Whats The Mystery Behind Which Bureaus Are Used By Card Issuers

Ulzheimer, the credit-reporting expert, says he understands why some card issuers might balk at divulging which credit bureaus they rely on.

I can see some card issuers being hesitant to disclose which bureau they use for card underwriting because consumers are often coached to apply with a lender that pulls the credit report where their score is the highest. Its a rudimentary way to game the system, to some extent, he says.

This isnt national security. But they are certainly not required to disclose that information to a potential applicant, Ulzheimer adds.

A card issuer typically picks one report from one bureau when deciding on a credit card application, he says. Why? Pulling reports from all three credit bureaus for every application would be too costly.

Ulzheimer says a card issuer chooses a bureau based, in part, on what type of agreement it has with that bureau. These contracts almost always include a commitment to buy a certain number of reports from a bureau, he says.

Weve seen reports of Chase, for example, pulling from each of the three major credit bureaus depending on the borrowers home state, Opperman says.

In some cases, a card issuer might pull a report combining data from more than one bureau, although Opperman says this isnt a common practice among card issuers.

Weve seen reports of Chase, for example, pulling from each of the three major credit bureaus depending on the borrowers home state.

Melinda Opperman, president, Credit.org

Secured Vs Unsecured Credit Cards

A little different than traditional credit cards, many of the cards on the list above are “secured cards” that require a refundable deposit in order for you to qualify. Most of the time, the structuring is easy. The higher the deposit you put down, the higher the line of credit. If you put down a $500 deposit, you then have a $500 line of credit. It’s as easy as that.

Sometimes a card will have a limit on how much of a deposit you can put down, but almost always, there will be a minimum deposit amount; usually around $200 .

You can generally add to your deposit to increase your line of credit , and sometimes, as with the Secured Mastercard® from Capital One, you can be considered for a higher credit line just for making payments on time, with no additional deposit needed.

That deposit might initially make secured credit cards less appealing, but remember, it’s refundable, and this safety net is there for a reason. For one, it should encourage you to use your card responsibly, and to only spend within your means, and then on the other side of things, it protects banks in case you’re unable to make your payments. If you have low credit, you are a risk to banks, so a refundable security deposit is a small price to pay in the long run. Do keep in mind though that the security deposit does not cover your monthly payments. You must still pay at least your minimum payment due on time each month.

Does American Express Report Authorized Users To Credit Bureaus

Yes. American Express reports authorized users to the three major credit bureaus, Experian, Equifax and TransUnion. But the authorized user has to be at least 18 years old. Also, they must provide their Social Security number and date of birth. Otherwise, American Express could cancel their credit card.

Note, American Express refers to its authorized users as additional card members.

What is American Express reporting policy?

American Express will report only the positive information to the authorized users credit report. Positive information means timely payments and low utilization rates that help the authorized user build credit.

If the main cardholder becomes delinquent, American Express will stop reporting the authorized user to preserve their credit score.

You May Like: How To Get Credit Report Without Social Security Number

Does My Corporate Credit Card Impact My Credit Score

https://money.com/does-my-corporate-credit-card-impact-my-credit-score/

Your credit score is like your reputation: It takes a long time to build up, but just one mistake can knock it down. A late credit card payment, for example, can cost you several points. And now, when a mere 20 points can make the difference between the best rates on car loans and mortgages, it’s important to pay attention to all the factors that could pull you up–or down. An easy way to keep your score in tip-top shape is to pay your credit card bills on time and keep your debt-to-available-credit ratio low.

But what about corporate credit cards? If you’ve got a job, there’s a chance your employer had you sign up for a corporate credit card for approved work expenses. But what if your employer is late paying the bill? Or you’ve had a month of hefty work charges such as airline and hotel bills that could inflate your level of debt?

“If your corporate card’s activity shows up on your credit report, then yes, it’s going to impact your score,” says Craig Watts, a spokesperson for Fair Isaac.

Why Knowing When Credit Card Companies Report To Credit Bureaus Is Important

Knowing when credit card companies report to credit bureaus can clear up some confusion you may have with your credit reports. Have you ever checked your credit reports and seen a balance, but you know you pay off your card every month in full?

This is likely because credit card companies provide a snapshot of your current balance when they report to the credit bureaus.

So, if youre concerned about how this snapshot of your balance may affect your credit, consider keeping tabs on your spending by your statement closing date. You could also make a payment before your statement closing date, so your balance is lower when its reported. Keeping a low balance can help your credit overall.

Why? Because when it comes to your credit scores, one important factor is your credit utilization.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

What Do The Credit Bureaus Say

As you might expect, the three credit bureaus decline to disclose which card issuers purchase their credit reports. Similarly, the Consumer Data Industry Association, a trade group representing credit bureaus, says it also is unable to shed light on the credit bureaus used by card issuers.

Tip: A hard inquiry lowers your credit score, albeit by a small amount. This is because it can send an uncertain signal to a potential lender. For instance, why did you apply for new credit? Are you going to max out a new credit line? This is why its important to only apply for credit when you need it.

Is A Charge Card A Good Fit For You

Its easy to find credit cards designed for people with no credit, bad credit, excellent credit and everything in between. Yet you generally need a good to excellent credit rating to qualify for most charge cards. Stellar credit is a must if youre interested in a premium charge card.

Before you apply for a new charge card , its wise to take a look at your three credit reports and scores. Of course you can check for ;and dispute any mistakes you find. Checking your credit will also give you an idea of the current condition of your credit and whether or not youre likely to be approved for a charge card.

If you discover that your credit is in good shape, next its time to evaluate the cost of the charge cards you are considering versus their benefits. A $550 annual fee may seem high, but if you think youll be able to take advantage of the benefits it may be well worth the cost. However, if you dont think youll use a charge cards specific benefits then you may be better off searching for a card thats a better fit;for your spending habits.

In the end, if you open a charge card be sure to manage it well. When you take care of a charge card, it has the potential to help you improve your credit rating and put you into an even better borrowing position in the future. After all, the lifetime value of a good credit score could save you tens of thousands of dollars, and maybe more.

Recommended Reading: What Credit Score Do You Need For Paypal Credit

Best Business Credit Cards That Dont Report To Personal Credit For 2021

Jordan is a financial analyst with over two years of experience in the mortgage industry. He brings his expertise to Fit Small Businesss and bank account content.

This article is part of a larger series on Best Small Business Credit Cards.

Editors note: This is a recurring post with regularly updated card details.

Business credit cards issued by banks that dont report card activity to your personal credit wont impact your personal credit score. You can use these cards as you normally would to earn introductory rewards, access cheap financing, and keep your business expenses separated. While all the cards listed in this article still require a personal credit check and personal guarantee, your personal credit score wont be damaged by ongoing business activity.

The best business credit cards that dont report to personal credit are:

- Wells Fargo Business Platinum Credit Card: Best overall for earning rewards and accessing an introductory 0% annual percentage rate period

- Wells Fargo Business Elite Card®: Best for lowest ongoing APR on larger businesses

- Costco Anywhere Visa® Business Card: Best for earning gas and travel rewards as a Costco member

- Wells Fargo Business Secured Credit Card: Best for boosting poor business credit scores

How We Evaluated Business Credit Cards That Dont Report To Personal Credit

When deciding on the best options for this list, we considered business credit cards that dont report ongoing activity to your personal credit as the most important feature. Although these cards protect your personal credit scores, its also important to consider cards that offer the most benefit for your business. So, we also reviewed cards with great rewards, card perks, and low fees that also help you build business credit.

Read Also: How To Get Your Free Credit Report From Experian

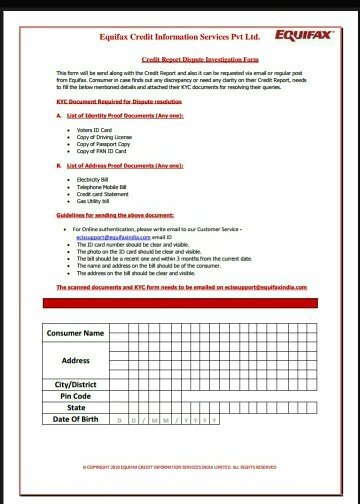

How To Get Additional Reports From Experian

The Federal Fair Credit Reporting Act is the law responsible for guaranteeing your access to your credit report each year. It also specifies other situations in which you can receive a free copy of your credit report.

You can get a free credit report in the following situations:

- You were denied or notified of an adverse action related to credit, employment, insurance, government license or other government-granted benefits, or another transaction initiated by you within the last 60 days and your credit report was the basis for the credit decision.

- You were denied a house or apartment rental or were required to pay a higher deposit than normally required within the last 60 days and your credit report was the basis for the credit decision.

- You are unemployed and intend to apply for employment within the next 60 days.

- You are a recipient of public welfare assistance.

- You have reason to believe that your credit report contains inaccurate information due to fraud.

Some lenders automatically provide your score when you are denied for a card, but some do not. If you know that you have a right to get a copy of your report you can request a copy of the report used to deny you and the lender must provide it.

Under certain state laws, residents in some states may be eligible for additional Experian credit report requests at a discounted price. Here’s the list of such states:

Stage 1: Establishing Business Credit Files

Each credit bureau has its own requirements for the creation of business credit files. If you have a business but arent seeing a credit report, you might be missing a few of these key ingredients.

Here are a few basic steps you should take that will apply to all the bureaus, and one for Dun & Bradstreet in particular.

Recommended Reading: How Much Does A Car Loan Affect Your Credit Score

American Express Prequalification And Preapproval

If you’re not sure your credit is good enough to qualify for a credit card with American Express, you can submit a request for prequalification through the card issuer’s website.

Prequalification starts when you seek out a credit card issuer and provide some information to see whether you might qualify for a particular offer. With credit cards, prequalification might be used interchangeably with preapproval, but they are different processes. Preapproval involves a credit card issuer asking a credit bureau for a list of those who meet the specific factors they have in mind. Preapproved consumers are then typically contacted by the card issuer and invited to apply.

In either case, the card issuer will run a soft credit check, which doesn’t impact your credit score. That check will allow the issuer to see which credit cards you have a good chance of getting approved for if you were to apply.

Of course, prequalification doesn’t mean you’re guaranteed to get approved for an American Express credit card. If you decide to submit a formal application, the card issuer will perform a hard credit inquiry, and may or may not approve you based on what it sees.

Apply For A Credit Card Based On Your Credit Score

It’s important to avoid applying for just any credit card. If your credit score isn’t considered good or better, you’ll have a hard time getting approved for a card directly from American Express. As such, it’s best to avoid the unnecessary hard credit inquiry and apply for a card with better approval odds.

Before you apply for a credit card, check your credit score to see where you stand. Then use an online tool like Experian CreditMatch to get an idea of which cards are accessible based on your credit profile. CreditMatch can pair you with cards suitable for your unique credit profile, so it’s a great resource if you’re unsure where to start.

Read Also: What Credit Report Does Comenity Bank Pull

About American Express Credit Guide

What information can I find on MyCredit Guide?

MyCredit Guide provides your VantageScore® credit score by TransUnion®, refreshed weekly upon login. MyCredit Guide also includes a range of information and tools to help you understand your credit score better and plan for the future. Some of the features include:

- Score Factors impacting your score

- Up to 12 months of score history

- Detailed TransUnion credit report

- Email alerts about critical changes to your TransUnion credit report information to help you identify potential fraud

- Score simulator to help you assess the possible impact of financial choices before you make them

How often is the credit score in MyCredit Guide updated?;;;

Your VantageScore credit score is updated weekly, upon login.;;

What are the “Score Factors” impacting my VantageScore credit score?

The “Score Factors” impacting your VantageScore;credit score tell you what information from your TransUnion credit report is impacting the calculation of your score. These are some key factors that could affect your credit score:

- Your history of making payments on time

- How old your credit accounts are

- How much credit you are using

- Recent inquiries for credit

- Recently opened new credit or loan accounts

- How much credit you have available

What is the Credit Score Simulator?

Please note the results of Credit Score Simulator are estimated and dont necessarily show the exact results a given behavior will have on your score.;;;

How accurate is the Credit Score Simulator?

Delta Skymiles Platinum Business American Express Card: Best For Frequent Flyers

- Great for Delta Loyalists

- Priority boarding

- Relatively high annual fee.

While the Delta SkyMiles® Platinum Business American Express Card may be great for business owners who spend a lot on general travel, if youre a frequent flyer and you like Delta, then you may want to consider one of the three Amex Delta business cards available to consumers, especially the Delta SkyMiles® Platinum Business American Express Card.

Cardmembers can earn 3 Miles on every dollar spent on eligible purchases made directly with Delta and on every eligible dollar spent on purchases made directly with hotels. Earn 1.5 miles per dollar on single eligible purchases of $5,000 or more , up to 50,000 additional miles per year and 1 Mile on every eligible dollar spent on other purchases.;

This alone doesnt make it the best card, but the travel perks certainly do.; With the Delta SkyMiles® Platinum Business American Express Card, you can earn a generous welcome offer. Earn 45,000 bonus miles and 5,000 Medallion® Qualification Miles after you spend $3,000 in purchases on your new Card in the first three months. And, in some cases, your benefits will extend to up to nine guests.;

Don’t Miss: Does Barclaycard Report To Credit Bureaus

At A Glance: How Do You Build Business Credit

The credit-building process for businesses can be boiled down to nine relatively straightforward steps.

We explore each of these steps at length below, so go ahead and keep reading if youd like a bit more detail.

Insider tip

Not sure if youll qualify for a business card? You might! Learn more about who qualifies as a business owner and how to apply for business credit cards.

The Definitive Guide To Building Business Credit

Great business credit scores can make it easier to access financing options from loans to credit cards and beyond with terms and features that meet your needs. Start building yours by establishing a business credit file, then opening trade lines or a business credit card.

Business credit is pretty much like personal credit, but for businesses.

If you understand;how your personal and scores work, youll have a good idea of how business credit works too. But there are some important differences.

Business credit reports and scores are completely separate from personal reports and scores. However, lenders will typically check your personal credit alongside your business credit when you apply for business financing. This is especially true for small businesses.

Not all businesses have a credit history, just like not all people have a credit history. If a business hasnt been around very long, isnt listed in directories, or hasnt established any trade lines like business credit cards, business loans, or vendor accounts, there might not be any information to show in a commercial report. Plus, in some cases you might need to open a business credit file yourself with the commercial credit bureaus.

Great business credit comes with a number of potential benefits, some of which could end up saving you a lot of money in the long run. You might enjoy:

You May Like: Why Is There Aargon Agency On My Credit Report