Have At Least One Gas Or Store Credit Card

For the longest time, I resisted getting a store card, such as a Macys credit card, because I saw no point in opening a new credit account just for one store.

But, now I know better. If you shop at one store a lot, and that store offers its own credit card, consider applying. These cards have some nice perks such as cash back or coupons.

More importantly, a store credit card can boost your credit. I cant document this, but I know getting a Macys card and keeping its balance at $0 each billing cycle boosted my FICO score by 20 points.

Just be sure you dont buy too much and run up a balance you cant clear each month. If you do that, youll be cutting into your available credit which will hurt your credit score.

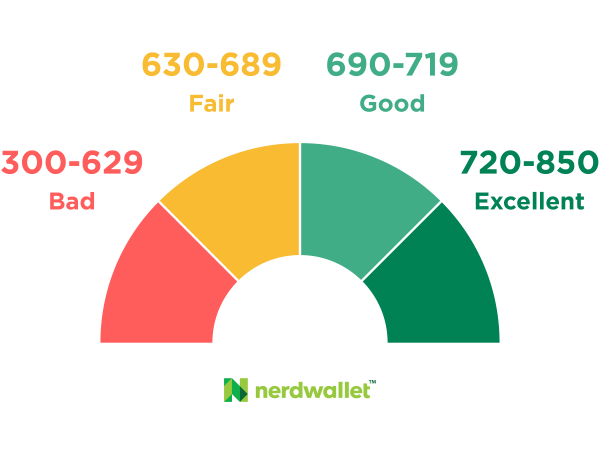

What Is A Bad Credit Score

Equifax tells consumers that generally a credit score range of 660 to 724 is good, 725 to 759 is very good, and 760 and higher is excellent.

That leaves scores below 660. If your credit score is between 560 and 660, its likely considered a fair score. That means you may get approved for credit by a lender, but you probably wont get the best terms available.

If your score falls below 560, then youre likely labeled having a poor credit score. Lenders generally consider these low scores poor credit risks and are unlikely to approve loans to people with these scores. If your credit score falls below 560, you may have to improve your credit score before trying to get approved for a loan or look for lenders that specialize in working with people with bad credit.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Carmax Lenders

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Pay All Your Bills On

This should be completely obvious, but it bears repeating. A single late payment could drop your credit score 20 or 30 points. That can drop you from average to fair credit in a matter of weeks. Its not just about repaying your creditors on time either. If you get behind with a utility company or a landlord, they may report the unpaid balance to the credit bureaus. That will also drop your credit score. This is why its critical to pay all bills on time, all the time.

Recommended Reading: 824 Fico Score

How To Increase Your Credit Score

A 690 Credit Score is lower than the Good range. It would be best to be careful with your credit score to not fall within the Fair credit range .

Checking your FICO Score is the best way to improve credit scores. Information about improving your credit score will be given based on your credit file information. These are some ways to improve your score.

Compare More Recommended Credit Card

Is your credit score not 650, 660, 670, 680, or 690? Find more top credit cards for your credit score range:

Note: According to our research, these credit cards offer the best chance of approval for applicants with credit scores of 650, 651, 652, 653, 654, 655, 656, 657, 658, 659, 660, 661, 662, 663, 664, 665, 666, 667, 668, 669, 670, 671, 672, 673, 674, 675, 676, 677, 678, 679, 680, 681, 682, 683, 684, 685, 686, 687, 688, 689, 690, 691, 692, 693, 694, 695, 696, 697, 698 and 699. This does not mean guaranteed approval as credit decisions take into factors other than FICO score.

Petal credit cards are issued by WebBank, Member FDIC.

Also Check: Is 694 A Good Fico Score

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Don’t Miss: Affirm Credit Score Needed

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580,youre in the realm of mortgage eligibility. With a score above 620 you shouldhave no problem getting credit-approved to buy a house.

But remember that credit is only onepiece of the puzzle. A lender also needs to approve your income, employment, savings,and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy ahouse and how much youre approved to borrow get pre-approved by a mortgagelender. This can typically be done online for free, and it will give you averified answer about your home buying prospects.

Popular Articles

Formulating A Plan To Improve Your 690 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

Don’t Miss: Usaa Credit Score Monitoring

Better Credit Means Lower Costs

Interest rates differ based on your credit score, so knowing what to expect on average can help you budget for your car. A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 3.64% or better, or a used-car loan around 5.35%.

|

19.85%. |

Someone with a score in the low 700s might see rates on used cars of about 5.35%, compared with 17.11% or more for a buyer scoring in the mid-500s, according to the data from Experian. Using a car loan calculator illustrates the difference that can make.

For example, on a $20,000, five-year used-car loan with no down payment, thats a monthly payment of about $382 for the buyer with a higher credit score versus $498 for the buyer with a lower credit score. The buyer with better credit would pay about $2,915 in interest over the life of the loan, while the buyer with lesser credit would pay around $9,894. Plus, in most states, bad credit can mean higher car insurance rates, too.

The differences arent quite as steep for new-car loans: Borrowers with scores in the low 700s can expect an average rate of 3.64% compared to 11.03% for borrowers with credit in the mid-500s.

What Does A Good Credit Score Really Mean

You may have heard people talk about a credit score and a credit report. Sometimes people use these interchangeably, even though theyre not exactly the same thing.

Your is a listing of all of your credit-related information. Your credit report includes personal information like name, date of birth, social insurance number, current and previous addresses, etc. It also includes a variety of credit-related financial information like credit card information, retail cards, lines of credit, personal loans, bankruptcy or court decisions against you, debts sent to collection agencies, and inquiries from lenders and other financial institutions that have requested your credit report over the past three years.

A credit report is meant to be a resource for lenders who want to see information about your use of credit. In Canada, the major credit bureaus are Equifax and TransUnion. These two companies collect the information about consumers credit and create the credit reports that lenders review.

However, your is a score typically between 300 and 900 thats generated based on your credit report and credit history. Credit scoring companies have proprietary algorithms that takes a consumers credit information and crunches it into a handy score.

So, what a good credit score means is that when the information on your credit report is run through the credit scoring calculations, their program rates you either a good credit risk for a lender or not so good.

You May Like: Paypal Credit Bureau

How To Raise Your Credit Score For A Car Loan

If you are worried about being subprime and getting approved or just want to save money with a lower interest rate, you can take action today to improve your credit score. First step? Check your credit report from the credit reporting agencies to see where you stand and how you can improve your credit rating.

Find Out More About Your Credit Score

A good score is 690 FICO. If your score is within the Very Good range, you can get lower interest rates and more favorable borrowing terms. Green Day Online offers a free credit report.

This report will help you assess your credit score and pinpoint the most critical factors. Learn more about the free credit score and the ranges they can reach.

Read Also: How Long Repo Stays On Credit Report

How To Maintain A Good Credit Score

Practicing healthy credit habits can help keep your score in a good range. Its smart to keep your balances as low as possible. Your credit utilization, which is how much of your available credit limit youre using, is a major factor in credit score calculations. Popular advice is to keep your utilization rate below 30%. But the lower the better its smart to leave some breathing room should an unexpected expense come up.

Because your payment history is another important credit score factor, youre likely to achieve and maintain a good credit score by not missing payments. Automate payments when you can because with multiple services, subscriptions and accounts, it can be easy to let one accidentally slip.

Aim to only apply for credit when needed. Of course, theres no need to avoid credit altogether. For many people, lifes major purchases may require loans or other credit, and a good credit score lays the groundwork for your credit goals. But because new credit may result in hard inquiries on your report its smart to limit credit applications.

Some people like to take advantage of rewards credit cards that are geared toward those with good credit scores. Just make sure youre mindful in your approach and not overspending and over-applying for the sake of some cash back or travel points.

Can You Get A Personal Loan With A Credit Score Of 659

There are very few lenders who will approve you for a personal loan with a 659 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

You May Like: R9 Credit Score

How To Improve Your 690 Credit Score

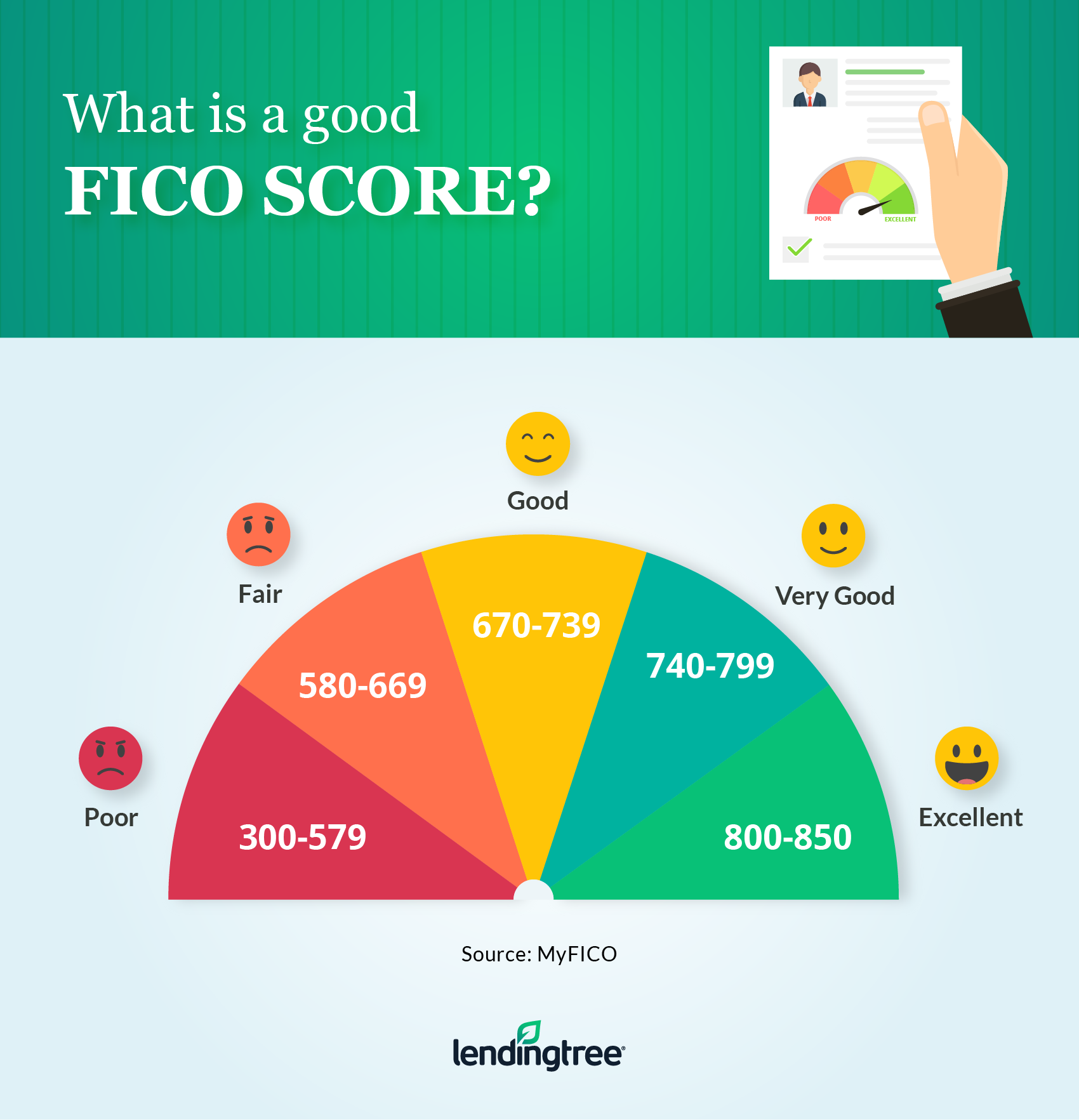

A FICO® Score of 690 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 690 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

40% of consumers have FICO® Scores lower than 690.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Be Punctual With Your Payments

Its a fact you have probably heard before: timely payment of your bills is the best way to improve a good credit score. You should find the one that works best for you and keep it. Some tools work better than others.

These include automatic bill-payment systems or reminders for your phone. Sticky notes and calendars are better for some people. Your passwords could be lost after six months. Keep your system current in case of emergency.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Understanding Your Credit Score

Your credit report is an essential part of getting your credit score, as it details your credit history. Any mistake on this document could lower your score. Its easy to check your credit score, and youre entitled to a free credit report from all three major credit reporting agencies once a year.

Its good practice to stay on top of your credit score and check it often for any errors to ensure youre in the best possible position. From there, you can assess your options for a conventional or government-backed loan and, when youre ready, apply for a mortgage.

Is There A Minimum Credit Score Needed To Buy A Car

Lets look back at the minimum credit score you can have to buy a car. Keep in mind, If you have enough saved to buy the car with cash, you dont need a loan, and your credit score wont come into play. You only need a minimum credit score to buy a car when you finance the purchase.

Above, we mentioned that borrowers who have low credit fall into a category called subprime. Subprime auto loan borrowers typically need a minimum credit score of 500. With a score of 450 or above, theres a chance you could get a deep subprime loan, but the interest rate may be so high that youre better off skipping the car purchase for now if you can.

If you can patiently build your credit score to at least 660 or slowly save up a larger fund to buy a car, youll have an easier time buying a car and making the payments than if you were to get a subprime or deep subprime car loan.

Read Also: Free Credit Report With Itin Number