Affirm And Your Credit Score

When you sign up for an Affirm point-of-sale loan, you are taking a credit instrument. But Affirm doesnt perform a hard credit check, only a soft pull on your credit information, so simply taking out the loan will not affect your score.

However, if you pay back the loan on time, youll experience a boost to your credit score, which helps you get financing from the banks. Its important to note that the converse is also true. If you dont pay back your loan on time, miss payments or are late with payments, it will affect your credit score negatively.

Does ‘buy Now Pay Later’ Financing Affect Your Credit

When youre making a purchase, you may be offered the option to buy now and pay later. This type of financing option allows you to make your purchase today and pay for it with installment payments over several months. Before you choose “buy now, pay later” financing, though, its important to understand how it may affect your credit.

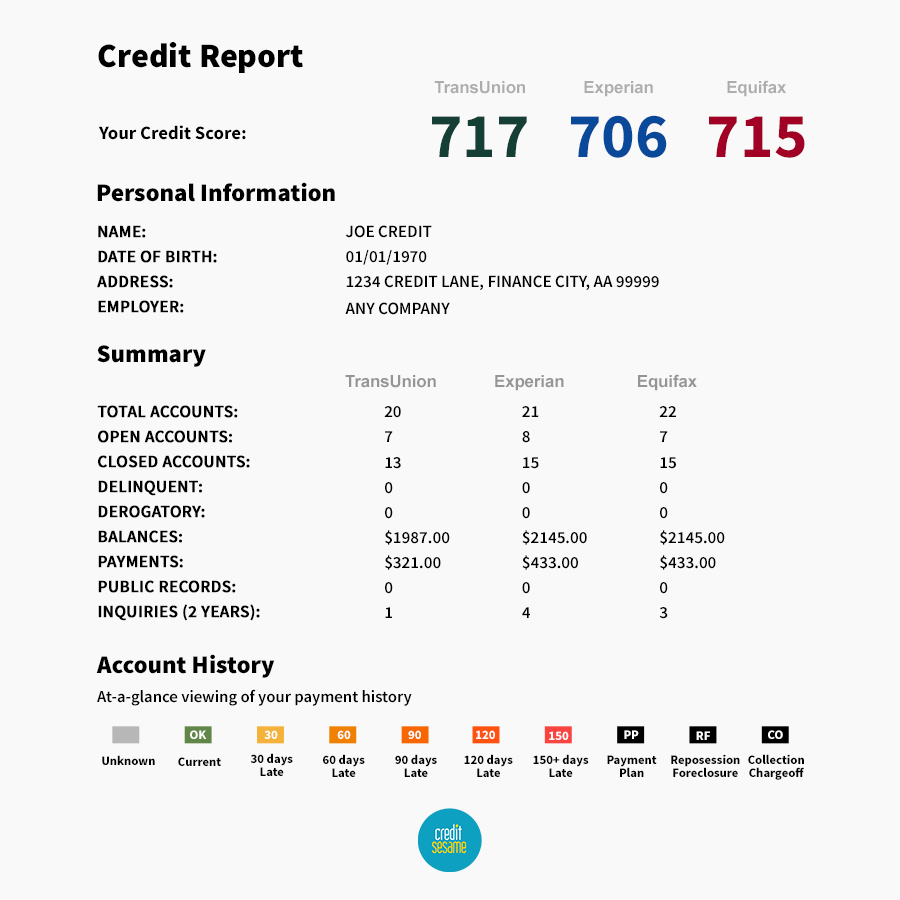

Your credit score is a three-digit number influenced by your borrowing and payment history as reported to one or all three of the major credit bureausEquifax, Experian, and TransUnion. If you choose a financing servicer that reports to any major bureau, your credit may be affected.

Dont Consider A Travel Loan If:

-

The APR on the loan is high: Consumer advocates say that a 36% APR is the highest rate a loan can have and still be affordable, but even a lower rate is sometimes not worth the cost. For example, a $3,000 loan with a 15% APR paid over 12 months would cost $250 in interest.

-

Youre struggling to pay off your current debt: If you carry a balance on credit cards or other loans, be careful about agreeing to more monthly payments. Too much debt can lead to a cycle of missed payments, fees and collection calls.

-

It tempts you to spend more than you can afford: A fly now, pay later loan can make it seem like youre spending less than you really are, since you dont have to pay the full amount upfront.

-

It takes money from your other goals: If the extra payments for this trip would eat into your emergency fund or other savings goals, it may be worth postponing the trip and saving up instead.

Read Also: Comenitycapital/mprcc

Also Check: Fingerhut Guitars

What If You Miss Payments

This is important enough to repeat, especially for those with already existing bad or no credit.

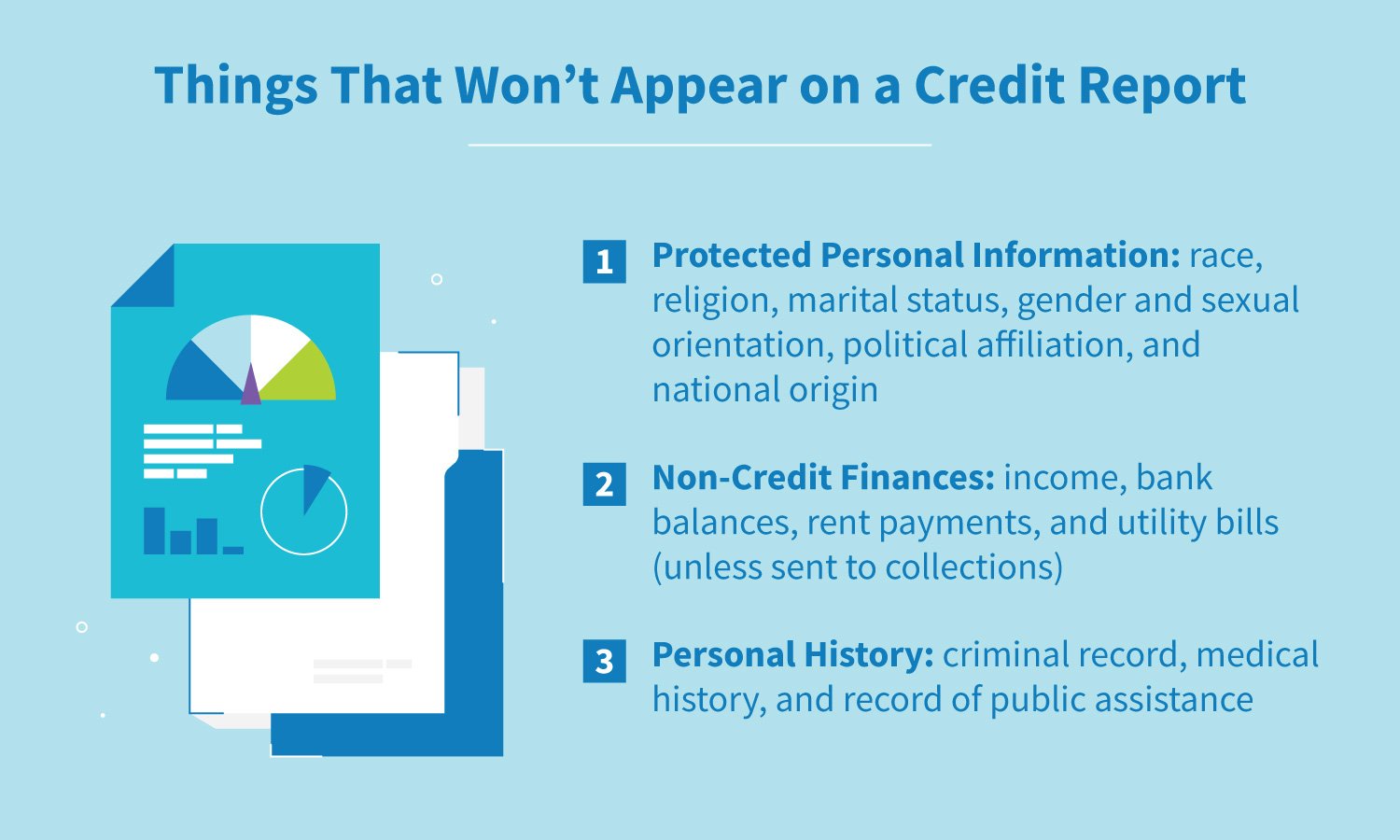

Even if a service says they dont report to the credit bureaus, they will likely report missed payments. When they say they dont report to the credit bureaus it means they dont report all payments to the credit bureau, which is important if youre trying to build credit or recover from bad credit.

If you miss payments, most services report it to the credit bureau. Because your payment history makes up the largest portion of your credit score, it could damage your credit score.

To make matters worse, if you miss your payments long enough that the service sends it to collections, the collection agency could report the collection to the credit bureaus. This hurts your credit score even further because collections mean you defaulted on the debt for 90 180 days.

Collections stay on your credit report for 7 years. They may not hurt your credit score for that long, but they are a tradeline on it, showing future lenders that you dont pay your bills on time. This could complicate things, so dont use a BNPL loan unless you can afford to pay it.

Is It Better To Use Affirm Or A Credit Card

If you have access to a credit card, its the better option if you make full use of the grace period but then repay your bill before incurring any interest charges. However, if youre like many Americans and prefer to keep the credit card for emergencies, Affirm is a viable alternative.

While your credit card might have a $15,000 limit, your bank or card issuing authority probably doesnt want to see you have an outstanding balance of more than $5,000 at any time. If you go over this ratio, youll end up affecting your credit score.

Since Affirm offers loans up to $17,500, its the ideal choice for financing a bigger-ticket item as opposed to using your credit card.

However, there are some issues with using Affirm. The company can charge a high interest rate, and if youre getting an 18% APR on your card, you can expect the rate at Affirm to be similar or higher. However, you get flexible spending limits, with up to 12-months to pay off your purchase.

Some retailers may partner with Affirm to offer a 0% APR on certain purchases.

Also Check: Carmax Financing Bad Credit

Does Affirm Report Your Activity To Credit Bureaus

Affirm generally will report your payment history to one credit bureau: Experian. There are a couple of cases where it won’t, however:

- You’re paying back a four-month loan with biweekly payments at 0% APR.

- You were offered just one option of a three-month loan at 0% APR during checkout.

If you pay late, Affirm will report this to Experian without exception. In the two cases above; you don’t get any credit for making on-time payments, but, if you pay late, Affirm will report this.;

How Does Affirm Make Money

Affirm makes money on the interest it charges for its consumer loans as well as fees paid by the merchants to handle payments on their behalf.

So far, the firm has stirred away from focusing on any other income channels. Given that the global market for online payments is valued at almost $5.5 trillion, theres plenty of money to be made within its current business model.

Lets take a closer look at each of the two revenue streams down below.

You May Like: Paypal Credit Soft Pull

Creating And Using An Affirm Account

Before you can make purchases through Affirm, you will need to have an account with the lender. You can do this easily through their website.

You will need to be at least 18 years old and be a permanent resident or citizen of the U.S. to qualify. You must have a cell phone number and agree to receive texts from the company. It is also ideal to have a credit score of at least 550.

The company has also launched a mobile app that can be downloaded at the Apple store and Google Play Store to create an account.

Do Not Pay Your Accounts In Collections

If a collection agency will not remove the account from your credit report, dont pay it! Dispute it! A collection is a collection. It doesnt help your score AT ALL to have a bunch of collections on your report with a zero balance. The only way your credit score will improve is by getting the collection accounts removed from your report entirelly.;

Dont pay collection accounts without a pay for delete letter. A pay for delete is an agreement that you will pay the outstanding debt if the collection company deletes the account from your report. You may be able to settle the balance for less than you owe, but many will want you to pay in full if they are deleting it from your report.

Dont Miss: Does Klarna Report To Credit

Also Check: How To Get Credit Report Without Social Security Number

How Experian Boost Works

Experian Boost is free to use and there are no existing membership requirements to sign up. To receive a boost, individuals create a free Experian account and navigate to the products page.

From there, users will be prompted to connect the bank account they use to pay their bills. For those wary of granting third-party access to their account, Experian explains that its product can access only read-only data from a bank, and doesnt have access to any of the funds. Once an account is connected, the feature scans transactions for on-time utility, cell phone and streaming video plans, including Netflix, HBO, Disney+ and Hulu payments. Experian needs at least three months of payments within a six-month window.

Experian Boost shows users which bills are pulled and when they were paid. The feature only pulls positive payment history, which means it wont report any negative information that could lower your credit score. Users also have the option to exclude any payments they dont want to be added to their file.

Read Also: Paypal Working Capital Phone Number

Buy Now Pay Later Services Offering No Hard Credit Checks

Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Buy now pay later no credit check loans are increasing in popularity. Youve probably seen it on your favorite retailers websites. When you checkout theres the option to buy now and pay later, allowing you to pay in four equal installments and usually for no interest or fees and with no hard credit check.

If you have no credit or bad credit, these can seem like a great optionbut only if you know how they work, and which companies are the best options for those in search of no-credit-check online financing.

In This Post:

Recommended Reading: Does Paypal Working Capital Report To Credit Bureaus

Need A Bnpl Loan That Won’t Impact Your Credit Score

Each BNPL loan handles credit checks and reporting to credit bureaus differently.

Although AfterPay does not consider itself a POS provider, AfterPay performs no credit check at all, making it a solid option for people who have poor or bad credit and have a hard time securing a loan otherwise . It doesn’t report loans to the credit bureaus.

Klarna also does not report information to the credit bureaus on its POS loans, according to Klarna. Klarna will perform a soft credit check, which won’t affect your credit score, if you’re taking out a ‘Pay in 4’ loan or a ‘Pay in 30 days’ loan. Additionally, if a consumer applies for a branded open line-of-credit product offered by Klarna’s partner bank, a hard inquiry may be conducted.

Your score won’t be affected if you take out an Affirm loan that charges 0% APR and has four biweekly payments or loans where people were given the option of a three-month payment term with 0% APR. If you take out a longer loan with interest, the loan will be reported to Experian.

Before you take out any BNPL loan make sure you’re clear on the terms and conditions, so you understand the interest rate and repayment schedule.

Affirm Reviews: Is An Affirm Loan The Best Choice For You

Affirm is a service that offers loans for online and in-store purchases. It provides short-term loan options at checkout with many retail partners.

This can make a larger purchase more affordable by spreading the cost.

Before you use Affirm, its worth reading some Affirm reviews to make sure you understand the interest rate and payment terms offered.

Read Also: What Credit Score Does Carmax Use

Does Affirm Show On Credit Report

Affirm may show on your credit report. If you received an installment loan with an interest rate above 0% with 4 bi-weekly payments or over a 3 month payment period, it likely will not show up on your report. In all other instances, Affirm installment loans will show up on your credit report with Experian.;

Affirm Funding Valuation & Revenue

According to Crunchbase, Affirm has raised a total of $1.5 billion across 9 rounds of venture capital funding. Notable investors in the company include the likes of Spark Capital, Wellington Management, Founders Fund, Lightspeed Venture Partners, Khosla Ventures, Andreessen Horowtiz, and many others. ;

The company raised its latest round of funding in September 2020, which netted them $500 million in the process. Unfortunately, no valuation figures were shared publicly. Its prior Series F round, announced in April 2019, catapulted the companys valuation to $2.9 billion.

The firm is set to target a valuation of $10 billion during its IPO. Affirm is going public by the end of 2020. For reference: Affirms European counterpart Klarna gathered a valuation of $10.6 billion during its most recent funding round.

For the fiscal year 2020 , Affirm generated $509.5 million in revenue while posting a net loss of $112.6 million over the same timeframe. In the year prior, the FinTech generated $264.4 million in revenue while loosing $120.5 million.

One noticeable bit about Affirms income statement is that about 30 percent of the companys revenue can be attributed to Peloton, the bike producer taking the world by storm. This consequently poses a major risk for Affirm going forward while giving Peloton some leverage in future negotiations.

Also Check: Why Is There Aargon Agency On My Credit Report

Establishing Or Building Your Credit Scores

Depending on your experience with credit, you might not have a credit report at all. Or, your credit report might not have enough information that credit scoring models are able to assign you a credit score.

With FICO® Scores, you need to have at least one account thats six months old or older, and credit activity during the past six months. With VantageScore, a score may be calculated as soon as an account appears on your report.

When you dont meet the criteria, the scoring model cant score your credit reportin other words, youre credit invisible. As a result, creditors wont be able to check your credit scores, which could make it difficult to open new credit accounts.

Some people may be in a situation where theyve only opened accounts with creditors that report to only one bureau. When this happens, they may only be scorable if a creditor requests a credit report and score from that bureau.

If youre brand new to credit, or reestablishing your credit, revisit step one above.

Start Raising Your Credit Score Today

An Affirm loan is a quick and easy way to finance large purchases at point-of sale. Offered at over 2,000 companies including Walmart, Wayfair, Casper, and Expedia, Affirm is known for requiring a soft credit check with no hidden fees.;

In the sections below, we will discuss the Affirm loan in greater detail as well as how it will affect your credit.;

What is an Affirm loan?

An Affirm loan is a point-of-sale payment plan that consists of monthly installments for consumers who are new to credit and want to make a large purchase. The companys point-of-sale financing appeals to many new buyers with since there is no minimum credit score required and no prior credit history requirements.;

Affirm uses what is called a soft credit check, a soft credit inquiry that doesnt affect your credit score, to process their borrowers applications for approval.;

Lenders at Affirm will also take a look at the extent of your credit and payment history. The company might even ask for a deposit or want to peer over your bank transactions to get a general idea of your spending habits before offering you a loan.

If youve already used a lot of credit and arent the sharpest at making payments, theres a good chance you wont get approved.;

Pros and cons of Affirm personal loans

If youre trying to decide if an Affirm loan is the right choice for you, weigh the pros and cons. Here is a quick breakdown:

Pros:

Cons:

A few other things you should know about Affirm loans:

TELL US,

Read Also: Does Zzounds Report To Credit Bureau

Affirm Review: Affirm Pros And Cons

| Pros | |

|---|---|

| No upfront fees for loans | Interest rate offered can be high |

| Easy to receive a quote and sign up | Taking a loan can affect your credit rating |

| Can make purchases with regular monthly payments rather than an initial lump sum | Affirm does not report on-time payments to credit bureaus |

| Some merchants offer zero-interest loans | |

| No fee to pay back early |

A good way to see others opinions and experience of Affirm is to check reviews with sites like Trustpilot .

Affirm generally gets very positive reviews through Trustpilot. As of June 2021, 86% of Affirm reviews were in the top excellent category, with only 9% rated bad.¹

Some positive references include the easy-to-use system and the ability to repay early. The impact on credit score for missed payment is a common frustration.

Applying For Buy Now Pay Later Financing

Making a loan application can affect your credit if the business pulls your credit information to approve your application. Some retailers that offer “buy now, pay later” financing may not require you to fill out a formal credit application. In that case, there wont be a on your credit report.

If youre asked to enter your social security number to applyeither your full social security number or the last four digitsthat signals your credit will be pulled to approve the application. The credit check results in a hard inquiry to your credit report and may cause your credit score to drop a few points. Inquiries are about 10% of your credit score and remain on your credit report for the next two years, though they only affect your score for 12 months.

Read Also: Does Zebit Report To Credit

Buy Now Pay Later No Credit Check: How Does It Work

It sounds almost too good to be true, right? How can you buy now and pay later? Whats the catch?

Theres no catch.

Plus, many Buy Now Pay Later loans dont affect your credit. Many companies that offer BNPL like Affirm and Afterpay only do a soft credit check which doesnt hurt your credit . But if you dont make your payments on time, it could hurt your credit.

Here well explore the questions, what is a soft credit check and how do BNPL loans work?