Will I Be Penalized For Shopping Around For The Best Interest Rate

A common misconception is that every inquiry decreases your credit score. This is not true. While an inquiry is recorded on your personal credit report every time you, one of your creditors or a potential creditor obtains your credit report, the presence of inquiries has only a small impact on your credit score. Many types of inquiries have absolutely no impact. Most scoring models take appropriate steps to avoid lowering your score because of multiple inquiries that might occur as you shop for the best car or home loan terms.

How Far Into Your Past Can A Lender Look

Everyone makes mistakes and getting to grips with your finances can be easier said than done. Plus, some of the causes of bad credit arent always easy to avoid. But a credit report isnt like a criminal record, it wont follow you around for life. Its simply there to give lenders an idea of your recent financial situation. Thats why enquiries only stay on your report for up to two years, and on public records for up to six years.

Start With A Local Store Or A Secured Loan

If you have steady income and have used the same mailing address for at least one year, you may wish to apply for credit with a local business or department store, or for a secured loan or credit card through a financial institution. Paying credit obligations on time will help you develop a good credit history and may enable you to obtain additional credit in the future.

You May Like: When Does Capital One Report To Credit Bureau

The Info In Your Credit Reports

For some people, there isnt enough information in their credit reports to generate a score at all. Thats because each credit-scoring model may have different minimum requirements for calculating a score. For example, FICO says consumers should have at least one credit account thats been open for at least six months and at least one account thats been reported to the credit bureau within the last six months.

How Exactly Is Your Credit Score Calculated

Knowing your credit score is one thing. Understanding exactly how its calculated is another thing altogether. If youre curious about how your credit score is determined, youve come to the right place. Well show you exactly how companies such as Equifax, Experian, and TransUnion come up with those numbers you know, the ones that determine if and what you qualify for when it comes to needing credit.

Besides giving you the formula these companies use to come up with your credit score, well also look at a few ways you can improve it. By the end of this article, youll know not only how your credit score is calculated, but also how you can best keep your score as high as possible.

Also Check: Does A Closed Account Affect Credit

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

If Your Credit Needs Some Tlc You Can Get To That Healthy Window Sooner Than You Think:

- Dont let late payments go past 30 days. Remember, outstanding debts more than 30 days late make up 35 percent of your score.

- Shred old cards and leave them open. Since 15 percent of your credit score is based on length of credit history, its typically better to shred a card and leave the account at zero, even if a card is 10 or 20 years old.

- Avoid paying for everything in cash. It sounds budget-savvy, but no credit means bad credit in the eyes of a lender. So, open at least three credit cards and make occasional buys.

Small as it seems, every change you make toward repairing your credit counts. Bumping up your score may nab you an almost 1.5-percent lower rate, with potential to save you hundreds of dollars a month on your mortgage.

Don’t Miss: What Credit Score Do You Need For Carecredit

How To Check Your Credit Score

If you are new to credit, its a good idea to check your own credit score before you start applying for additional credit cards or loans. That way, you wont make the mistake of applying for a when your own credit is still average.

Many banks and credit card issuers give you access to free credit scores. provide weekly credit score updates and keep track of potential threats to your credit . You can also access your credit score through certain popular personal finance apps, such as Mint.

Some free credit score services will provide you with a VantageScore instead of a FICO score. VantageScore is one of FICOs main competitorsand although its scoring system is slightly different than FICOs, the credit ranges overlap. If you have good credit with VantageScore, youll have good credit with FICO.

Best Ways To Improve Your Credit Score

There are multiple ways to improve your credit score. Heres some of them:

Is your score trending downwards though you have a good payment history? It could be because of an error in your report. For instance, it may happen that you have cleared one of your loans but its still reflecting in your report. This may hurt your score a tad bit. Hence, its advised to go through your report periodically. If you spot any discrepancies, bring it up to the credit agencies. Eliminating such errors can boost your score.

Continue using your older card to have a stronger and lengthier credit history. Of course, if you find that its getting difficult to make timely payments, you have no other option but close the card. Remember that a credit card account, which you have been maintaining for over a period always helps to boost your score.

Your score will take a hit if you dont repay in due time. Every time you default, it gets recorded in your report and eventually hurts your score. Always remember that your creditworthiness reflects your repayment history. Hence, to improve your score, keep making timely payments.

One way to deal with this is by setting up standing instructions. In that way, you wont miss the repayment dates.

You May Like: How To Remove Hard Inquiries In 24 Hours

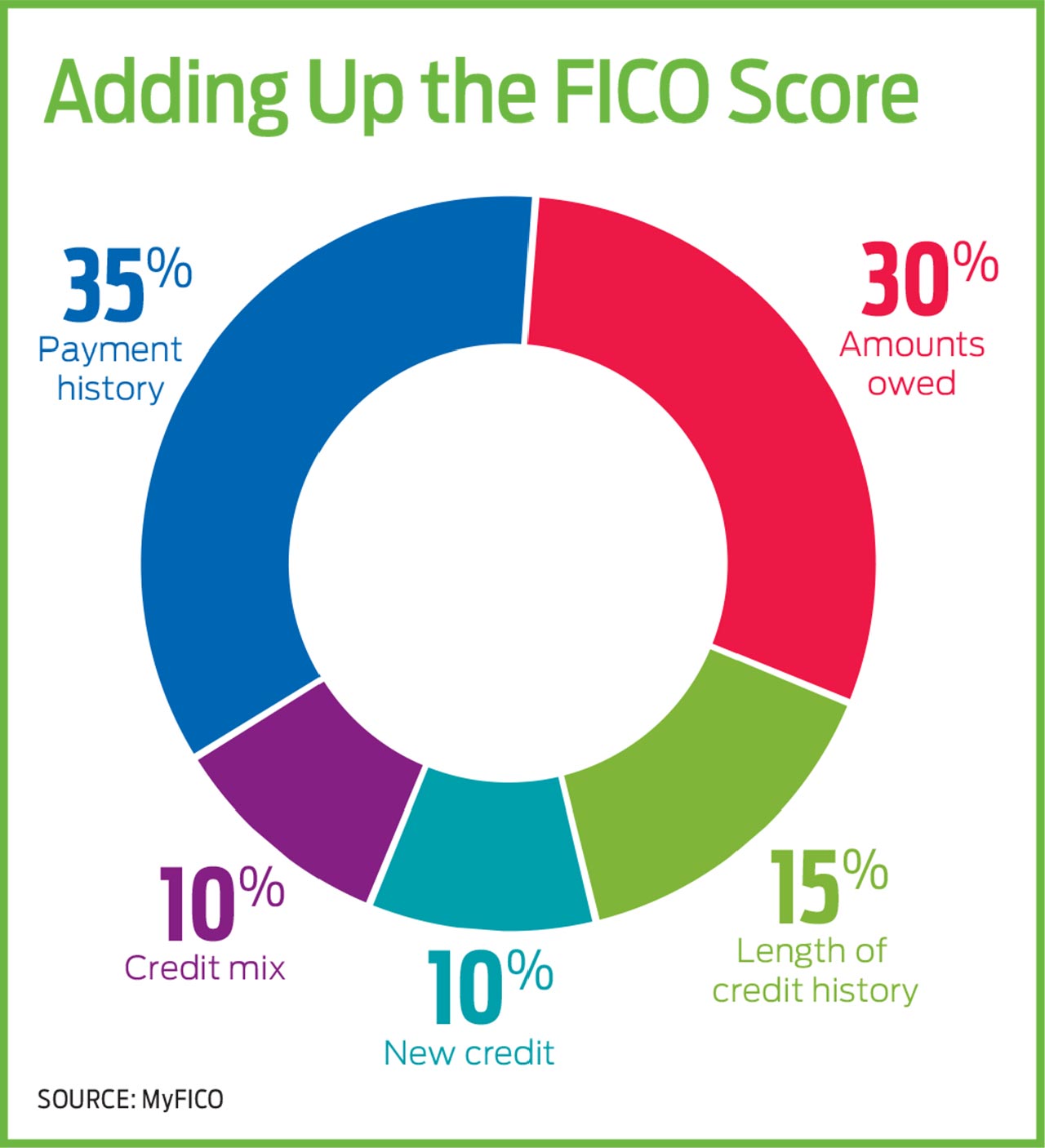

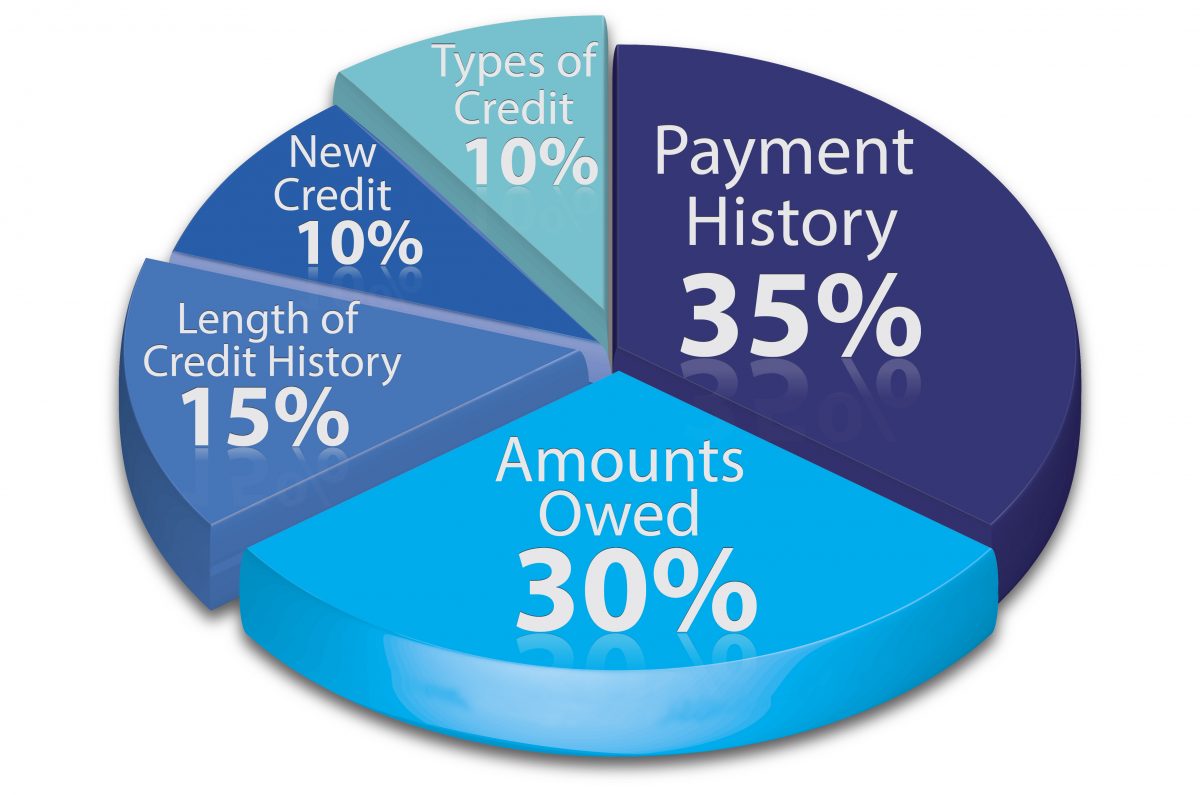

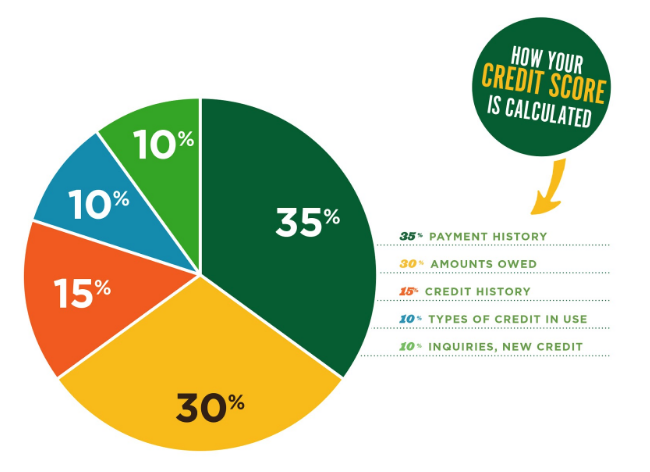

What Goes Into A Credit Score

Because some parts of your bill-paying history are more important than others, different pieces of your credit history are given different weights in calculating your credit score.

Even though the specific equation for coming up with your credit score is proprietary information owned by FICO, we do know what information is used to calculate your score.

| What Makes Up Your FICO Credit Score | |

|---|---|

| Payment history | |

| New credit | 10% |

Payment history: Lenders are most concerned about whether or not you pay your bills on time. The best indicator of this is how youve paid your bills in the past.

Late payments, charge-offs, debt collections, and bankruptcies all affect the payment history portion of your credit score. The better your history of paying debtssuch as loan payments or credit card billson time, the higher your credit score.

More recent delinquencies hurt your credit score more than those in the past.

Amounts owed: The amount of debt you have in comparison to your credit limits is known as . The more money you already owe, the less flexible your spending is, which makes it riskier for you to take on new debt, which lowers your credit score.

Keep your credit card balance at about 30% of your or less to improve your credit score.

Length of credit history: Having a longer credit history is favorable because it gives more information about your spending habits. A longer history of reliable borrowing means your score will be higher.

Repayment History Of Credit Card Bills And Loan Emis

shutterstock

It’s widely believed that repayment of your credit card bills and loan EMIs is given a significant weightage by bureaus when calculating your credit score. Making timely and full repayment of your credit card bills and loan EMIs helps in building a favourable credit history, which gradually builds up to a strong credit score.

Whereas on the flip side, any irregularity in credit card and loan repayments is capable of damaging your credit score, as such actions depict you as financially undisciplined.

Also, the loan accounts co-signed/guaranteed by you are also included in your credit report for computation of credit score, because co-signing/guaranteeing makes you equally liable for that loans timely repayment. So, when the primary borrower delays or defaults, your credit score would be impacted too, along with that of the primary borrower. That’s why it is advisable to regularly review the repayment activities of your co-signed or guaranteed loan accounts and ensure timely payments to prevent your credit score and future credit eligibility from getting harmed.

Also Read: Why Do Millennials Fall Into Credit Card Debt Trap?

Also Check: Public Records On Credit Report

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

Who Calculates Your Credit Score

The three main credit reference agencies – Experian, Equifax and Callcredit – use different methods for working out credit scores, which means there isnt a single magic number you can turn to. Check out our guide on how to check your credit score if youve not done it before.

Whatever the number, the rule of thumb remains the same higher scores indicate lower risk, and vice versa. You can check your credit score for free with some credit reference agencies.

Don’t Miss: Does Les Schwab Report To Credit Bureaus

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Can You Repair Your Credit Score

Your credit score isnt fixed it reflects your credit situation only at the time a check takes place.

One slip-up can reduce your score. In order to avoid this, its important to always pay your bills and make loan repayments on time and not overextend yourself financially.

If you see something in your credit score report that looks questionable, get in touch with the credit provider to get it checked or corrected. Outdated information can result in you being refused a loan or line of credit.

And if you think you have been a victim of identity theft, contact the police and credit providers fraud department so they can investigate this for you.

Recommended Reading: Centurylink Collections Agency

What Credit Youve Previously Used

Another factor that they will consider when calculating your credit score is what type of credit youve used in the past.

Although its not one of the most significant factors, it is still considered especially if your credit report is lacking in other information.

Keep in mind, however, that you should only take out a credit card if you plan to use it responsibly.

It wont improve your credit score just because youve taken out an account.

Ways To Maintain And/or Increase Your Credit Score

Knowing how your credit score is calculated can be useful, but how can you put all this information into action? Heres how you can stack the odds in your favor, so those credit scores add up to new opportunities and more financial freedom.

- Soft inquiries impact your credit score less than hard inquiries. If you plan on qualifying for a loan, only submit soft inquiries if youre absolutely sure about moving forward. Sometimes this requires a hard inquiry. According to Equifax, though, if you are shopping for a new auto or mortgage loan or a new utility provider, the multiple inquiries are generally counted as one inquiry for a given period of time, typically anywhere from 14-to-45 days.

- Budgets are a great way to make sure you can pay your credit card on time. Get into the habit of mentally setting aside any amounts you put on your credit card, so that theyre accounted for when you go to pay bills.

- Paying off your credit card before the due date will help your statement show a $0 balance. Then, when the credit card companies report your balance to the credit bureaus, youll be in good standing.

- Take advantage of credit card offers only when they make sense for you. Look for cards with $0 annual fees, generous rewards for purchases you already make, and any other perks that might benefit you. Using credit cards can actually be great, as long as you do it smartly.

Read Also: Does Carvana Report To Credit Bureaus

What Personal Details Do Not Affect My Credit Score

Now that you have an idea of what goes into your score, it’s good to know what doesn’t factor into your score. A recent survey from the Consumer Federation of America found that out of 1022 adult respondents, 40% believed marriage status influenced credit scores, while 43% thought age also played a part.

Your score is a representation of how you manage financial responsibility, not a testament to you as an individual. Things like age, ethnicity, religion and marital status are excluded in the calculation of your score. Your employer, salary and occupation are likewise not included in the equation.

Length Of Credit History15%

A consumers credit history length accounts for 15% of their credit score, making it the third most impactful factor. To evaluate the length of a borrowers credit history, the scoring models identify the average age of all accounts the ages of the oldest and newest accounts the length of time each account has been open and the date on which each account was last active.

For this reason, its best not to close older accounts in good standingespecially if you plan to apply for a mortgage or other large loan soon. Improving this aspect of your score typically requires time and patience. That said, becoming an authorized user on an older account in good standing may help you boost the age of your credit and improve your score.

Also Check: Opensky Credit Increase

Bank Of Baroda Relying On Cibil Score To Control Retail Npas

In a bid to control defaulters, Bank of Baroda is being extra careful of it retail customers. Over 50% of the banks home loan borrowers have minimal risk with high credit scores. Moreover, it is also offering the lowest rates in the market at present thereby giving a tough competition to the bigger banks like State Bank of India and HDFC Ltd. Bank of Baroda was one of the first banks to base the interest rates for home loans on the Cibil scores. The rate of interest varied from 8.65% to 9.65% depending on the CIBIL score. Thanks to the tighter norm of checking the CIBIL score, BoB has improved its portfolio. The bank had 57% borrowers with a CIBIL score of 760 and above. Retail loans at BoB were growing at 33.55% over the previous year. There was an exponential increase in the auto personal loans as both of them registered an increase of 39% as on half year ended September 2018, as compared to the previous year. The bank expects to grow at a similar pace in the second of the fiscal. The total retail non-performing assets of the bank are at Rs.1,827 crore, which is 2.40% of its total NPA pool. This is an improvement from March 2018 when the bank’s retail NPAs were 2.83% of the total NPAs.

In the first 6 months of FY19, BoB has 75% of new customers with a CIBIL score of 760 and above, said Virendra Sethi, general manager in charge of retail loans at BOB. In addition, Bank of Baroda is also

27 December 2018

Simplifying How Credit Bureaus Calculate Your Credit Score

Credit score. This term has been no less than a revolution in Indias financial sector since the past decade or so. You might have come across tons of information and advice surrounding the importance and role of credit scores in our financial lives. More so, if you have taken or enquired about a loan or . But amidst the flurry of information, we are dumped with when it comes to credit score advice, a lesser touched upon aspect is how credit bureaus actually calculate your credit score.

And with the new year 2022 knocking at our door, isn’t this an opportune time to understand this crucial aspect of your financial life? After all, a credit score holds the potential to make or break your loan and credit card approval chances.

So read on as we help clear the air surrounding the concept of credit score and simplify how credit bureaus calculate your credit score.

Also Check: Coaf Inquiry