When Should You Apply For Mortgage Preapproval

A mortgage preapproval is one of the first and most essential steps toward buying a home. It is wise to understand how much house you can afford before you start shopping. Therefore, you might want to get prequalified for a mortgage as you start looking at homes. Then, when you feel ready to put an offer on a home, you can get preapproved for a mortgage. This way, you will avoid preapproval expiration if you decide to shop around for a while.

Therefore, a borrower should apply for a mortgage preapproval when they are actively in the home buying process, but not so far in advance that they run the risk of their preapproval expiring. If you are unsure if you should get a mortgage preapproval letter, you may want to have a conversation with a mortgagor you trust. They will help you with a prequalification to help you start the home buying process and get a good idea of what you can afford. Then, when youre ready to put an offer in on a home, you can get a preapproval.

Re: Building A House How Long Is A Credit Report Good For Before They Have To Pull Another

In our case, it was pulled for pre-approval April 2008 with our mortgage broker. They pulled again Oct 2008 just to check dti,etc. then just pulled monday so we can lock in rate,etc for closing in 5-6 weeks.

Ours may be alittle different as we are going with a custom home builder & not a big company.

Why Lenders Pull Credit Again

There is often a long lapse of time between when you apply for a mortgage and when you actually close. If it is a purchase, you could be looking at as long as six months before you close. That is a long time to let your credit go unchecked. What if you racked up your credit card bills when you purchased furniture for the home? What if your car broke down and was unfixable and you had to purchase a new car? These things might not make you unable to afford the mortgage, but they definitely affect your debt ratio. If your ratio is beyond the recommended guidelines for the loan program, the lender has to pull their approval. If they dont, they could be on the hook with the overseeing agency, such as Fannie Mae or Freddie Mac. Lenders are held responsible with the new regulations, such as the Dodd-Frank Act and the Ability-to-Repay Rule.

Also Check: Does Kornerstone Credit Report To The Credit Bureaus

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

What Is A Good Credit Score

There is no single answer to the question “What is a good credit score”? Different lenders have different standards for credit scores they will accept on the loans they offer. And the three credit reporting agencies do not rank credit scores in exactly the same way.

Experian and Equifax both rank credit scores in the ranges you see below. They believe any score above 670 is good and any score below 580 is poor.

Recommended Reading: Does American Express Report To Credit Bureaus

What Credit Score Do I Need For A Mortgage

There isnât a specific credit score you need for a mortgage, and thatâs because there isnât just one credit score.

When you make an application for a mortgage or other type of credit, lenders work out a credit score for you. This is to help them decide if they think youâll be a risk worth taking – if youâll be a responsible, reliable borrower and likely to repay the debt. Usually, a higher score means youâre seen as lower risk â the more points you score, the more chance you have of being accepted for a mortgage, and at better rates.

Minimum Credit Score Required For Mortgage Approval In 2021

Categories

Getting approved for a mortgage these days can be a real challenge, especially with housing prices constantly on the rise. In Toronto, for instance, youll be paying over $820,000 for a home, which is nearly $100K more than the average price the year before.

Unless youre rolling in cash, thats a lot of money to have to come up with in order to purchase a home. Moreover, a lot goes into getting a mortgage. Lenders look at a number of factors when theyre assessing a borrower for a mortgage such as a sizeable down payment, a good income and, of course, a favourable credit score.

A high credit score, in particular, will not only get you approved for the mortgage but a favourable interest rate as well. Being that credit scores are such a significant part of the lending process, its no wonder that we get so many inquiries about what qualifies as an acceptable score in terms of getting approved for a mortgage.

Also Check: Does Speedy Cash Report To Credit Bureaus

You Can Check Your Own Credit With No Impact On Your Score

When you check your own credit whether you’re getting a or a it’s handled differently by the credit reporting agencies and does not affect your credit score. If you are applying for a mortgage and haven’t already checked your credit report for errors, do so now. You can get a free copy of your credit report at www.annualcreditreport.com. If you find any errors, get them corrected as soon as possible.

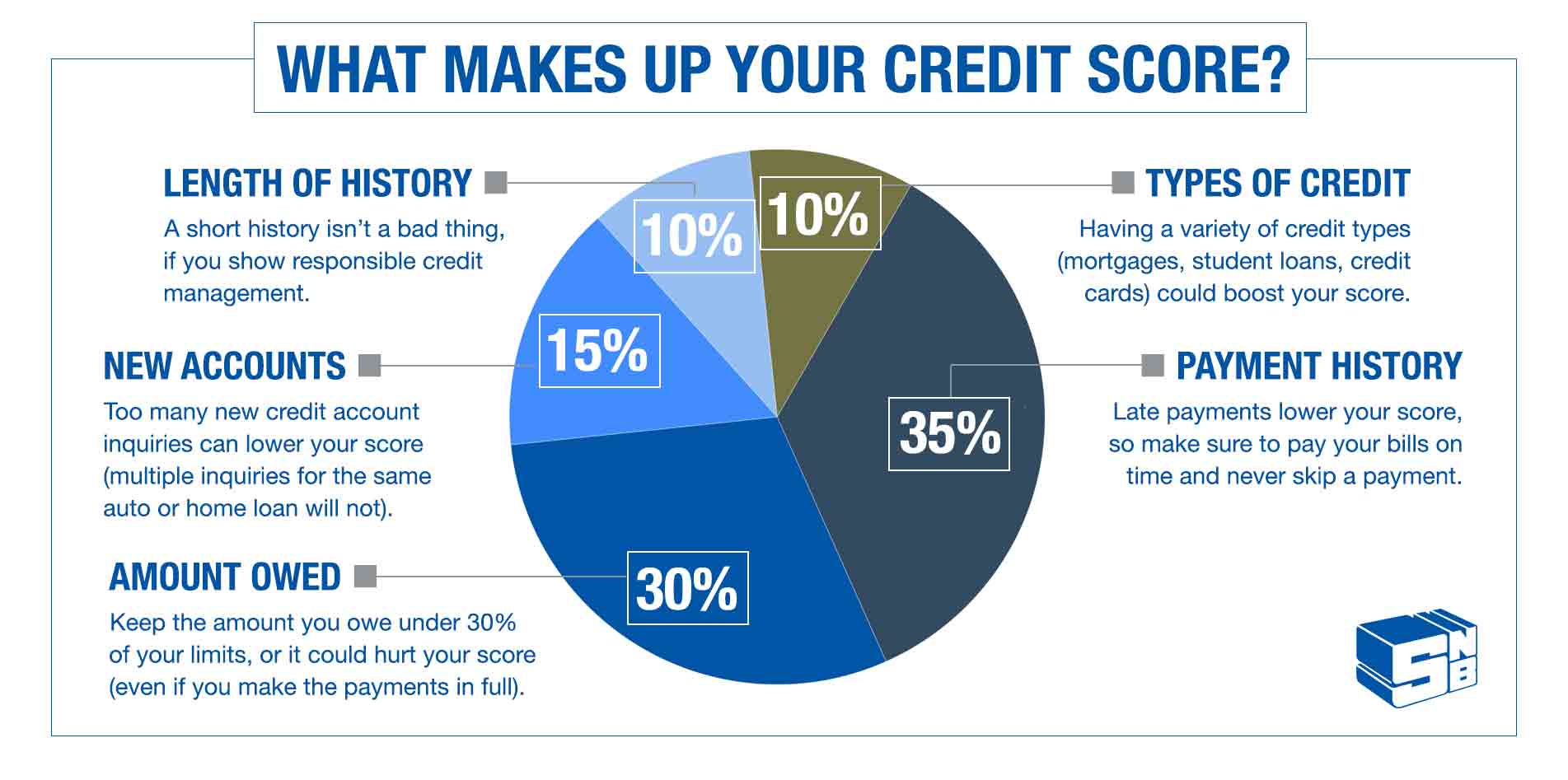

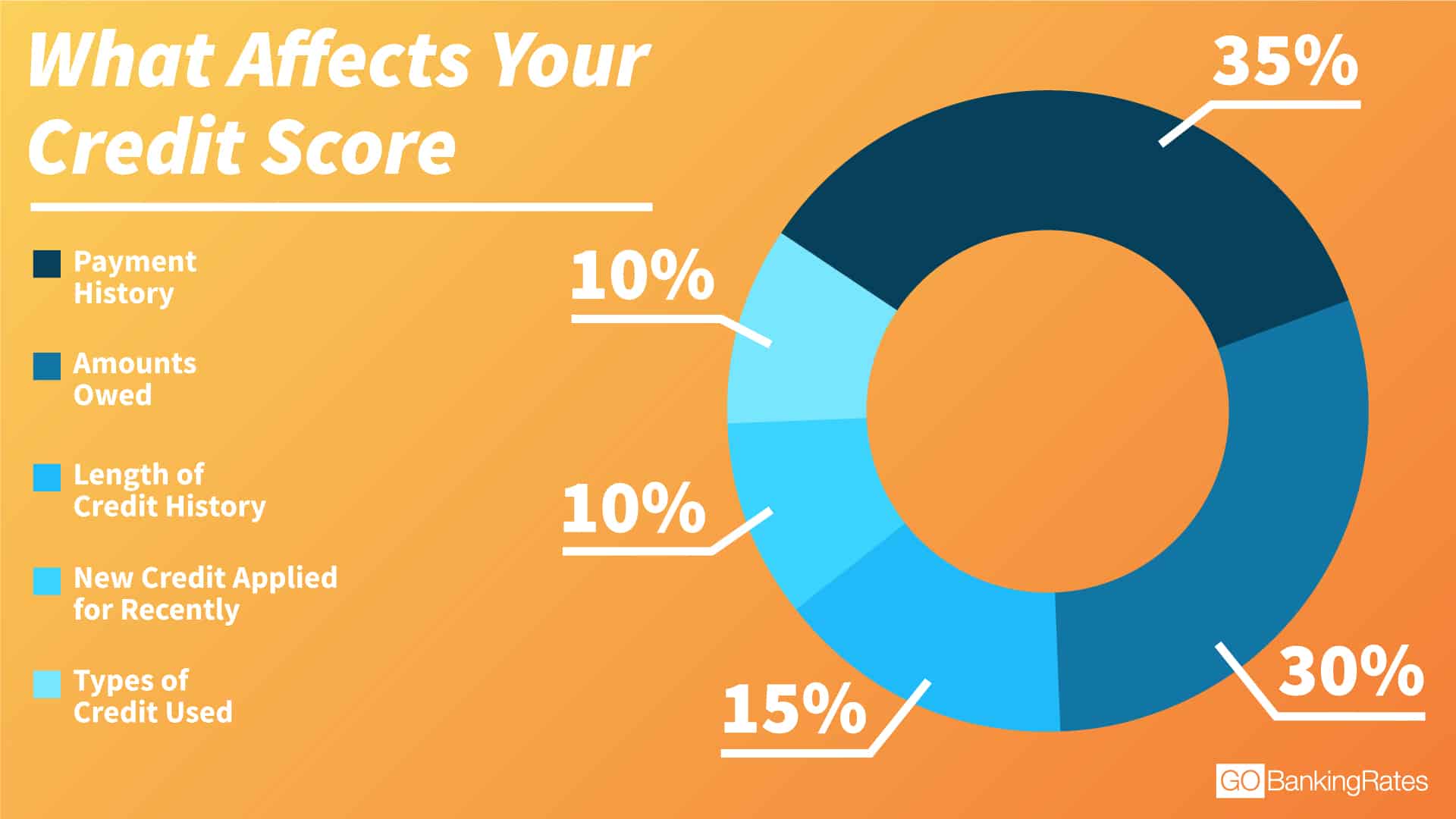

A Mortgage Diversifies Your Credit

The kinds of credit you use credit cards, auto loans, mortgage also affect your score, but not nearly as much as paying on time. In credit-speak, your credit cards are revolving credit, and your mortgage is an installment loan.

In general, the more credit diversity, the better, and a mortgage adds to the mix.

Don’t Miss: 698 Credit Score Mortgage

Will Rate Shopping Hurt My Credit

Each time you apply for new credit youre going to be hit with a hard inquiry. As noted, hard inquires will pull your score down by a few points.

However, FICO models allow consumers to shop for the same type of credit within a certain period of time.

The credit bureaus identify that youre comparison shopping by recognizing the types of credit for which youre applying.

According to the Consumer Federal Protection Bureau , the impact on your credit is the same regardless of the number of inquiries, as long as the inquiries are made by mortgage brokers or lenders within a 45-day window.

However, its important to note that some companies are using older FICO models. Some older FICO models allow for just 14 days for multiple inquires to have the impact of just one.

For this reason, a good rule of thumb is to try to limit your credit pulls for rate shopping to two weeks.

Information Held On The Databases

What loans are included?

- Tax liabilities

Consent for personal information to be included on adatabase

Under data protection regulations, organisations that hold your personalinformation must show why they are holding it.

Central Credit Register

The legal basis for the Central Bank to collect and hold personalinformation in the Central Credit Register is set out in the Credit ReportingAct 2013 and the Regulations.

Since 2017, lenders must submit your personal and credit information to theCentral Credit Register.

Irish Credit Bureau

The ICB relies on the principle of legitimate interests under the GeneralData Protection Regulation as the legal basis to collect and processyour personal and credit information.

The legitimate interests include supporting a full and accurate assessmentof loan applications, helping to avoid over-indebtedness and supporting faster,consistent lending decisions. You can read more about what entitles theICB to process your personal data .

Consent for a lender to check your credit history

When you apply for a loan, the lender must check the Central Credit Registerif the loan is for 2,000 or more. Lenders can also check the Central CreditRegister if the loan application is for under 2,000.

Your consent is not required for lenders to check the Central CreditRegister.

What information about you is held on the databases?

How far back does the information go?

Central Credit Register

Irish Credit Bureau

How long is information kept?

You May Like: How To Get Credit Report Without Social Security Number

If I Meet A Minimum Credit Score Will I Be Accepted For A Mortgage

Not necessarily as lenders take lots of factors regarding your affordability into consideration. You are more likely to be accepted if you meet a minimum score as this suggests that youre a careful borrower.

However, its also important to prepare for your application for a mortgage by organising your:

-

Pay slips and proof of bonuses/commission and tax paid or self-assessment tax accounts if youre applying for a self-employed mortgage

-

Passport, birth certificate and drivers license

-

Proof of deposit

-

Proof of address

-

Gift letter If you’re receiving help with your deposit, the lender will need a letter from the person providing the gift explaining that they are gifting the deposit and understand that they in no way own any share of the property being mortgaged or expect the money to be paid back.

Lenders work across a lot of different criteria, and your credit score is just one part, so even if you do not meet the minimum levels, you should speak to one of our specialist mortgage advisors to see how we can help.

Do Credit Checks Keep You From Refinancing

Even in a still-hot sellers real estate market, refinance mortgage applications account for more than 60% of all mortgage applications, according to the Mortgage Bankers Association.

Low interest rates continue to defy the odds, and rising home values have ignited a flurry of refinances.

Some mortgage rate shoppers, however, worry about too many credit pulls which lower their credit scores. They shy away from refinancing.

After all, a lower mortgage payment wont do much good if borrowing costs rise for other items.

Fortunately, there are laws in place to protect the consumer who wants to shop around for the best mortgage rate.

Recommended Reading: Does Paypal Report To Credit Bureaus

Why Doesnt My Mortgage Appear On My Credit Report

A home is the biggest purchase most Americans ever makeand a home mortgage is the biggest loan most of us will ever take out. So shouldn’t your mortgage show up on your credit report? Generally, it willbut there are some situations where your mortgage may not appear on your report. Your mortgage may not show up on your credit report if your lender doesn’t report to credit bureaus, if your mortgage is new and hasn’t been reported yet, or if there’s an error on your loan paperwork, among other reasons.

To understand why your mortgage might not show up, it’s important to know how credit reports work. A is a record of how you use credit, based on factors such as the amount and type of debt you carry and whether you pay your bills on time. Each of three major credit reporting agenciesExperian, TransUnion and Equifaxcompiles a credit report on you based on information provided by your creditors and other sources. Whenever you apply for a loan, credit card or other type of credit, lenders can look at this report to assess your creditworthiness.

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 87 votes.

Read Also: Mprcc On Credit Report

Mortgage Lenders Look For Inquiries When They Pull Credit

One last thing lenders look for when they pull credit prior to the closing is how many inquiries you have on your report. Inquiries are other lenders who pulled your credit in the interest of either increasing your existing credit lines or extending new credit. Even if you dont have any new credit lines reporting, the inquiries may hurt you. The lender may require a written explanation for these inquiries. They may also need extra time to determine if you had any new credit extended to you. Because it sometimes takes a little while for new credit to show up on a report, the lender has to proceed with caution. If they provide you with the mortgage knowing there was a chance you had new debt out there, they could end up stuck with the loan on their own portfolio because no one on the secondary market will purchase it any longer.

In order to prevent any issues with your credit, dont make any changes before you close on your loan. Any purchases you need to make can wait. If you cannot pay cash, then consider yourself unable to afford it at the moment. This way you take away any risk of your credit score changing for the worse. Also, avoid any other inquiries with any lenders. Even if the inquiry is literally just an inquiry and you are not serious about another loan, dont take the chance. Every lender handles these situations differently. Some will take your word for it that you didnt open anything new, while others will delay the closing until they have concrete answers.

What Can Your Experian Credit Score Tell You

The credit score you need to get a mortgage varies, as thereâs no one credit score or universal âmagic numberâ. However, if you have a good credit score from one of the main such as Experian, you are likely to have a good credit score with your lender. Checking your Experian Credit Score before you apply for a mortgage can give you an idea of how lenders may see you, based on information in your Experian Credit Report. It can also help you work out if you need to improve your credit history before making your mortgage application.

You May Like: How Long Do Inquiries Stay On Chexsystems

Can I Get A Mortgage If My Credit Score Is Low

When we talk about minimum credit scores required to get approved for a mortgage, were talking about conventional lenders, such as big banks. These traditional lenders are usually quite stringent about their mortgage approval requirements, including the credit scores needed for mortgage approval.

There are options for bad credit borrowers who are looking for a mortgage to finance a home purchase. Credit unions, trust companies, and subprime lenders are potential sources for mortgages for borrowers who cant qualify with their banks because of their sub-par credit scores. These sources often deal with people who may be viewed as risky to conventional lenders.

Have you considered a bridge loan to help purchase the home of your dreams?

It should be noted that if you do plan to apply for a mortgage with one of these lenders with a bad credit score, you will likely pay a higher interest rate than you would if you had a higher credit score and applied with a conventional lender.

Thats why its best to consider taking the time to improve your credit score before applying for a mortgage. That way youll have an easier time getting approved for a home loan and clinch a lower rate, which will make your mortgage less expensive.

Loans Canada Lookout

What If My Credit Scores Drop During The Mortgage Application Process

If a mortgage lender qualified borrower for a home loan and has submitted the application, the credit score that was pulled at the time of the mortgage application will be used throughout the mortgage approval process. That score is good for 120 days:

- Borrowers with a middle score of 650, that credit score will be used throughout the mortgage application process

- In the event credit score changes during the mortgage process, it does not matter

- This is because the 650 credit score will be used until closing

- The initial credit score is good for 120 days

- After 120 days is when credit scores expire and a new credit report needs to be pulled

- Most mortgage loans close in 60 days or less

- Many mortgage lenders will do a soft credit pull prior to issuing a clear to close

- The reason for the soft pull is not to get a new credit score but to see if the borrower has incurred more debt that may affect their debt to income ratios

- What underwriters look for is that borrowers have not incurred more debt or had late payments

- This can affect either the debt to income ratios and/or financial distress and the ability to repay the new mortgage loan

- Many times when borrowers use their credit cards and their credit utilization ratios are higher, then it is normal for borrowers credit scores to drop

As long as it does not affect the debt to income ratios, there should be no issues.

Recommended Reading: How To Remove Items From Credit Report After 7 Years