Formulating A Plan To Improve Your 824 Credit Rating

First aid foremost, you need to understand that it takes time for you to build up your credit score. Dont expect it to be improved in the next week or the next month, even if you do everything necessary to improve it.

If you have any negative factors on your credit report right now, including a late payment, a bankruptcy, or an inquiry, you may want to pay the bills now and then wait. Remember that time is your ally, not your enemy. In the end, there is no quick fix for rebuilding a credit score. It takes time.

In formulating a plan to rebuild your credit rating, you need to understand how specific actions that you take will harm or hurt your credit score. For example, will working with your creditor to close an existing account in favor of rebuilding a new one with more favorable terms hurt or harm you?

Here are two factors for you to consider: a change to your credit report will affect your credit score , and your score is based entirely on the figures that are already in your report.

A major question that people have is how long it will take for them to improve their credit score. But heres what these people are missing: there isnt anything you can do to boost your actual score. Instead, you can do many things to rebuild your history of credit, and the healthier your credit history, the more elevated your credit score will be.

How To Improve Your 824 Credit Score

A FICO® Score of 824 is well above the average credit score of 704. An 824 FICO® Score is nearly perfect. You still may be able to improve it a bit, but while it may be possible to achieve a higher numeric score, lenders are unlikely to see much difference between your score and those that are closer to 850.

Among consumers with FICO® credit scores of 824, the average utilization rate is 7.7%.

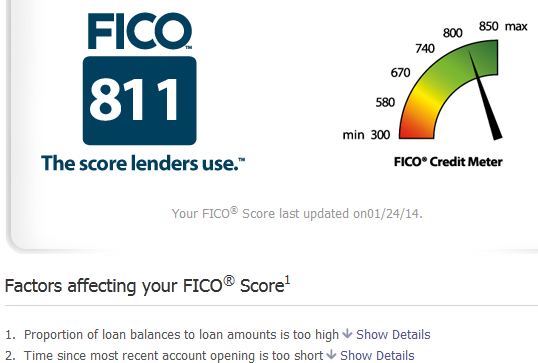

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive a report that uses specific information in your credit report that indicates why your score isn’t even higher.

Because your score is extraordinarily good, none of those factors is likely to be a major influence, but you may be able to tweak them to get even closer to perfection.

How To Get An 822 Credit Score

Theres no one path you can follow to get an excellent credit score, but there are some key factors to be aware of while you continue to build and maintain it.

Even if youre holding steady with excellent credit, its still a good idea to understand these credit factors especially if youre in the market for a new loan or youre aiming for the highest score.

Read Also: What Credit Score Do You Need For Affirm

What Is A Good Credit Score In Canada

A good credit score in Canada is typically one that is 680 or higher. Of course, there are many different types of credit scores , and keep in mind that the credit scores a lender sees are usually different from those that you might have access to. Additionally, your Equifax credit scores might be different from your TransUnion scores. The image below illustrates the different credit score ranges in Canada and can help you determine if your credit score is a good credit score.

How Can I Get A Good Credit Score

To get a good credit score, you need to know first what your credit score is. It might already be good! You can find out what your credit score is by signing up for your Free Credit Report with TotallyMoney. It only takes a few moments, wonât harm your credit rating, and doesnât cost a penny. If you already know what your credit score is, and it could do with improving, you need to convince lenders that youâre a responsible borrower and that you can you can be relied upon to pay back what you owe. For more on how to get a good credit score, read our guide: â11 tips on how to improve your credit score.â

Don’t Miss: How To Get Credit Report Without Social Security Number

Recognize That Your Rates Can Increase

Currently, credit card companies cannot raise your credit rate for at least one year after you have opened your account, unless any of the following circumstances apply:

- A six month introductory rate exists

- You are late paying your bill by sixty days

- You have a card with a variable rate that is tied to an index and that index increases

You need to recognize that your credit rates will increase in the future, at least after the initial twelve months, and you need to establish with your potential creditor exactly when your rates will increase, by how much, and if there is anything you can do to lower your rates.

What Is The Highest Credit Score

For most situations, 850 is the best FICO score possible. It’s extremely difficult to reach a perfect credit score, though. Only 20% of Americans have a credit score of 800 or higher. Even if you’re one of the people with the best credit score in the country, you might not reach 850.

Wondering how to get a 850 credit score? Here are some ways to improve your credit score — and move closer to the highest credit score you can get:

- Paying off your credit card balance every month

- Correcting errors on your

- Keeping an old credit card open, even if you don’t use it often

- Paying your bills on-time

- Requesting an increase to your credit limit

If you reach a FICO credit score of 800 or higher, you should congratulate yourself. Raising your credit score takes hard work, dedication, and patience. Even if you don’t have perfect credit, an excellent credit score is something to be proud of.

Recommended Reading: Is Creditwise Good

Excellent Credit Qualifies You For Top

Years before Kevin King, a credit consultant business owner and personal finance podcaster, became known by the moniker The 800 Credit Score Man, the only plastic he could get with his 585 credit score was a JC Penney credit card with a $100 limit. He made improvements over time, and was pleasantly surprised when he took advantage of a free credit score check and discovered it had climbed to 805.

The first thing I did was call my brother because he was the only person in the world who knew how low my score was. It was a great feeling. It gave me a sense of pride, swagger, and I felt that I had clout, he says.

Beyond clout, high credit scorers such as King also gain access to top-notch consumer benefits.

Excellent credit gives you leverage to take advantage of the best kinds of offers that lenders and other businesses might make to get you and keep you as a customer, says Rod Griffin, director of public education for Experian, one of the three major credit bureaus.

Ready to start taking advantage of your top-notch credit status? Here are three big moves you should consider once you join the excellent credit score club.

Protect Your Exceptional Credit Score

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

Mortgage fraud occurs when a borrower, broker or an appraiser lies about information on the application for a mortgage loan. During the mortgage crisis, Experian estimated that first-party fraudlike loan stackingmay have accounted for more than 25% of all consumer credit charge-offs at the time.

Credit-monitoring and identity theft protection services can help ward off cybercriminals by flagging suspicious activity on your credit file. By alerting you to changes in your credit score and suspicious activity on your credit report, these services can help you preserve your excellent credit and Exceptional FICO® Score.

Recommended Reading: How Does A Balance Transfer Affect Your Credit Score

What Is A Good Credit Score And Tips To Maintain It

Get answers to commonly asked questions related to the credit score and credit reports

If you are wondering what exactly constitutes a good credit score and how it is calculated, we have all the details for you. Read on to find out everything about a good credit score and the various benefits it offers.

About Good Credit Score

How Do I Get Bcr

You can get your Business Credit Score & Report in Just 3 Easy Steps

Step 1: Fill in your business details such as business, PAN, Address, name of authorized signatory, PAN of authorized signatory

Step 2: Secure pay for your report using Debit or Credit Card / Net Banking details

Step 3: Upload your documents such as scanned copy of PAN, address Proof, Authorization Letter etc.

Your report will be sent to you within 7 working days upon successful verification of the shared documents.

Don’t Miss: Bpvisa/syncb

What Is A Crif Credit Score

It is a three- digit number which gives a bank or a lender a sense of your creditworthiness i.e. whether you have been repaying your dues regularly or not. If the credit score is good, then the lender understands that you have used loans or credit cards in the past and have repaid all the dues properly and regularly. This makes lender comfortable to approve your current application for a loan or credit card.

CRIF credit score generally ranges between 300900. 300 is the lowest score indicating poor credit score and 900 is the highest score possible. A score above 700 is generally considered good.

Factors That Affect Credit Scores

Five factors are included and weighted to calculate a person’s FICO credit score:

- 35%: Payment history

- 15%: Length of credit history

- 10%: New credit and recently opened accounts

- 10%: Types of credit in use

It is important to note that FICO scores do not take age into consideration, but they do weight the length of credit history. Even though younger people may be at a disadvantage, it is possible for people with short histories to get favorable scores depending on the rest of the credit report. Newer accounts, for example, will lower the average account age, which in turn could lower the credit score.

FICO likes to see established accounts. Young people with several years worth of credit accounts and no new accounts that would lower the average account age can score higher than young people with too many accounts, or those who have recently opened an account.

Read Also: No Credit Card Credit Scores

Instantly Boost Your Score

A higher score means lenders see you as lower risk. So, a good score will be good news if you’re hoping to get a new credit card, apply for a loan, or even a mortgage. Whatever you need credit for, making sure your score’s good, or even better excellent, means you’re more likely to be accepted, and offered better rates. Here, we’ll take a look at what a good credit score is, how it’s calculated, and what factors make it âgoodâ.

Here’s What Americans’ Fico Scores Look Like

by The Ascent Staff | July 29, 2020

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The average American has a FICO credit score of 706. But unless your credit score is exactly 706, this doesn’t tell you much about where you stand. Wondering how you compare with other American consumers? Here’s a look at the current distribution of FICO scores, and some guidelines that can help you interpret what your score means.

Read Also: What Is Syncb Ntwk On Credit Report

How Is A Credit Score Calculated

Whenever you apply for credit, lenders will look at information from your credit report, application form, plus any information they hold on you . All this data is then used to calculate your credit score. Every lender has a different way of calculating it, largely because they all have access to different information but they also have different lending criteria.

Generally, the higher your score, the better your chances of being accepted for credit, at the best rates.

like ourselves, calculate a version of your credit score. How each CRA calculates this varies but there are certain factors they all consider, including – how much you owe, how often you apply for credit, and whether your payments are made on time. You can read more about the factors that influence your score in our guide to what affects your score.

Credit Score: Is It Good Or Bad

Your score falls in the range of scores, from 800 to 850, that is considered Exceptional. Your FICO® Score and is well above the average credit score. Consumers with scores in this range may expect easy approvals when applying for new credit.

21% of all consumers have FICO® Scores in the Exceptional range.

Less than 1% of consumers with Exceptional FICO® Scores are likely to become seriously delinquent in the future.

Don’t Miss: When Do Companies Report To Credit Bureau

Now You Qualify For The Lowest Interest Rates And Best Credit Cards

Thomas J. Catalano is a CFP and Registered Investment Adviser with the state of South Carolina. He is a CFP, registered investment advisor, and he owns his own financial advisory firm. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If youve earned an 800-plus credit scorewell done. That demonstrates to lenders that you are an exceptional borrower and puts you well above the average score of U.S. consumers. In addition to bragging rights, an 800-plus credit score can qualify you for better offers and faster approvals when you apply for new credit. Heres what you need to know to make the most of that 800-plus credit score.

What Counts Towards Your 824 Credit Score

In essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 824 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Don’t Miss: Does Titlemax Report To Credit Agencies

What Report Options Are Available To Me Ffcr Instant Only Report:

There are 3 report options which are available for your use:

FFCR : You are entitled to one FULL FREE ANNUAL CREDIT REPORT from CRIF once a year. This can take up to 3 working days to get ready for your viewing.

Instant: You can download an instant copy of your Credit Report instant within 5 minutes by paying the amount of INR399.

Only Report: You can also get only your credit report instantly without score at INR 99 from CRIF.

What Is A Good Credit Score For A Mortgage

Your credit score arguably matters more on a mortgage application than with any other type of personal financing. With a mortgage, a good credit score might save you thousands of dollars in interest every year.

For example, say you have a FICO credit score around 640 when you apply for a $350,000 mortgage. FICOs Loan Savings Calculator estimated that in June 2020, your APR would be around 3.957% on a 30-year, fixed-rate loan. Your monthly payment would be $1,662, and youd pay $248,424 in interest over the life of your loan.

Now, imagine you work to improve your FICO Score to 680. With the higher score, you might qualify for an APR of 3.313%. Based on the lower rate, your monthly payment would be $1,535 for the same home. You would pay $202,726 in interest over your 30-year loan term. Because you improved your credit score from fair to good, you would save:

- $127 per month

- $1,524 per year

- $45,698 over the life of the loan

If youre aiming to qualify for a mortgage lenders lowest rates, that generally falls under a FICO Score of 760 or higher. Of course, getting a great mortgage rate requires more than just a brag-worthy credit score. But the three-digit numbers sold alongside your credit reports are a key factor that mortgage lenders consider when you apply for financing.

Read More:How Your Credit Score Affects Your Mortgage Rates

Don’t Miss: How Often Does Usaa Update Credit Score