Secured Credit Cards And Student Credit Cards

You cannot add authorized users to secured credit cards or student credit cards. Because these cards have low credit limits, they are a less-risky way to build credit. Only making small purchases and paying your balance in full each month are the best way to maximize these card options. These two types of credit cards can improve your credit score quicker than being an authorized user on another credit card.

Understand What Can Change Your Credit Score

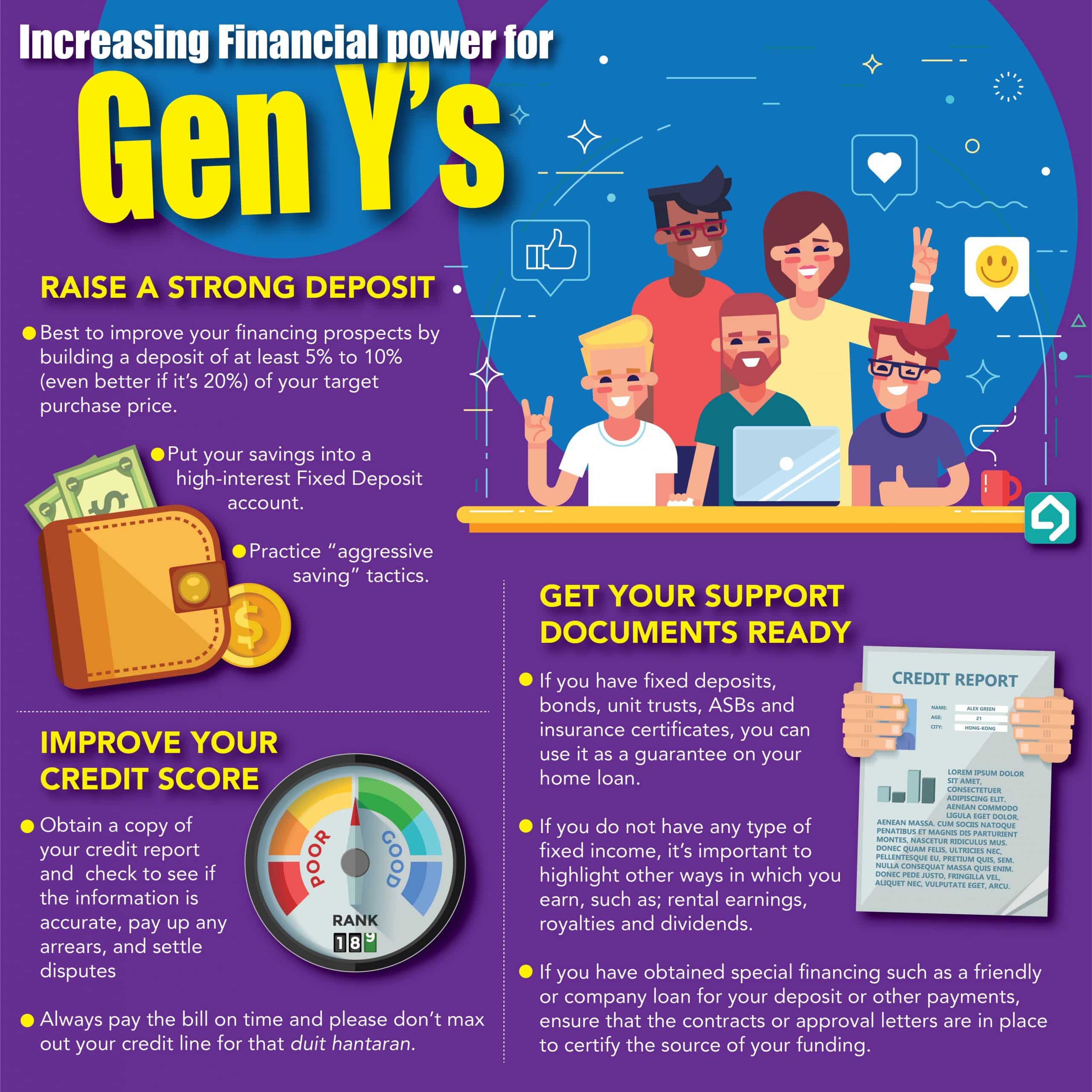

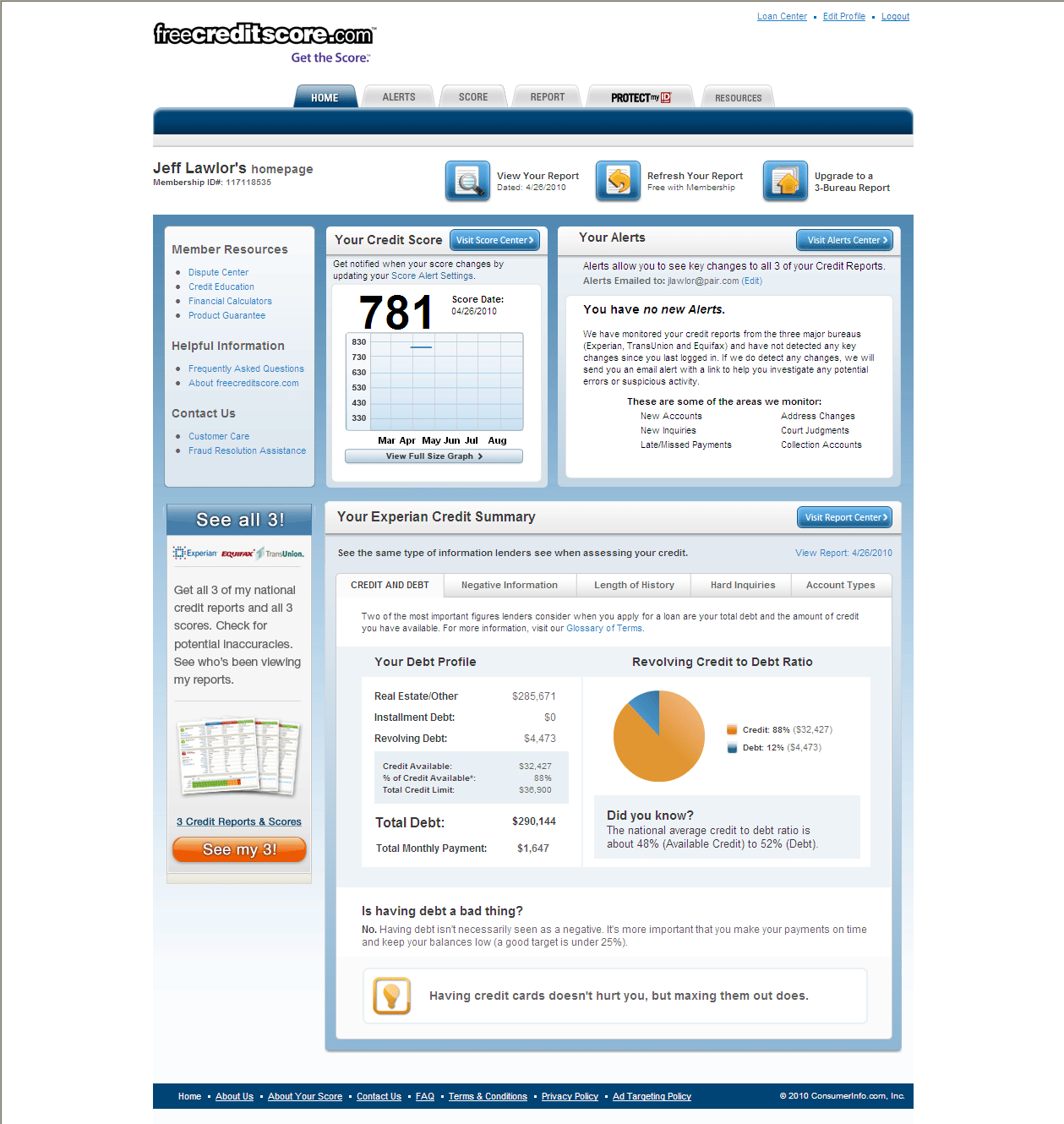

A good first step toward understanding your credit is checking your credit reports, which are generally available online from a number of reputable institutions. Youre entitled to free credit reports once a year from each of the three credit bureaus. You can check the report for mistakes to flag, such as a bill you paid but is mislabeled as unpaid, or someone elses information mixed with yours.

These errors could be dinging your credit score through no fault of your own. Reporting those errors is an important step.

Here are five other common reasons why your credit score may have dropped recently.

Re: When Does Discover Report Your Account Opening To Credit Bureaus

Opened 1/24

Received and activated card 1/29

First statement cut 2/6

Reported 2/7 just in time for my monthly 3b pull.

Sidenote â Amex was opened the same day, claimed 2-3 business days to get the card whereas Disco said 3-5, i got the Disco firstâ¦. and Amex still hasnt cut a statement yet or reported

Received and activated card 1/29

First statement cut 2/6

Reported 2/7 just in time for my monthly 3b pull.

Sidenote â Amex was opened the same day, claimed 2-3 business days to get the card whereas Disco said 3-5, i got the Disco firstâ¦. and Amex still hasnt cut a statement yet or reported

AMEX reports after the second statement.

And, OP my Discover reported after the first statement cut.

Donât Miss: Does Paypal Credit Report To Credit Bureaus

You May Like: What Credit Score Do You Start Out With

Summary Of Capital One Reports Business Credit Activity

Capital One reporting your business credit activity to your personal credit reports can temporarily penalize your credit situation. You will need to be smart with how you use your Capital One business credit card and time your future credit card applications. Having another best small business credit card can give you more flexibility in building business credit with minimum effect on your personal credit.

Why Timing Is Important

This is why understanding when the information on your credit card usage shows up on your credit report is important.

The reason your score has dropped in the suggested scenario is a high the balance you carry on your credit card compared with that cards credit limit. This ratio is expressed in a percentage and considered the second most influential factor in credit scoring after payment history.

Its generally recommended to utilize less than 30% of your credit to avoid damage to your scores. Ideally, you want to keep the ratio in the single digits.

Reported drastic changes in credit utilization can affect your credit score immediately and significantly. For example, if you havent been carrying a lot of credit card debt and then maxed out a credit card, your scores could take a hit. On the other hand, if your credit issuer has reported that you paid down a large part of your debt, you may see immediate positive results.

Fluctuations in your credit score can also be crucial when youre shopping for a loan, such as a mortgage or car loan. If your credit score is close to a FICO score threshold, even a small negative change can push you into a higher credit risk profile, which could increase your interest rates or even hurt your approval chances.

Recommended Reading: How To Add Utility Bills To Your Credit Report

Also Check: Does Walmart Credit Card Report Authorized Users

Dont Max Out Your Credit

While you want your credit score to be higher, you want your credit utilization ratio to be lower. That ratio is the percentage of your available credit that you spend. Look at it this way: If you have a credit limit of $1,000 and you spend $500 before you pay the bill, thats a credit utilization ratio of 50 percent.

But, not using credit at all often doesnt help, since you arent building a track record of responsible credit usage. Generally, its recommended that you use as little as possible of your available credit as a low credit utilization ratio indicates that you arent overspending and are doing a good job of managing your budget.

Here are some tips to keep that ratio low:

- Ask to increase your credit limit. If your credit limit goes up but your spending stays flat, your credit-utilization ratio will fall.

- Pay your bill more often. Rather than racking up a larger bill that you pay each month, you can pay in smaller installments multiple times per month. This keeps the balance that your credit card company reports to the credit bureaus lower.

- Charge less on your card. A simple way to keep that credit utilization low is to minimize how much youre charging each month.

Alternatives To Discover Credit Cards

While Discover has a great selection of credit cards, it lacks in some areas, such as travel and rewards. Other great alternatives include American Express credit cards, Chase cards or Citi cards. Youll find some great cards to help fill in the gaps that Discover lacks. Or if youre not sure if Discover products are right for you, compare credit cards from other providers.

You May Like: Which Credit Score Do Lenders Use

What You Can Do

If youre concerned about your credit utilization in relation to credit reporting, you might consider asking your credit card issuer for a higher credit limit. Having more credit available and not using as much may help boost your credit. Just be sure to do your research first. And keep in mind that having more available credit could actually hurt your scores if it tempts you to rack up more debt.

Additionally, you can make multiple payments throughout the month to lower your overall balance. That way, when the balance is reported to the bureaus, your credit utilization is in good shape.

If you want to get a better handle on your credit, you can always check your credit reports from Equifax and TransUnion on and dispute any errors you see.

Is It Beneficial To Know When Discover Will Report To Credit Bureaus

Having knowledge of when Discover will report to bureaus can be beneficial if you want a particular to be reported.

In particular, it is common for consumers to pay their credit card balance down to zero at the end of every billing cycle.

This demonstrates that they can reliably service their debt, and in turn it will result in an improvement to their credit score.

This also has the added benefit of decreasing interest payments in the long run.

Most consumers may also have multiple credit cards with Discover and perhaps other banks which they exploit by using the AZEO method in another attempt to improve their credit score.

This method involves keeping one credit card between 1% to 8% credit utilization and all others at zero balance.

Of course throughout any billing cycle, you may well be using all of your credit cards, which means your balance will constantly be changing.

The theory behind the AZEO method is to reduce the balance on all credit cards to zero except for one, before the end of the statement due date.

Doing so has the effect of improving ones credit score.

Consumers usually prefer to implement the AZEO method just before applying for another credit card or loan, in order to raise their credit score and decrease their likelihood of receiving adverse reasons for denial of credit.

Also Check: How To Dispute Credit Report Errors Online

Why Knowing When Credit Card Companies Report To Credit Bureaus Is Important

Knowing when credit card companies report to credit bureaus can clear up some confusion you may have with your credit reports. Have you ever checked your credit reports and seen a balance, but you know you pay off your card every month in full?

This is likely because credit card companies provide a snapshot of your current balance when they report to the credit bureaus.

So, if youre concerned about how this snapshot of your balance may affect your credit, consider keeping tabs on your spending by your statement closing date. You could also make a payment before your statement closing date, so your balance is lower when its reported. Keeping a low balance can help your credit overall.

Why? Because when it comes to your credit scores, one important factor is your credit utilization.

How Credit Updates Work

The businesses you have accounts withcredit card issuers and lenderssend your updated account information to the at different times throughout the month based on their own schedule. Information in your account updates includes your current balance, payment status, and credit limit. New inquiries to your credit stemming from any applications youve submitted are also reported to the credit bureaus. After receiving updates, credit bureaus compile that information and adjust your credit report accordingly.

You can dispute inaccurate or incomplete information to remove it from your credit report. If you dispute an item, the results of a dispute will update as soon as the credit bureau completes the investigation. This credit bureau has 30 days to complete its investigation and, in some cases, may have an extra 15 days to investigate.

Also Check: How To Remove Repossession From Credit Report

Read Also: Is 660 A Good Credit Score

Re: When Does Discover Report Balances

Thanks, CD.

Yapsalot… you mention that you had a $600 balance as of Aug 9. Was that a single $600 charge, or were there multiple smaller charges between Aug 5-9 that together totalled $600?

Also, do you mind telling us what your CL for the Discover card is? I am wondering whether Discover has a policy of reporting when your utilization gets up to a certain %. If your CL is $1000 then $600 is a big number. If your CL is $10,000 it is not and it is strange that Discover would report it.

One of strangest things to my mind about what happened is that the card had a $600 balance as of Aug 9, but there was still a delay of another two weeks before Disover reported that Aug 9 balance to the CRA.

When You Need To Speed Things Up

Lets say youre about to apply for a mortgage, but your score is a little low due to inaccurate information on your credit report. Or maybe youve paid off a large amount of debt, but it hasnt shown up on your report yet.

When it comes to interest rates, a few points off your credit score can keep you from the best rates, which can be costly over time. But given the nature of a mortgage application, you cant wait for 30 days or more for your report to show your current credit status.

Rapid rescoring is one way to address this dilemma. If your lender sees the potential for you to get a better rate, then the lender can request a rapid rescore from a credit bureau. This involves offering proof that the rescore will make a difference in your rate. The lender also has to pay a fee for this service.

Note that only the lender can make this request, not you. But dont hesitate to ask a potential lender about rapid rescoring if you think it will help your case.

Be Proactive With Your Credit Report

Remember, you can get a free credit report every year from each major bureau. If you plan to apply for credit, dont wait until the last minute to see whats on your credit reports.

Check your credit reports at least three to six months in advance so you know if there are issues that need to be addressed. says Griffin. That way, youll avoid unhappy surprises that could derail your application for credit.

More from U.S. News

Read Also: How To Freeze Your Credit Report

Is The Discover It Secured Credit Card Worth It

For cardholders attempting to improve their credit scores, the Discover it® Secured Credit Card is one of the best options on the market. With a mere $200 deposit you can start establishing your credit history, and you can get your deposit back in as little as seven months with responsible credit usage. Plus, you get the benefit of a great rewards program.

The information related to Discover it® Secured Credit Card, Capital One Platinum Secured Credit Card and Citi® Secured Mastercard® has been independently collected by ValuePenguin and has not been reviewed or provided by the issuer of this card prior to publication.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

How Often Does Discover Raise Your Credit Limit

Discover doesnt explicitly reveal its policy regarding raising your credit limit. However, anecdotal information is available from many sources. In fact, one of our editors reports that her Discover card, which she said shes owned for one and a half years, has already given her an automatic increase.

Automatic increases are best. The reason is that you will not be charged with a hard pull when the credit card company reevaluates your credit. In contrast, when you request a higher credit line, Discover will require a hard pull that can damage your score.

Now, asking for an occasional increase for one of your cards wont have a substantial impact on your score. However, if you make requests to multiple cards, your score could be significantly hurt, as it indicates a need for more credit that may be due to financial distress.

You can do a few things that invite your card issuer to reevaluate your credit limit without you requesting it. The first is to make your card company aware when your income increases or fixed expenses decline.

Many credit card websites allow you to maintain your personal profile that includes your annual income online. Make sure you include secondary sources of household income, such as Social Security or retirement account benefits, student financial aid, and self-employment income.

You May Like: How To Report Credit Card Fraud To Amazon

What Happens If You Have A Card That Doesnt Report To All Three

If you have a card that doesnt report your activity to any of the three credit bureaus, youll get no benefit from using it responsibly. And if it reports to only one or two, the credit benefit of using the card will be limited.

For example, lets say you have a credit card that reports to Experian and TransUnion, but not to Equifax. Over time, youve used your card responsibly and established a good history on your credit reports with those bureaus.

But if you go to apply for a loan or a new credit card and the lender calculates your credit score based on your Equifax credit report, it will be as if you never had the credit card. Again, youll get no benefit.

You May Like: How To Remove Repossession From Credit Report

What Category On The Vantagescore Or Fico Credit Score Range Your Credit Score Currently Sits

If your score is very low, even a small sign of improvement in your payment history and reducing card balances might increase your credit relatively fast. But it will take more than paying your credit card bill on time for a month or two to really move your score into a range thats considered good enough to get unsecured credit cards:

- Developing a solid payment history

- Keeping your card balances at less than 30% of each cards credit limit

Also Check: How To Remove Eviction From Credit Report

Which Credit Cards Help Authorized Users Build Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Adding someone to your credit card as an is a simple way to potentially buoy their credit scores, assuming youve paid the account on time and havent used too much of your available credit. But to make this strategy actually work, youll want to be sure that information about that account is included on their credit reports. Otherwise, adding someone to your card whether its a child, partner or parent wont do a thing for their scores.

Getting that same account to appear as a “tradeline” on your authorized users credit reports will depend on two major factors:

-

The issuers policy. All major issuers NerdWallet surveyed reported authorized user activity to the three major credit bureaus Equifax, Experian and TransUnion in some form. But some noted that they dont report information if the primary account includes negative information or if the authorized user is under a certain age.

-

The credit bureaus policy. Even when issuers report an authorized user account, the credit bureaus might not include it in the authorized users credit report if it includes negative information or if the authorized user is under a certain age, depending on their policy.