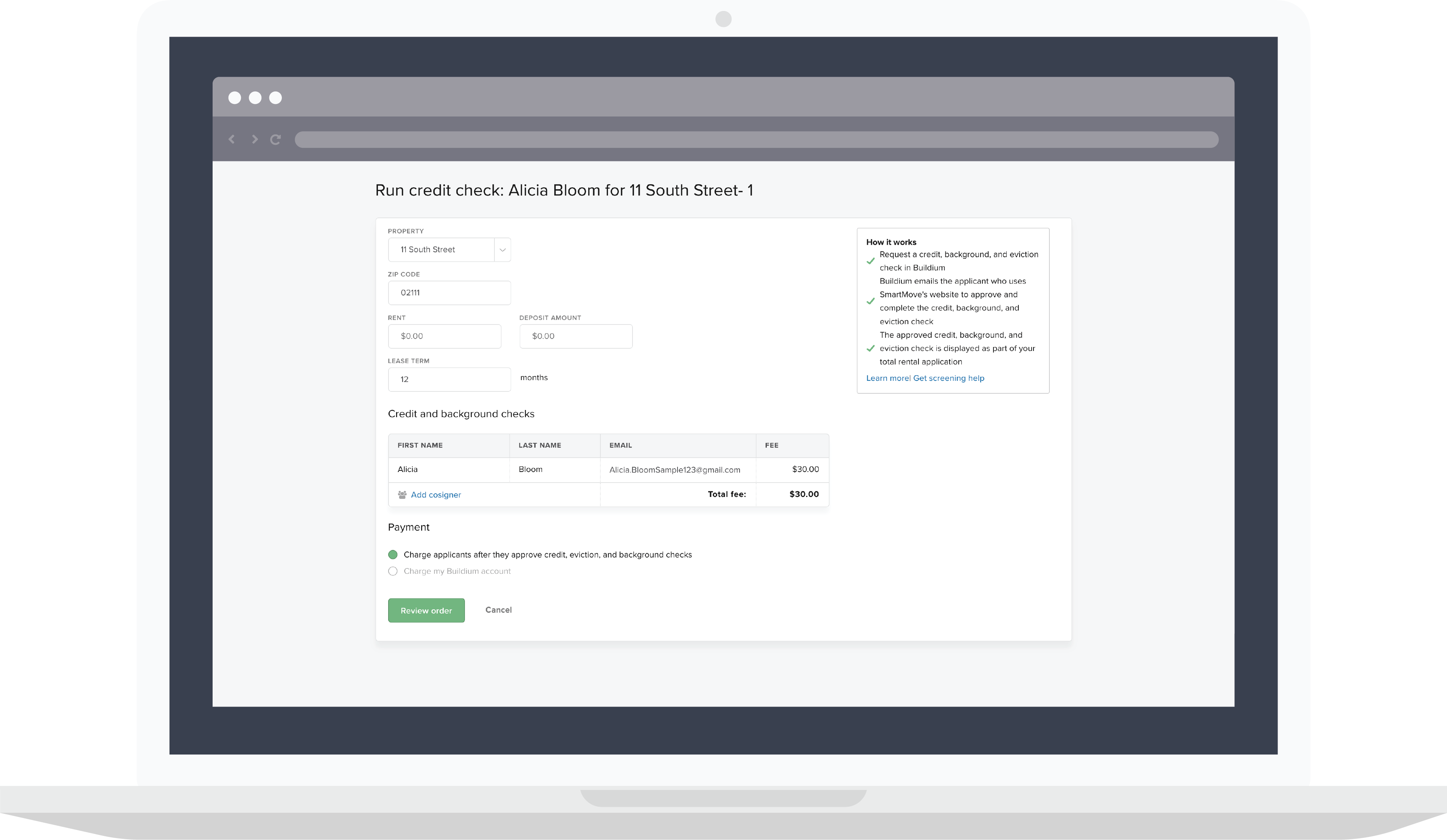

Yes. Some landlords report to tenant screening services, like Experian’s RentBureau or TransUnion’s SmartMove. Even though your credit report may not read “eviction”, a check with one of these services will reveal your eviction record. If the screening service has incorrect information about your rental history, you should contact them to dispute the information. If someone rejects your lease application because of one of these rental reports, they must give you the name and contact information of the company that made the report.

An eviction will make it difficult to rent in the future. The best way to avoid an eviction is to pay your rent on time and comply with your lease.

When Does An Eviction Show Up On Your Credit Report

That means it will remain there for seven years from the date of delinquency, even if you eventually pay it off. The other way the results of your eviction could appear on your credit report is through the public records section. This happens if the eviction lawsuit results in a civil judgment and you owe unpaid rent and/or court fees.

Recommended Reading: Open Sky Unsecured Credit Card

How Background Checks Work

Running a background check online can be done pretty quickly, once the prospective tenant has logged on and provided the necessary information. But background checks are only one part of the application process, and properly screening a new tenant could easily take two to three days.

A Background Check Can Take 2-3 Days

One reason a thorough background check can take longer than expected is that landlords and property managers should contact the tenants current landlord to learn why the tenant is leaving. Most tenants wont tell you they are in the process of being evicted, so youll need to wait for their current landlord to respond to an inquiry.;

A landlord should also contact the prospective tenants current employer to learn if the tenant still has a job. Some tenants who are getting fired or laid off rush to find a new place to live before they become unemployed. While its never nice to see someone lose their job, a tenant without a source of income is one that could soon end up being evicted.

Items in a Background Check

A background check normally contains the following reports:

Temporary Rental Relief Due To The Coronavirus Pandemic

If you live in an apartment building with a federally-backed mortgage and cant pay your rent due to COVID-19, the CARES Act created a 120-day moratorium on evictions caused by not paying rent. Your landlord cannot charge late fees or penalties during this time.

The Act does not cancel rent, so you will still owe the money eventually.

Check with your landlord or property manager to find out whether your buildings mortgage is federally insured. You can also check out the National Low Income Housing Coalitions searchable database and map of covered properties.

The eviction moratorium started on March 27, 2020, and expired on July 24, 2020. However, there have been discussions in Congress about extending the eviction moratorium and expanding it to cover all renters.

Many states have issued their own eviction moratoriums due to COVID-19. The National Low Income Housing Coalition maintains a list of state and local bans.

Don’t Miss: What Credit Score Does Carmax Use

Can You Repair The Damage Or Remove The Information From Your Credit Report

If a landlord has turned over any unpaid money due to a collection agency, paying off what you owe can help. As stated above, once the balance is paid off, some of the newer credit-scoring models will remove it from your credit reports. Plus, it just looks better to future lenders to see that you have rectified the debt.

Going forward, the best way to repair any credit damage from an eviction is to tune up your financial health. By paying your bills on time and keeping your debt low, your scores will eventually start to improve.

While damaging information can stay on your credit report for seven years, debts carry less weight the older they get as more positive information is added to your credit reports. You may choose to seek help from a nonprofit , which can help you organize a budget to start repairing your credit health.

How Can I Check If I Have Evictions

Past evictions should be shown in the âPublic Recordsâ section of your . You can request a copy of your credit report from one of themajor credit bureaus. Since each report slightly different information, you may need all three reports to find an eviction.

Evictions will also show up on a rental history background check. There are numerous websites where you can pay a small fee to have your report run. It can take a while for recent evictions to appear, however, between 30 to 60 days after an issued judgment.

Read Also: Does Cashnetusa Report To Credit Bureaus

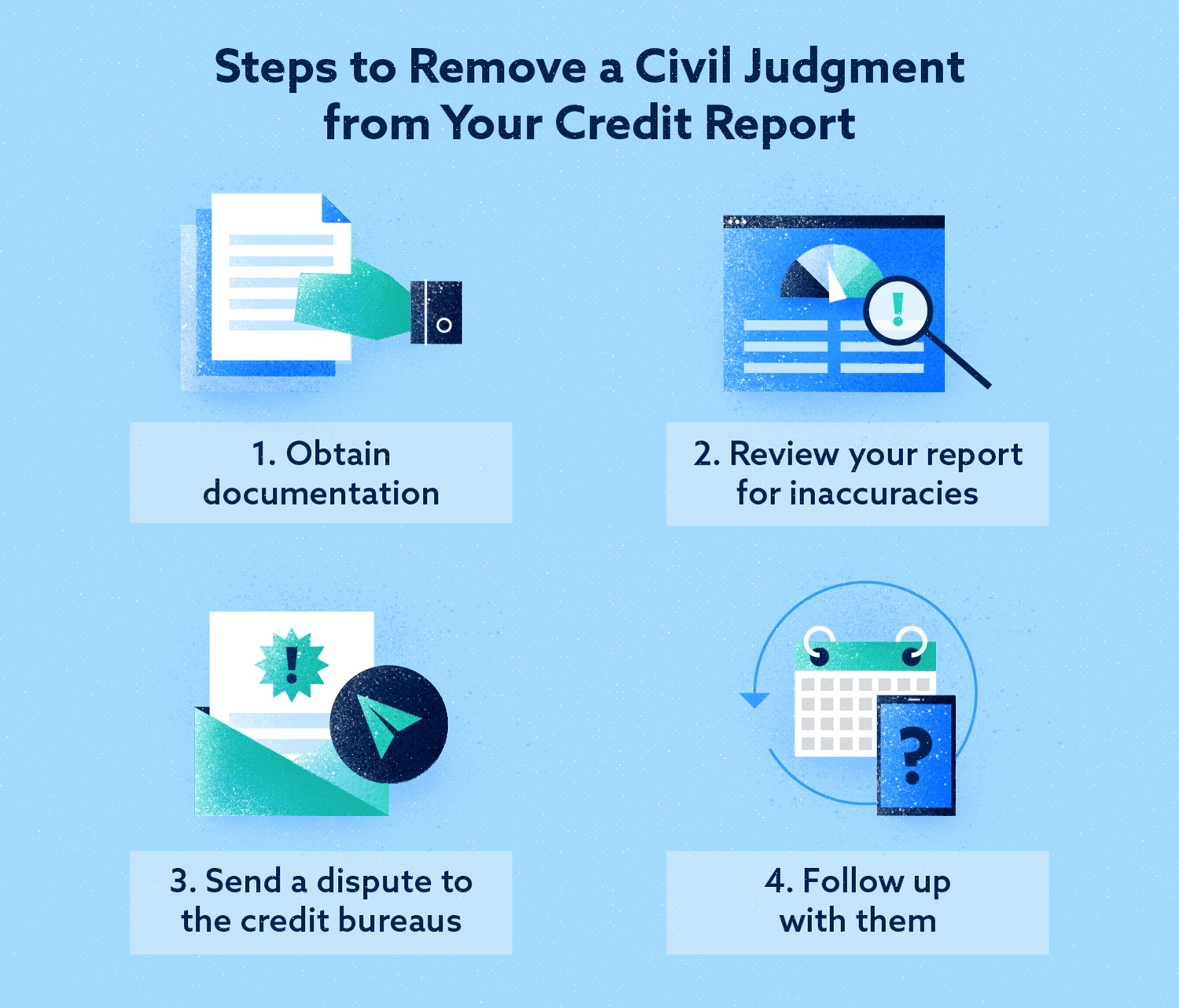

What Should I Do If My Civil Judgment Is Inaccurately Reported

Its possible your civil judgment may stay on your credit report and public record inaccurately. This can be due to a variety of reasons, such as clerical errors or disputes that got lost in the mail.

If you see a civil judgment on your record that shouldnt be there: rectify it. Its important to remove mistakes that negatively affect your credit score, your ability to rent and your ability to apply for new credit.

To remove the civil judgment, contact the county and/or the credit bureaus yourself. You can also ask for legal advice and get assistance. Call the today to learn how we can help you remove inaccurate marks on your credit report.

How Do You Get Evicted

You can be evicted for breaking any of your lease terms. The most common reason people are evicted is for nonpayment of rent. But you could be evicted for other reasons, such as subletting your rental without permission, sneaking in a pet, bringing in someone to live with you who is not on the lease, damaging the premises, being a nuisance to neighbors or other tenants, or not leaving when your lease is up.

If the landlord has a valid reason to evict you, they need to follow the eviction process for your state. That usually entails first giving you a formal notice of eviction, which is generally a letter or email that explains the reason youre being evicted and what you can do to avoid it. If you dont comply, expect your landlord to file the eviction with the local courthouse next. The court then notifies you as to when youll need to appear. If you lose in court, youll need to move out.

Don’t Miss: What Credit Report Does Paypal Pull

So It Doesnt End Up In My Credit Report

The eviction itself does not. However, anything that is related to the eviction may be reported. There are a few ways that eviction-related items could end up on your report.

Judgements

Lets say you get evicted for lack of paying rent and, after you move out, the landlord discovers a whole host of damage you caused in the home before you moved out. The landlord can sue you for that damage and, if a judge finds it appropriate, can issue a judgement against you requiring you to pay.

Judgements like these do show up on your credit report and do negatively affect your score. How much depends on the algorithm used and the size of the judgement itself. Judgements appear in the public records section of your report.

Collections

If youve been very late on your payments and have a large outstanding balance with your landlord, he may put you into collections. Again, this is a legal process that culminates with the court mandating that you pay according to a judgement of some kind. Collections will also appear on your credit report and will drastically reduce your score.

Either way, eviction information can remain on your credit report for up to seven years. If the statute of limitations is longer where you live, you could be looking at a longer run.

How Does An Eviction Impact Your Future Housing Prospects

Unfortunately, an eviction will almost undoubtedly hurt your ability to secure housing in the future.

Many landlords perform credit checks on prospective tenants. So, if your credit report contains debts owed through collection agencies or civil judgments, that will raise a big red flag on your application.

Even if a landlord cant tell that the collection debt is rent-related, theyll still question your ability or propensity to pay the rent on time each month.

Youll also have trouble getting approved for a mortgage, credit card, or personal loan during those seven years because your credit score will take a huge hit.

Also Check: How Long Do Late Payments Stay On Your Credit Report

You May Like: How To Report To Credit Bureau As Landlord

How To Dispute Inaccurate Eviction Information On Your Credit Reports

If eviction-related information has been incorrectly reported to the credit reporting agencies, you can file a dispute with the three firms .

You should get a copy of your report from each agency and look carefully to review exactly what has been reported. If you see inaccuracies, contact the reporting agencies and start a dispute. Know that by providing any supporting evidence will help your case, such as canceled checks that can prove payments were made.

If a judge dismisses a civil suit brought by your landlord, you can also petition the credit agencies to remove the information. Youll need to get copies of court records and submit them to each agency per their process, which you can find on their respective websites.

Likewise, if you believe the collections information is incorrect, you can dispute it with the credit reporting agencies to try to have it removed from your report.

Does A False Eviction Affect My Credit Score

Your credit report doesn’t differentiate between a false and legitimate eviction. If the eviction goes through the proper channels, even if it was a simple clerical error, it will show up on your credit report and can have a profound impact on your credit score. Your credit report will show a “Civil Judgment,” and that will lead to negative marks that lower your credit score. Even if you paid off the debt owed to the landlord, the hit to your credit score from the civil judgment could remain indefinitely. If you’re successful in getting the eviction expunged from your record, you’ll still need to contact the credit bureaus and have them remove the civil judgment. Removing the civil judgment from your credit report requires gathering the documentation proving the expunged eviction or dismissal, sending a credit dispute to each bureau, and following any instructions they send back.

Recommended Reading: Does Klarna Affect Your Credit Score