Ways To Improve Your Credit Scores

If you’re looking to improve your credit scores, these tips can help.

- Pay your bills on time. This is one of the most crucial steps to getting and keeping a good credit score. The best way to pay on time is to set up automatic payments so you won’t miss a bill. But make sure you have enough money in the connected bank account to avoid an overdraft.

- Minimize overall debt. If possible, don’t lean on credit to buy items you’re not able to pay for in cash, or that you can’t pay off by the end of the month. This keeps your payments manageable and your ongoing credit utilization ratio low. Your goal should be to bring your credit card balance to $0 at month’s end.

- Monitor your credit regularly. There are many ways to check your credit score for free, including via Experian. Doing so can help you identify dips in your score quickly and course-correct if necessary. Free credit monitoring from Experian can help you keep tabs on both your FICO® Score and credit report, and keep you updated when there are any changes to your credit report.

- Avoid applying for unnecessary credit cards. Not only do some cards have pricey annual fees, but an abundance of cards might result in more spending than you can handle.

- Practice responsible spending habits. Setting up a budgeteven a general one that categorizes your spending into a few overall buckets and doesn’t require too much upkeepcan help you spend within your means over the long term.

Other Reasons Your Credit Score May Drop

If you increase the amount of credit you have by over 30%, that may cause a temporary drop in your credit score. The normal credit utilization rate is 30%.

If credit bureaus see that you are using over 30% of your available credit, you may be seen as a risk.

Have you applied for new credit? That may cause an autonomous algorithm to temporarily lower your credit score.

Have you been paying your credit card bills late? Newly implemented FICO scoring metrics can drop your credit score by 20 points for habitually paying your bill late.

Have you fully paid a mortgage, car loan, or personal loan? That can also cause your credit score to dip temporarily.

You Recently Applied For A Mortgage Loan Or New Credit Card

Whenever you apply for a new line of credit, lenders will request a copy of your credit report to determine your creditworthiness. They decide whether to lend to you by viewing characteristics like your payment history, credit usage and the types of accounts you currently hold.

Each time you authorize someone other than yourself, such as a lender, to check your credit history, a hard inquiry is recorded on your credit report and could slightly affect your score for up to two years.

As your credit profile matures, it’s natural to accumulate hard inquiries. But if you apply for too much credit in a short period of time, it can negatively impact your scores and affect the likelihood that lenders will approve you for new credit.

Depending on how many inquiries you already have, a new hard inquiry could cause your score to drop, but potentially only for a short period of time. And any effect on your credit score should disappear in about one year.

Read Also: Does Paypal Credit Report To Credit Bureaus

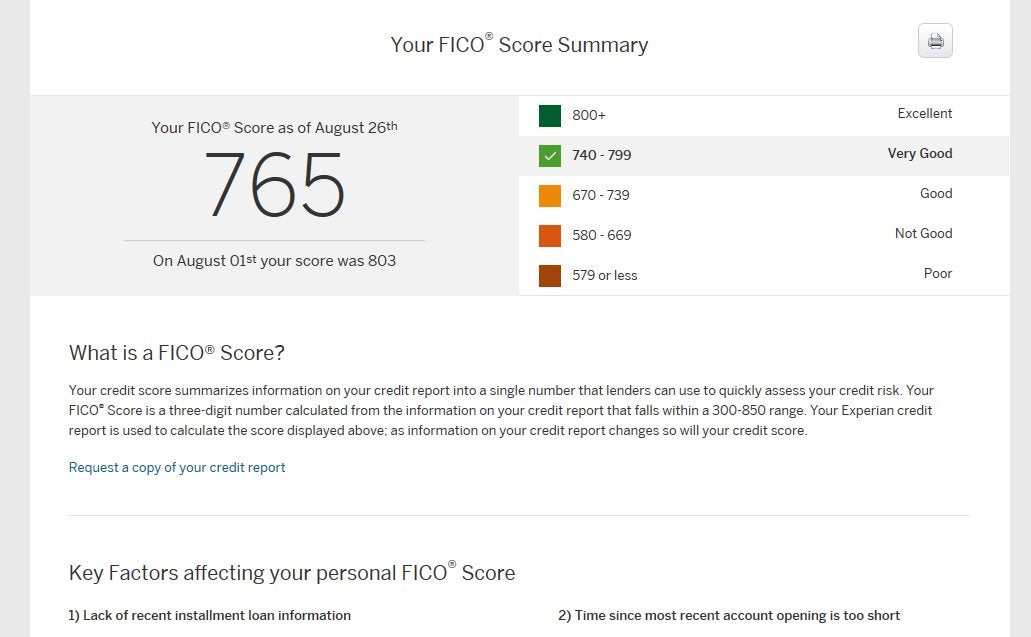

Check And Understand Your Credit Score

Its important to know that not all credit scores are the same, and that they fluctuate from month to month, depending on which credit bureaus lenders use and how often lenders report account activity. So, while you shouldnt worry if you see your scores rise or fall by a few points, you should take note when a big change occurs.

The two main consumer credit scoring models are the FICO Score and VantageScore. Here are the factors that comprise your FICO Score and how much each factor is weighed:

- Payment history

- Amounts owed

- Length of credit history

- New credit

Here are the factors influencing your VantageScore:

- Total credit usage, balance and available credit

- Payment history

- Age of credit history

- New accounts

There are a variety of options for checking your credit score for free.

For example, consumers can get a free FICO Score from the Discover Credit Scorecard even without having a Discover credit card, and a free VantageScore by creating a LendingTree account. American Express and Capital One also offer free credit scores to both card account holders and the general public, though many other card issuers offer free access only to their cardholders.

Here are the tiers that credit scores can fall into, according to FICO:

| FICO Score tiers |

| Poor credit |

Why Is My Credit Score Low After Getting A Credit Card

When you apply for a credit card, the issuer performs a hard credit check to determine whether you qualify. This can cause your credit score to temporarily drop by up to five points. If you make a large purchase after receiving your new card, it can increase your credit utilization ratio. As a result, your score could drop even further.

Recommended Reading: Will A Sim Only Contract Improve Credit Rating

How Can I Raise My Credit Score 100 Points In 30 Days

How to improve your credit score by 100 points in 30 daysGet a copy of your credit report.Identify the negative accounts.Dispute the negative items with the credit bureaus.Dispute Credit Inquiries.Pay down your credit card balances.Do not pay your accounts in collections.Have someone add you as an authorized user.

Add Utility And Phone Payments To Your Credit Report

Typically, payments such as utility and cellphone bills wont be reported to the credit bureaus, unless you default on them. However, Experian offers a free online tool called Experian Boost, aimed at helping those with low credit scores or thin credit files build credit history. With it, you may be able to get credit for paying your utilities and phone bill even your Netflix subscription on time.

Note that using Experian Boost will improve your credit score generated from Experian data. However, if a lender is looking at your score generated from Equifax or TransUnion data, the additional sources of payment history wont be taken into account.

There are also services that allow rent payments to be reported to one or more of the credit bureaus, but they may charge a fee. For example, RentReporters feeds your rental history to TransUnion and Equifax; however, theres a $94.95 setup fee and a $9.95 monthly fee.

How much will this action impact your credit score?

The average consumer saw their FICO Score 8 increase by 12 points using Experian Boost, according to Experian.

When it comes to getting your rent reported, some RentReporters customers have seen their credit scores improve by 35 to 50 points in as few as 10 days, according to the company.

Don’t Miss: Why Is My Credit Score Not Going Up

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Why Paying Off Debt Can Hurt Your Credit

It seems counterintuitive, but paying off debt can hurt your credit. Here are a few scenarios for you to consider:

Does your Amex account have a set credit limit? Some Amex cards work like traditional revolving credit cards offering a set credit limit and affecting your credit utilization ratio as such. But other Amex cards dont have a set credit limit Without a predetermined limit, these cards wont affect your utilization ratio. If this applies to your Amex card, the 41-point drop could be from something else.

Did you close your account?;If you close a revolving account once you pay it off, it could hurt your score because it will lower your credit limit. If you did that would account for the drop.

Do you have a very high score to begin with? Any changes in your credit behavior can adversely affect a high score, at least in the short term. If you dropped 41 points from an 840 to a 799 there is actually no practical difference between the scores.

There could be additional reasons why your score dropped that dont necessarily mean your credit is in trouble. For instance, it could take 30 days for your lower balance to show up on your credit. If its not been that long, give it time. The 41-point drop could be a result of your previous 84% credit utilization ratio.

See related:;VantageScore vs. FICO: Whats the difference?

Recommended Reading: Does Annual Credit Report Affect Score

Theres A Mistake On Your Credit Report

Although fairly uncommon, its possible that a mistake on your credit report may have impacted your score.

Mistakes could be the result of an on-time payment being reported as late, a payment being reported to the wrong account, or even just a small typo that transposed two numbers.

A mistake could also signal that youve been the victim of identity theft, so its important that you look into the matter immediately.

What to do:

The simplest way to prevent a mistake from hurting your credit score is to regularly check your credit reports using a free online service.

If you spot an error, you can dispute the information by writing a letter to the credit bureau that issued the report. Along with your letter, include copies of any relevant paperwork, like bank statements or credit card bills, that support your case.

Both of Canadas credit bureaus will allow you to submit a dispute letter online or by mail.

You Made An Expensive Purchase

Another important factor in your credit score is the amount of available credit;you’re using, or your credit utilization ratio. It comes as a surprise to many people but, if you make a big purchase on your credit card one month, you could see a credit score drop even if you pay the balance in full on your due date.

This happens because credit card issuers typically report the as of the last day of the billing cycle. The balance on your credit card statement is often the balance that appears on your credit report.

It’s relatively easy to correct the impact of a high balance. Simply pay down the balance promptly, avoid making other credit card purchases, and wait for the updated balance to show on your credit report. This will help you recover the lost credit score points.

Also Check: Does Closing A Credit Card Hurt Your Score

You Applied For Additional Credit And Lenders Checked Your Credit Report

It might seem unfair, but your credit score will take a hit if you’ve applied for new credit and a bank or lender checks your credit report to assess the risk you pose as a borrower. As previously mentioned, when a lender looks at your credit report because you’ve applied for new credit, this is considered a hard inquiry which can lower your credit score.

But not all inquiries will hurt your credit score it all depends on the type of inquiries they are! For example, if you check your own credit report or credit history, this is considered a soft inquiry, and soft inquiries have absolutely no impact on your credit score.

Hard inquiries can stay on your credit report for up to three years, but they only account for about 10 percent of your overall credit score.

Use Free Services To Understand Whats Helping And Hurting Your Score

The second thing you can do is use services that provide what are called educational scores. These scores are not calculated using the FICO formula, but by using a variety of other credit scoring formulas. These services do an excellent job of educating you about your credit score. You get pertinent information such as whats hurting your score and whats helping your credit score so you can figure out whats going on and what you need to improve.

Three services I can recommend are , Experian;and Quizzle. Theyre all free. You dont need a credit card. Ive used them all and theyre very easy to use. You may pick one or you could use all three of them if you want to compare them.

True, its not your FICO;Score and people criticize them for that, which is fine. I actually did a comparison and I found that theyre generally pretty accurate. More importantly, the services do a good job of helping you improve your score.

You May Like: Does Debt Consolidation Affect Your Credit Score

Paid Off A Student Loan Or Car Loan

Paying off any loan is an achievement that’s worth celebrating. But the types of credit you have also are considered high impact on your VantageScore® 3.0. This means having a good mix of credit between revolving debt and installment debt . If you pay off the only loan you have, that affects the diversity of your accounts.;

Dispute Inaccurate Information On Your Credit Reports

Sometimes, your credit score might suffer because something wound up on your credit reports that shouldnt have been there. Of course, you wont know unless you check them.

Under normal circumstances, consumers are entitled by federal law to one free credit report every year from each of the credit bureaus Equifax, Experian and TransUnion accessible through annualcreditreport.com. However, during the coronavirus pandemic, the bureaus are allowing consumers to access their reports weekly through April 2021.

If you spot legitimate, incorrect information while reviewing your reports, such as accounts that arent yours, a name mix-up with another person or incorrectly reported payments, you can file a dispute. The Consumer Financial Protection Bureau, a federal agency responsible for protecting consumers and offering financial education, provides dispute instructions for each bureau.

Its worth taking a look at your reports, even if you have no reason to suspect there might be a problem. According to a report from the Consumer Financial Protection Bureau, 68% of credit or consumer reporting complaints received by the bureau in 2020 dealt with incorrect information on peoples credit reports.

How much will this action impact your credit score?

Whether your credit score changes and how much it changes depends on what you are disputing.

Also Check: How Long For Things To Fall Off Credit Report

Derogatory Remarks On Your Credit Reports

Since your based on information in your credit reports, negative information can drag your score down. For example, if you have a bankruptcy listed on your reports, it can have a negative effect on your score for a long time. A Chapter 7 bankruptcy remains on your credit report for up to 10 years while a Chapter 13 bankruptcy remains on your report for up to seven years.

Some other examples of derogatory remarks that can lower your credit score include collection accounts and foreclosures. An original debt creditor usually sends your account to collections after failing to collect a debt from you. A foreclosure happens when you default on your mortgage. These negative remarks remain on your credit reports for up to seven years.

Although a derogatory remark can stay on your credit report for up to ten years, its impact lessens over time. Also, practicing good credit habits can help you rebuild your credit faster.

The Bottom Line About Building Credit Fast

When youre working to fix your credit, it takes good behavior over time. However, lowering your utilization rate by paying down existing debt, getting a new credit card or requesting a credit line increase on an existing card can provide the quickest credit score boost.

Any late payments and debts sent to collection should be handled promptly otherwise, theyll just cause more pain once they hit your credit reports. Its also wise to review your credit reports on a regular basis. in order to spot errors that might be dragging down your credit score.

Knowing what actions to take that can help improve your credit score and being a responsible borrower can boost your chances of increasing your credit score by 100 points or even more.

Recommended Reading: How To Get My Own Credit Report

Monitor Score Changes With Creditwise From Capital One

Staying on top of the information in your credit report can help alert you to potential problems. But waitâdoesnât checking your credit report hurt your credit score?

Thankfully, thatâs a myth. The Consumer Financial Protection Bureau confirms that requesting your credit report wonât hurt your credit score.;

You could use a credit monitoring tool like . CreditWise is free and available to everyoneânot just Capital One customers.;

With CreditWise, you can access your free TransUnion® credit reports and weekly VantageScore® 3.0 credit score anytime, without hurting your score. You can even see the potential impacts of financial decisions on your credit score before you make them with the CreditWise Simulator.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion. Just call 877-322-8228 or visit AnnualCreditReport.com to learn how.

You Missed Or Made A Late Payment

Your payment history is the most important part of your credit history it accounts for 35% of your total score. That means that even one missed or late payment can cause your score to take a nosedive.

Any payment thats more than 30 days past due will result in your credit card company reporting you for delinquency to one of the two major credit bureaus, Equifax and TransUnion. Payments that are late by 60-90 days or more will ding your score even further.

Unpaid bills will end up going into collections, which means that your lender will hire a debt collection agency to try and recover the money you owe. Any debt you have that goes into collections will stay in your credit report for 7 years and cause serious damage to your score.

What to do:

First things first: make the payment that you missed, as soon as possible. If you stay on top of your payments moving forward, your score will eventually start to improve.

It can be helpful to set a reminder on your calendar app for all of your recurring payments. There are also a number of free credit monitoring services available that will send you an email reminder every time you have a payment due.

You May Like: How To Up Credit Score