Poor Credit Scores From Fico

FICO considers a credit score to be poor if it falls below 580. According to FICO, a person with a FICO score in that range is viewed as a credit risk. Why? Their research shows that about 61% of those with poor credit scores end up delinquent on their loans.

This level of risk could make it difficult to get approved for credit cards, mortgages, car loans and more. A poor score can come with other consequences too. For example, you may need to pay a fee or put down a deposit to get a credit card or home utilities.

Negative Credit Card Balance: Main Points

Having a negative balance on a credit card isnt a bad thing, but it has some points to consider:

- Negative balances dont affect credit. Most credit models typically consider negative balances equivalent to a $0 balance. This means a negative balance wont hurt a credit score.

- Negative balances wont improve a credit score, either. Frequent card users will likely zero a negative balance within a short period of time, meaning there may not be a long-term effect on their credit utilization rate .

- A negative balance means a cardholder is usually in good standing. Paying off your balance every month will ensure that you keep your low, make on-time payments, and maintain or improve a healthy credit score. Finding a credit account with a negative balance likely means youre on top of your bills and keeping up with financial decisions.

- Having a negative balance can make closing a credit account more cumbersome. While its not the worst consequence to deal with, closing a credit account with a negative balance means there are a few more steps involved to get your money back and close the account for good.

How Bad Credit Can Affect You

Everyoneâs situation is different, but you can see how bad credit scores might affect you when you look at some of the places in life where credit can come into play and where higher scores might help:

- With some improvement of your credit score, you might increase your chance of qualifying for cards with no fees and higher credit limits.

- Loans and mortgages: A higher credit score could help you get approved for auto loans, mortgages and other types of loans.

- Interest rates: Interest is the price you pay for borrowing money. In many cases, a higher credit score could help with getting better interest terms.

- Rental applications: When you apply for a lease, your potential landlord could look at your credit to decide about leasing to you.

- Employment applications: Potential employers sometimes pull credit reports during a background check. But they have to get permission from you first.

- Insurance premiums: In some states, your credit history could influence the cost of things like car insurance.

- Deposits: A stronger credit score might allow you to skip security deposits to set up service with utility companies and cellphone providers.

Thatâs just a quick look at the importance of credit. If youâre not satisfied with your credit scores, there are steps you can take to improve them.

You May Like: What Affects Credit Score Negatively

Late Or Missed Payments

It can be easy to forget to pay a bill that is not set up with auto-pay. If a bill is past due for too long, the bill will likely be sent to a collection agency or reported against you, subsequently affecting your credit score. This will negatively influence your credit score, even if you simply forgot to pay the bill.

How Do Errors Impact Your Credit Score

Your is calculated using different models such as VantageScore and FICO, the two most widely used credit-scoring models. Each model has its proprietary metrics and criteria. However, both use data from the major credit reporting agencies to generate your score.

Both scoring models also consider similar factors when calculating your score. These include your total credit usage and length of credit history, for example. But your payment history is the most important factor when determining your credit score.

Your payment history alone makes up around 35% of your FICO score and 42% of your VantageScore 4.0. Since payment history is so significant, a single inaccurate late payment could impact your score considerably. According to FICO, if your report has a 90-day missed payment, your score could drop by as much as 180 points.

Read Also: Can You Remove Hard Inquiries From Your Credit Report

What Do You Do With A Negative Balance On A Closed Credit Card Account

If you have a negative balance while closing a credit card account, its likely that the card issuer will settle that by refunding the money before officially closing the account. However, you may find yourself with a negative balance if you get one last refund right before the account is officially closed. Once that happens, your online account access may be cut off. In this case, contact the card issuer by phone and ask for an inquiry into the account to process a refund. Ideally, do this within 30 to 60 days of the account closing.

Keeping Your Identity Safe

If your identity has been compromised, acting fast is key. Here are a few signals to look for:

- Suspicious activity on your bank statementsThis can include withdrawals or purchases you didn’t make or can’t explain.What to do: Contact your bank ASAP, close all compromised accounts and dispute the fraudulent transactions

- Identify and dispute errors on your credit reportThese might be accounts you didn’t open, wrong addresses or employers.What to do: Notify Equifax, Experian or TransUnion, request a fraud alert, a copy of your credit report and dispute any errors

- A company you use has a data breachThis compromise can range from just your name to your bank account or Social Security number.What to do: Notify all creditors with whom you have accounts, including banks and credit card companies

Also Check: How To Get Negative Stuff Off Credit Report

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

What Affects Your Credit Score

There are manyin fact, hundredsof credit scores that lenders use to help make lending decisions. Several factors affect those credit scores. But in almost all credit scores, the two factors that affect your credit scores the most are your payment history and credit utilization rate.

- Payment history: With the FICO credit scoring models, your bill payment history makes up 35% of your credit score. Consistently making payments on time helps your score, while missing payments will hurt it. Furthermore, the longer your payment is late, the more your score will suffer. And recent late payments have a greater effect than those that happened further in the past.

- Amounts owed: FICO scores consider how much of your available revolving credit you’re using at any given time, also called your credit utilization ratio, for 30% of your score. Your is based on the amount you owe on revolving credit such as credit cards compared with the total amount of credit that you’ve been extended. To calculate your ratio, divide all your revolving credit balances by your total credit limits on those accounts. The more you owe relative to your total credit limit, the more it could lower your credit score. In general, always try to maintain a ratio of 30% or less to avoid hurting your score. For top credit scores, keep your utilization under 6%.

There are three other factors that affect your credit score to a lesser degree.

Recommended Reading: How To Get Late Car Payments Off Credit Report

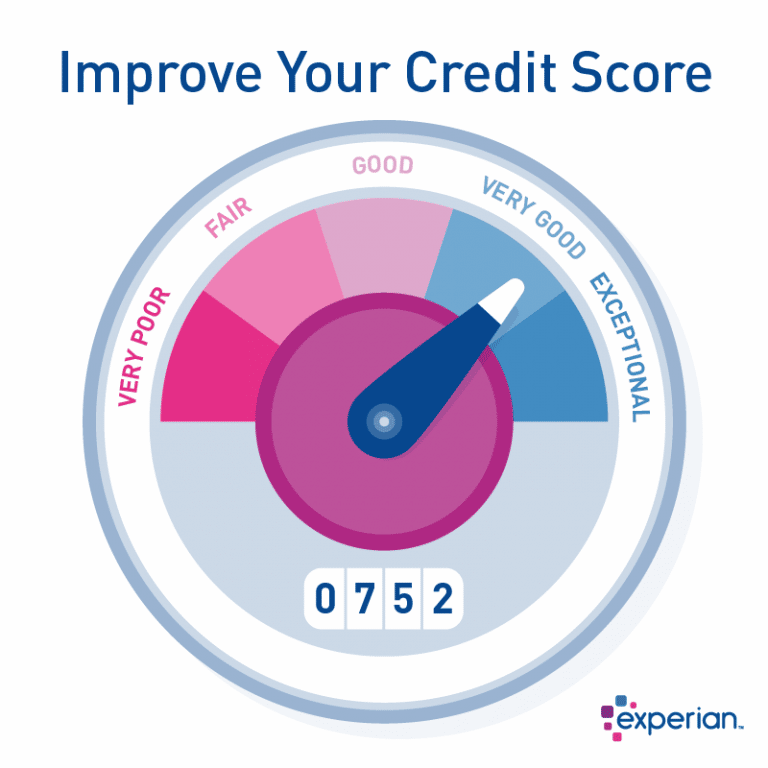

What Is Considered A Bad Credit Score And Rating

To a certain extent, bad credit is relative. As long as they obey laws forbidding discrimination, lenders get to determine their own lending criteria. Some seek only borrowers with exceptionally good credit ratings, and exclude applicants many others would accept. Other lenders focus on borrowers with less-than-ideal, or “subprime,” credit. Still others offer an array of products designed for borrowers with a variety of credit ratings.

Regardless of their target borrower profiles, many lenders evaluate potential borrowers’ credit ratings using credit scores: three-digit numbers derived by performing statistical analysis on the information in your credit report. Credit scores predict how likely you are to fail to repay a loan, with higher scores indicating lower risk that you’ll fail to meet your obligations. The most popular scoring systems, the FICO® Score and VantageScore® models, generate scores in the range of 300 to 850.

Lenders often use credit scores as a first step in their lending decision processes, excluding borrowers whose scores fall below a minimum threshold they choose. Lenders often also use credit scores to help set the interest rates they charge borrowers, and may direct applicants whose scores fall in certain ranges to particular products. Riskier borrowers might be offered credit cards with higher interest rates, for instance, while borrowers with the highest credit scores might be offered lower rates and bonus programs.

| Rating |

|---|

| 300-579 |

You Won’t Enjoy The Best Rewards Credit Cards

The best rewards credit cards require the highest credit scores. When your score is good or excellent, you can access the best introductory offers and cash-back incentives available among credit products today.

Some higher tier credit cards also give away special invitations to exclusive concert and event pre-sales, reward you with cash back on streaming services and more.

Whether you’re a sports fan, a movie buffs or an adventure seekers, one of CNBC Select’s top picks for cash-back cards is the Capital One Savor Cash Rewards Credit Card. It offers a competitive 4% cash back on dining and entertainment, 3% at grocery stores and 1% on all other purchases. New cardholders can earn a one-time $300 cash bonus once they spend $3,000 on purchases within the first three months from account opening.

Recommended Reading: How To Dispute Items On Credit Report

How To Remove Negative Items Related To Identity Theft

If you believe youve been a victim of identity fraud, you should first file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

After you report the incident, make sure to take the following steps:

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact the credit bureaus through phone or mail to dispute any credit information that doesnt belong to you

- Place a security freeze and fraud alert on your credit report

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

What Is Bad Credit

Bad credit refers to a person’s history of failing to pay bills on time, and the likelihood that they will fail to make timely payments in the future. It is often reflected in a low credit score. Companies can also have bad credit based on their payment history and current financial situation.

A person with bad credit will find it difficult to borrow money, especially at competitive interest rates, because they are considered riskier than other borrowers. This is true of all types of loans, including both secured and unsecured varieties, though there are options available for the latter.

Also Check: Is 706 A Good Credit Score

Keep Unused Credit Card Accounts Open

Don’t close your unused credit card accounts. And don’t open new accounts that you don’t need. Either move can damage your credit score.

If bad credit has made it difficult for you to get a regular credit card, consider applying for a secured credit card. It is similar to a bank debit card, in that it allows you to spend only the amount you have on deposit. Having a secured card and making timely payments on it can help you rebuild a bad credit rating and eventually qualify for a regular card. It also is a good way for young adults to begin to establish a credit history.

The Impact Of Negative Items On Your Credit Score

When you fail to make payments on time or have debt settlements or foreclosures on your record, that takes points off your score Fair Isaac calls them damage points. The better your credit score, the more of a hit you take when you incur damage points. That means that one missed payment could drop your score by as much as 110 points, according to credit bureau Equifax. Even a hard inquiry on your report, such as occurs when you apply for new credit, can drop your score 15 points enough to put you down into a lower tier. These are some of the negative items that impact your credit score.

Recommended Reading: Is Discover Credit Score Accurate

What Are Bad Credit Causes

A lender can deny a potential borrower a loan due to a number of bad credit causes. Bad credit is a persons record of past failures to make timely payments for bills and loan payments, and the likelihood that they will delay or default on payments in the future. When a potential borrower has a bad credit history, it is difficult for them to get approved for loan applications, , or even get apartments to rent.

When an individual makes late payments or defaults on the payments altogether, the lender or creditor reports the information to the credit bureaus. The information is included in the individuals credit report, which lenders and other creditors use to make decisions on whether or not to extend credit to potential borrowers. A corporate borrower can also have bad credit, based on their payment history with creditors.

Ways To Help Improve Bad Credit Scores

With time, credit scores can improve. In general, you can help yourself by committing to responsible credit use and good financial habits. Here are some strategies that might help:

Recommended Reading: What Credit Score Do You Need For A Mortgage

Your Insurance Premiums May Go Up

Most U.S. states allow , giving auto and homeowners insurance companies permission to factor your money habits into their assessment of your risk.

A dip in your credit score will not automatically increase your premium, nor will your policy be canceled if you drop below 600. But a bad credit score could prevent you from getting the lowest possible rate. If you want to see your credit-based insurance score, you can request a report through LexisNexis.

What Is A Bad Or Poor Vantage Score

VantageScore is another credit scoring model that also uses data from consumers’ credit history to help predict their likelihood of repaying a loan. Like FICO scores, VantageScores also generally use the range of 300 to 850. With the newer VantageScore models, a score of 601 to 660 is considered to be fair, while a score of 500 to 600 is poor. Scores between 300 and 499 are very poor.

| Applicants will not likely be approved for credit. | |||

| 500-600 | Poor | 21% | Applicants may be approved for some credit, though rates may be unfavorable and with conditions such as larger down payment amounts. |

| 601-660 | Applicants may be approved for credit but likely not at competitive rates. | ||

| 661-780 | Applicants likely to be approved for credit at competitive rates. | ||

| 781-850 | Applicants most likely to receive the best rates and most favorable terms on credit accounts. |

Recommended Reading: How To Increase Credit Score

What Is A Derogatory Mark

Derogatory marks cover things like missed payments and a declaration of bankruptcy. Most derogatory marks stay on your credit report for 7 to 10 years, depending on how bad the mark.

Your credit report acts as a compiled history of your borrowing transactions. Good borrowing behavior, like on-time loan repayments counts in your favor. Borrowing behavior that lowers your score include missed payments and defaulting on a loan.

Getting Approved For A Loan Can Be Difficult

Your credit score directly affects your likelihood of securing approval for a new loan or credit application. The lower your score, the less likely you are to find a willing lender. Even If youre close to your lenders prime-subprime or quality level cutoffs, many lenders simply dont make loans to subprime borrowers or those who fall below a particular quality level. Although this can feel like the lender is being capricious, many borrowers can be affected by this in real ways.

Practically speaking, a credit score of 698 isnt much different from a credit score of 702 but if 700 is an important level to the lender, those four points can make all the difference.

Read Also: How To Get Good Credit Score At 18