How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

A Card For Frequent Hotel Users: Mariott Bonvoy Boundless Credit Card

If hotels are more familiar than your bedroom, consider the . Heres what you get.

- If you spend $3000 in your first 3 months youll get 3 free night awards plus 10x total points.

- 10x total points on up to $2500 in total purchases at gas stations, grocery stores, and restaurants in your first 6 months.

- 6x points for every dollar spent at 7,000 participating hotels.

- 10x points from Mariott.

What To Do Before Applying For A Credit Card If Your Fico Score Is 700 To 749

Even if youve been in the 700 to 749 credit score range for a long time, never assume thats still the case. Credit scores are a moving target! The score you have today will be different a month from now, and again a year from now.

For that reason, there are a few steps you should take before you even make application for a credit card.

Read Also: Why Is My Credit Score Different On Credit Karma

Rewards For Everyday Spending: Credit One Bank Platinum Rewards Visa

The has a $95 annual fee, but the rewards package is comprehensive enough that youre likely to come out ahead. This is a great choice for people who use their card a lot. Here are the rewards.

- 5% cash back on groceries, gas, internet, mobile phone services, and cable or satellite TV, up to $5000/year. 1% cash back after $5000.

- 1% cash back on all other purchases.

- Up to 10% cash back at selected retailers.

The 5% category covers a wide range of day to day spending, and if you make the $5000 limit youll get $250 back. The cash back is credited to your statement automatically and theres no limit to the rewards you can earn.

This is a card for day to day use, not travel: there is a foreign transaction fee.

The downside: The APR is high at 23.99%, so youll want to pay off your balance in full each month. Youll have to spend around $1900 in the 5% categories to make up for that annual fee.

Learn More About Your Credit Score

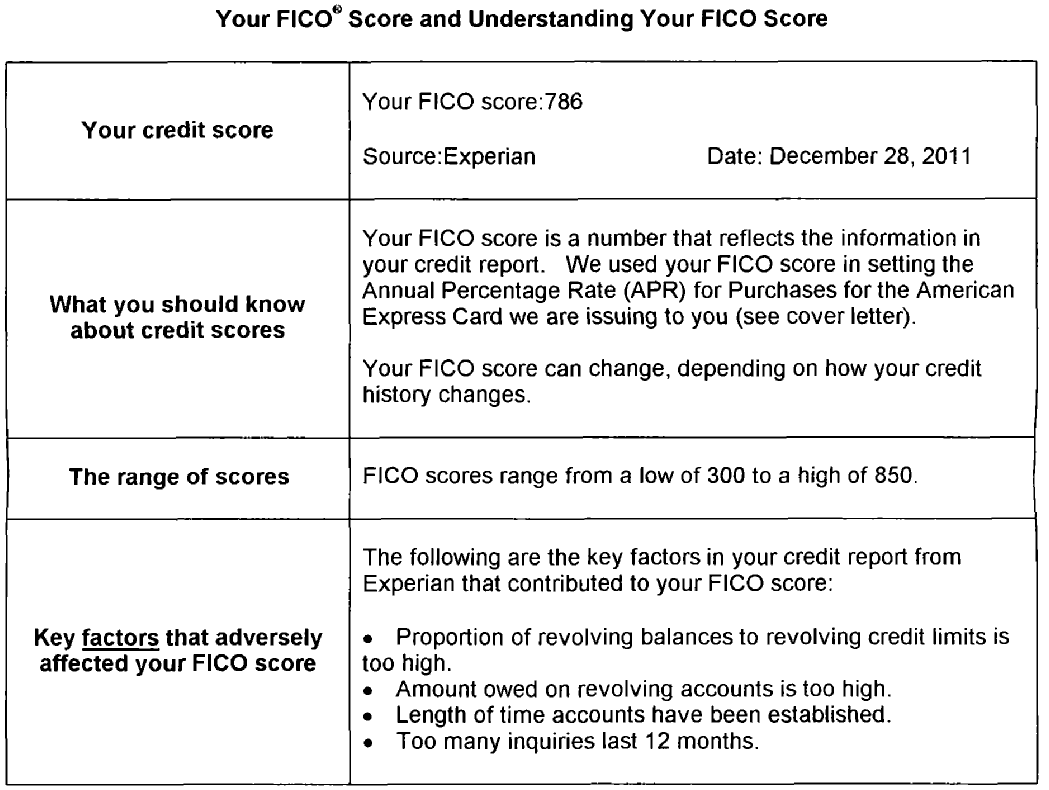

A 748 credit score is Very Good, but it can be even better. If you can elevate your score into the Exceptional range , you could become eligible for the very best lending terms, including the lowest interest rates and fees, and the most enticing credit-card rewards programs. A great place to begin is getting your free credit report from Experian and checking your to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Also Check: How To Get Rid Of Inquiries On Your Credit Report

Can I Get A Personal Loan Or Credit Card W/ A 748 Credit Score

Like home and car loans, a personal loan and credit card is easy to get with a 748 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 748 score means you likely have few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

How To Improve A 748 Credit Score

Its a good idea to grab a copy of all three of your credit reports from Equifax, Experian, and TransUnion to see what is being reported about you. If you find any negative items, you may want to hire a credit repair company such as Lexington Law to help you dispute them and possibly have them removed.

Lexington Law specializes in removing negative items. They have over 28 years of experience and have removed over 10 million negative items for their clients in 2018 alone.

They can help you with the following items:

- hard inquiries

- bankruptcies

Don’t Miss: Do Hard Inquiries Affect Credit Score

Monitor Your Credit Score From Now On

You should do this at least on a monthly basis. That will give you an opportunity to identify any irregularities immediately.

Brand-new issues are easier to fix than those that have been sitting for a few months or years. The information will be fresh on your mind, and youll likely have documentation to prove your case.

Can I Get A Mortgage & Home Loan W/ A 748 Credit Score

Getting a mortgage and home loan with a 748 credit score should be easy. Your current score is in the second highest credit rating category that exists. You shouldn’t have any issues getting a mortgage or a home loan.

The #1 way to get a home loan with a 748 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Don’t Miss: When Does Citi Card Report To Credit Bureaus

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure; the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

Recommended Reading: How To Get A Bankruptcy Off Your Credit Report

Credit Score: Is It Good Or Bad

Your FICO® Score falls within a range, from 740 to 799, that may be considered Very Good. A 748 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers.

25% of all consumers have FICO® Scores in the Very Good range.

In statistical terms, just 1% of consumers with Very Good FICO® Scores are likely to become seriously delinquent in the future.

Best Balance Transfer Card: Us Bank Visa Platinum Card

If you want to consolidate credit card debt with a balance transfer card, the U.S. Bank Visa Platinum Card could be the card youre looking for. The 20-month 0% intro APR for both purchases and balance transfers is one of the longest in the industry. That gives you enough time to pay any balances you transfer. Theres no annual fee. The card has no annual fee, and theres a range of additional benefits. The regular APR is 14.49% 24.49%

The regular APR is from 12.99% to 22.99%, and the minimum credit score is 690.

The downside: you wont be able to transfer a balance from another U.S. Bank card.

Recommended Reading: How To Get Fico Credit Score

Why A Very Good Credit Score Is Pretty Great

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 748 typically pay their bills on time; in fact, late payments appear on just 23% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

A 748 Credit Score Is Considered A Good Credit Score By Many Lenders

| Percentage of generation with 700749 credit scores |

|---|

| Generation |

| 14.7% |

Good score range identified based on 2021 Credit Karma data.

A credit score is a number that lenders use to help assess how risky you might be as a borrower. Credit scores are based on credit reports, which contain information about your credit history. Generally, a good credit score can signal to lenders that youre more likely to pay back money you borrow.

Having good credit can be a game-changer. It can mean youre more likely to be approved when you apply for a credit card or loan. Good credit can also help you qualify for lower interest rates and better loan terms.

Its not quite as simple as that though. You dont have just one credit score. Heres why. Scores can be calculated using different scoring models, like the ones created by FICO and VantageScore. These credit-scoring models use several factors to generate your scores, drawing on data from different sources, namely the three main consumer credit bureaus . So there are actually many different versions of your credit scores.

With so many different credit scores out there, what counts as a good credit score can vary. What one model or lender defines as good could be different from what other models or lenders define as good.

Heres what you need to know about building and maintaining a good credit score and, if youre aiming higher, how you can eventually take that score from good to excellent.

Read Also: A Credit Score Tells A Lender How

+ Credit Scores By Income

700+ Credit Scores by Income

People who make at least $50,000 per year are significantly more likely to have a credit score of at least 700. And people who pull in $75,000 to $99,999 per year are in the sweet spot for a score that begins with a 7 or an 8. But note that it is possible to get into the 700-plus club if you earn less or wind up with a way lower score even if you make a lot more. Its all about spending within your means.

Improving Your 748 Credit Score

A FICO® Score of 748 is well above the average credit score of 704, but there’s still some room for improvement.

Among consumers with FICO® credit scores of 748, the average utilization rate is 31.8%.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll also find some good general score-improvement tips here.

You May Like: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Can I Get A Car / Auto Loan W/ A 728 Credit Score

Trying to qualify for an auto loan with a 728 credit score is relatively cheap. There isn’t as much risk for a car lender . Taking out an auto loan out with a 728 credit score, shouldn’t be very difficult.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. As you know, a good credit score can help you get approved and get better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and based on the credit youre applying for. There are also different scoring models, so a good score may vary depending on what product or services you use to see your scores. That said, read on to learn what a good credit score range is when you check your score with TransUnion.

Read Also: Does Credit Limit Increase Hurt Score

What Is The Average Credit Score In Canada By Age

Categories

A good credit score is a valuable tool for anyone trying to navigate their financial life. True, making a decent income and saving money are also healthy practices, but a solid credit score is one of the key factors that can;put you in the position to get approved for loans and other types of credit products. You can use those products to pay for your childrens education, get married, even buy a car or a house. While everyones financial goals are different, one thing is certain. Its important to learn about your own credit score so you can always keep it in the best shape possible.

It can be tough to predict what your own will look like in the years to come. You could experience debt issues, job loss, or get your finances back on track, no one can predict the future. While its never a good idea to compare your finances to someone elses, it can be beneficial to understand where your credit score should be during different times in your life as well as how that can affect the overall health of your credit.;

What Is Considered A Good Credit Score

by The Ascent Staff | Nov. 20, 2018

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Here’s what it means to have good credit, what it can do for you, and how to take your score to the next level.

Here’s what it means to have good credit, what it can do for you, and how to take your score to the next level.

There is no formal definition of a good credit score. It varies depending on what you’re applying to borrow for, but it’s generally accepted to be in the range of 670 to 739 in the FICO scoring model. Here’s how the FICO score works, what is considered a good credit score, and how to increase your credit score from good to great.

Read Also: How To Boost Credit Score 100 Points

Auto Loans For Good Credit

The best rates for auto loans are typically available to people with good-to-excellent credit, but what good credit means to auto lenders can vary. Beyond the base credit-scoring models like FICO and VantageScore, there are also industry-specific scores that lenders could check, such as FICO® Auto Scores.

Even though you may not know which specific score a lender will use, its still a good idea to have an understanding of your overall credit health when shopping around. You can check your credit from Equifax and TransUnion for free on . You can also periodically get a free credit report from each of the three main consumer credit bureaus from annualcreditreport.com.

And yes, its important to shop around! Take some time to compare offers to find the best terms that could be available to you. In particular, the rates offered at car dealerships may be higher than rates you might be able to find at a bank or credit union, or with an online lender.

If youre shopping around for auto loan rates, consider getting preapproved to boost your negotiating power when youre at the dealership. A preapproval letter can be a great way to show car dealers youve done your homework and wont accept a subpar financing offer. Just be aware that it can result in a hard inquiry, which can temporarily ding your credit.

And if you already have a car loan but youve improved your credit since you first got it, you might be able to find a better rate by refinancing.