Is It Hard To Get Approved For Furniture Financing

Bad credit can make it tough to finance a furniture purchase. If youre willing to shop around, however, you can find reasonable financing deals from retailers, loan marketplaces, and credit card issuers so you can get the furniture you need. Compare personal loan rates from multiple lenders in minutes.

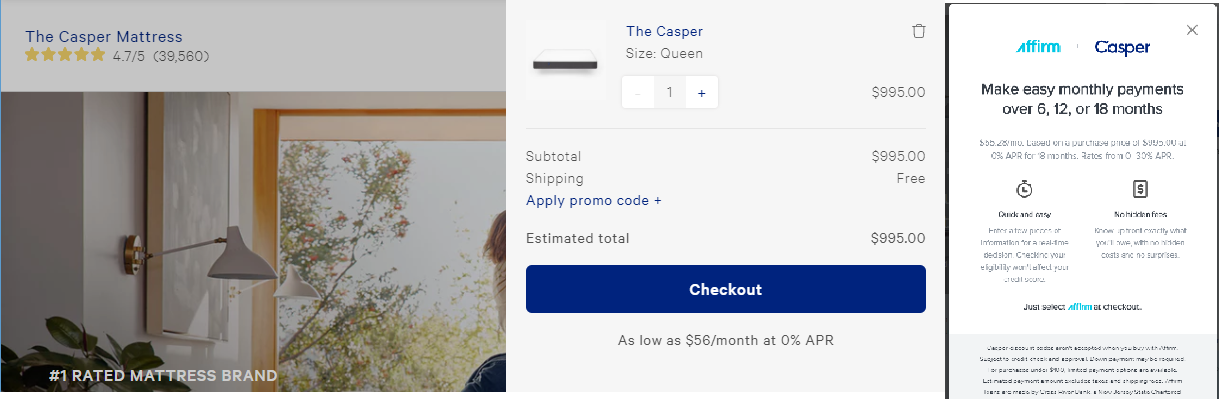

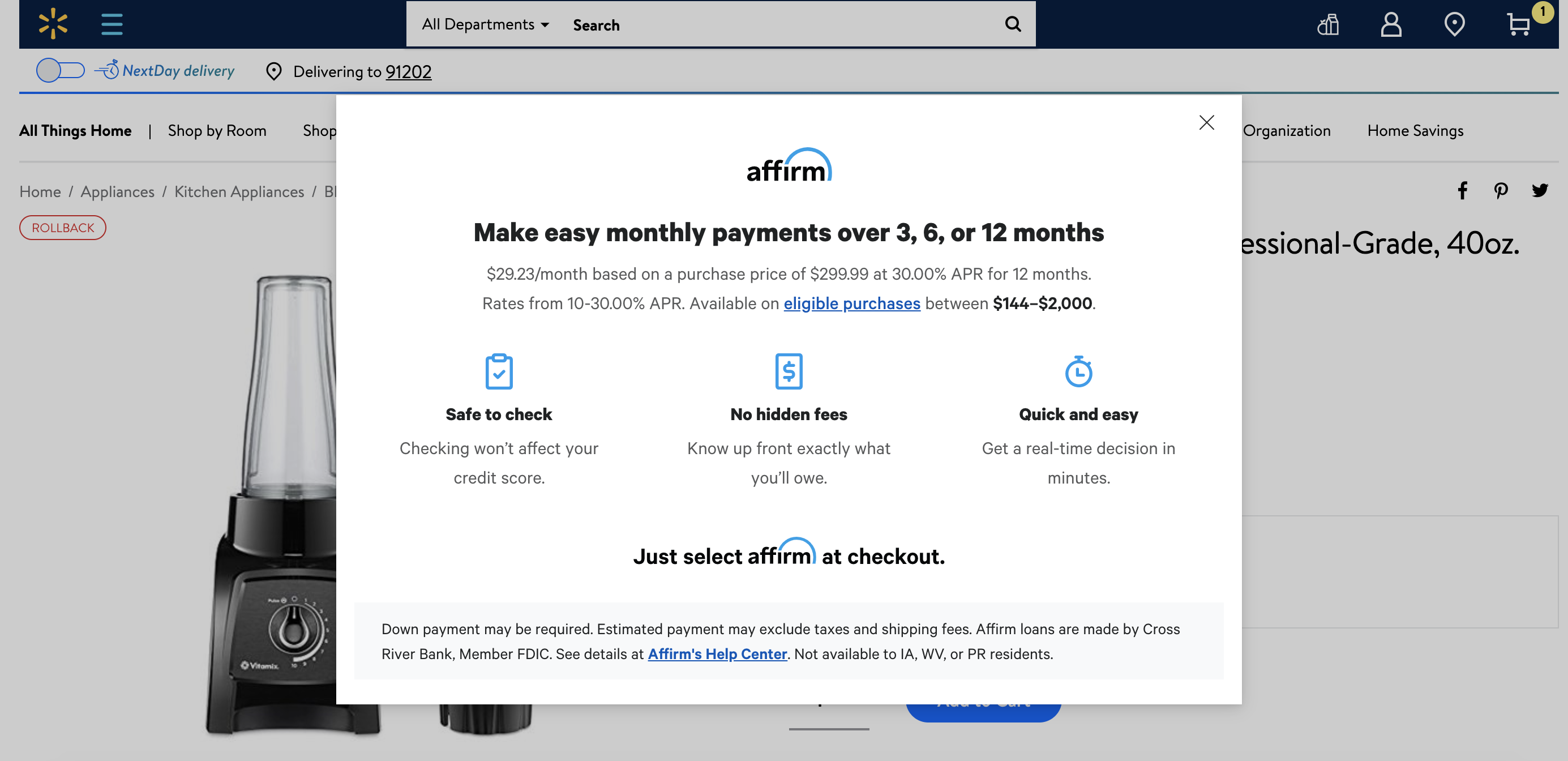

Affirm Personal Loan Rates Terms And Fees

Affirm provides personal loans with interest rates from 10.00% – 30.00% with no other fees. Depending on the retailer, some Affirm loans offer a 0% APR, which could be a good option for consumers who need time to pay off the loan. Generally, loan terms are 3, 6 or 12 months ; but select merchants may offer different terms, such as a 30-day payment option for purchases under $50. If a retailer allows you to use Affirm for purchases between $50 and $99.99, you must choose between a loan term of 0.25 months or 0.25 months.

| Loan Amount Range |

|---|

| Yes |

Does Klarna Perform A Credit Check On Me And Will This Affect My Credit Score

As a responsible lender, we want to make sure were helping our customers make the right financial decisions for their circumstances. When a credit check is performed, we verify your identity using the details you provided and we look at information from your credit report to understand your financial behaviour and evaluate your creditworthiness.

Depending on the payment method or service you choose, we may perform different types of searches to check your financial standing. You can find an overview of the credit checks we run for our payment options and services and whether they impact your credit score below.

- Creating a One-time card

- Taking out a Covid-19 related payment holiday.

For the above mentioned, we will perform a credit check will not be visible to other lenders and therefore wont impact your credit score in any way.

Using Klarna might affect your credit score when:

- Applying for one of our Financing options.

- Taking out a standard payment holiday for our Financing options.

If you decide to use Financing, we might perform a credit check with credit reference agencies to complete your credit assessment. This credit check will show up as an inquiry on your credit report, will be visible to other lenders and might impact your credit score.

These checks are performed in accordance with Klarnas Terms & Conditions.

Was this article helpful?

Don’t Miss: Transunion Credit Report Without Ssn

How Does Affirm Approve Borrowers For Loans

Affirm will ask you for a few pieces of personal information your name, email, mobile phone number, date of birth, and the last four digits of your social security number. Affirm uses this information to verify your identity and to make an instant loan decision. Affirm will base its loan decision not only on your credit score but also on several other data points about you. This means you may be able to obtain financing from Affirm even if dont have an extensive credit history.

Do You Pay Interest With Affirm

Interest on loans through Affirm are only charged interest on the purchase amountor, principal balance. It’s why we can be transparent about the total cost at the time of credit approval, even before the user accepts it. And because we never charge any late or penalty fees, that amount will never change.

Read Also: Does Paypal Credit Report To Credit Bureaus

Dont Consider A Travel Loan If:

-

The APR on the loan is high: Consumer advocates say that a 36% APR is the highest rate a loan can have and still be affordable, but even a lower rate is sometimes not worth the cost. For example, a $3,000 loan with a 15% APR paid over 12 months would cost $250 in interest.

-

Youre struggling to pay off your current debt: If you carry a balance on credit cards or other loans, be careful about agreeing to more monthly payments. Too much debt can lead to a cycle of missed payments, fees and collection calls.

-

It tempts you to spend more than you can afford: A fly now, pay later loan can make it seem like youre spending less than you really are, since you dont have to pay the full amount upfront.

-

It takes money from your other goals: If the extra payments for this trip would eat into your emergency fund or other savings goals, it may be worth postponing the trip and saving up instead.

Also Check: Fingerhut Guitars

What Are The Benefits Of Using Affirm

;;;;;For more information about Affirm and their policies, please refer to their FAQ page.

Also Check: What Credit Score Does Carmax Use

Affirm Can Help You Avoid The Siren Song Of Minimum Payments

Ideally, you might have access to;a credit card with an introductory APR of 0% for 12 to 15 months. Then youd be able to finance your purchase without paying any interest, provided you were able to pay it off before the introductory period ended and your interest rate shot up.

However, if you dont have access to those kinds of offers, or you know youre liable to give in to the siren song of making only minimum payments and pocketing the extra cash to spend elsewhere, then Affirm might be the better deal for you.

Affirm offers you concrete terms and a set repayment plan with a fixed monthly payment over a fixed amount of time. No need to worry about your own willpowerthis will just be another monthly bill that is due in full. Do you ever waffle on paying your electric bill? I hope not.

Thats not to say that using Affirm is completely risk-free, however. Like any credit product, it needs to be used responsibly.;If youre a seasoned professional musician whose amp just got stolen on the first week of your comeback tour? Using Affirm to buy a new one is a no-brainer.

However, if youre a CPA who once played tuba in high school whos convinced you could be the second coming of Jimi Hendrix, if only you could get that sweet electric guitar youve been eyeing? Maybe rethink it. Making foolish purchases via Affirm is only slightly smarter than making them via a credit card with a high APR and major late fees.

Why Does Affirm Keep Denying Me

The main reason Affirm usually denies payment is that their systems cannot verify who you are. To complete payment via Affirm the company must be able to confirm your identity so they can check that you are credit worthy. In most cases, your full name, address and phone number is enough to check your identity.

Don’t Miss: Does Carmax Check Credit

Do Not Pay Your Accounts In Collections

If a collection agency will not remove the account from your credit report, dont pay it! Dispute it! A collection is a collection. It doesnt help your score AT ALL to have a bunch of collections on your report with a zero balance. The only way your credit score will improve is by getting the collection accounts removed from your report entirelly.;

Dont pay collection accounts without a pay for delete letter. A pay for delete is an agreement that you will pay the outstanding debt if the collection company deletes the account from your report. You may be able to settle the balance for less than you owe, but many will want you to pay in full if they are deleting it from your report.

Also Check: How To Get Credit Report Without Social Security Number

Can You Have 2 Afterpays At Once

Yes you can, Afterpay will monitor your account. If you are up to date with your payments you have the option to have multiple orders running simultaneously. In the case that you have overdue payments or too many scheduled payments Afterpay will decline your application and provide you with the reason.

Don’t Miss: Which Business Credit Cards Do Not Report Personal Credit

Trying To Build Credit Don’t Count On Some Silicon Valley Lenders For Help

Like many of her peers, 20-year-old Vanessa Montes de Oca doesn’t have a credit card. In her case, it’s not for lack of interest or even lack of trying.

She’s already been rejected for several credit cards, which she chalks up;to her lack of;credit history. She’s also part of the under 21 pack, which makes it much tougher for her to get a card in her own name;thanks to a;2009 federal law.

Still, the fashion design student likes to shop. And companies like Affirm, PayPal and Klarna are happy to help her do so, positioning themselves as a sort-of digital alternative to credit cards for the Millennial crowd.

What these Silicon Valley financiers;don’t advertise, however,;is that they won’t help you;build conventional credit. When you;make on-time payments on a regular credit card, it’s beneficial to;your;credit score.;”It’s like the sun rising in the East and setting in the West,” says credit expert John Ulzheimer. That’s not the case with these companies, whose policies are all over the lot and aren’t made sufficiently clear.

When Montes de Oca first learned;about;Affirm, she was checking out at her favorite online clothing retailer UNIF;and it appeared as a payment option. She never used to be able to buy too much at once.;”It’s a;little more on the expensive side,” she says of the store.

Part of what’s;incentivized her to do so: She thought;it;would help;her credit score.

Does Affirm Report Your Activity To Credit Bureaus

Affirm generally will report your payment history to one credit bureau: Experian. There are a couple of cases where it won’t, however:

- You’re paying back a four-month loan with biweekly payments at 0% APR.

- You were offered just one option of a three-month loan at 0% APR during checkout.

If you pay late, Affirm will report this to Experian without exception. In the two cases above; you don’t get any credit for making on-time payments, but, if you pay late, Affirm will report this.;

Recommended Reading: Does Klarna Report To Credit

Does Affirm Show On Credit Report

Affirm may show on your credit report. If you received an installment loan with an interest rate above 0% with 4 bi-weekly payments or over a 3 month payment period, it likely will not show up on your report. In all other instances, Affirm installment loans will show up on your credit report with Experian.;

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

You May Like: What Credit Report Does Comenity Bank Pull

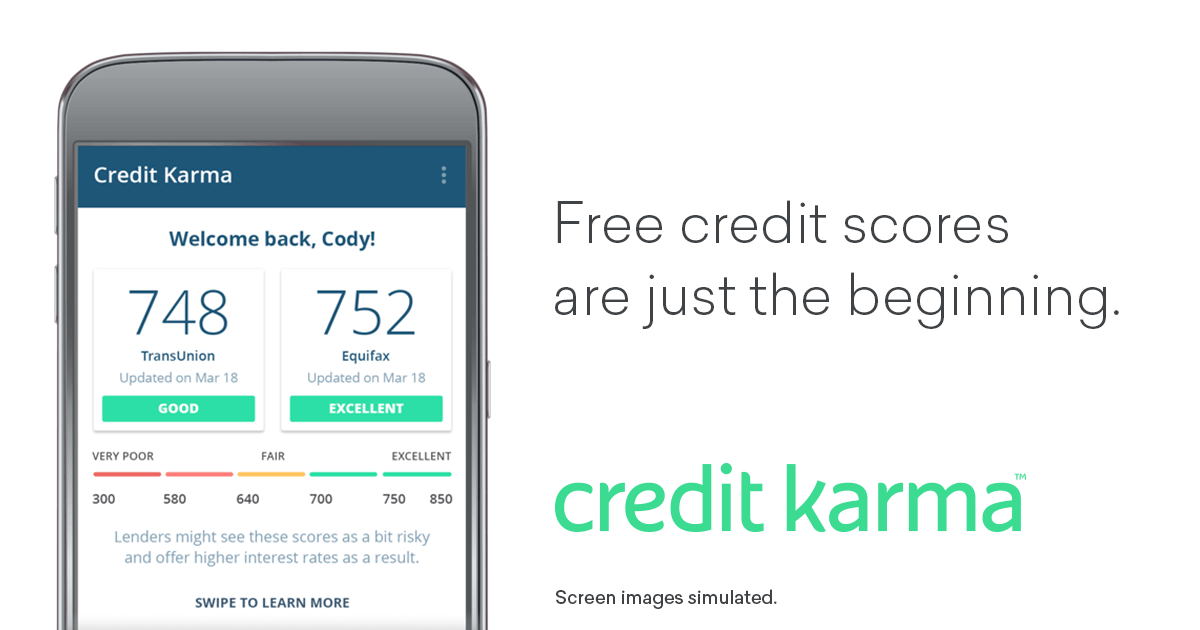

Start Raising Your Credit Score Today

An Affirm loan is a quick and easy way to finance large purchases at point-of sale. Offered at over 2,000 companies including Walmart, Wayfair, Casper, and Expedia, Affirm is known for requiring a soft credit check with no hidden fees.;

In the sections below, we will discuss the Affirm loan in greater detail as well as how it will affect your credit.;

What is an Affirm loan?

An Affirm loan is a point-of-sale payment plan that consists of monthly installments for consumers who are new to credit and want to make a large purchase. The companys point-of-sale financing appeals to many new buyers with since there is no minimum credit score required and no prior credit history requirements.;

Affirm uses what is called a soft credit check, a soft credit inquiry that doesnt affect your credit score, to process their borrowers applications for approval.;

Lenders at Affirm will also take a look at the extent of your credit and payment history. The company might even ask for a deposit or want to peer over your bank transactions to get a general idea of your spending habits before offering you a loan.

If youve already used a lot of credit and arent the sharpest at making payments, theres a good chance you wont get approved.;

Pros and cons of Affirm personal loans

If youre trying to decide if an Affirm loan is the right choice for you, weigh the pros and cons. Here is a quick breakdown:

Pros:

Cons:

A few other things you should know about Affirm loans:

TELL US,

How Can You Use Klarna At Walmart In

The process for using Klarna at Walmart is similar to the method for Quadpay. You have to first install the Klarna app and search for the Walmart store inside the app.

Once there, you can either add items to your cart and proceed to Pay with Klarna or specify the total amount you want to pay in-store at Walmart.

Once you have completed the initial transaction, you will have the freedom to complete the purchase through 4 easy installments, with each paid once every 2 weeks.

You May Like: Paypal Credit Soft Or Hard Pull

Is There A Credit Limit

Affirm does not have a set . Instead, the company decides your eligibility and loan limit on a case-by-case basis, considering factors like your credit score, past payment history on Affirm loans, and your ability to pay. This means that you may be able to be approved for more than one loan at a time, depending on your situation.

You can boost your odds of approval for future Affirm loans by paying off your current Affirm loans on time and working to increase your credit score.;

Applying For Buy Now Pay Later Financing

Making a loan application can affect your credit if the business pulls your credit information to approve your application. Some retailers that offer buy now, pay later financing may not require you to fill out a formal credit application. In that case, there wont be a on your credit report.

If youre asked to enter your social security number to applyeither your full social security number or the last four digitsthat signals your credit will be pulled to approve the application. The credit check results in a hard inquiry to your credit report and may cause your credit score to drop a few points. Inquiries are about 10% of your credit score and remain on your credit report for the next two years, though they only affect your score for 12 months.

Read Also: Does Zebit Report To Credit

You May Like: Aargon Collection Agency Scam

Account Not Showing On Your Credit Report Here’s Why

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina. He is a CFP, registered investment advisor, and he owns his own financial advisory firm. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

When you’re reviewing your , you may notice;that some of your financial accounts don’t show up. In some situations, you may see accounts on your credit report from one bureau but not on the other two. Or, there may be accounts that dont appear on any of your credit reports from any of the major credit bureaus.

There are a few explanations for this, and it’s all based on how credit reporting works.

Affirm Is Straightforward About What You Will Pay

Affirm promises you wont be hit with any hidden fees or prepayment penalties. For instance, if you come into an unexpected windfall and decide to use it to pay off your Affirm loan, Affirm is cool with that. They wont charge you a fee for denying them the additional interest.

Affirm wont even hit you with a late fee if youre late with a payment. They will, however, probably not opt to give you another loan in the future. They also do not offer extensions on your loans, so be sure you pick a term long enough so your monthly payments arent a burden.

Affirm is also an alternative to;personal loans;that offer fixed repayment terms and, in some cases, better interest rates than credit cards for borrowers with excellent credit. Affirm is attractive because it may offer you financing at the point-of-sale, whereas;a personal loan takes between 24 hours and;a week to get approved.

You May Like: Is 586 A Good Credit Score

Affirm And Your Credit Score

When you sign up for an Affirm point-of-sale loan, you are taking a credit instrument. But Affirm doesnt perform a hard credit check, only a soft pull on your credit information, so simply taking out the loan will not affect your score.

However, if you pay back the loan on time, youll experience a boost to your credit score, which helps you get financing from the banks. Its important to note that the converse is also true. If you dont pay back your loan on time, miss payments or are late with payments, it will affect your credit score negatively.