What Is A Credit Report

A credit report is a detailed breakdown of an individual’s credit history prepared by a . Credit bureaus collect financial information about individuals and create credit reports based on that information, and lenders use the reports along with other details to determine loan applicants’ .

In the United States, there are three major credit reporting bureaus: Equifax, Experian, and TransUnion. Each of these reporting companies collects information about consumers’ personal financial details and their bill-paying habits to create a unique credit report; although most of the information is similar, there are often small differences between the three reports.

Never Miss Or Be Late On Any Credit Repayments It Can Have A Disproportionate Impact

Sounds obvious? Well, it is. Even if you’re struggling, try not to default or miss payments because it can have a disproportionate impact. Doing this once or twice could cause problems that can cost you for years. Defaults in the previous 12 months will hurt you the most.

The easy solution is to pay everything by direct debit, then you’ll never miss or be late. While we normally caution against only making minimum repayments on debts one technique is to set up a direct debit to just repay the minimum, purely as a vehicle to ensure you’re never late. Then manually pay more each month on top.

If you are in difficulties, the cliché “contact your lender” is a good one. Hopefully it will try to help. Changing your repayment schedule is preferable to you defaulting and though it will hit your credit score, it’s better than a county court judgment or decree against you.

Ask For Late Payment Forgiveness

Paying on time constitutes 35% of your FICO Score, making it the most important action you can take to maintain a good credit score. But if youve been a good and steady customer who accidentally missed a payment one month, then pick up the phone and call your issuer immediately.

Be ready to pay up when you ask the customer rep to please forgive this mistake and not to report the late payment to the credit bureaus. Note that you wont be able to do this repeatedly requesting late payment forgiveness is likely to work just once or twice.

You have 30 days before youre reported late to the credit bureaus, and some lenders even allow as long as 60 days. Once you have a late payment on your credit reports, it will stay there for seven years, so if this is a one-time thing, many issuers will give you a pass the first time youre late.

How much will this action impact your credit score?

If youre a day or two late on a credit card payment, you might get hit with a late fee and a penalty APR, but it shouldnt affect your credit score yet. However, if you miss a payment by a whole billing cycle, it could drop your credit score by as many as 90 to 110 points.

Also Check: Zzounds Financing Review

How Borrowell Can Help

Monitor & Track

Sign up for free in just 3 minutes with no commitment or impact on your credit score. Track your success, flag errors and spot fraudulent activity.

Understand & Improve

Canada’s first AI-powered Credit Coach, Molly, will share personalized tips, articles, and tools that may help improve your credit.

Find the Right Product

Get automatically matched with financial products from over 50+ partners that fit your credit profile. See your likelihood of approval and apply in just a few clicks.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to;file a dispute with Equifax Canada. You will need to complete the;;enclosed with your package. You can also review;how to dispute information on your credit report;for additional details on the Equifax dispute process.

Don’t Miss: Carmax Credit Score Requirements

Review Your Credit Report

You are entitled to one free a year from each of the three reporting agencies and requesting one has no impact on your credit score. Review each report closely. Dispute any errors that you find.;This is the closest you can get to a quick credit fix.

A government study found that 26% of consumers have at least one potentially material error. Some are simple mistakes like a misspelled name, address, or accounts belonging to someone else with the same name. Other errors are costlier, such as accounts that incorrectly are reported late or delinquent; debts listed twice; closed accounts that are reported as still open; accounts with an incorrect balance or credit limit.

Notifying the credit reporting agency of wrong or outdated information will improve your score as soon as the false information is removed. About 20% of consumers who identified mistakes saw their credit score increase.

‘i Am Not A Number I’m A Free Man’ Er Not With Credit Scoring

We don’t have a right to be lent money. While the Government pushes lenders to offer more credit, especially in the small business and mortgage worlds, ultimately it’s still a commercial decision from firms about whether they want to lend.

This is done with a massive system of automated impersonal credit checks. It’s often far cheaper for a lender to reject some people who it;should;be lending to than it is to accept some it shouldn’t be lending to.

You may feel it’s unjust, but;The Prisoner‘s call “I am not a number, I am a free man” doesn’t work in credit scoring. Here you;are;just a number, and you have to understand that, as frustrating as it may seem.;;

Read Also: What Credit Score Does Carmax Use

Dispute Credit Report Errors

Under the Fair Credit Reporting Act, you have the right to an accurate credit report. This right allows you to dispute credit report errors by writing to the relevant credit bureau, which must investigate the dispute within 30 days.

Errors, which can stem from data entry snafus by creditors, easily interchangeable Social Security numbers, birthdays, or addresses, or identity theft, can all hurt your credit score.

For example, if you already have a history of late payments, an inaccurately reported late payment on the report of someone could have a dramatic and fairly immediate negative impact on your score because late payments represent 35% of your credit score. The sooner you dispute and get errors resolved, the sooner you can start to increase your credit score.

Make Sure You Always Pay Your Credit Accounts On Time

Your payment history is the most important factor in your credit score calculation. Everyone knows that not paying their credit accounts will hurt their score, but you might not realize that a late payment will stay on your report for up to seven years.

If you regularly make on-time payments it gives prospective lenders comfort that you are responsible with your money. On the other hand, if you have a history of being behind on payments, its critical that you change this pattern as soon as possible.

Even if you are unable to pay your cards off in full on a monthly basis, which is widely considered the best approach, making the minimum payment regularly will keep your accounts in good standing.

If you have trouble remembering to make the minimum payments, I recommend that you set automatic payments up within each credit account so that you wont miss any payments. Youll just have to make sure you always have enough money in your bank account because most lenders will charge you a fee for insufficient funds if you dont.

Also Check: How Accurate Is Creditwise

Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

Use A Credit Build Card To Build A History & Restore Past Issues

You need to build a decent recent history to show that you can be responsible with credit and use it well. The catch-22 is that as you have a poor credit history, getting credit is difficult.

The solution is to grab a credit rebuild card. See the full;;guide for full help, how to protect yourself, and top picks.

This is a card with a hideous rate, say 35% APR, which accepts people with a poor credit history. Yet provided you repay the card IN FULL each month, preferably by direct debit, and never withdraw cash, you won’t be charged interest, so it’s no problem.

Then just spend say, £50 a month on the card, and provided you have no other issues after six months or so, things should start to improve. After a year, it should make quite a difference.

Obviously, if you already have a credit card you aren’t using, then you can do the same on that without the need to apply for a new one.

Read Also: Does Paypal Credit Report To Credit Bureaus

Add Rent Payments To Your Credit Report

If you regularly pay rent on time, add those payments to your credit report to boost the amount of positive information reported to the credit bureaus. You can do so by signing up with a service like RentTrack or PayYourRent. In many cases, getting your landlord or property management company on board will limit the fees you’ll be charged.

Keep Your Credit Cards Open

Even if you’ve stopped using a credit card, keeping the card open increases the amount of available credit you have, which can contribute to a lower utilization ratio. If the card has an annual fee, it might not be worth keeping unless you benefit from the card in other ways. But rather than closing your account, you could call the issuer and ask if you can change to another card the issuer offers without an annual fee.

Read Also: Does Paypal Credit Affect Your Credit

Option 1 Request A Credit Limit Increase

Another way to reduce your credit utilization ratio if youre carrying high balances is to bump up your credit limits.

For example, if youre carrying $700 in debt on a card with a $1,000 credit limit, your credit utilization is 70%. If youre successful in increasing your credit limit to $2,000, then your utilization rate drops to 35%.

Some issuers make it easy to request a credit limit increase via your online account. For example, Citi allows cardholders to make such a request on the Credit Card Services page:

You can also call the number on the back of your card to make the request. Know that some issuers may conduct a hard pull on your credit before granting you a higher credit line, which can ding your credit score a few points. Your score will recover, but inquire exactly how your request will be handled before you allow them to proceed so you know what to expect.

Note: If youve only had the card a few months, have a history of late payments or are carrying really high balances, your request may be denied until youre seen as a less risky customer.

How much will this action impact your credit score?

The impact a credit line increase could have on your credit score depends on much of an increase you get. If its enough to bring your utilization under 30%, you should see a reasonable increase in your score. However, it wont improve your score as much as paying off your balance and bringing your utilization to or near zero.

How To Raise A Credit Score In 30 Days

While it typically takes a few months to make a significant difference in your credit score, there are things you can do right now that can help you raise your score in a matter of weeks. Here are some suggestions to help give your credit score a quick boost:

Fix any mistakes on your credit report Perhaps the fastest way to increase your credit score is to identify any errors on your credit report and have them rectified. Youre entitled to pull your from credit bureaus like Equifax or TransUnion and go through it to see if there are any mistakes that could be pulling your score down. If there are, fixing them can give you an immediate boost to your score.

Need to dispute an error on your credit report? Heres how you can do it. ;

Increase your available credit Asking for a higher credit limit from an established creditor can not only increase your available credit line but also raise your credit score.

Negotiate with creditors You may be able to ask creditors to accept partial payments for debt that is currently in collections in exchange for reporting the debt as paid.

Be an authorized user on someone elses account If you have any family members with good credit, adding you as an authorized user on their account can help increase your credit score. Each one of their timely payments will boost your record.

Recommended Reading: What Credit Score Does Carmax Use

It’s As Much About ‘will You Make The Lender Money’ As It Is About Risk

Many people write to us incensed after rejection “I’ve a perfect credit score, I’ve never missed a payment, why on earth did they reject me?” This is based on a misunderstanding; lenders are credit scoring to see if you match up to their wish list of what makes a profitable customer.

Of course, someone who is a bad risk is likely to be scored out as unprofitable by most companies. But the risk of not repaying isn’t the be-all and end-all.

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know. Here are some other things to look out for:

Your Credit Score Is Important Heres How To Improve It

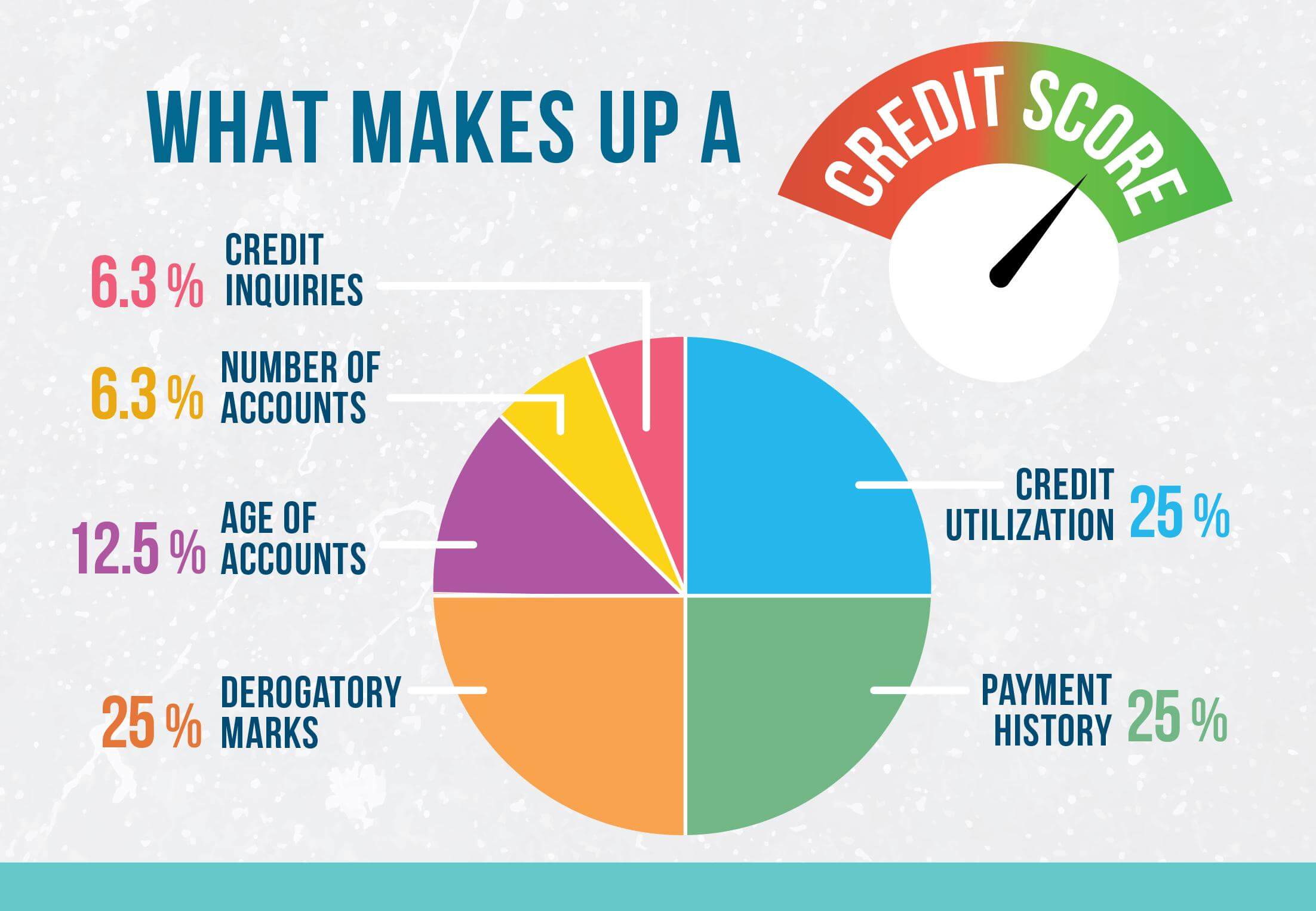

Your credit score factors in your payment history, the amount of credit available to you and thelength of time your credit accounts have been opened. It dictates whether or not youll be approvedfor car loans, mortgages and credit cards, and it determines your interest rates.

If you miss a bill payment, max out credit cards or have a credit account or loan go tocollections, your credit score may take a dip. Here are eight;tips that can help you improve yourcredit score.

1. Verify information on your credit report.

Every 12 months you can get free;copies of your credit;reports from the three major credit bureaus Experian, TransUnion and Equifax only at;Annualcreditreport.com. Once you have it, be sure all the information is accurate. Errors could negatively impact yourcredit score, so review everything from the most basic information like your name and address tomore detailed information like balances on accounts.

2. Go directly to the credit bureaus.

Did you know with Experianadding your phone and utility bill history may increase your credit score? This additionalinformation provides a more complete view of your payment profile to the credit agency and topotential lenders.

3. Strategically pay down your credit card balances.

4. Dont use up your credit limit.

5. Dont unnecessarily close any accounts.

6. Refinance your home equity line of credit.

7. Use a secured card.

8. Pay your bills on time.

Also Check: Speedy Cash Late Payment

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

Where Can I Get My Credit Score

You actually have more than one credit score. Credit scores are calculated based on the information in your credit reports. If the information about you in the credit reports of the three large consumer reporting companies is different, your credit score from each of the companies will be different. Lenders also use slightly different credit scores for different types of loans.

There are four main ways to get a credit score:

Check your credit card or other loan statement. Many major credit card companies and some auto loan companies have begun to provide credit scores for all their customers on a monthly basis. The score is usually listed on your monthly statement, or can be found by logging in to your account online.

Talk to a non-profit counselor. Non-profit and HUD-approved housing counselors can often provide you with a free credit report and score and help you review them.

Use a credit score service. Many services and websites advertise a free credit score. Some sites may be funded through advertising and not charge a fee. Other sites may require that you sign up for a credit monitoring service with a monthly subscription fee in order to get your free score. These services are often advertised as free trials, but if you dont cancel within the specified period , you could be on the hook for a monthly fee. Before you sign up to try one of these services, be sure you know what you are signing up for and how much it really costs.

Read Also: How To Remove Items From Credit Report After 7 Years