How Good Is Your Credit Score

Can a Personal Loan Hurt My Credit Score?

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Personal credit report disputes cannot be submitted through Ask Experian. To dispute information in your personal credit report, simply follow the instructions provided with it. Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address.

To submit a dispute online visit Experian’s Dispute Center. If you have a current copy of your personal credit report, simply enter the report number where indicated, and follow the instructions provided. If you do not have a current personal report, Experian will provide a free copy when you submit the information requested. Additionally, you may obtain a free copy of your report once a week through April 2022 at AnnualCreditReport.

Resources

Get the Free Experian app:

What Is The Average Credit Score In Canada By Age

Categories

A good credit score is a valuable tool for anyone trying to navigate their financial life. True, making a decent income and saving money are also healthy practices, but a solid credit score is one of the key factors that can;put you in the position to get approved for loans and other types of credit products. You can use those products to pay for your childrens education, get married, even buy a car or a house. While everyones financial goals are different, one thing is certain. Its important to learn about your own credit score so you can always keep it in the best shape possible.

It can be tough to predict what your own will look like in the years to come. You could experience debt issues, job loss, or get your finances back on track, no one can predict the future. While its never a good idea to compare your finances to someone elses, it can be beneficial to understand where your credit score should be during different times in your life as well as how that can affect the overall health of your credit.;

Why Do Lenders Check Your Cibil Score Before Approving Your Loan

Since CIBIL score measures your overall creditworthiness, a lender is certain to check your score when reviewing your loan application for a variety of reasons. They are:

-

To check your credit history and past record

-

To see whether you are capable of repaying debts

-

To review your credit balance and understand the risk level of your profile

-

To judge whether you qualify for the loan

-

To decide on the loan amount to offer you and interest rate applicable

You May Like: How To Read A Transunion Credit Report

What Does Fico Score Mean

I wanted to explore what the FICO score means in present times and what individuals associate it with. In this post I go through the meaning of FICO and what you need to know about it.

Close

I wanted to explore FICO and what individuals associate it with just to get a sense of whether people think itâs a scary thing or not. When I went around and spoke to individuals about what a FICO score meant to them, I got a lot of similar responses. They said things like âItâs a big black box of confusion, so I donât mess with itâ and âFICO is an antiquated metric that is realistically an inaccurate representation of most peopleâs credit worthiness, including my own.â These conversations were with individuals ranging from age 24 to 32, which is a smaller representation of the community than I would have liked. That being said, they hit on some pretty key points that are worth talking about. Building your FICO score is tough. The people that I spoke with were worried that if they made one wrong move at such a young age, it could haunt their FICO scores and therefore their credit-worthiness for the better part of their adult life.

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

You May Like: How Do You Raise Your Credit Score

There Are Ways To Improve It

An excellent credit score is like the top math score on the SAT. With both, 800 is exceptional.;

But if your credit score isn’t near that number, you should know what constitutes a good credit score that will let you qualify for a loan at a decent interest rate.

The answer: It should be at least in the mid to high 600s.

If your score isn’t that high yet, you’ll need to exercise good borrowing behavior, take some strategic steps, and have patience. You may also want to take advantage of two new programs offered by credit industry companies that are designed to improve those numbers .

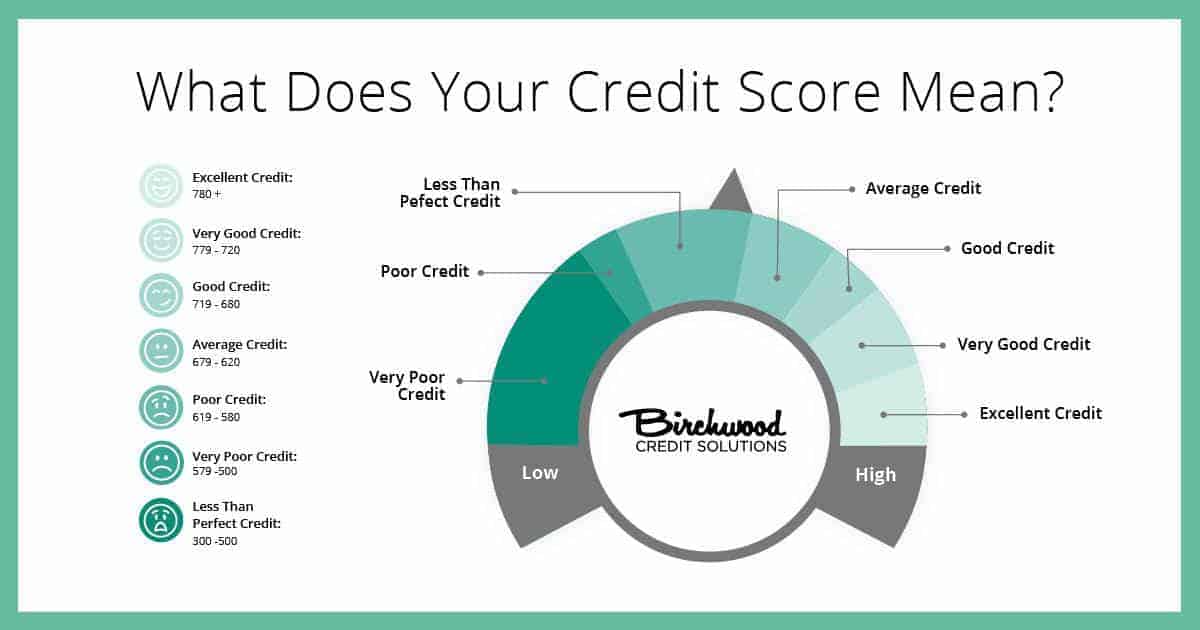

The FICO score is the brand of credit score used by most consumer lenders, so it’s the one to pay the most attention to. FICO credit scores typically range from a low of 300 to a high of 850. ;When you get a credit score report from your lender, your number is often depicted on a continuum like a spectrum or rainbow, with bright green denoting the 800 range and red representingwell, you know.

FICO says there’s no “cutoff”;where, say, a good credit score becomes a very good credit score, or a very good credit score becomes exceptional. But Experian, one of three major credit bureaus that supply data used in the FICO score,;lays out the boundaries this way:

How Can I Check My Credit Score

Its easy to review your credit scores, although you might have to pay a fee. Experian offered a free FICO score and credit report in June 2020, as well as a free credit report, if you created an account with the company. Equifax was charging $15.95 for a report and a score at that time, and TransUnion was offering unlimited score and report access plus credit monitoring for $24.95 per month.

You can view your each year under federal law, but credit bureaus arent required to provide free credit scores.

You might be able to get your credit scores from other sources as well:

- You can ask the lender about your score during the application process when you apply for a loan.

- VantageScore maintains a list of partner sites that sometimes offer free access to your score.

- You can purchase FICO credit scores on the FICO website.

Your credit score depends on the information in your credit report, so your report might actually be more important. Get your credit reports from each reporting agency, review the information, and fix any errors to be sure that your score accurately reflects your borrowing history.

Also Check: When Will Chapter 7 Bankruptcy Be Removed From Credit Report

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. Its important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.

Age Of Your Credit History

Another factor weighed in your credit scores is the age of your credit history, or how long your active accounts have been open.

Canceling a credit card can affect the age of your credit history, especially if its a card youve had for a while, so weigh that potential impact when youre deciding whether to close a card. Only time can offset the impact of closing an older account, but youll also lose the credit limit amount on a closed card, which can negatively affect your credit utilization rate.

Heads up that card issuers may decide to close your accounts if youre not actively using them, so make sure you keep any accounts you dont want closed active with at least an occasional minimal purchase.

Don’t Miss: Which Credit Score Is Correct

What Is The Average Credit Score In Canada And How Do You Compare

What is the average credit score in Canada, and how do you rank among average Canadian credit scores? More so, what is a good credit score in Canada?

Often, Canadians want to know how they measure up to other people when it comes to their credit score. Is your credit score better than the average credit score? Maybe its worse?;

First, let’s answer the question you are here to find out:

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is;generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

Read Also: What Does Charge Off Mean On Credit Report

What Is The Difference Between A Fico Score And Other Credit Scores

Only FICO Scores are created by the Fair Isaac Corporation and are used by over 90% of top lenders when making lending decisions.

Why? Because FICO Scores are the industry standard for making accurate and fair decisions about creditworthiness. They help millions of people get the credit they need for a home, a new car, or a special purchase.

You may have seen ads for other credit scores, or likely even purchased them in the past. These other credit scores calculate your scores differently than FICO Scores. So while the other credit scores may seem similar to the FICO Score, they aren’t. Only FICO Scores are used by 90% of the top lenders.

Reasons Why Outstanding Debt Spells Bad News For Your Credit Score:

1. It maximises your credit utilisation ratio:

- A good credit utilisation ratio is 30% or lower.

- A high ratio means you are using too much credit and can, as a result, reduce your credit score

2. It makes repayment of future loans difficult:

- If you have outstanding debts, it means that you could already be paying high EMIs.

- Borrowing more loans in the future with outstanding debts can create a major repayment burden and even cause bankruptcy.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

How Good Should My Credit Scores Be

To buy a house?A 2019 Credit Karma report found that the average VantageScore 3.0 credit score that first-time homebuyers needed to buy a house in the U.S. was 684 which is at the lower end of the good credit range. But credit requirements vary depending on your state .

To rent an apartment?Prospective landlords may run a credit check before you can sign a lease, but theres no single credit score benchmark you need to hit to be able to rent an apartment. It can depend on the factors the landlord is looking for in a tenant, as well as where youre looking to rent.

To get approved for a credit card?Its possible to get approved for a credit card with poor credit or even no credit at all. Once you know what range your credit scores fall into, you can research cards that suit you and your goals.

If you have no credit, look for secured cards or cards for beginners . If you have limited or poor credit, secured cards or cards advertised for building or rebuilding credit could be a helpful leg up. Once youve improved your credit, you may be able to qualify for more-enticing offers, such as rewards cards or balance transfer cards.

Good credit scores can mean better terms, but its still worth comparison shopping.

How To Get Your Credit Score

You can find your credit scorewhich is based on information from your credit reportfrom a variety of sources. First, you can check your score for free through services like . Some banks, credit unions, and credit card issuers make your credit score available either on your billing statement or online, as well.

Finally, you can access your credit score from any of the major credit bureaus: Equifax, Experian, and TransUnion.

To help you understand your score, many of the companies that provide your credit score also will include a gauge that helps you figure out whether you have good or bad credit and the factors that influence your credit score.

Your credit report contains the information used to calculate your credit score. As a result of the financial hardship caused by the global pandemic, you can now access your credit report for free each week through AnnualCreditReport.com, through April 20, 2022.

Read Also: What Credit Score For Care Credit

Read Also: Is 643 A Good Credit Score

Here Are The 4 Most Important Sections In Your Cibil Report

– Credit Summary:

This section includes details on the kinds of credit accounts that you had in the past or have currently, along with the details regarding the balance. Usually, the account information is divided into segments such as revolving accounts like credit cards, instalment accounts like car loans, real estate accounts like home loans or loans against property, as well as any collection accounts.

– Account History:

This section consists of all details related to your credit accounts. Be it the lenders name, the type of credit you borrowed, the account number, the date the account was opened, the date you made your most recent payment, the loan amount you have borrowed, the current balance, and a monthly record of your repayment, it will all be included in the report.

– Public Records:

This is a section that lists big financial slipups, both current and previous. This includes criminal arrests or bankruptcies. Pay special attention to this section and identify the causes of these errors and ensure that you dont repeat them in the future.

– Credit Enquiries:

Things to know about CIBIL Score

Fdi Inflows Were At The Highest Level In October In India

Rupee depreciation to a record low level has resulted into a rise in the Foreign direct investment in India. In October 2018, the countrys FDI was at the highest level in six months as the benchmark stock index declined.;As per the latest data from the;Reserve Bank of India;,;Gross FDI inflows were $6.54 billion in October, the highest since $6.7 billion in April.;Fall in the equity market and opportunistic;buying doubled;with the weakening;rupee;were some of the main reasons, India witnessed;high gross FDI inflows in September and October,;said;Saugata;Bhattacharya, chief economist at Axis Bank.;In;addition, there;were;a;couple of large corporate acquisition deals in the previous months and possibly some early IBC resolutions.;The rupee became;Asias worst-performing;currency;on;11 October 2018 as it;hit a record low of 74.48.;However, this meant that a single dollar would have fetched more of the local currency, making sense for multinational companies to bring capital into India where they have units. Madan;Sabnavis, chief economist at CARE Ratings;stated that;FDIs come based on opportunity and availability of investible funds.;India still is fast growing with hospitable FDI;rules,;and the country;offers better prospects especially for the long;term.;In November, the World Bank said India had climbed 23 positions in its Ease of Doing Business Index to 77th p

9 January 2019

Recommended Reading: Does American Express Report To Credit Bureaus

Issuer Identification Numbers: The First 6 Digits

A cards Issuer Identification Number , or Bank Identification Number , indicates which credit card company it originates from and clarifies which card network it belongs to. And that, in turn, tells you a bit about the benefits available to cardholders.

Below, you can find examples for each of the 10 largest U.S. credit card issuers. Just remember that a single large issuer can have numerous IINs, if it offers a broad portfolio of credit cards.

| Issuer |

|---|

| USAA Platinum Mastercard |

Digits 7-18: Account Numbers

This is your individual account number. It can have as many as 12-digits, the last three of which will be included on your monthly statements, along with the final digit of the card number. Although your account number will change when you get a replacement credit card because the original was lost or stolen, you wont actually be opening a new account. So this wont affect your credit score.

The Final Digit: The Validator

The last number helps protect the account from unauthorized use by catching common transcription errors made by either humans or machines when inputting series of numbers. How and why this works are matters too complex to cover in the course of this discussion, but feel free to read up on the topics if you wish!

You May Like: Does Closing A Credit Card Hurt Your Score