Why Creditors Do Not Want To Help You Fix Your Payment History

At this point, you may be asking, Ali, its just one stinking, lousy, ten-dollar 30-day late payment, and Ive always been on time and have been a loyal customer. Why wouldnt the creditor just not remove it?

Heres what you need to know The regulatory agencies constantly audit creditors.

If they find a company reporting their consumers as current despite them being late, then this can be interpreted as the company trying to conceal the defaults from shareholders. This may lead to a heavy regulatory fine for your creditor.

Unless youre avictim of fraud and or identity theft, the only way to remove a recent late payment from the credit report is by getting the original creditor to agree to remove the late payment.

And remember, will not work for late payments unless the late occurred over 4 years ago on a closed account.

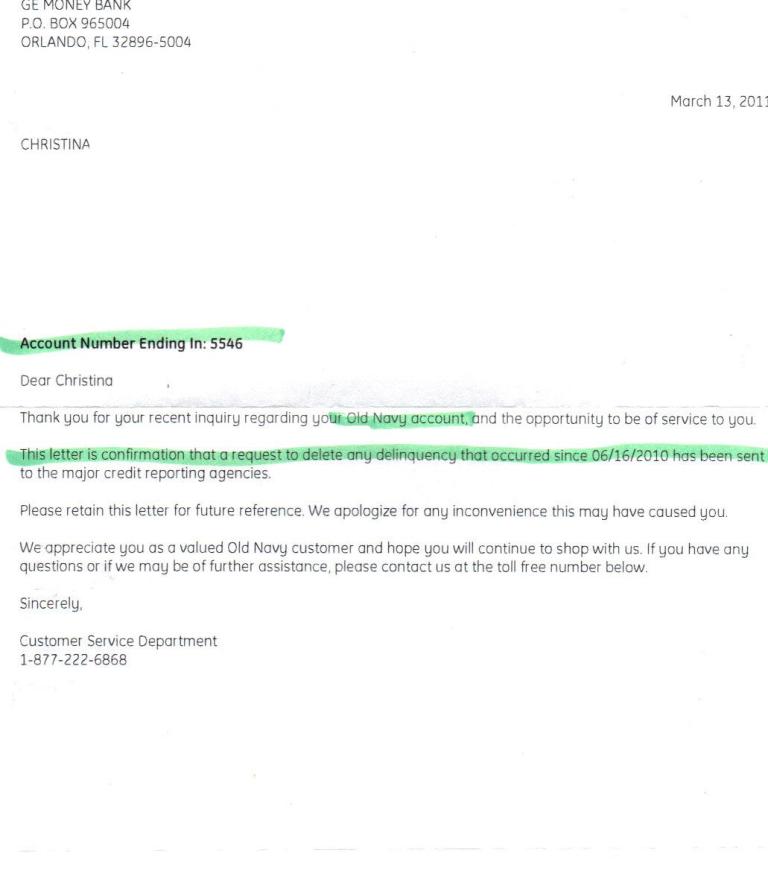

Luckily there is a way around this! I have had tremendous success in getting creditors, even stubborn ones like Barclays, JP Morgan Chase, and Capital One, to remove 30, 60, and even 90-day late payments.

I have done this by providing the creditors with a chronological letter, backed with proof, which explains the following:

1. Why the late payment occurred in the first place.

2. Why the consumer was not aware the bill was due.

3. What extenuating circumstances interfered in the situation.

4. Proof that the consumer had the financial capability to pay the bill.

Fortunately, I have laid out my strategy to remove late payments from your records below.

Should I Hire A Credit Repair Company To Remove Late Payments

Generally speaking, the only reason a credit reporting agency or a data furnisher, such as a bank, would remove a late payment from your credit report is that it is either incorrect or has reached its credit reporting time limit.

Before you pay a credit repair company to attempt to have your late payments removed, ask yourself a few questions:

- Are the late payments accurate?

- Has seven years passed since the date of the late payment?

- Does my lender have a record of these late payments?

If you answered “yes” to these questions, then it’s unlikely you’ll be able to have the late payments removed, whether you hire a credit repair company or attempt to do it yourself.

Check Your Credit Report To See If The Late Payments Are Accurate

To start, review your credit reports and the details about the late payments. Consider which account is being reported late, when the late payments were reported and the amount that was reported past due. Keep in mind, interest and fees can lead to larger past-due balances.

If you’re able to, review your own financial records about the account to see if there’s a discrepancy. While even being one day late is enough for some creditors to charge you a late fee and dole out other penalties, many won’t report an account as delinquent until it is 30 days past due.

Once a late payment is reported to one of the credit bureaus , it can stay on your credit report for up to seven years. Even if you later bring your account current, the payment you missed will remain in your credit history as a record of what happened.

Most negative information, late payments included, will be removed from your credit reports after seven years. Additionally, when a series of late payments leads to your account being closed, charged off or transferred to a collection agency, the entire account will be removed seven years after the first missed payment that led up that status. Chapter 7 bankruptcies stay on your credit report for up to 10 years, but the accounts included in the bankruptcy are also removed after seven years.

Recommended Reading: Navy Federal Personal Loan Approval Odds

How To Remove Settled Accounts From Credit Reports

How to settle the outstanding account and remove it from a credit report can be tricky because some accounts can only be removed in specific situations.

You must also look at if the account is affecting your score negatively or if its just hanging out and showing your payment history.

If the account has no direct effect on your score, its a good idea to leave it alone.

Settled accounts that provide payment history can actually be helpful in the long run and make your credit score rise.

This will show that you have a good history of payments and arent a risk to any finical situation.

As for the accounts that affect your score negatively, there areways to remove them before the 7 years are up.

Get Your Negative Items Professionally Removed

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Also Check: What Credit Score Do You Need For Apple Card

How To Dispute Inaccurate Information On Your Credit Report

You can also dispute any inaccurate information on your credit reports with the appropriate credit bureaus. Once a dispute is filed with the bureau, it will reach out to the creditor that supplied the information and ask them to verify it and respond to your claim.

If the creditor makes a change in response to your dispute, it must notify all other consumer reporting agencies to which it reported the information of the change.

Because each bureau handles disputes independently, you should check your report with each to make sure the changes have been made. If they haven’t, contact each of the credit reporting companies that are reporting the information separately to initiate a dispute with them.

Experian has an online portal you can use to submit a dispute, or you can file a dispute by phone, mail or fax if you prefer. Equifax and TransUnion have similar systems and options.

Filing a dispute is free, and you can attach or send copies of supporting documentation to verify your claim. However, some items that appear on your credit report typically aren’t disputable, such as correct legal names and addresses.

Once a credit bureau concludes its investigation, it may verify, update or delete the item in question. Disputes are generally resolved in 30 daysalthough they may be completed even sooner.

How To Remove A Late Payment From Your Credit Report

Having a late payment on your credit report can be devastating to your credit score. If you try to get credit in the future, late payments can be very detrimental to the process. Here are the basics of how to remove a late payment from your credit report.

Why Remove It?

If you have a late payment on your credit report, you may be wondering why it is so important to get it removed. After all, it is only one late payment. According to credit experts, if you have a late payment of over 90 days, this can be just as detrimental as a bankruptcy, lien, or other judgment against you. This can significantly lower your credit score and make it difficult for you to get a decent interest rate on a loan in the future. These late payments will stay on your credit report for at least seven years in most cases. Therefore, it is imperative that you get the late payments removed as soon as possible.

Get Your Credit Report

If you suspect that you have a late payment, you need to get a copy of your credit report. Sometimes, when you make a late payment, a creditor might not report it to the credit bureaus. This means that you need to determine if the late payment is actually showing up on any of your credit reports before going through the trouble of trying to get it removed.

Contact Your Creditor

Ask Them to Remove It

Negotiation

Dispute with Credit Bureaus

Read Also: Does Balance Transfer Affect Your Credit Score

Mortgage Lates Will Sink Your Credit Scores

- Late mortgage payment must be 30+ days past due to impact credit scores

- If youre only a few days late youll likely only have to pay a late fee

- So it typically doesnt happen by accident

- Impact will vary based on credit history and number/severity of late payments

Aside from having to pay any late fee associated with the overdue payment, youll also see your credit scores sink big time if youre 30 days late on the mortgage.

Depending on where your scores stood prior to the mortgage late, they could fall anywhere from 60 to 100+ points.

After 30 days, this delinquency information is relayed to the credit reporting agencies, at which point the damage is done.

Simply put, mortgage lates severely damage your credit score. And mortgage lenders and banks arent particularly keen on lending to homeowners who couldnt pay their home loan on time in the past.

However, because of the frequency of mortgage lates committed by homeowners in recent years, some mortgage lenders and banks now allow one 30-day mortgage late in the past 24 months before a subsequent home loan application. So theres a bit of leeway.

Unfortunately, that only allows you to be late on the mortgage once in the last two years.

What happens if you miss your payment more than once, or get a rolling late, which essentially counts for two late payments?

Or if you get a 60-day late, or worse? What do you do? In most cases, youll probably be denied a mortgage.

When To Consider Using A Goodwill Letter

When you send a goodwill letter to a creditor, youre asking them to do you the favor of removing accurate information from your credit reports. Your only hope is that the creditor will want to stay in your good graces and be willing to extend this courtesy. A goodwill letter also shows that you are willing to take some initiative when it comes to your credit health, and thats generally a good sign.

Typically, you should consider sending a goodwill letter to a creditor when youve made a late payment and have a good excuse. For example:

- You thought your bill was set up for automatic payment, but you were mistaken

- You switched banks and your payment was accidentally forgotten during the transition

- You moved and your bill never arrived at your new address

- You were in the midst of a balance transfer and you didnt realize your old balance wasnt paid off

- A financial crisis temporarily impacted your ability to cover your bills

In any case, your goodwill letter should ask for mercy and relief from an accidental late payment, but you should also be able to confirm the same mistake will not happen again. As a result, you should consider sending a goodwill letter when you are truly ready to take your credit seriously and never miss a payment again.

Also Check: Speedy Cash Access My Credit

Why A Goodwill Letter May Not Work

Weve heard from some readers who have said their credit card issuers say its illegal for them to remove late payments, or provide other similar reasons.

Its not illegal for a creditor or lender to change any information on your credit reports including late payment history. Credit reporting is a voluntary process. Theres no law that requires a lender or creditor to furnish data to credit bureaus. Theres also no law that requires the credit bureaus to accept the data a lender/creditor provides and include it on your credit reports.

Companies like lenders, creditors, and collection agencies must apply to be data furnishers with the credit bureaus. The application must be approved before a company can have information about their customers included on a credit report. When a company is approved to furnish data to the credit bureaus, the company has to sign agreements with Equifax, TransUnion, and Experian. The agreements say what a data furnisher is and isnt allowed to do when it comes to credit reporting.

Often, the credit bureaus will include language in their agreements which says a data furnisher agrees not to change accurate, negative account information. This is commonly the case for debt collectors, for example, who must agree not to delete a paid but accurate collection account simply because theyve received payment from a consumer.

Three Steps For Disputing Information On Your Credit Report

Under the Fair Credit Reporting Act, you have the right to a fair and accurate credit report. If you submit a dispute, the three credit bureaus are legally obligated to investigate the item in question. They must also forward any data you provide about the error to the data furnisher .

Here are the steps, in order, that you should take if you find an error on your credit report.

Also Check: Fedup-4u

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Late Payment Letter To Credit Bureaus Round 1

Send this letter to credit bureaus if any account is reporting a late payment. This letter requests that the credit bureau verify the late payment with the creditor. It also requests that the credit bureau remove specific kinds of inquiries and place a promotional suppression on your credit file.

Your Name

You May Like: Does Walmart Take Klarna

Hire A Credit Repair Professional

A final way to get a late payment removed from your credit report , is to hire a top-rated . Start by signing up for a free phone consultation to see what kind of help they can offer for your particular situation.

Make sure you have copies of your three credit reports on hand so you can give them the exact details. Chances are, theyll identify items that are easy to remove and set you up with a case facilitator.

Choosing a Credit Repair Company

When you choose a reputable credit repair service like Lexington Law, youll work directly with a qualified paralegal who actually does the majority of your casework.

There are a lot of perks that come with hiring a professional credit repair company. A huge one is that they get the job done quickly. This can be particularly helpful if youre repairing your credit in preparation for a major loan application like a house or car.

Youll also likely see better results with a credit repair company compared to going at it alone. Thats because they are trained legal professionals who work with bureaucratic credit reporting agencies and creditors every single day.

They dont risk being taken advantage of by anyone and know exactly what to say and what not to say. So if you have several late payments or just a few with other negative items listed on your credit report, its definitely worth getting a professional opinion.

Reviews

Ask Your Creditor For A Goodwill Adjustment

Perhaps the most effective way to get rid of a late payment is simply to ask. This tactic works best if you generally have a positive payment history with a particular creditor and just had a few blips in your payments.

To request a goodwill adjustment, write a formal letter directly to the creditor. While you can try this move over the phone, most customer service representatives dont have the authority to grant a late payment deletion. So, you would need to find a higher-level manager to have a real shot at it.

How to Write a Goodwill Letter

In your goodwill letter, include basic information like your name, contact information, account number, and dates of your late payments. Then, its time to get personal.

Explain that youve been a dedicated customer for so many years and that making a late payment is extremely rare for you . Its also helpful to identify specific reasons for your tardiness in paying.

Did you have an unexpected car expense that month? Or did you miss a lot of work due to an illness? Whatever happened, this is your chance to explain yourself.

Using a Goodwill Letter Template

While its great to follow a template for inspiration, make sure you also put your own spin on the letter. Keep it short and simple, while also sounding polite.

Also Check: Whats A Good Paydex Score

What If Its Not A Mistake

If you made a late payment and it shows up correctly on your credit reports, your chances of getting it removed are slim.

According to a TransUnion spokesperson, If late payment information is indeed accurate and properly reported by a lender, then it cannot be removed from a consumers report by the credit-reporting agency.

You may hear about ways to get an accurately reported late payment removed from your credit reports, but you should know that these methods are probably a scam.

Ultimately, you can avoid late payments on your credit reports by making sure you pay your bills on time and in full. One tip is to set up automatic payments for your credit accounts.

If you do pay late and a late payment ends up on your credit reports, you may be stuck for seven years until the late payment falls off. But its likely that the longer its been, the less impact a late payment can have on your credit, especially if youve since been working on building your credit with responsible use.