Length/depth Of Credit History

How long youve been using loans and lines of credit is important to the predictiveness of a credit score. For example, a good credit score based on years of information has a better chance of accurately forecasting a borrowers risk than a good score based on a month or two of information. Years of positive information also make the occasional mistake less damaging.

Bear in mind, however, that its not when you first used credit that really matters. Rather, credit scores generally use the age of the oldest open account on your credit report or the average age of your open accounts.

This, along with the types of credit you use, makes up the Depth of Credit portion of a VantageScore.

How Is A Business Credit Score Different From Personal Credit Score

A business credit scorediffers from a personal FICO or credit scorein the following ways:

-

Rating Agencies:Consumer lenders useTransUnion,Equifax, andExperian while business financing companies rely on Dun & Bradstreet, Experian, Equifax, and even their own proprietary formulas

-

Range:Personal credit scores range from 300 to 850. Business credit scores are from 0 to 100

-

Standardization:FICO or VantageScore are used by the majority of consumer credit bureaus. Business lenders, on the other hand, tend to develop their own standards or use rating agencies like Dun & Bradstreet to make their lending decisions. Nearly every small business financing lender uses a different formula

-

Access:You can see your personal credit score for free from multiple sources, but there are a limited number of sources available for viewing your business credit score. The three major business credit bureaus will all provide you with your score for a fee.

-

Data:While most small business financing companies only consider your business credit score or FICO score, some will look at both

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Also Check: Credit Carmax

How To Check Your Credit Score

Checking your credit score helps you predict how borrowers will view your applications for credit cards or loans. If you see that your credit score is lower than you want, you have an opportunity to improve your score before you take major financial steps, such as applying for a mortgage.

Avoid sites that claim to provide a free credit score if they mention a trial subscription or ask for your credit card information. You may be charged within a few days if you don’t take some action to stop the trial.

You can check your own credit score, and you should, through any of a variety of services. There are online sites that offer free credit scores. If you have a checking account, many banks will also offer customers a chance to monitor their credit scores through their online accounts.

Does Checking My Credit Scores Affect My Credit

Checking your credit scores and reports on Credit Karma wont hurt your credit its a soft inquiry. In fact, keeping tabs on your credit scores is a good way to spot potential issues early. For example, if your scores suddenly drop, it could be a sign that theres an error in your credit report information or that you may be a victim of identity theft.

Also Check: Sync/ppc On Credit Report

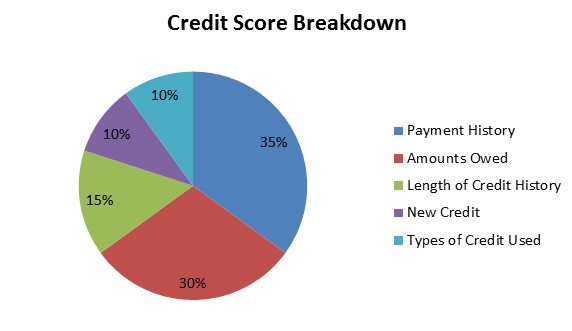

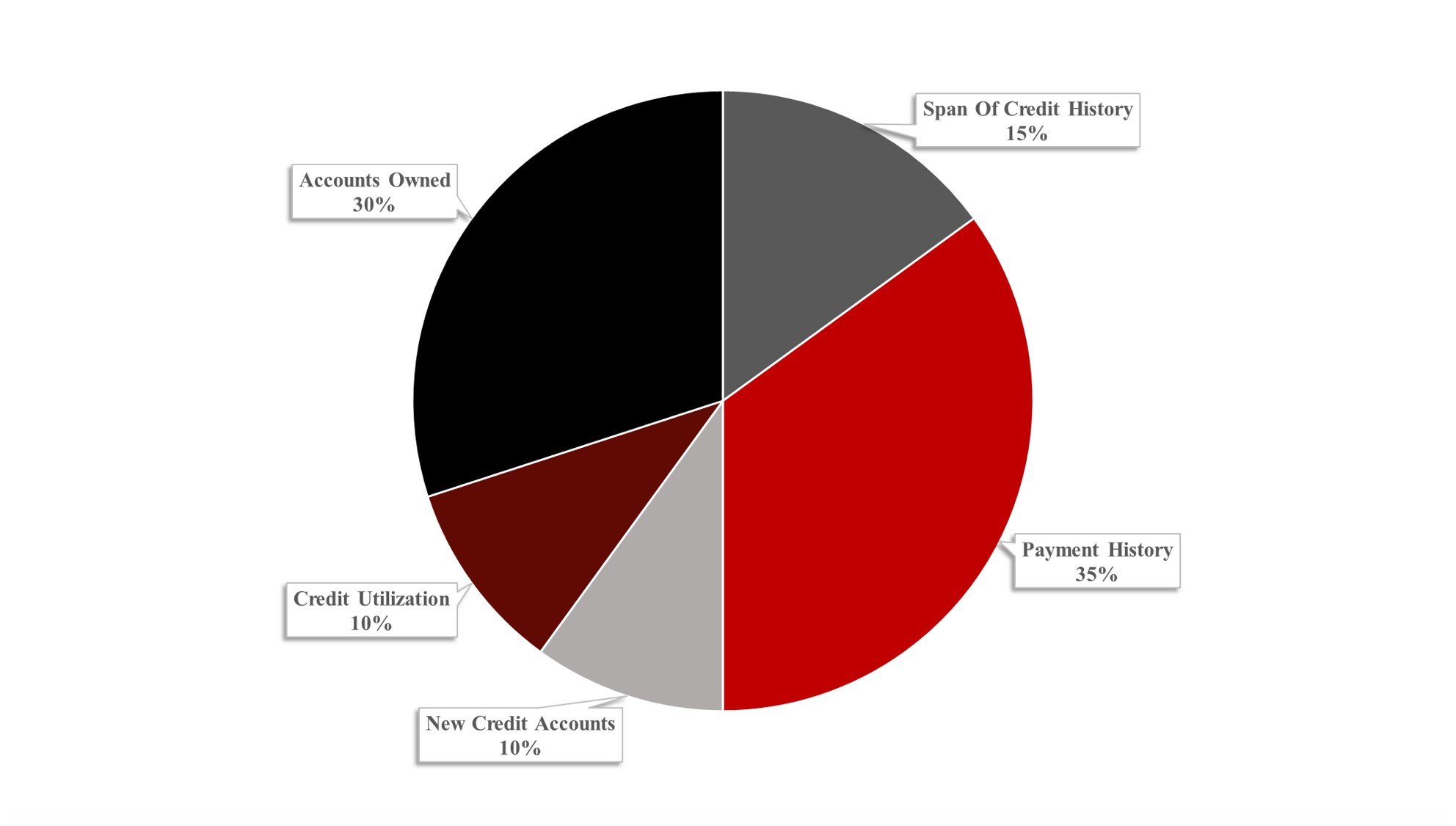

What Counts Toward Your Score

Your credit score shows whether or not you have a history of financial stability and responsible . The score can range from 300 to 850. Based on the information in your credit file, major credit agencies compile this score, also known as the FICO score. Here are the elements that make up your score and how much weight each aspect carries.

Fewer Credit Cards Are Better

Like many award-travel enthusiasts, I have numerous credit card accounts. In response to hearing that, some conclude that my credit must be terrible. They might be surprised to learn that I have excellent credit not despite my numerous accounts, but because of them.

Each account, when managed responsibly, adds positive information to my credit history and helps me to maintain my high credit scores. So if you have little-used accounts with no annual fee, theres really little reason to close them.

Look at it from the lenders perspective: Would you rather offer a new line of credit to someone with a very limited record of paying back loans, or someone with a very extensive history of managing multiple credit lines responsibly?

Don’t Miss: Business Cards That Don’t Report To Personal Credit

Why Your Credit Score Matters

For some people, a credit score might not be that important. If you never borrow money from lenders or use credit and rarely enter into leases then your credit score may not factor heavily into your personal finances. That said credit scores are very important for most people. Even if you haven’t ever had a reason to pay attention to your credit score, you are almost certain to run into a situation where it will matter. The biggest way a credit score impacts your life is by how it affects your ability to take on new debt.

Loan providers, creditors, and landlords will all be concerned with your credit score. The reason they care about your credit score is that without it, they have no way of knowing how reliable of a borrower you will be. If you have bad credit or you don’t have a credit history, lenders will be less willing to loan you money. They may also deny your loan or new credit card account application or approve you with higher interest rates.

How To Improve Your Credit Score

Improving your credit score can be easy once you understand why your score is struggling. It may take time and effort, but developing responsible habits now can help you grow your score in the long run.

A good first step is to get a free copy of your credit report and score so you can understand what is in your credit file. Next, focus on what is bringing your score down and work toward improving these areas.

Here are some common steps you can take to increase your credit score.

You May Like: Does Affirm Report To Credit Agencies

Factors That Affect Credit Scores:

FICO doesnt collect credit data on its own. Instead, it pulls your calculated by and crunches that information into a three-digit credit score.

While the inner workings of the FICO scoring system are a closely guarded secret, the company is open about the five general components of a FICO credit score and how big a role each plays in coming up with the number.

Heres a breakdown of the five elements of the FICO score:

Fdi Inflows Were At The Highest Level In October In India

Rupee depreciation to a record low level has resulted into a rise in the Foreign direct investment in India. In October 2018, the countrys FDI was at the highest level in six months as the benchmark stock index declined. As per the latest data from the Reserve Bank of India , Gross FDI inflows were $6.54 billion in October, the highest since $6.7 billion in April. Fall in the equity market and opportunistic buying doubled with the weakening rupee were some of the main reasons, India witnessed high gross FDI inflows in September and October, said Saugata Bhattacharya, chief economist at Axis Bank. In addition, there were a couple of large corporate acquisition deals in the previous months and possibly some early IBC resolutions. The rupee became Asias worst-performing currency on 11 October 2018 as it hit a record low of 74.48. However, this meant that a single dollar would have fetched more of the local currency, making sense for multinational companies to bring capital into India where they have units. Madan Sabnavis, chief economist at CARE Ratings stated that FDIs come based on opportunity and availability of investible funds. India still is fast growing with hospitable FDI rules, and the country offers better prospects especially for the long term. In November, the World Bank said India had climbed 23 positions in its Ease of Doing Business Index to 77th p

9 January 2019

Read Also: Does Paypal Credit Affect Credit

You Have More Than One Credit Score

At any given time, there are dozens of credit score models that can be used by lenders or insurance companies to evaluate applicants or customers. Theres no single accurate or real score the score lenders use depends on their needs at that time. If you opt to check your credit on Credit.com, youll see your VantageScore 3.0 credit score and your credit score from the credit bureau Experian.

Instead of obsessing about the number, look at what your score is telling you about your credit. Is it good? Not so good? Do you have things you need to focus on improving? Are there errors that you need to dispute?

What Affects My Credit Score

Every now and again, FICO scoring models get an update. At the moment, most auto and bank card lenders use FICO 8 models, while mortgage companies rely on FICO 2, 4 or 5. The newest iteration, FICO 9, isnt widespread yet.

Is 700 a good credit score?

If your credit score sits above the 700 mark, give yourself a pat on the backyoure doing pretty well. Youre firmly in the good credit score range on the FICO scoring model, so you should be eligible for some decent card and loan deals. Incidentally, the average credit score in America was 710 in 2020.

You May Like: Removing Hard Inquiries From Your Credit Report

What Is The Average Credit Score For Young Adults

There are two main models to score your credit: FICO and VantageScore. Under both models, the highest credit score you can get is 850. But, as a beginner building credit, no one expects you to have a perfect credit score!

According to Value Penguin, the average credit score for people aged 18-23 is 674. This would be considered a Good credit score on the FICO model:

- 800 to 850 Exceptional

- 580 to 669 Fair

- 300 to 579 Very Poor

If youve never opened a line of credit and your starting score falls in the Fair or Very Poor range, speak with a financial professional. There could be an error on your credit report or you might be a victim of .

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: What Credit Bureau Does Paypal Credit Use

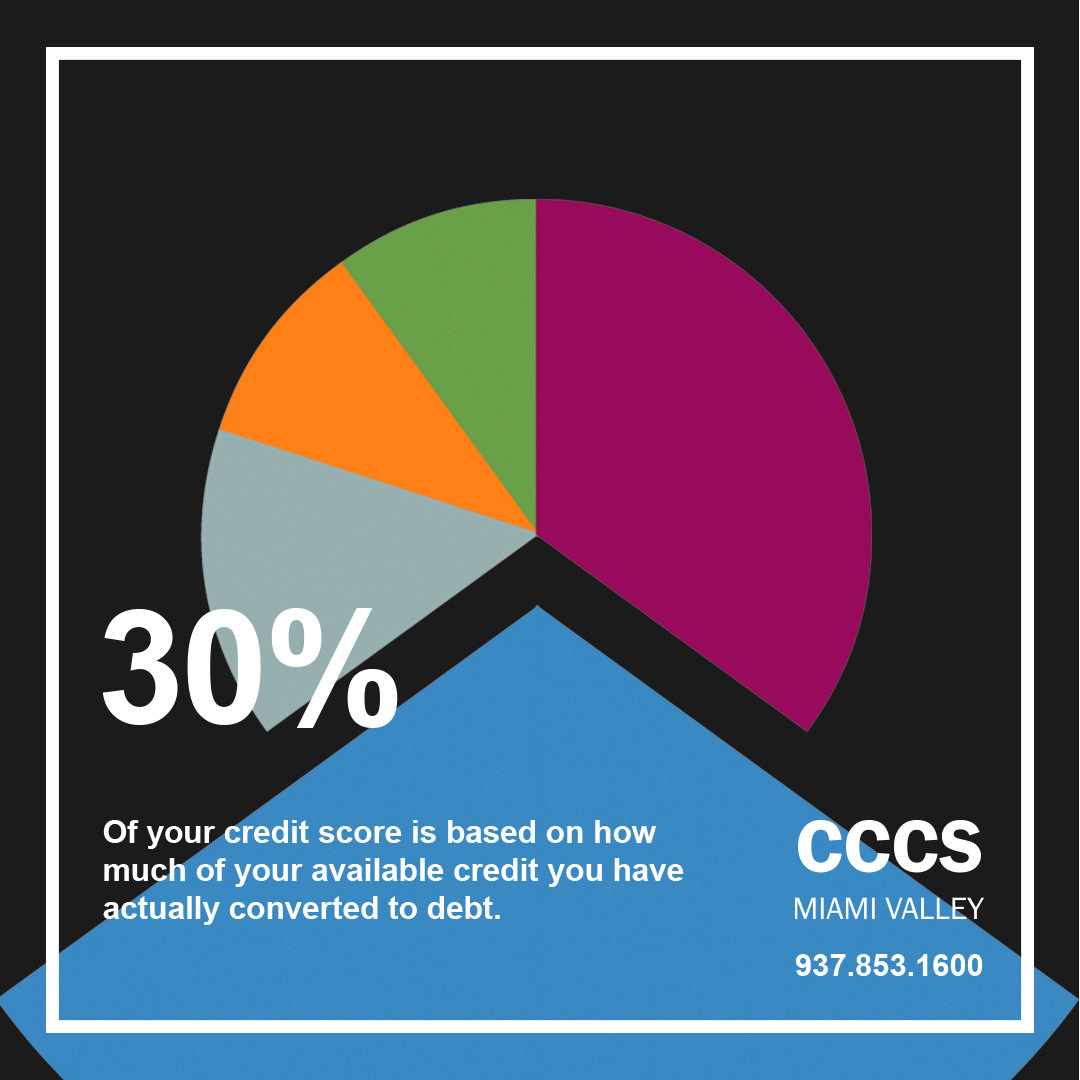

How Much Is Owed

When you apply for credit, how much you already owe really matters to a lender. Your current payments will determine if you can manage any more payments in your budget for the additional money you borrow.

While you might think that you can handle more credit, statistically speaking, theres a chance you might not be able to. If you are close to maxing out all of your credit cards or your line of credit, it means that you are a higher risk to lenders. Higher risk to a lender means that theres a greater chance that you wont keep up with your payments.

Another aspect of this part of your credit score reflects how much of your available credit limits you use on an ongoing basis. If you usually use 60% or more of your credit limit on a credit card or line of credit, it will impact your credit score negatively. This is because if something were to happen to your income and you owe a lot of money, you would find yourself struggling to keep up with payments.

What Goes Into A Credit Score Can It Be Improved

There are a couple of different words that can follow the word credit, and the difference is important to understand. What goes into your credit score is different than how your credit report is determined. A credit report shows the payments you have made over time, while your credit score is a number that measures and qualifies your creditworthiness as it compares to others.

Your credit score will be a three-digit number, and its used by lenders to make a decision on whether or not to approve you for a loan. It communicates how likely you are to repay them and, in theory, demonstrates how reliable you are as a candidate for a loan. The higher your score, the more likely a lender is willing to loan you funds. A higher number is a favorable indicator that you are creditworthy and can be trusted to repay the full amount in a timely and reliable manner. This number can also even determine the terms at which youre offered a loan. It can mean a lower interest rate or other perks for having a good credit score.

These days, its also more than just lenders that take a look at your credit score. Sometimes landlords, employers, and even insurance firms look at the credit score as a measurement of how responsible they can presume you to be.As for what goes into a credit score, lets take a deeper look at the factors that contribute to the number that represents you.

Don’t Miss: Does Zebit Report To Credit Bureaus

Types Of Credit In Use: 10%

The final thing the FICO formula considers in determining your credit score is whether you have a mix of different types of credit, such as credit cards, store accounts, installment loans, and mortgages. It also looks at how many total accounts you have. Since this is a small component of your score, don’t worry if you don’t have accounts in each of these categories, and don’t open new accounts just to increase your mix of credit types.

Who Calculates Your Credit Score

The three main credit reference agencies – Experian, Equifax and Callcredit – use different methods for working out credit scores, which means there isnt a single magic number you can turn to. Check out our guide on how to check your credit score if youve not done it before.

Whatever the number, the rule of thumb remains the same higher scores indicate lower risk, and vice versa. You can check your credit score for free with some credit reference agencies.

Also Check: Does Barclaycard Report To Credit Bureaus

Getting Your Credit Score Has Never Been Easier

Developed by Fair, Isaac, and Company in 1956, the FICO scoring system initially flopped. Credit bureaus didnt adopt FICO until 1991, and consumers didnt gain on-demand access to bona fide FICO scores until much later than that. Now, thanks to the internet, you can see your FICO score in minutes. Lets explore two ways to get your score right now.

What Else Do Mortgage Lenders Consider

Your credit score is a key factor in determining whether you qualify for a mortgage. But its not the only one lenders consider.

Income: Lenders will also look at your income. They want to make sure you make enough money each month to afford your payments.

Debt-To-Income Ratio: Lenders also look at your monthly debts. Lenders vary, but they generally want your total monthly debts, including your estimated new mortgage payment, to consume no more than 43% of your gross monthly income. If your debt-to-income ratio is higher, you might struggle to qualify for a mortgage.

Down Payment: The bigger your down payment, the more likely it is that youll qualify for a mortgage with a lower interest rate. Thats because lenders think you are less likely to stop making your payments if youve already invested a significant amount of your money into your loan. A higher down payment, then, makes your loan less risky for lenders.

Savings: Lenders want to make sure that you have funds available to make your mortgage payment if your income should unexpectedly dry up. Because of this, most will want to see that you have enough money saved to cover at least two months of mortgage payments.

Employment History: Lenders vary, but they usually like to see that youve worked at the same job, or at least in the same industry, for at least 2 years. They believe youre less likely to lose that job, and that stream of income, if youve built up a longer work history.

Recommended Reading: Minimum Credit Score For Carmax