What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

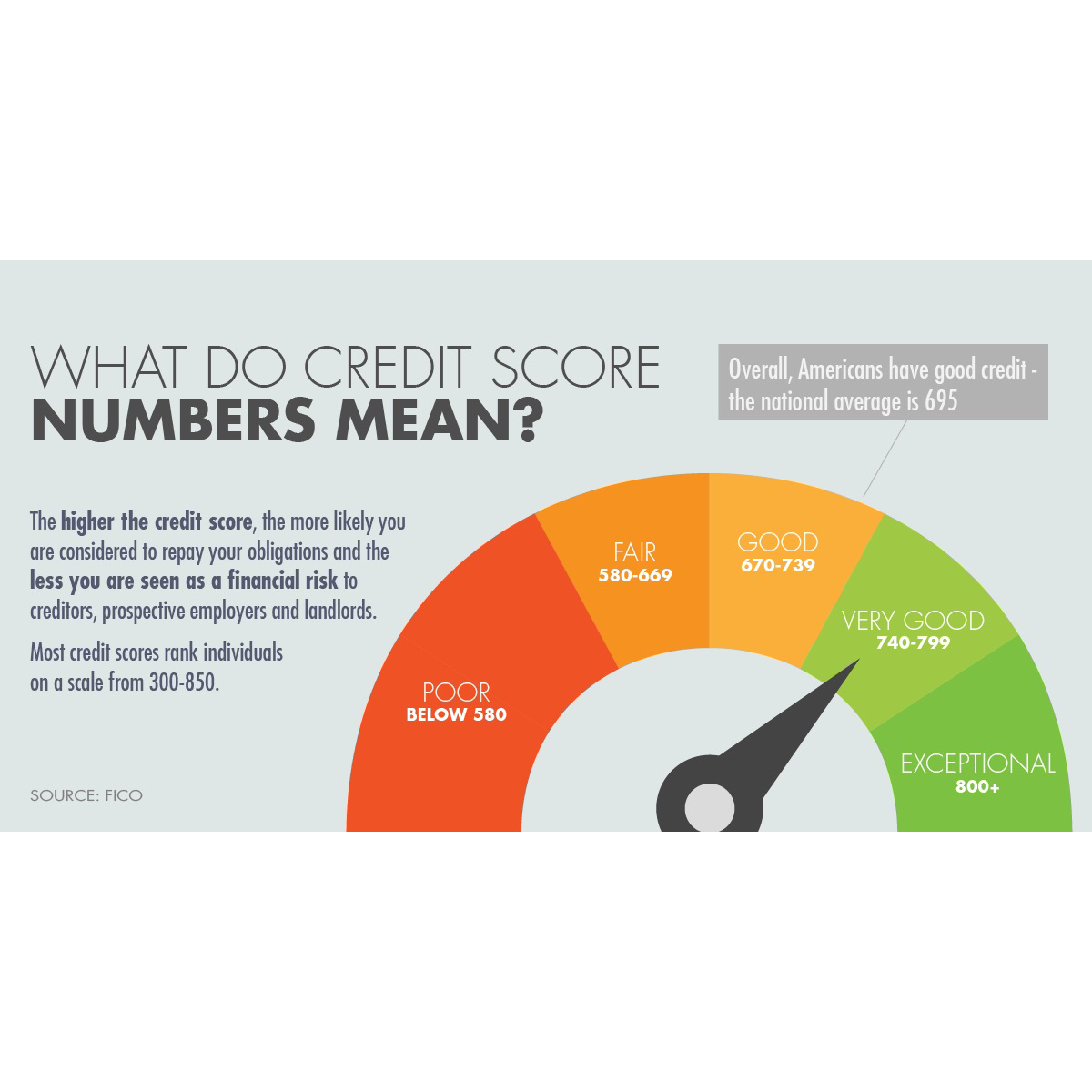

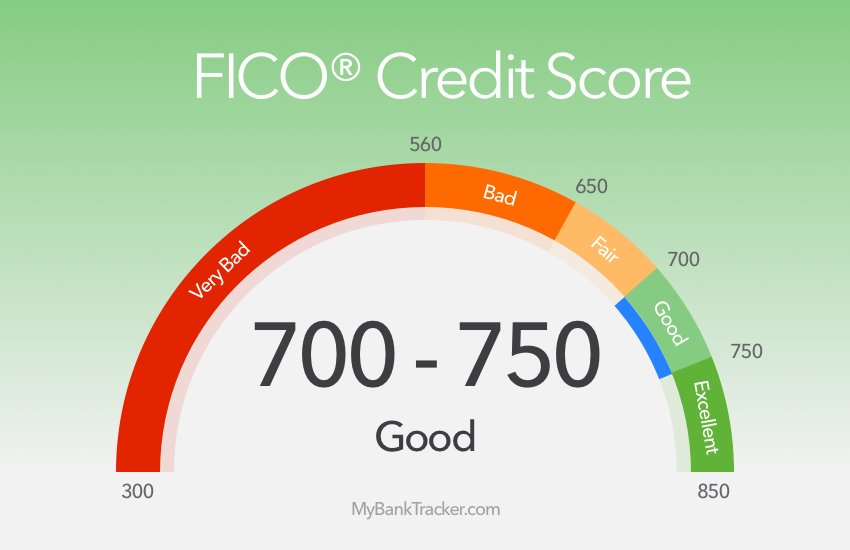

What Is Considered A Good Credit Score

Now that we understand what these scores assess, we can characterize and compare different credit score ranges. For this article, well focus primarily on FICO score ratings. Thats because the;vast majority;of lending decisions utilize FICO scores, so its the standard by which youll likely be judged.;

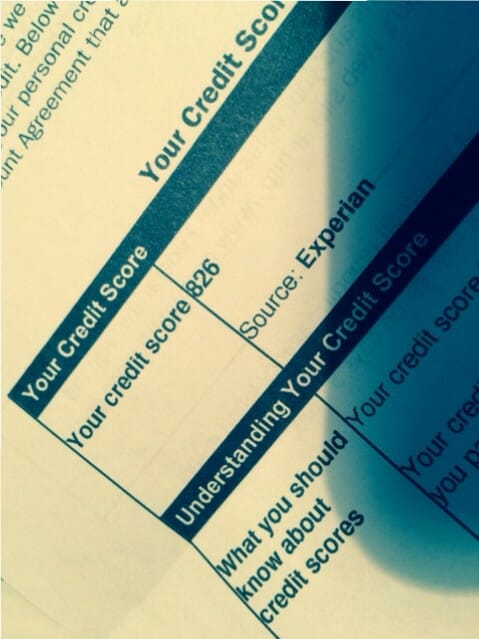

How To Get Your Credit Score

You can find your credit scorewhich is based on information from your credit reportfrom a variety of sources. First, you can check your score for free through services like . Some banks, credit unions, and credit card issuers make your credit score available either on your billing statement or online, as well.

Finally, you can access your credit score from any of the major credit bureaus: Equifax, Experian, and TransUnion.

To help you understand your score, many of the companies that provide your credit score also will include a gauge that helps you figure out whether you have good or bad credit and the factors that influence your credit score.

Your credit report contains the information used to calculate your credit score. As a result of the financial hardship caused by the global pandemic, you can now access your credit report for free each week through AnnualCreditReport.com, through April 20, 2022.

Read Also: What Credit Score For Care Credit

Your Score Range: 800

Your score sits between 800 and 850 on the FICO scale, putting you in a category with only 18 percent of the population. Although you have little or no room for improvement, this score tells lenders and potential lenders that you are an excellent investment. Achieving a top score shows that you are a low risk and that lenders are very likely to receive payment on loans they grant to you.

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO;Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Recommended Reading: How Much Does A Hard Inquiry Affect Credit Score

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Issuer Identification Numbers: The First 6 Digits

A cards Issuer Identification Number , or Bank Identification Number , indicates which credit card company it originates from and clarifies which card network it belongs to. And that, in turn, tells you a bit about the benefits available to cardholders.

Below, you can find examples for each of the 10 largest U.S. credit card issuers. Just remember that a single large issuer can have numerous IINs, if it offers a broad portfolio of credit cards.

| Issuer |

|---|

| USAA Platinum Mastercard |

Digits 7-18: Account Numbers

This is your individual account number. It can have as many as 12-digits, the last three of which will be included on your monthly statements, along with the final digit of the card number. Although your account number will change when you get a replacement credit card because the original was lost or stolen, you wont actually be opening a new account. So this wont affect your credit score.

The Final Digit: The Validator

The last number helps protect the account from unauthorized use by catching common transcription errors made by either humans or machines when inputting series of numbers. How and why this works are matters too complex to cover in the course of this discussion, but feel free to read up on the topics if you wish!

You May Like: Does Closing A Credit Card Hurt Your Score

The Structure Of The Card Number

Although it may seem random, credit card digits are each strategically placed and represent a vital piece of information. Accurate transactions would not be possible without the specific sequence of numbers, the precise shape and exact size, all of which adhere to strict standards dictated by the ISO and enforced by the ANSI .

These standards allow cards to be used worldwide. The only difference among them is Visa, Mastercard and Discover are always 16 digits while American Express employs a 15-digit format.

Understanding Credit Score Factors And Improving Your Credit Scores

The elements from your credit report that shape your credit scores are called credit score factors. Some factors that may affect credit scores are:

- Your total debt

- Number of late payments

- Age of accounts

Factors indicate what elements of your credit history most affected the credit score at the time it was calculated. They also tell you what you must address in your credit history to become more creditworthy over time. Monitoring your credit on a regular basis can help you keep a close eye on how these factors are affecting your score and what you may be able to do to improve your score.

You May Like: What Credit Report Does Paypal Pull

Users Of Credit Ratings

Credit ratings are used by investors, intermediaries such as investment banksList of Top Investment BanksList of the top 100 investment banks in the world sorted alphabetically. Top investment banks on the list are Goldman Sachs, Morgan Stanley, BAML, JP Morgan, Blackstone, Rothschild, Scotiabank, RBC, UBS, Wells Fargo, Deutsche Bank, Citi, Macquarie, HSBC, ICBC, Credit Suisse, Bank of America Merril Lynch, issuers of debt, and businesses and corporations.

- Both institutional and individual investors use credit ratings to assess the risk related to investing in a specific issuance, ideally in the context of their entire portfolio.

- Intermediaries such as investment bankers utilize credit ratings to evaluate credit risk and further derive pricing of debt issues.

- Debt issuers such as corporations, governments, municipalities, etc., use credit ratings as an independent evaluation of their creditworthiness and credit risk associated with their debt issuance. The ratings can, to some extent, provide prospective investors with an idea of the quality of the instrument and what kind of interest rate they should be expecting from it.

- Businesses and corporations that are looking to evaluate the risk involved with a certain counterparty transaction also use credit ratings. They can help entities that are looking to participate in partnerships or ventures with other businesses evaluate the viability of the proposition.

What Can I Do To Improve My Credit Score

When you get your credit score, you might get information on how you can improve it. Improving your score a lot is likely to take some time, but it can be done. Under most scoring systems, focus on paying your bills in a timely way, paying down any outstanding balances, and staying away from new debt.

Don’t Miss: What Credit Score Does Carmax Use

What Is A Credit Score

A credit score is a number between 300850 that depicts a consumer’s creditworthiness. The higher the score, the better a borrower looks to potential lenders. A credit score is based on : number of open accounts, total levels of debt, and repayment history, and other factors. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner.

Other Card Numbers: The Cvv And The Expiration Date

The Card Verification Value is a series of three or four digits usually found on the back of the credit card. It represents another validation process and thus adds a level of protection. Some credit card issuers call it the Card Verification Code . Its purpose is the same regardless of its name.

An expiration date is assigned to the card by the issuing bank and can also help with security by requiring yet another verification step. A card number may have been stolen, but without the expiration date, that number becomes nearly worthless.

Recommended Reading: Is 779 A Good Credit Score

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers’ student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers’ average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. It’s important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.

What Does Your Credit Score Measure

A credit score number measures the likelihood that a borrower will be severely past due on at least one account in the next 18 months. Both the popular FICO and Vantage risk models share this objective.

The modeling equations use historical data found on your consumer report to predict future payment behavior. Lenders base underwriting decisions on these forecasts.

| 1% |

Recommended Reading: How To Remove Items From Your Credit Report Yourself

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters;

| Installment; | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan.; | |

| Open; | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving; | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R.; | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M.; |

Numbers;

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Mortgage Debt Grew By 2% In 2020

- 44% of U.S. adults have a mortgage.

- The average FICO® Score for someone with a mortgage in 2020 was 753.

- The percentage of consumers’ mortgage accounts 30 or more DPD decreased by 46% in 2020.

Mortgage debt represents the largest outstanding debt in the U.S., and in 2020 consumer balances grew by 2%the same rate they grew from 2018 to 2019. Despite the pandemic, consumers across the country still bought homes, many fueled by the record drop in interest rates that accompanied the economic decline. Nearly half of all adults in the U.S. have a mortgage, and the average FICO® Score among these homeowners is more than 40 points higher than the national average.

Mortgage accounts saw the second largest decrease in accounts 30 or more DPD, dropping by 46% in 2020. Compared with 2019’s drop from the prior year of 6%, 2020’s improvement in 30 or more DPD accounts is significant.

This is likely due to the fact that the CARES Act and other government intervention provided relief for mortgage borrowers, giving those impacted by COVID-19 the right to request a forbearance. During forbearance, it was stipulated that mortgage accounts could not be reported negatively to the credit bureaus, a move that helped insulate consumer credit scores.

Recommended Reading: When Do Credit Cards Report Late Payments

Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need; your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

What’s In My Fico Scores

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.

You May Like: Is 584 A Good Credit Score

Youre Much More Than A Number

While your score is an important factor, it isnt the only one. Lenders often use additional data and criteria to make decisions on lending.

Contact us to learn more about options available through our Georgia Heritage Federal Credit Union, or step into one of our credit union branches in the Savannah Metropolitan Area.

- MAILING ADDRESS: PO Box 1920 Savannah, GA 31402

What Do My Credit Score Numbers Mean

550? 725? 680? What does your credit score mean? In this chart, we take a look at what goes into having excellent, very good, good, fair, bad and very bad credit.

See what your credit score tells lenders and where you can improve. This useful guide to credit scores, compiled by Credit.coms Credit Experts, is based on the most common credit scoring range used by FICO.

Of course these are generalizations with almost as many exceptions as rules, but it provides a useful guide for any consumer.

If youre trying to build or maintain your credit, it helps to monitor it regularly, along with your credit reports, to check your progress and look for areas you need to work on. You can obtain your credit reports for free from each of the three major credit reporting agencies once a year through AnnualCreditReport.com. And you can get your credit score for free once a month using Credit.coms free Credit Report Card.

|

Quality |

Also Check: Will A Sim Only Contract Improve Credit Rating

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time.;The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:;

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.;

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the;Centers for Disease Control and Prevention.;

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Don’t Miss: Does Checking Your Credit Score Affect Your Credit Rating